Tax Rate For Ay 2022 23 Companies Understand Corporate Tax Rates for AY 2021 22 AY 2022 23 AY 2023 24 AY 2024 25 Learn about exemptions conditions and implications for companies Stay informed

Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims Company tax rates for the 2001 02 to 2010 11 income years Find out company tax rates from 2001 02 to 2023 24

Tax Rate For Ay 2022 23 Companies

Tax Rate For Ay 2022 23 Companies

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

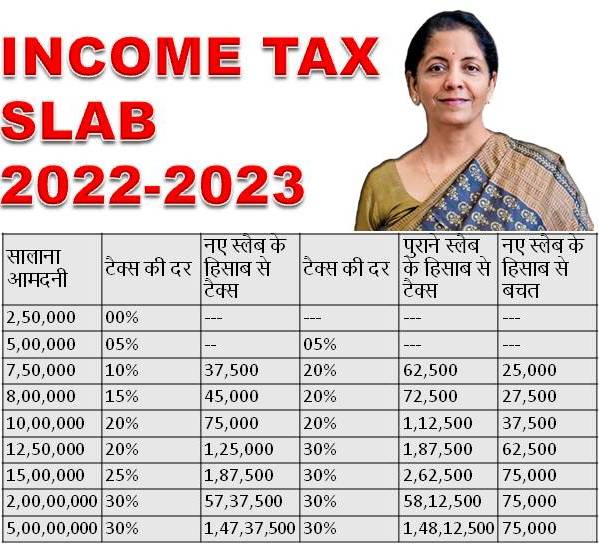

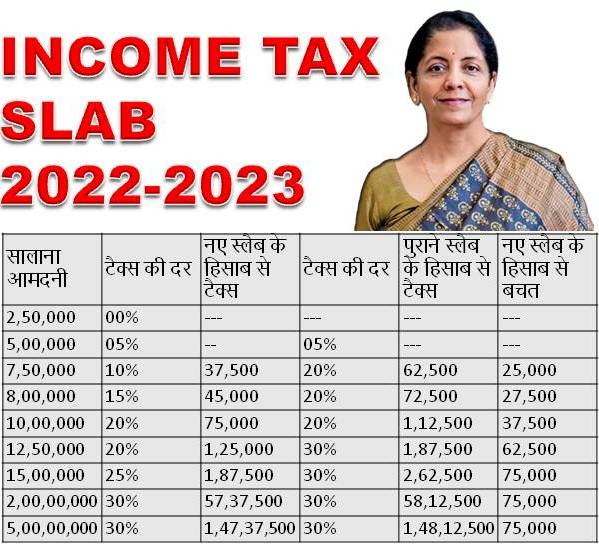

Income Tax Slab For AY 2022 23

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

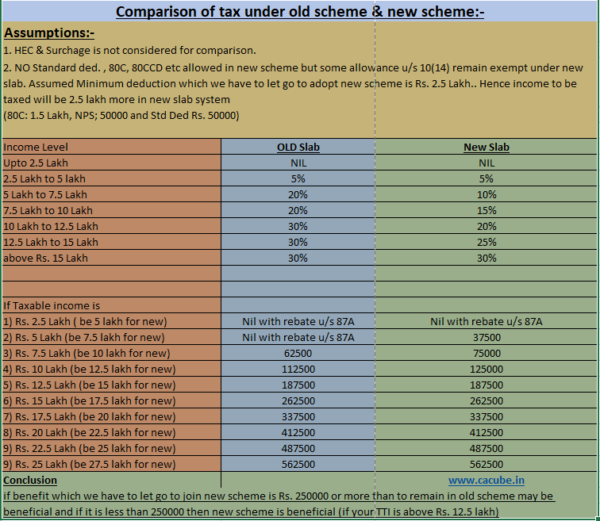

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259-1536x1024.jpeg

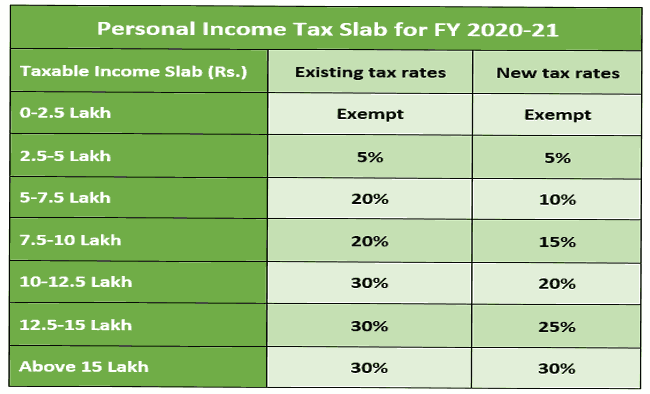

From the 2021 22 income year onwards companies that are base rate entities must apply the 25 company tax rate The rate was previously 27 5 from the 2017 18 to Tax Slabs for Domestic Company for AY 2024 25 Surcharge Marginal Relief and Health Education Cess Note A Company shall be liable to pay Minimum Alternate Tax MAT at 15

Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime Section 115BAA states that domestic companies have the option to pay tax at a rate of 22 plus sc of 10 and cess of 4 The Effective Tax rate being 25 17 from the FY

Download Tax Rate For Ay 2022 23 Companies

More picture related to Tax Rate For Ay 2022 23 Companies

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Income Tax Slab Rates For The A Y 2020 21 And A Y 2021 22 YouTube

https://i.ytimg.com/vi/hPVw8TCQikM/maxresdefault.jpg

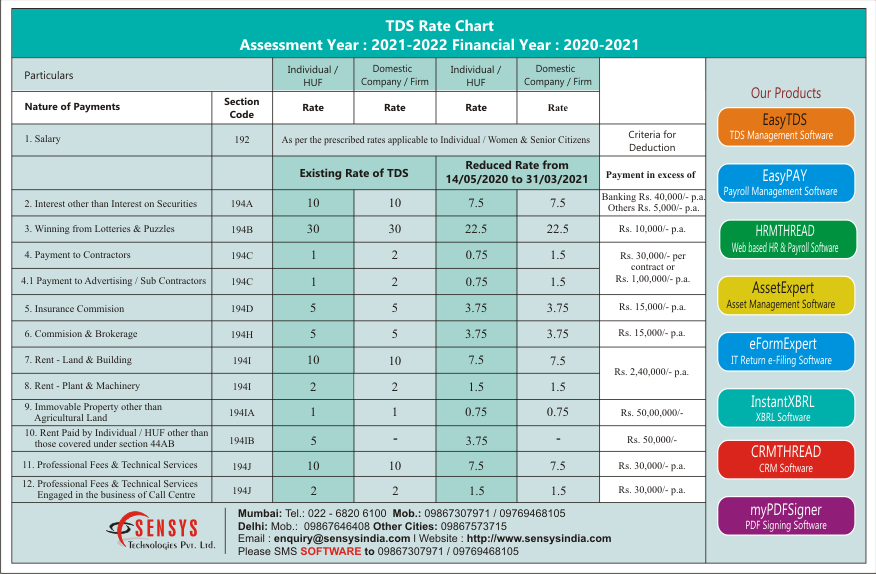

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2020/04/Rate-Chart-AY-2021-22_Sensys_New.png

Corporate Tax The income tax paid by domestic companies and foreign companies on their income in India is corporate income tax CIT The CIT is at a specific In this article we look at the income tax rate applicable for private limited companies during the assessment AY 2022 2023 How to calculate total income for a Company Income tax is levied on the total income of the

