Tax Law Changes For 2022 Block has got you covered with an outline of the new tax breaks that can help you get back the most money possible this tax season Check out the need to know 2023 new tax laws and related changes below

The IRS continues to share updated information for people preparing to file their 2022 tax returns as well as anyone who has previous year tax returns awaiting processing by the IRS Get critical updates that may affect your tax filing and recent IRS news The Inflation Reduction Act changed a wide range of tax laws and provided funds to improve our services and technology to make tax filing easier for you Since the Inflation Reduction Act is a 10 year plan the changes won t happen immediately

Tax Law Changes For 2022

Tax Law Changes For 2022

https://spgasior.com/wp-content/uploads/2022/01/tax-law-changes.png

My Take On The Proposed Tax Law Changes For 2022 Focus CPA

https://focus-cpa.com/wp-content/uploads/2021/11/tax-law-changes-2022.jpg

Tax Law Changes For 2022 Stock Photo Download Image Now Internal

https://media.istockphoto.com/id/1349035144/photo/tax-law-changes-for-2022.jpg?s=170667a&w=0&k=20&c=h3ttjrGmxUF5GL4HNgWgrYrKDdEz5moDa_MI7PMbCTI=

After another year of tax law changes there are significant updates for the 2022 filing season with the possibility of a smaller refund or bigger tax bill For some filers certain Any minimum tax paid will be creditable against regular tax in future years The proposal will be effective for tax years beginning after Dec 31 2022 This new tax regime will be fraught with many technical issues and Treasury will be tasked with providing extensive guidance

