Tax Incentives For Residential Solar Power Verkko 28 elok 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

Tax Incentives For Residential Solar Power

Tax Incentives For Residential Solar Power

https://www.intermtnwindandsolar.com/wp-content/uploads/2018/05/DJI_0005.jpg

Are There Any Tax Incentives For Investing In Energy Saving Equipment

https://www.fdc.ie/wp-content/uploads/2022/07/Are-there-any-tax-incentives-for-investing-in-energy-saving-equipment-or-systems-scaled.jpg

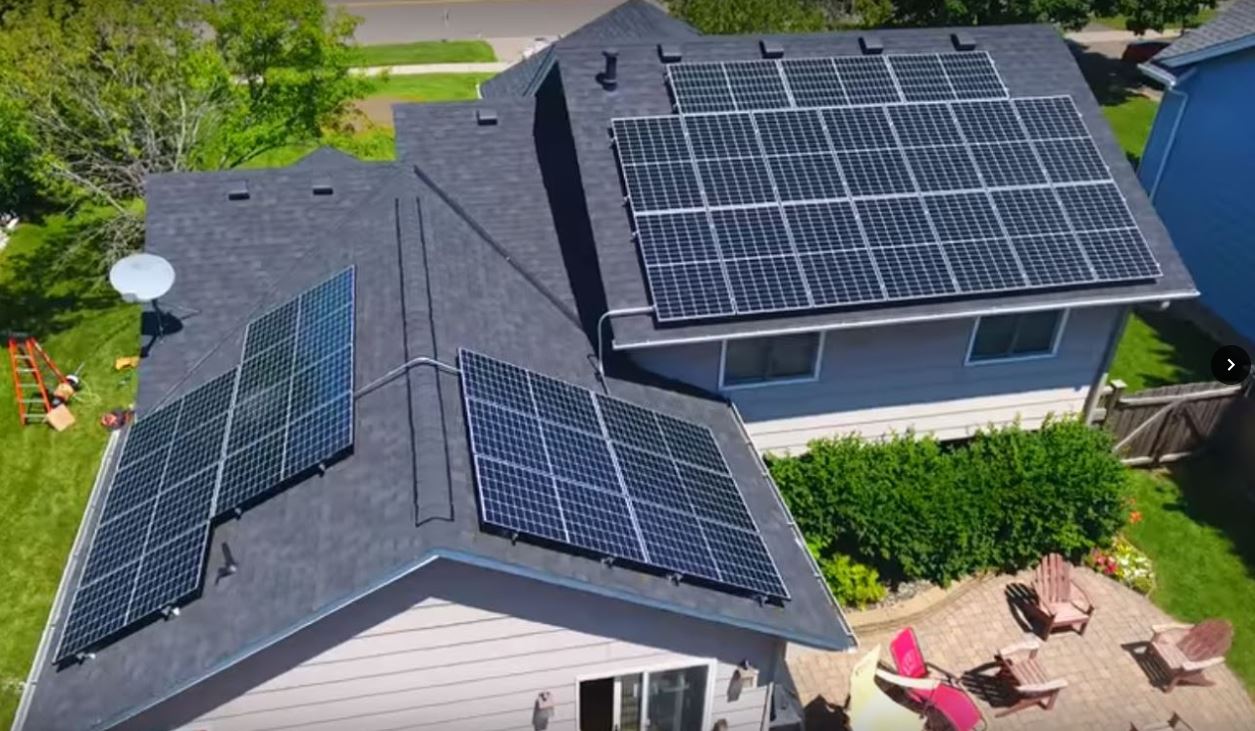

Apple Valley MN 9 92kW Residential Solar Electric System Minnesota

https://www.trunorthsolar.com/wp-content/uploads/2018/08/Kevin-Ellis-Apple-Valley-Solar-Photo.jpg

Verkko 4 tammik 2018 nbsp 0183 32 In Finland self consumption of solar energy is exempt from grid charges and electricity taxes up to a maximum of 800 megawatt hours per year Companies and municipalities receive subsidies of 24 to 40 percent if they invest in photovoltaics However this subsidy does not apply to residential buildings and Verkko 6 kes 228 k 2023 nbsp 0183 32 The credit lowers your federal taxes So if you spend 24 000 on a system you can subtract 30 percent of that or 7 200 from the federal taxes you owe You must take the credit for the year

Verkko 27 huhtik 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500 Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 To claim the solar tax credit when you file a tax return you ll have to fill out IRS Form 5695 which covers residential energy projects 0 Internal Revenue Service 2023 Form 5695

Download Tax Incentives For Residential Solar Power

More picture related to Tax Incentives For Residential Solar Power

Tax Incentives Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/tax_incentives.jpg

What Solar Tax Form Is Used To Claim Credits

http://www.skippingstonesdesign.com/wp-content/uploads/2022/03/load-image-2022-03-29T235018.174.jpg

State By State Tax Incentives For Solar Power Residential Solar Alliance

https://solarpowered.com/wp-content/uploads/2023/01/State-by-State-Tax-Incentives-for-Solar-Power.jpg

Verkko 19 lokak 2023 nbsp 0183 32 In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property It also increased the credit s value Verkko 8 syysk 2022 nbsp 0183 32 Let s take a look at the biggest changes and what they mean for Americans who install rooftop solar The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a

Verkko 13 jouluk 2023 nbsp 0183 32 The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the Verkko 1 tammik 2017 nbsp 0183 32 Assuming an installation cost of 4000 per kilowatt capacity kWC which is roughly the cost of solar PV installation during our period of analysis a taxable portion of 40 based on National Renewable Energy Laboratory 2009 and Barbose et al 2012 and a sales tax rate of 6 the sales tax rate for MA and CT the

Tax Incentives For Renewable Energy Sources Current Status And

https://www.jpm.law/wp-content/uploads/2023/06/clean-renewable-energy-or-electricity-production-tax-credits-and-incentives-financial-concept-green-energy-symbols-atop-coin-stack-eg-solar-panel-wind-turbine-fuel-cell-battery-and-th-1024x683.webp

Senate Democrats Would Take Some Small Steps To Clean Up Energy Tax

https://www.taxpolicycenter.org/sites/default/files/styles/manual_crop_1500w/public/blog/ap_932456086173.jpg?itok=MSbntoZX

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Verkko 28 elok 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

All Solar Panel Incentives Tax Credits In 2023 By State

Tax Incentives For Renewable Energy Sources Current Status And

Solar Tax Credit Incentives For Your Project Verogy

Solar Panel Pros And Cons Modernize

USA Solar Electric About Our USA Solar Installation Company In San

Residential Solar Tax Incentives

Residential Solar Tax Incentives

Will The Government Give Tax Incentives For Going Solar Solar Solar

Home Solar Power Systems Offer Great Returns When Analyzed Properly

2023 Residential Clean Energy Credit Guide ReVision Energy

Tax Incentives For Residential Solar Power - Verkko 30 marrask 2023 nbsp 0183 32 The Residential Clean Energy Credit often called the federal solar tax credit is an incentive you can earn when installing solar panels or other clean energy equipment on your property The tax credit equals 30 of installation costs and can reduce what you owe in federal income taxes by thousands of dollars