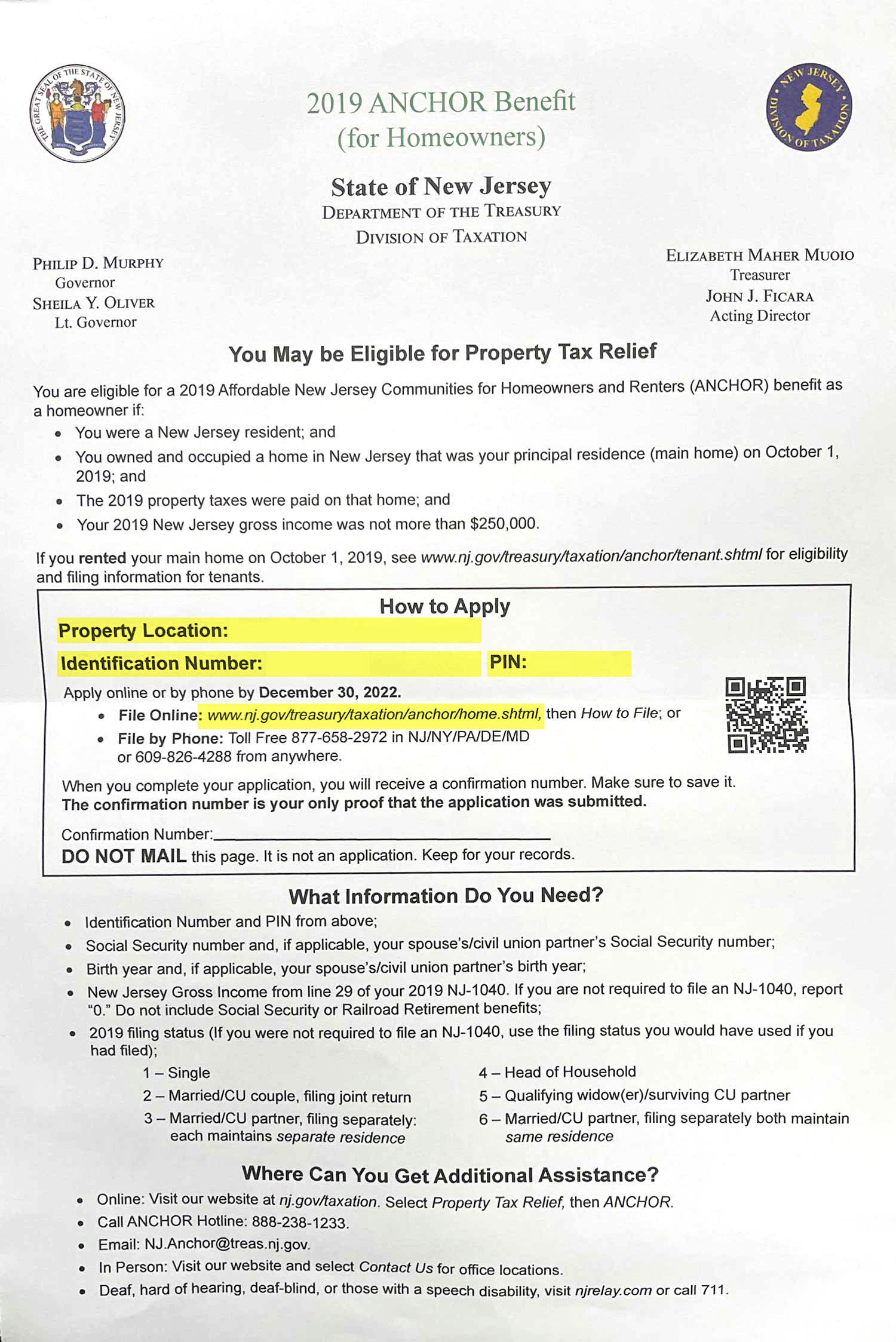

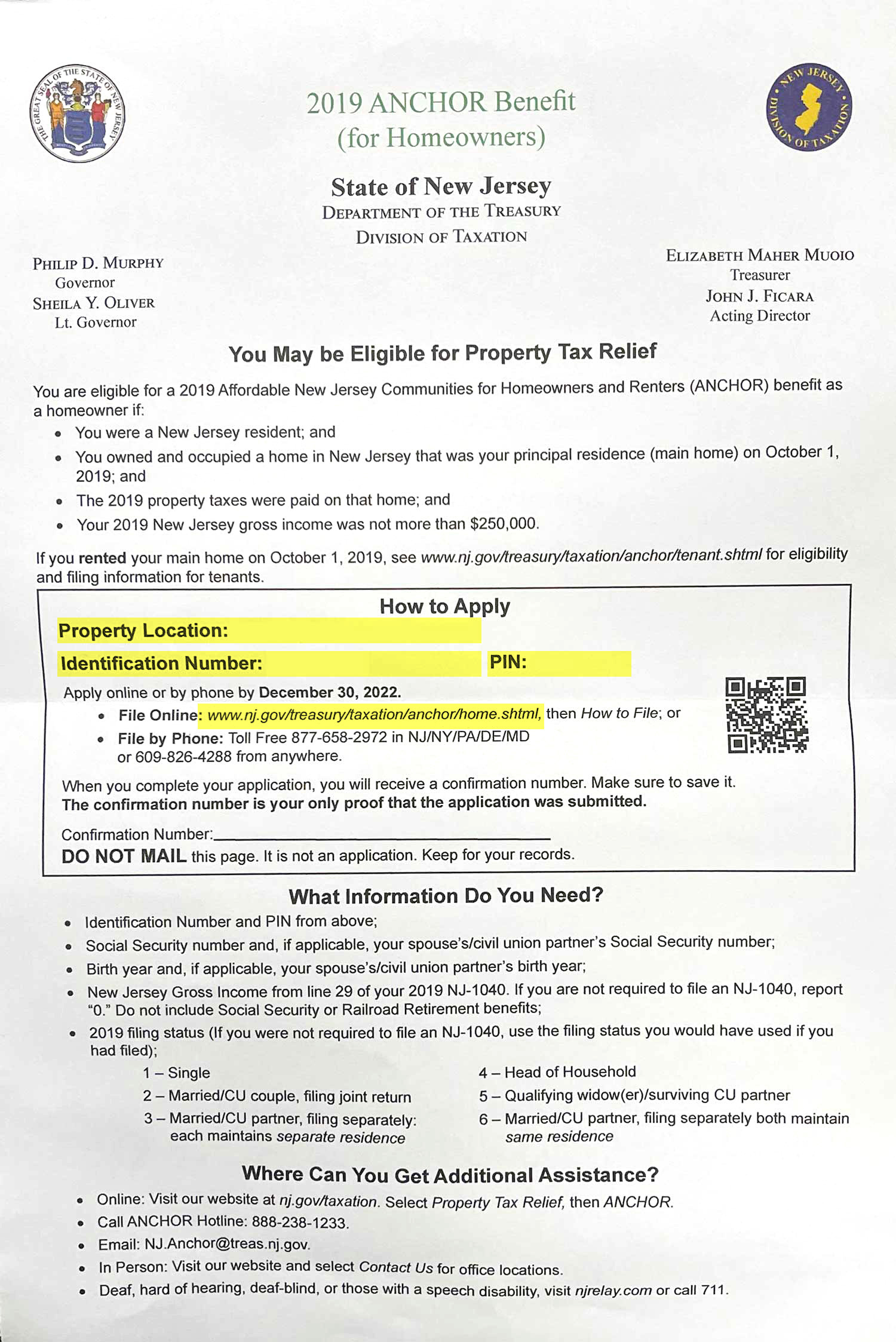

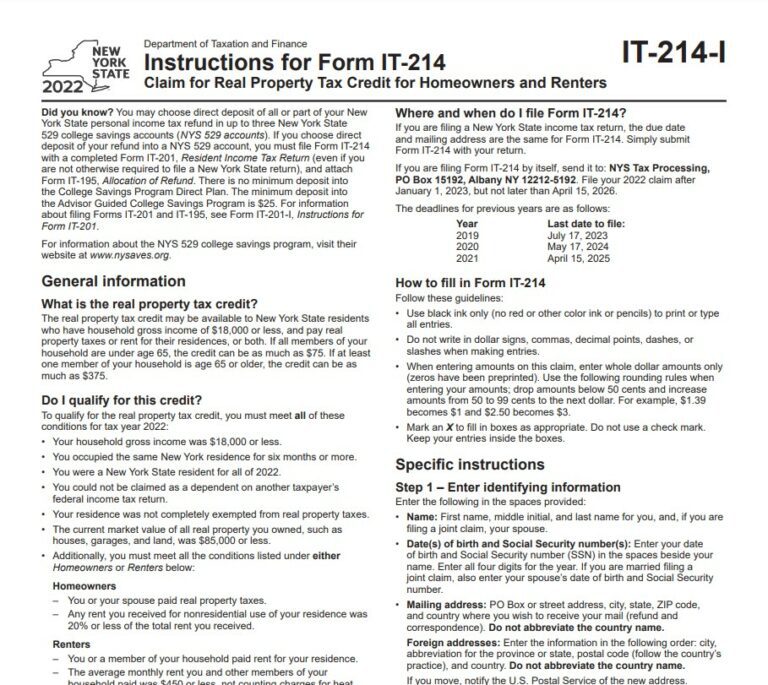

Tax Rebate 2024 New York Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

