Tax Incentives For Renewable Energy Operators in the power industry are granted exemption from payment of customs and import duties in respect of plant machinery equipment and accessories imported specifically and exclusively for generating off grid power using renewable or clean energy sources

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS Tax incentives on renewable energy play a significant role as there is an increased demand for electricity The encouragement from tax incentives brings about investment in renewable energy which help create off

Tax Incentives For Renewable Energy

Tax Incentives For Renewable Energy

https://www.jpm.law/wp-content/uploads/2023/06/clean-renewable-energy-or-electricity-production-tax-credits-and-incentives-financial-concept-green-energy-symbols-atop-coin-stack-eg-solar-panel-wind-turbine-fuel-cell-battery-and-th-1024x683.webp

Promoting Agroecological Farming Practices For Food Security Farmers

https://farmersmag.co.za/wp-content/uploads/2023/06/young-farmers-are-collecting-orange_1150-5724-1.webp

Tax Incentives For Renewable Energy In India

http://blog.sustvest.com/wp-content/uploads/2023/06/Tax-Incentives-for-compressed-1024x577.jpg

March 29 2023 Image credit potjanun 123RF Funding tax and regulatory challenges are preventing renewable energy companies in Nigeria from staying profitable and scaling up says a recent KPMG report The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered

Consumers can find financial incentives and assistance for energy efficient and renewable energy products and improvements in the form of rebates tax credits or financing programs Visit the following sections to search for incentives in your area and to learn more about financing options The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing

Download Tax Incentives For Renewable Energy

More picture related to Tax Incentives For Renewable Energy

Tax Incentives For Renewable Energy In India

https://blog.sustvest.com/wp-content/uploads/2023/08/blog-24-64cc7a833a0b4-scaled.webp

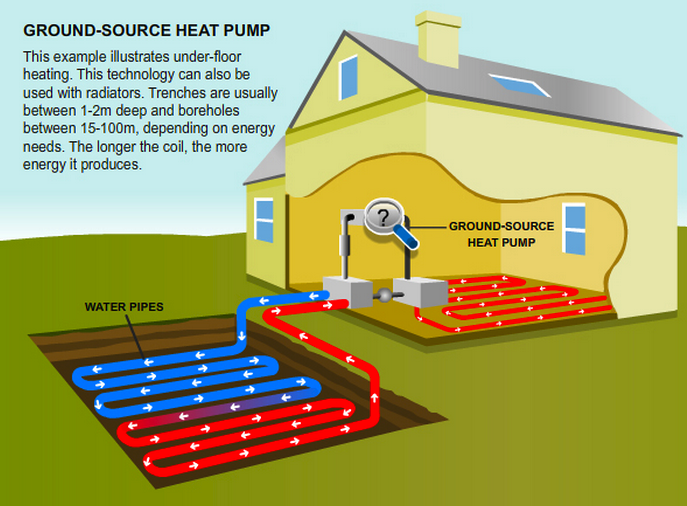

Surfen L ffel Tag How To Ground Source Heat Pumps Work Nachbarschaft

http://www.carmichaelbrowns.co.uk/wp-content/uploads/2012/07/Screen-shot-2012-09-11-at-12.29.26.png

Tax Incentives For Renewable Energy Impacts And Analyses Nova

https://novapublishers.com/wp-content/uploads/2018/12/9781536104561-e1544466322781.jpg

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

[desc-10] [desc-11]

Publications ACCES American Coalition Of Competitive Energy Suppliers

http://competitiveenergy.org/wp-content/uploads/2015/01/ACCES-image-consumer-news-letter1.jpg

Renewable Energy Incentives Kaukauna Utilities

https://www.kaukaunautilities.com/wp-content/uploads/2019/11/Renewable-Energy-1.png

