Tax Rates 22 23 Hmrc Use these rates and thresholds when you operate your payroll or provide expenses and benefits to your employees

Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025 2022 2023 Tax Rates and Allowances Click to select a tax section Income Tax Use our Tax Calculator to Calculate Income Tax Tax Free Personal Allowance the amount of

Tax Rates 22 23 Hmrc

Tax Rates 22 23 Hmrc

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt30482d40649c84c3/6179a93afdb9af22b36e3ec3/Autumn_budget_table_1.png

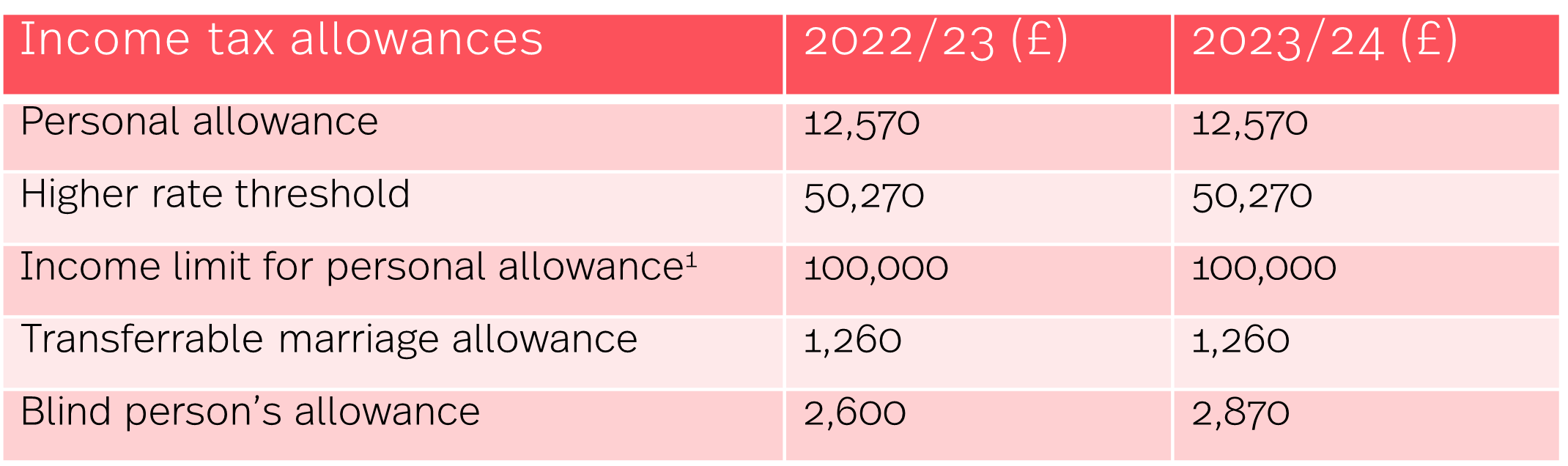

Autumn Statement 2022 HMRC Tax Rates And Allowances For 2023 24

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt8743826b67930bd8/63767939ac59ed1089b31054/table_1.png

South Carolina s 2021 Agenda Why Income Tax Cuts Matter

https://www.fitsnews.com/wp-content/uploads/2020/12/income-tax-rates.jpeg

From the same date a small profits rate of 19 will apply to profits up to 50 000 For businesses with profits between 50 000 and 250 000 tax will be charged at the main rate subject to marginal relief provisions For the tax year 2022 2023 the UK basic income tax rate was 20 This increased to 40 for your earnings above 50 270 and to 45 for earnings over 150 000 Your earnings below 12 570 were tax free This is

In 2022 23 the rate of primary Class 1 NICs for employees charged on their earnings the rate of secondary Class 1 NICs for employers charged on their employees earnings This briefing sets out direct tax rates and principal tax allowances for the 2022 23 tax year as confirmed in the Autumn 2021 Budget on 27 October 2021 and the Spring Statement

Download Tax Rates 22 23 Hmrc

More picture related to Tax Rates 22 23 Hmrc

2022 Paye Tax Tables Brokeasshome

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt15ae6fdb1fe5ecfb/6179cc9fc2de5e0b3c33c550/Autumn_budget_table_5.png