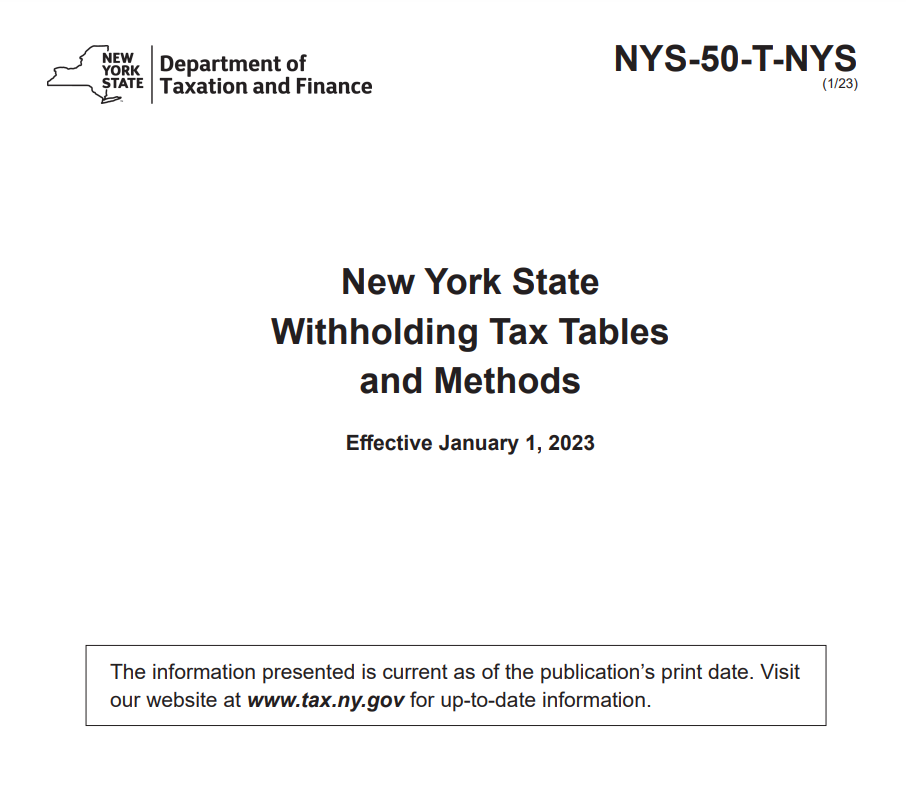

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either View Powers and Duties under New York State Law Jan 22 2024 Audit Report on the New York City Department of Transportation s Jan 17 2024 for the third payment even if they received a first or second Economic Impact Payment or claimed a 2020 Recovery Rebate Credit