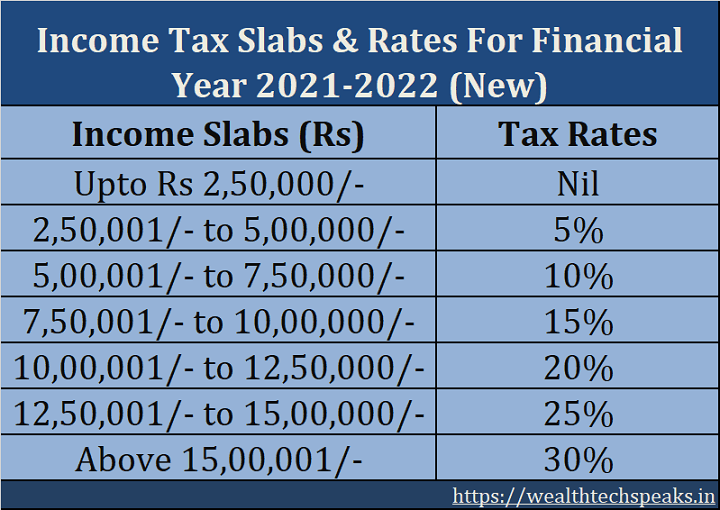

Income Tax Rates for AY 2022 23 for Individuals With effect from A Y 2021 22 the individuals HUFs are given two options for discharging their tax obligations while e filing From 2021 22 through to 2023 24 and later periods the small business company tax rate is 25 Otherwise the general company income tax rate is 30 From 2016 17 to

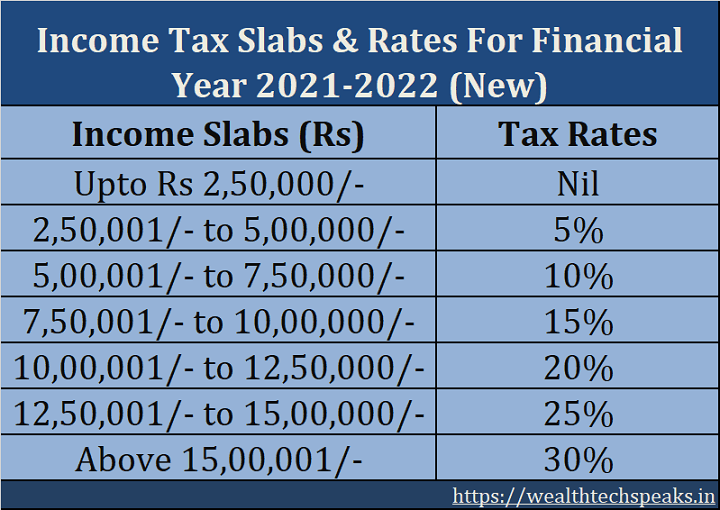

Income Tax Rates For Fy 2021 22 Ay 2022 23 Fy 2022 23 Ay 2023 Mobile

https://wealthtechspeaks.in/wp-content/uploads/2020/07/New-Income-Tax-Slab-Rates-FY-2021-22.png

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-for-senior-citizens-FY-2022-23.webp

https://taxguru.in/income-tax/corporate-tax-rate...

Understand Corporate Tax Rates for AY 2021 22 AY 2022 23 AY 2023 24 AY 2024 25 Learn about exemptions conditions and implications for companies Stay informed

https://taxguru.in/income-tax/income-tax-rates...

Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

Income Tax Rates For Fy 2021 22 Ay 2022 23 Fy 2022 23 Ay 2023 Mobile

Income Tax 2022 23 Slab Bed Frames Ideas

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Income Tax Rates Slab For FY 2023 24 AY 2024 25 Ebizfiling

2022 Deductions List Name List 2022

2022 Deductions List Name List 2022

2022 23 Tax Rates TAX

New Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Mobile

Tax Rate For Ay 2022 23 Companies - Companies with profits between 50 000 and 250 000 will pay tax at the main rate reduced by a marginal relief This provides a gradual increase in the effective Corporation