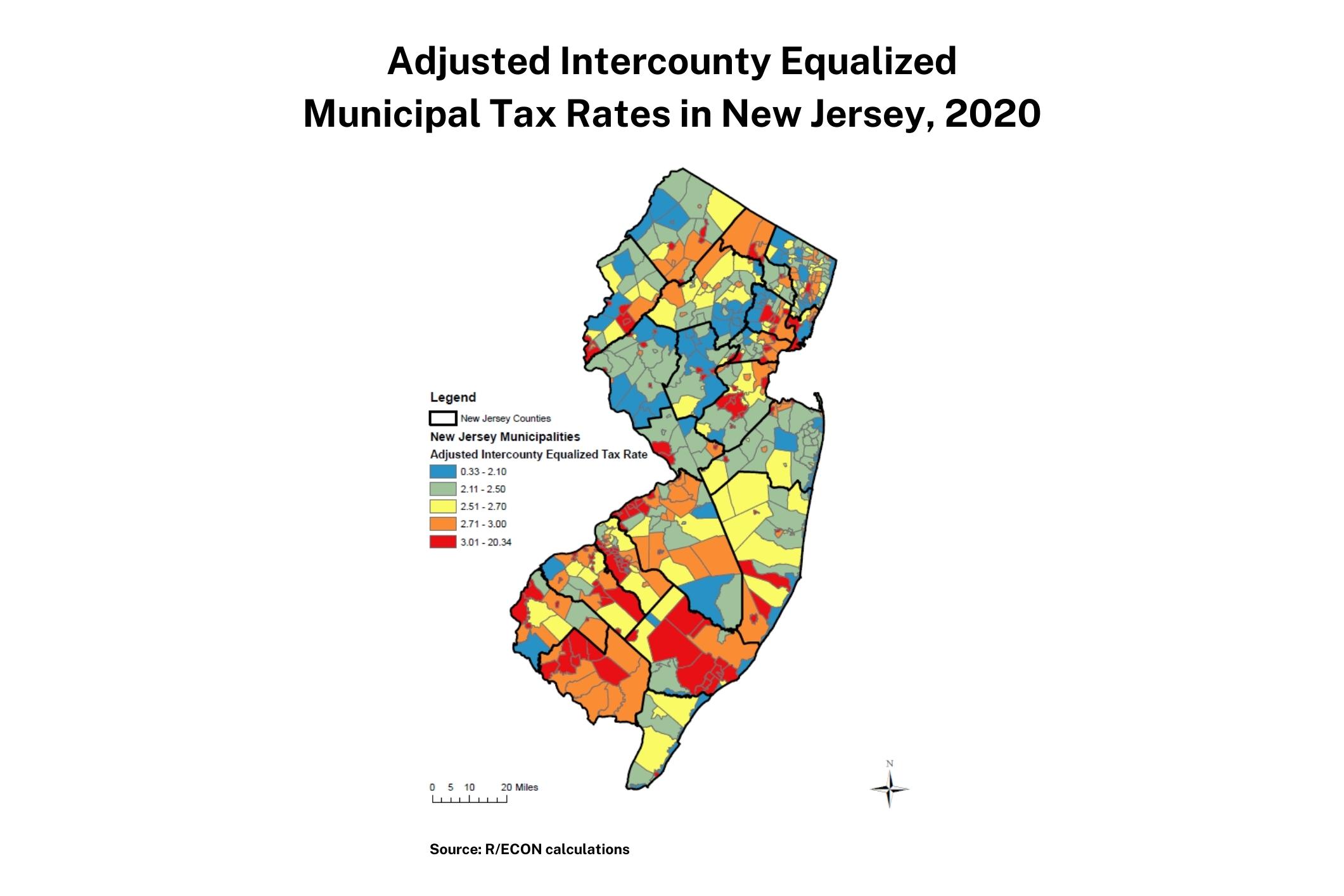

Report Release What Influences Differences In New Jersey s Municipal

http://policylab.rutgers.edu/wp-content/uploads/2022/09/Municipal-Tax-Rates.jpg

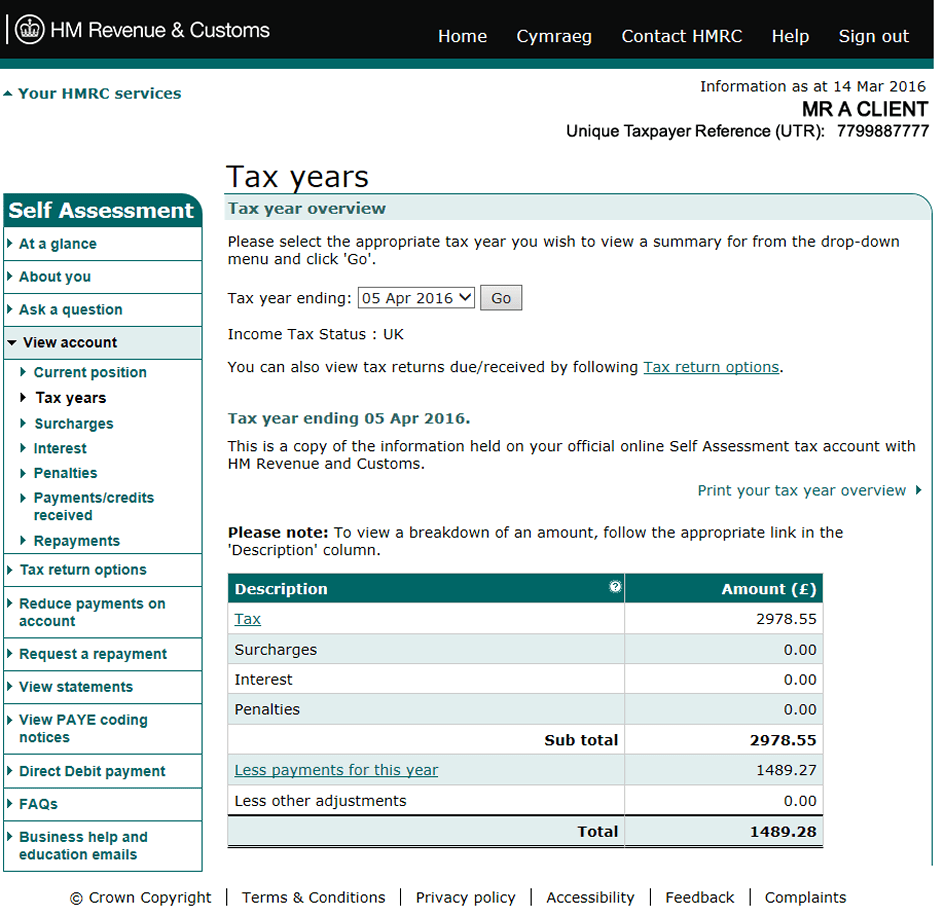

How To Print Your Tax Calculations Better co uk formerly Trussle

https://images.ctfassets.net/bed00l8ra6lf/1c8O9gTiS0yPCj2IORQRha/83df0441e65fdafc9ed02bc52c484409/7._FC_tyoprintyourtaxyo.png

Tax Rates 2023 24 updated for Autumn Statement 2023 Class 1 NICs announcement on 22 November 2023 Download The 2022 23 tax calculator provides a full payroll salary and tax calculations for the 2022 23 tax year including employers NIC payments P60 analysis Salary Sacrifice