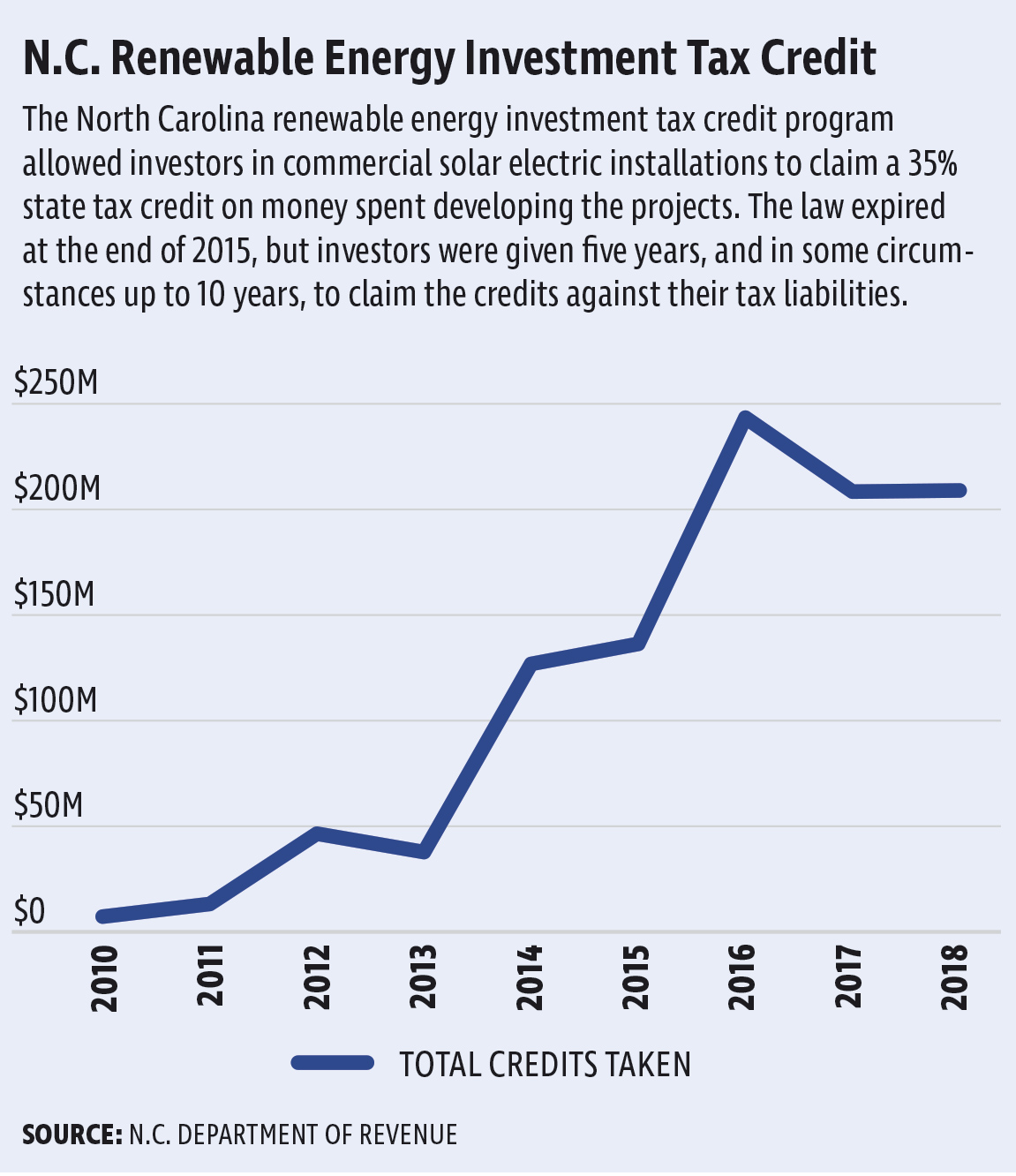

https://news.bloombergtax.com/daily-tax-report...

Operators in the power industry are granted exemption from payment of customs and import duties in respect of plant machinery equipment and accessories imported specifically and exclusively for generating off grid power using renewable or clean energy sources

https://www.eia.gov/energyexplained/renewable...