Tax Rebate 2024 New York

Tax Rebate 2024 New York

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Setting your 2024 New Year s resolutions We ve got one that ll help you keep more money in your pocket throughout the new year review and update your Form IT 2104 Employee s Withholding Allowance Certificate instructions Form IT 2104 is one of the forms your employer asks you to complete when you begin a new job in New York State The Tax Relief for American Families and Workers Act of 2024 aims to provide tax relief to American families workers and businesses Under the new legislation businesses will need to file these forms for payments made after December 31 2023 exceeding 1 000 instead of the previous threshold of 600

The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns the Governor accelerated the distribution of 2 2 billion in tax relief to more than 2 million New Yorkers Modified the Investment Tax Credit for certain farmers and new business owners into a refundable credit for five years and repealed the transferability of the credit Extension and Enhancement of the Film Tax Credit New York State will raise the film tax credit s annual cap to 700 million and restore the credit to 30 for qualified expenses

Download Tax Rebate 2024 New York

More picture related to Tax Rebate 2024 New York

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

The plan will also accelerate the implementation of 1 2 billion in New York s existing Middle Class Tax Cut for 6 million New Yorkers which first began to be implemented in 2018 and establish a 1 billion property tax rebate program to put money back into the pockets of more than 2 million New Yorkers who have had to endure rising costs as Strategic Operating Plan In 2024 we re launching a new pilot tax filing service called Direct File If you re eligible and choose to participate file your 2023 federal tax return online for free directly with IRS It will be rolled out in phases and is expected to be more widely available in mid March

Note Are you wondering why you received a property tax rebate check from New York State last year You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

New York Tax Rebate 2023 All You Need To Know Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/04/New-York-Tax-Rebate-2023.png

https://www.newsweek.com/will-there-new-stimulus-payment-2024-rebate-1856477

Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

https://www.tax.ny.gov/star/

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

New York Issued 2 1 Million Property Tax Rebate Checks In Late Summer And Early Fall Saying It

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Property Tax Rebate New York State Printable Rebate Form

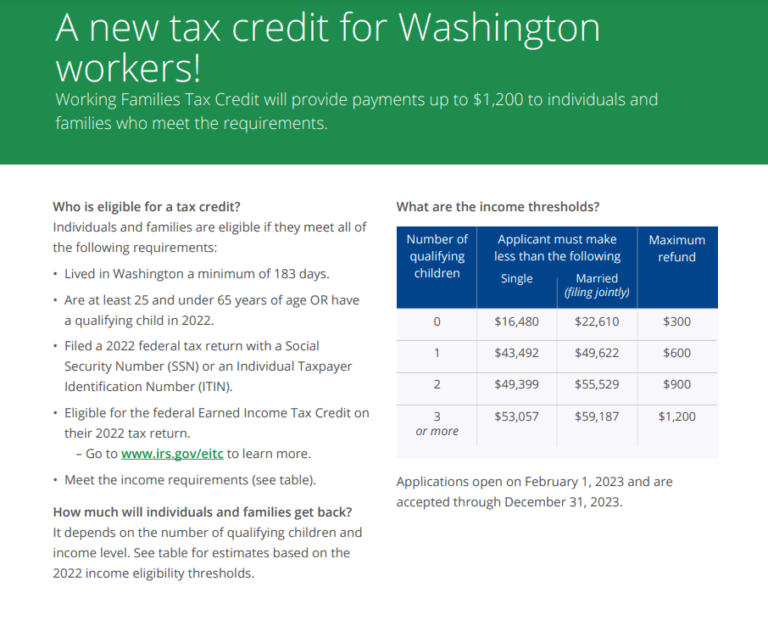

Understanding The Washington Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

BUDGET 2023 New Reforms In Tax Rebate Leaving You Confused Check This Out

BUDGET 2023 New Reforms In Tax Rebate Leaving You Confused Check This Out

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Georgia Income Tax Rebate 2023 Printable Rebate Form

New Income Tax Regime Will Be Default Citizens Union Budget 2023 Live Updates Income

Tax Rebate 2024 New York - Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come