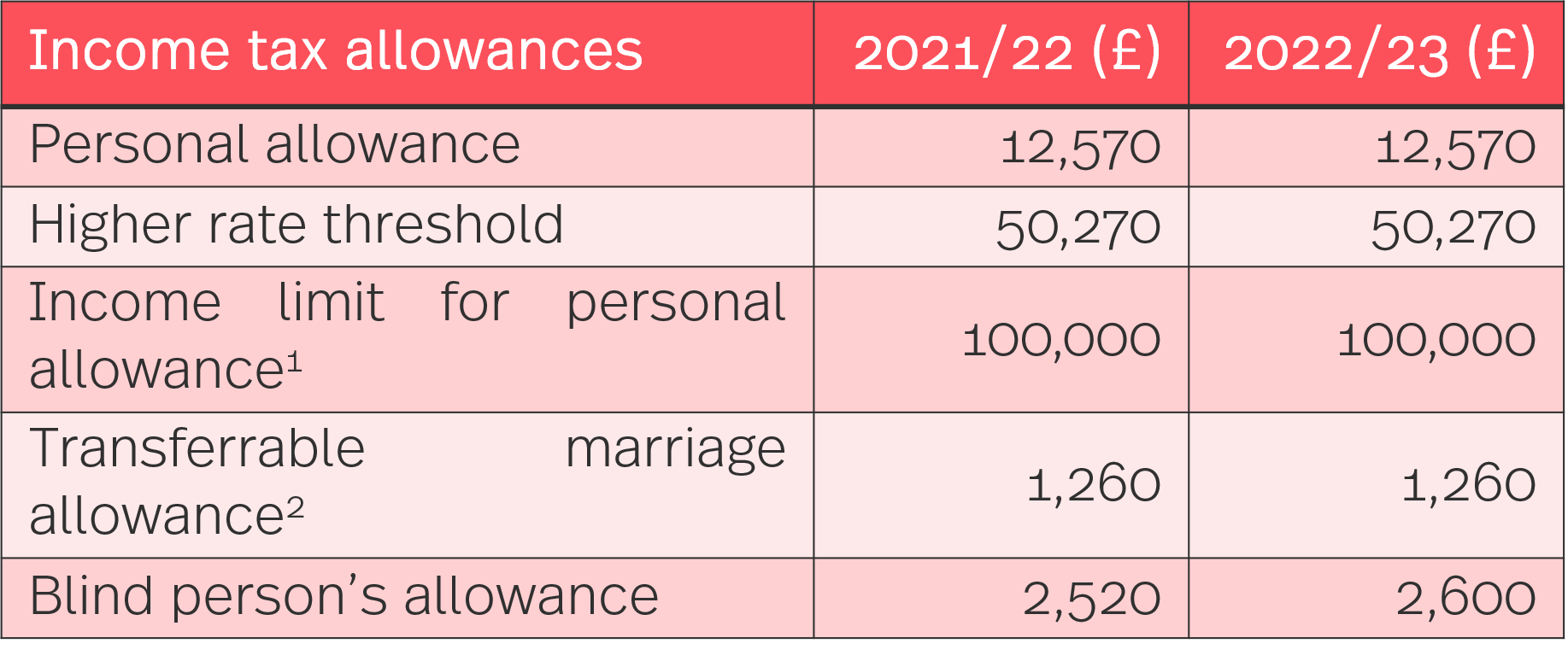

A summary of key tax rates and allowances for 2022 23 and 2021 22 Tax rate tables for 2022 23 including income tax pensions annual investment limits national insurance contributions vehicle benefits and other tax rates

Set Sales Tax Rates In The TSYS Mobile App Talus Pay

https://theme.zdassets.com/theme_assets/1867027/13f2ebb84fa5f64995493792818211d4e095edf3.png

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt052283fe5234fa4f/6179a949412fb409f16bfc24/Autumn_budget_table_3.png

https://www.gov.uk/guidance/rates-and-thresholds...

Use these rates and thresholds when you operate your payroll or provide expenses and benefits to your employees

https://www.gov.uk/government/publications/rates...

Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Set Sales Tax Rates In The TSYS Mobile App Talus Pay

