Tax Rebate 2024 Az 2023 Arizona Families Tax Rebate You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income Note that the rebate is not subject to Arizona income tax and should be subtracted from your federal adjusted gross income on your 2023 Arizona individual income tax return ADOR will provide taxpayers with Form 1099 MISC online on and after January 31 2024 by visiting azdor gov arizona families tax rebate and clicking on View my 1099 MISC

Tax Rebate 2024 Az

Tax Rebate 2024 Az

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Jan 26 2024 10 31 AM The Arizona Families Tax Rebate is not subject to state income tax so the amount should be subtracted from the federal adjusted gross income on state tax forms More than 700 000 families were eligible for this tax credit for roughly 250 per child up to three kids for a maximum rebate of around 750 How much of that will now go to taxes That depends

Last year Arizona lawmakers passed legislation cutting the state s income tax rate to a flat rate of 2 5 from 2 98 The new Arizona flat personal income tax rate wasn t expected until IRS Arizona families that got tax rebate owe US taxes on it Howard Fischer Jan 16 2024 Jan 16 2024 Updated This Tucson neighborhood is a top place to go in 2024 Conde Nast Traveler says

Download Tax Rebate 2024 Az

More picture related to Tax Rebate 2024 Az

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

The announcement comes over five months after the Arizona Families Tax Rebate was signed into law as part of the Fiscal Year 2024 state budget Hobbs calls the rebate the first of its kind saying A 750 rebate could carry a tax of 165 for filers in the 22 federal tax bracket That bracket applies to married couples who file jointly and earned between 89 451 and 190 750 in 2023

What is the Arizona Families Tax Rebate On Oct 31 2023 Governor Katie Hobbs announced the tax rebate which involved a one time payment of up to 750 for those eligible According to ADOR Many Arizona families will soon pocket a tax rebate of up to 750 courtesy of the Arizona Legislature The rebate carved out of the state s 2 5 billion surplus was aimed at parents of

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Michigan-Tax-Rebate-2023-768x675.png

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

https://www.the-sun.com/wp-content/uploads/sites/6/2022/04/kc-gov-little-comp.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

https://familyrebate.aztaxes.gov/

2023 Arizona Families Tax Rebate You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required

https://azdor.gov/news-center/arizona-families-rebate-recipients-will-need-report-rebate-income-tax-returns

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income

Georgia Income Tax Rebate 2023 Printable Rebate Form

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Illinois Ev Tax Rebate 2023 Tax Rebate