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS

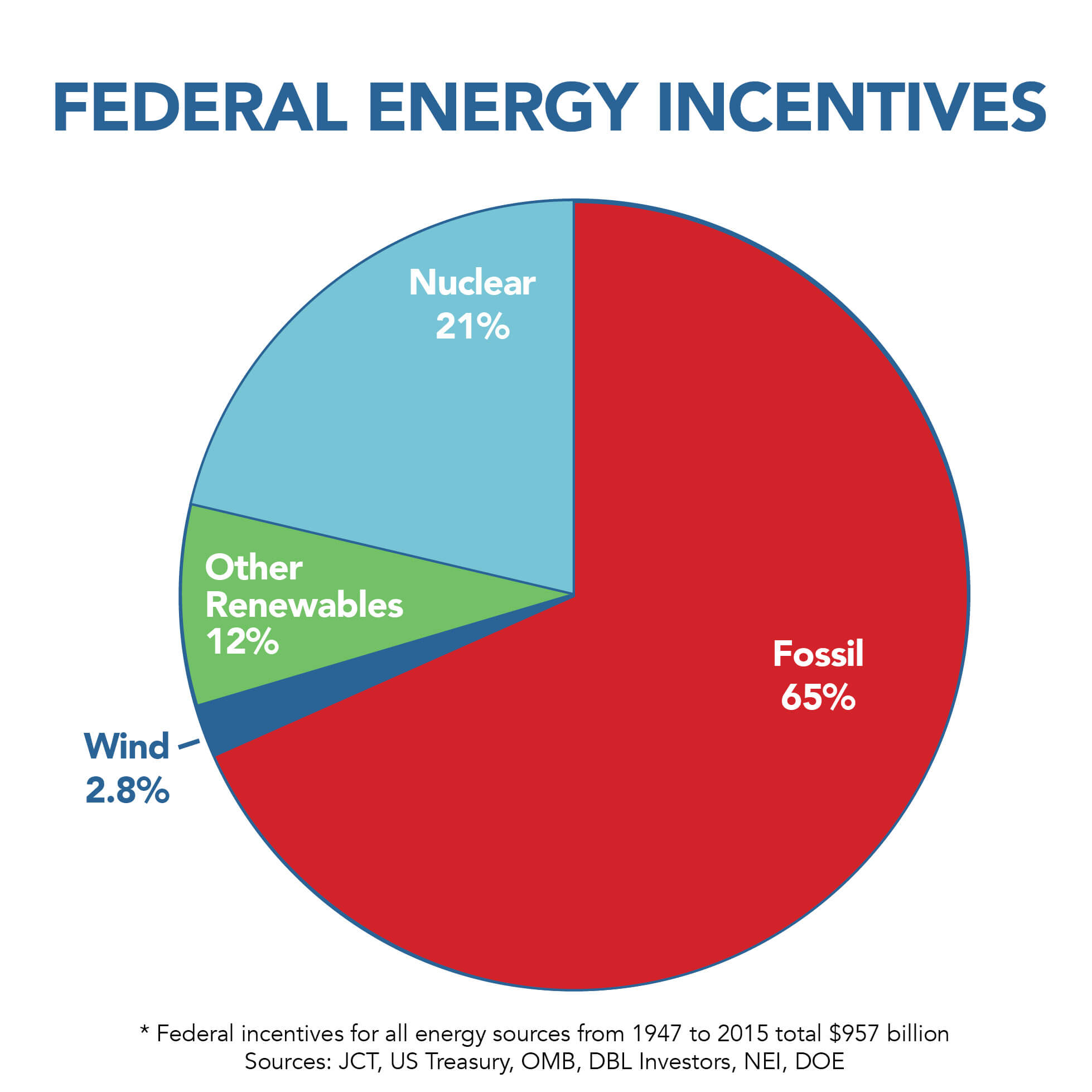

Wind Energy Less Than 3 Of All Federal Energy Incentives Says New Analysis

Publications ACCES American Coalition Of Competitive Energy Suppliers

April 28 2021 3 Phases Renewables Inc

Pros Cons Of Renewable Energy Sources Clean Energy Ideas

Bac Lieu Prioritises Renewable Energy

Five Reasons To Make A Renewable Energy Resolution

Five Reasons To Make A Renewable Energy Resolution

Tax Incentives For Renewable Energy Solar Consultant

Renewable Energy Tax Credits Iowa Utilities Board

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

Tax Incentives For Renewable Energy - [desc-14]