Tax Rebate 2024 Georgia Georgia House speaker to make major tax announcement A major tax announcement is expected at the State Capitol at 1 p m Wednesday WANF ATLANTA Ga Atlanta News First Georgia legislative leaders are expected to make what they call a major tax announcement at the State Capitol on Wednesday

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to It includes applicable withholding tax tables basic definitions answers to frequently asked questions and references to applicable sections of Title 48 of the Official Code of Georgia Annotated O C G A which govern withholding tax requirements Additional information concerning withholding tax is available at

Tax Rebate 2024 Georgia

Tax Rebate 2024 Georgia

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

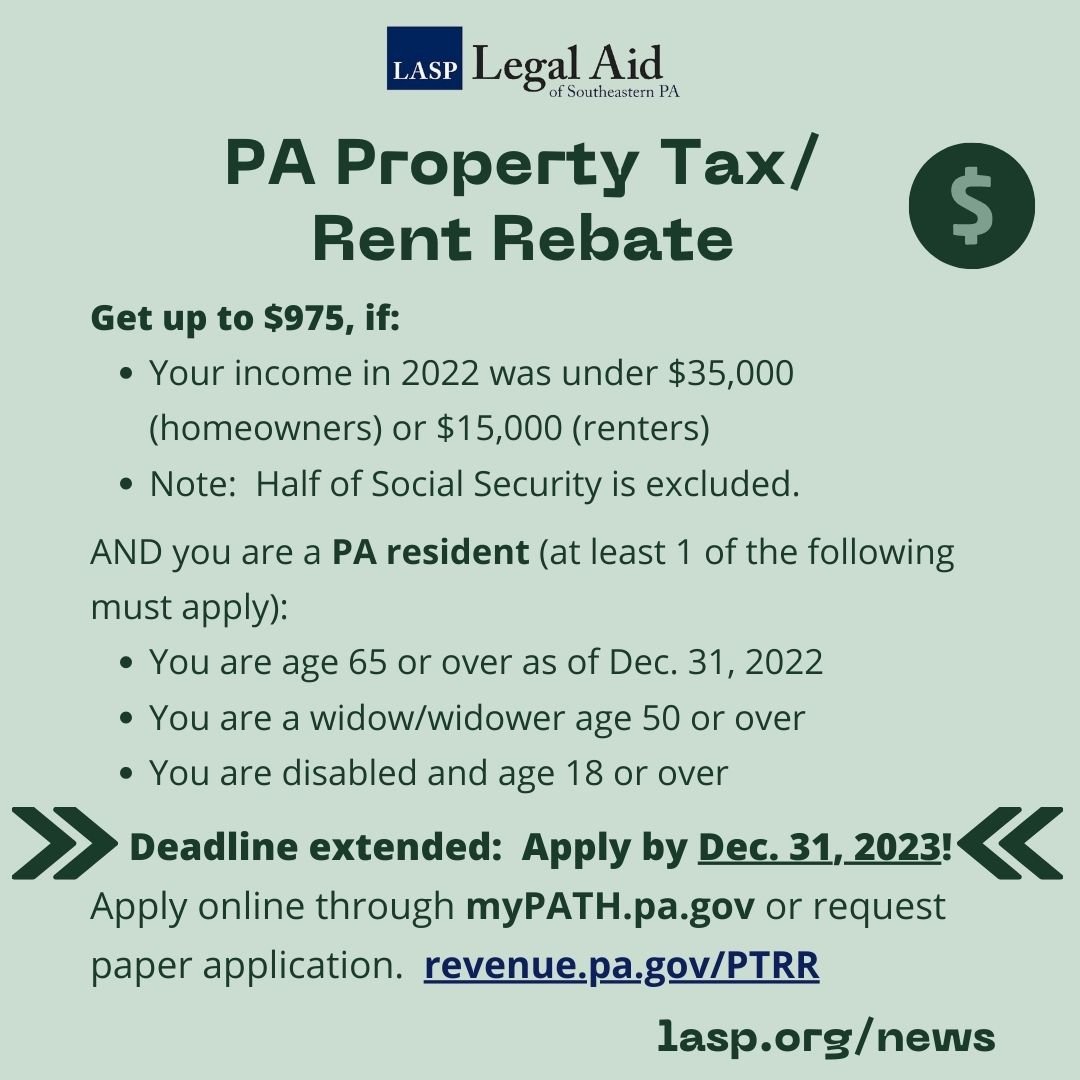

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

As of Monday the new year brought in a new tax rate lowered from an income tax of 5 75 to 5 49 Gov Brian Kemp wants that income tax level to go even lower to 5 39 for state residents By accelerating the reduction the rate for Tax Year 2024 will be 5 39 percent rather than the 5 49 percent set by HB 1437 This will mark a cut of 36 basis points from the Tax Year 2023 rate of 5 75 percent