How To Increase The Chances Of Getting A Tax Refund CherishSisters

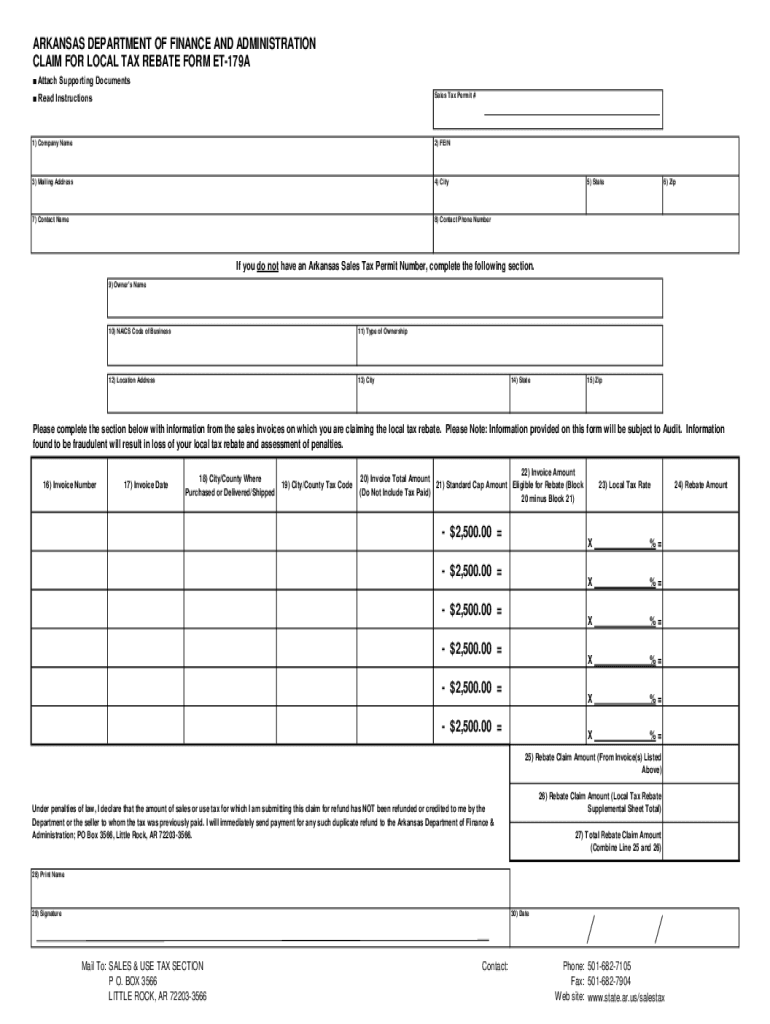

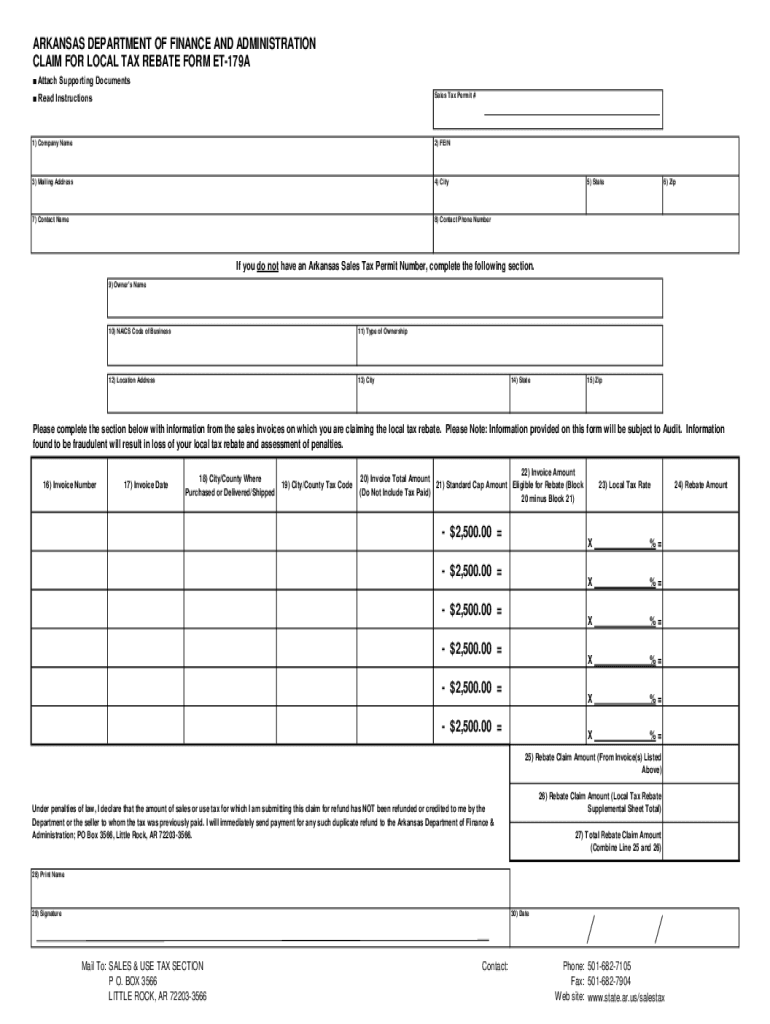

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Income Tax Rebate Under Section 87A

Tax Rebate Services Find Out If You re Due A Tax Refund

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Tax Rebate 2024 Az - The Center Square Those who received a tax rebate from the Arizona government in 2023 will have to pay federal taxes on the money Qualifying Arizona families received a tax rebate starting on Oct 30 2023 with 250 for each dependent under 17 and 100 each for dependent adults but the total went no higher than 750 for any family The Center Square reported at the time