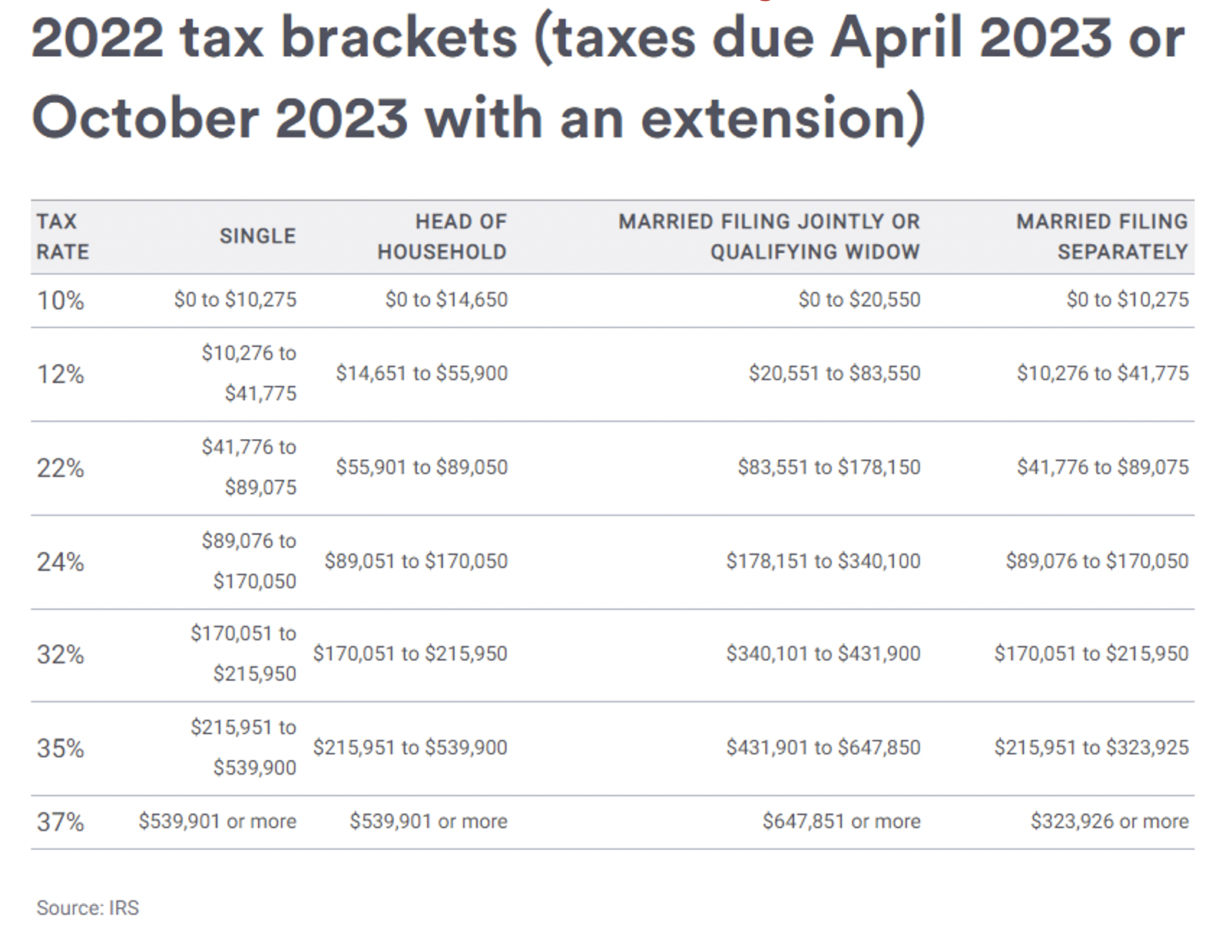

On Nov 10 2021 the IRS announced inflation adjustments for 2022 affecting standard deductions tax brackets and more The changes effective when you file in 2023 are the result of higher The U S Senate on August 7 2022 passed budget reconciliation legislation H R 5376 that includes significant tax law changes All 50 Senate Democrats voted for the legislation while all 50 Senate Republicans voted against it

Download Tax Law Changes For 2022

More picture related to Tax Law Changes For 2022

Tax Law Changes For 2022 Stock Photo Download Image Now 1040 Tax

https://media.istockphoto.com/id/1349035080/photo/tax-law-changes-for-2022.jpg?s=170667a&w=0&k=20&c=GS1gNwHLOcFI2V2hlZstU2K9wYVgLDXE_0Fbe27u1dY=

Tax Law Updates Jackson Associates Bookkeeping Tax Services

https://jacksonbkpg.com/wp-content/uploads/2021/12/tax-2021.jpg

Advantages Of Using A Grantor Trust In Planning North Dakota Estate

https://germanlawgf.com/wp-content/uploads/2021/12/Tax-Planning-for-2022-scaled.jpg

On August 16 2022 President Biden signed into law H R 5376 commonly referred to as the Inflation Reduction Act of 2022 or IRA the budget reconciliation legislation that includes significant law changes related to tax climate change energy and healthcare From reporting monthly child tax credit payments to changes to charitable contributions the 2022 tax season will look different There were several tax law changes in 2021 which will

Tax Year 2022 For tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows Reverts back to up to 2 000 for 2022 2025 Each dependent child must be under age 17 Refundable up to 1 400 but no longer fully refundable Proper tax planning requires an awareness of what s new and changed from last year and there are lots of tax law changes and updates for 2024 that you need to know

2022 Tax Law Changes You Need To Know About

https://taxprocpa.com/images/2022-tax-law-changes.jpg

What Are The Tax Brackets For 2022 In California Printable Form

https://www.taxjar.com/wp-content/uploads/[email protected]

https://www.hrblock.com/tax-center/filing/tax-law-changes

Block has got you covered with an outline of the new tax breaks that can help you get back the most money possible this tax season Check out the need to know 2023 new tax laws and related changes below

https://www.irs.gov/newsroom/tax-updates-and-news-from-the-irs

The IRS continues to share updated information for people preparing to file their 2022 tax returns as well as anyone who has previous year tax returns awaiting processing by the IRS Get critical updates that may affect your tax filing and recent IRS news

2018 Tax Law Changes For Businesses

2022 Tax Law Changes You Need To Know About

Tax Laws Passed At The End Of 2019 Not All Are 20 20 Baker Newman Noyes

New Tax Law Changes Updates For 2022 TaxSlayer

Navigating Tax Law Changes In 2023 An Essential Guide For Bookkeepers

Overview To The Employment Law And Tax Law Changes Effective From 2022

Overview To The Employment Law And Tax Law Changes Effective From 2022

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

Executive Actions To Reform The Cost benefit Analysis Of U S Tax

11 MMajor Tax Changes For 2022 Pearson Co CPAs

Tax Law Changes For 2022 - First off the deadline to file individual tax returns is April 18 Other deadlines are January 17 2022 4th quarter 2021 estimated tax payment due March 15 2022 Partnership and S corporation returns for calendar year 2021 April 18 2022 1st quarter 2022 estimated tax payment due