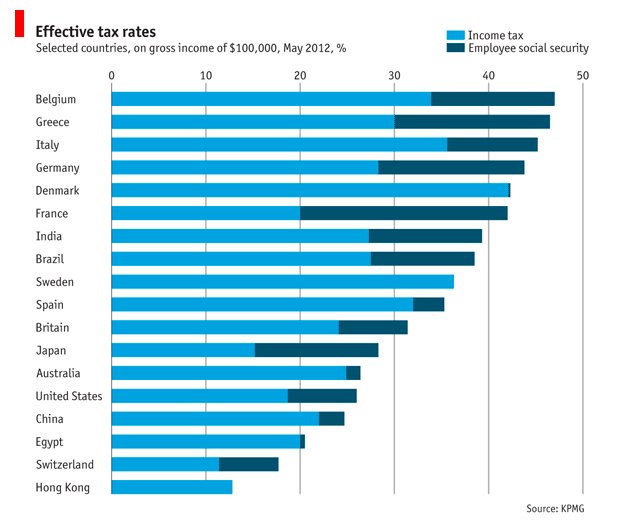

Thinking Aboot Effective Tax Rates

Add Tax Rates OfficeRnD Help

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

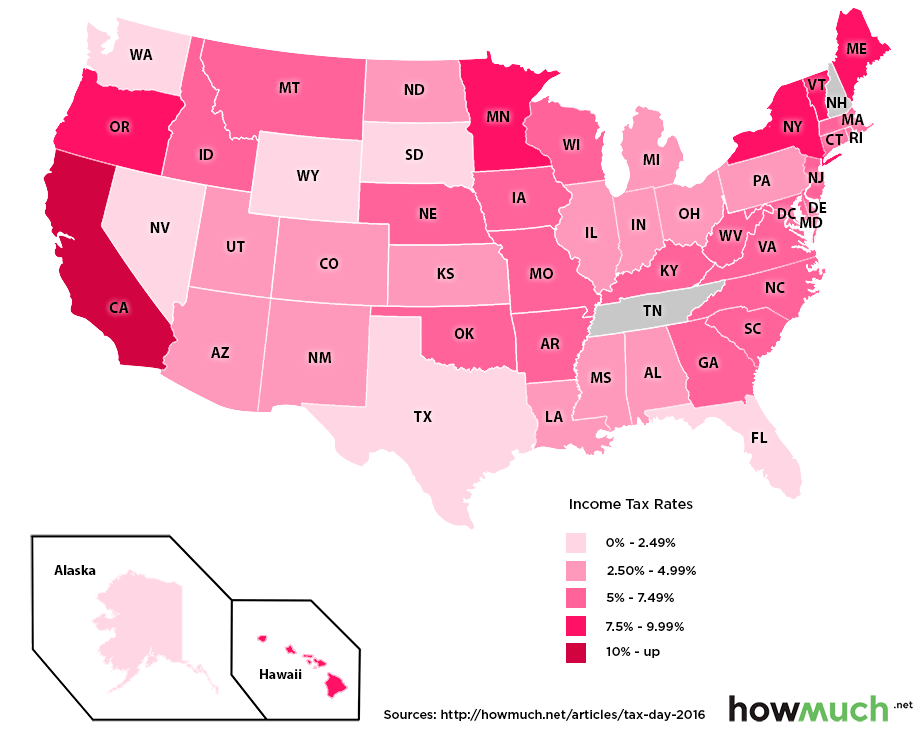

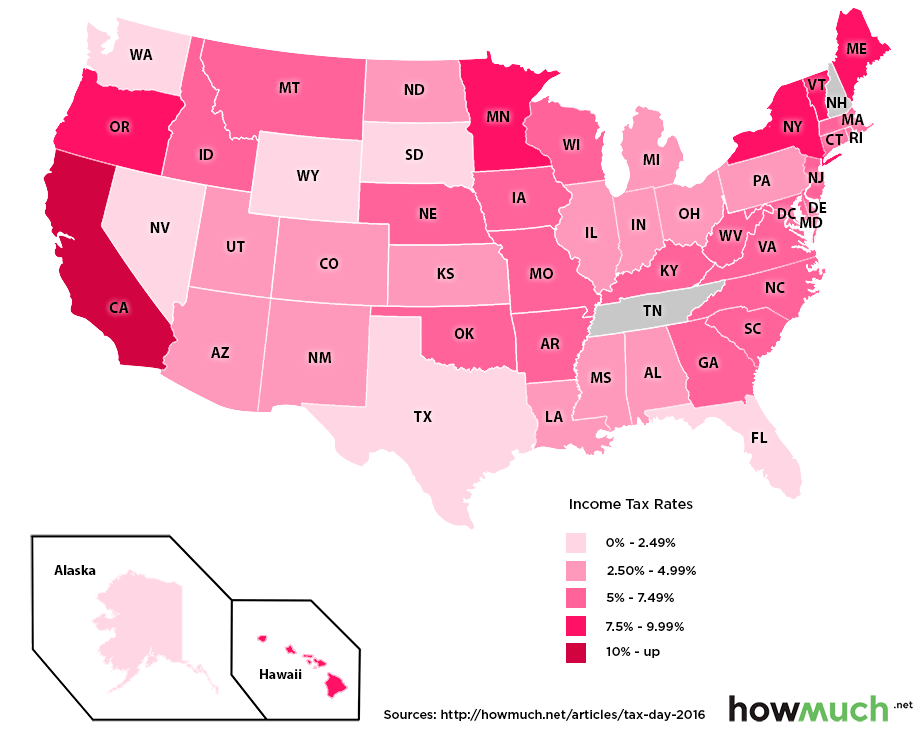

States With The Lowest Income Tax Rates

States With The Lowest Income Tax Rates

Income Tax 2022 23 Slab Bed Frames Ideas

2020 21 Tax Card

How To Obtain Your Tax Calculations And Tax Year Overviews

Tax Rates 22 23 Hmrc - In 2022 23 the rate of primary Class 1 NICs for employees charged on their earnings the rate of secondary Class 1 NICs for employers charged on their employees earnings