Tax Rebate 2024 Status Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

January 24 2024 5 00 AM EST CBS News Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax refund check Understanding the Tax Relief for American Families and Workers Act of 2024 Thomson Reuters Tax Accounting January 22 2024 5 minute read On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 Jump to Enhanced Child Tax Credit

Tax Rebate 2024 Status

Tax Rebate 2024 Status

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

If you e file your return you can usually see your refund status after about 48 hours with Where s My Refund You can get your refund information for the current year and past 2 years Check your refund Check your refund on an amended return Amended returns take up to 3 weeks to show up in our system and up to 16 weeks to process If the IRS Accepts an E Filed Return By Then Direct Deposit refund may be sent as early as 10 days after e file received Paper check mailed sent apx 1 week after that IRS may start

The Tax Relief for American Families and Workers Act of 2024 Part 1 Tax Relief for Working Families Calculation of Refundable Credit on a Per Child Basis Under current law the maximum refundable child tax credit for a taxpayer is computed by multiplying that taxpayer s earned income in excess of 2 500 by 15 percent New Mexico New Mexico taxpayers could see a rebate check of up to 1 000 this year The payment will go out to everyone who has filed their 2021 tax return by May 31 2024 and has not been

Download Tax Rebate 2024 Status

More picture related to Tax Rebate 2024 Status

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Visit us to learn about your tax responsibilities check your refund status and use our online services anywhere any time If your refund status says we sent you a letter requesting additional information The 2024 Tax Preparer and Facilitator Registration application is now available Tax Day is Apr 15 2024 for most taxpayers Taxpayers in Maine or Massachusetts have until Apr 17 2024 due to the Patriot s Day and Emancipation Day holidays Taxpayers living in a federally

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to If you have a personal finance question for Washington Post columnist Michelle Singletary please call 1 855 ASK POST 1 855 275 7678 Last year that came to 3 167 on average The 2024 tax

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

https://images.ctfassets.net/ifu905unnj2g/5KwPoo8zZu1ZPIrfn2FdSo/94bf8ce97dc0bc624b3626de0e452578/Screenshot_110422_105531_AM.jpg

https://taxfoundation.org/blog/bipartisan-tax-deal-2024-tax-relief-american-families-workers-act/

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

January 24 2024 5 00 AM EST CBS News Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax refund check

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Georgia Income Tax Rebate 2023 Printable Rebate Form

How To Increase The Chances Of Getting A Tax Refund CherishSisters

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Income Tax Rebate Under Section 87A

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax Calculation Examples FinCalC TV

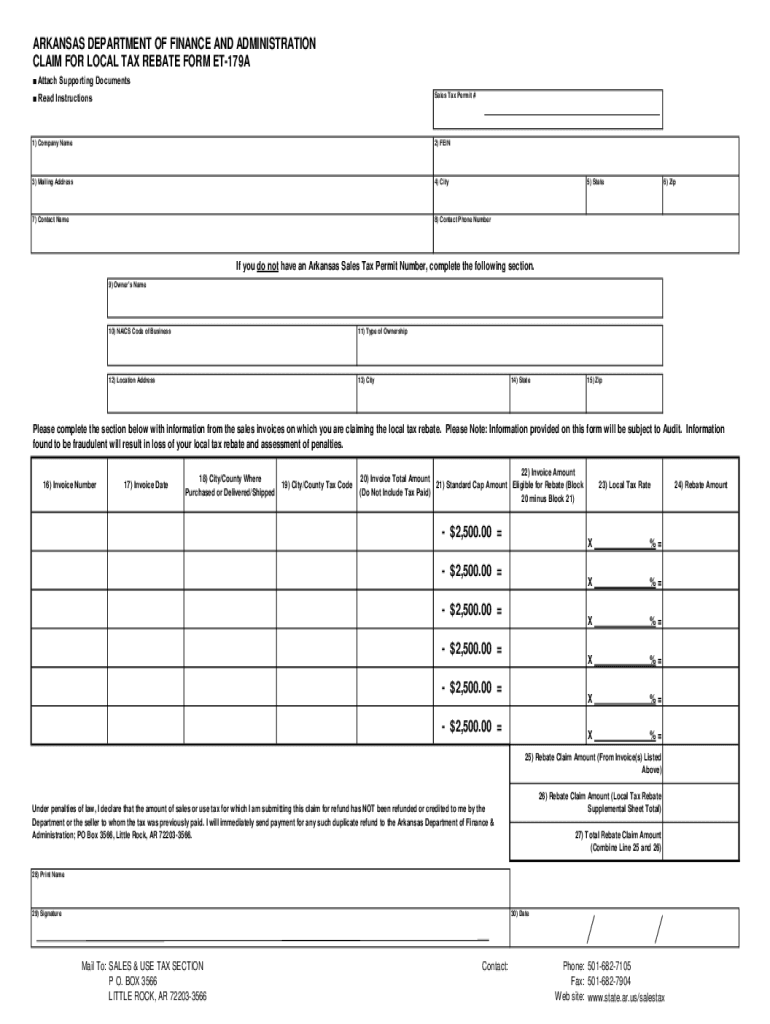

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Tax Rebate 2024 Status - If the IRS Accepts an E Filed Return By Then Direct Deposit refund may be sent as early as 10 days after e file received Paper check mailed sent apx 1 week after that IRS may start