If legislators agree the tax rate for 2024 would be set at 5 39 on the General Assembly to speed up the tax cut by moving the 5 39 state income tax rate due to take effect in 2025 to 2024 Georgia can easily afford accelerating the tax relief The state has built up a surplus of 16 billion during the last few years including 11 Gov Brian Kemp signs bill to reduce Georgia income tax starting in 2024 Dave Williams Capitol Beat News Service 0 00 0 59 ATLANTA Gov Brian Kemp signed the largest tax cut in Georgia history Tuesday legislation he said when fully implemented will save a family of four with an annual household income of 60 000 more than 600 a year

Download Tax Rebate 2024 Georgia

More picture related to Tax Rebate 2024 Georgia

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Georgia Tax Rebate Schedule When Can You Expect Your Refund Marca

https://phantom-marca.unidadeditorial.es/833ac641bd0aded8e3724f763ee84d4d/resize/1200/f/jpg/assets/multimedia/imagenes/2022/04/04/16490645502029.jpg

Published 8 04 AM PST February 24 2022 ATLANTA AP Gov Brian Kemp s plan to pay 1 6 billion worth of state income tax refunds is advancing with lawmakers looking to help the Republican governor fulfill his promise to give some of Georgia s historic surplus back to taxpayers as both Kemp and legislators seek reelection On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Georgia s income tax currently has a series of brackets that top out at 5 75 on earned income above 7 000 a year That s already scheduled to change Jan 1 to a flat income tax rate of 5 49 under a 2022 law After that if state revenues hold up the rate is supposed to drop 0 1 per year until reaching 4 99 Form 501 NOL New Schedule 7 Beginning in tax year 2023 the Net Operating loss is included in the Form 501 501X as Schedule 7 The standalone form 501 NOL should only be used for years prior to 2023 Passive Loss Capital Deduction Update A new line was added to Schedule 1 Computation of Georgia Taxable Income for this type of deduction

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://www.atlantanewsfirst.com/2024/01/24/georgia-house-speaker-make-major-tax-announcement/

Georgia House speaker to make major tax announcement A major tax announcement is expected at the State Capitol at 1 p m Wednesday WANF ATLANTA Ga Atlanta News First Georgia legislative leaders are expected to make what they call a major tax announcement at the State Capitol on Wednesday

https://www.kiplinger.com/taxes/state-stimulus-checks

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

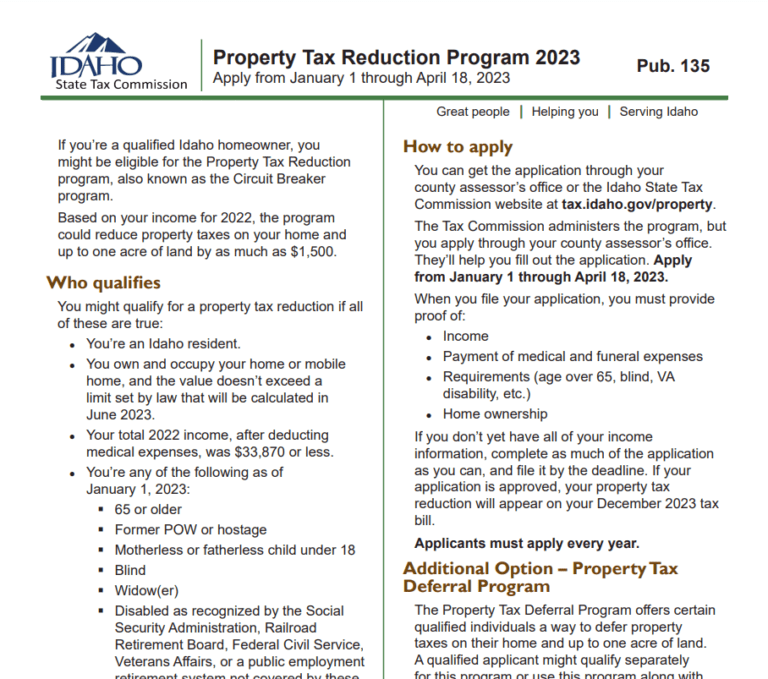

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money Printable Rebate Form

Missouri State Tax Rebate 2023 Printable Rebate Form

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Tax Rebate 2024 Georgia - Gov Brian Kemp signs bill to reduce Georgia income tax starting in 2024 Dave Williams Capitol Beat News Service 0 00 0 59 ATLANTA Gov Brian Kemp signed the largest tax cut in Georgia history Tuesday legislation he said when fully implemented will save a family of four with an annual household income of 60 000 more than 600 a year