Tax Rebate 2024 Tennessee TN 2023 06 The Internal Revenue Service announced today tax relief for individuals and businesses in parts of Tennessee affected by severe storms and tornadoes that began on Dec 9 These taxpayers now have until June 17 2024 to file various federal individual and business tax returns and make tax payments

Image credit Getty Images Jump to category Alabama Rebate Checks Arizona Family Rebates California Stimulus Colorado TABOR Refunds Georgia Tax Rebates Maine Energy Relief Payments IR 2023 250 Dec 22 2023 WASHINGTON The Internal Revenue Service today provided tax relief for individuals and businesses in parts of Tennessee affected by severe storms and tornadoes that began on Dec 9 These taxpayers now have until June 17 2024 to file various federal individual and business tax returns and make tax payments

Tax Rebate 2024 Tennessee

Tax Rebate 2024 Tennessee

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

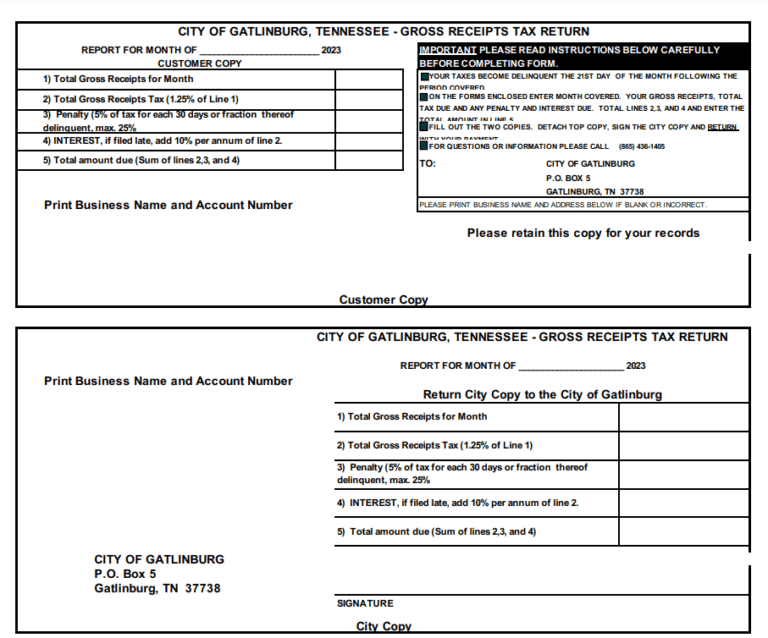

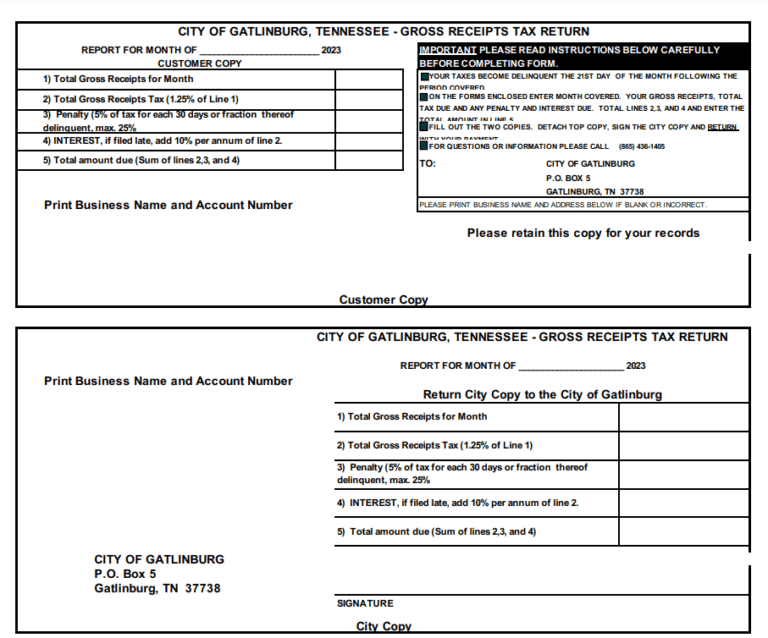

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief Request a Refund Get My Tax Questions Answered Legislation Among Largest Tax Cuts in Tennessee History Tax Webinar 1 30 TN Business Tax Basics Click here for more information 2 15 2024 Business Tax Due Date Annual filers with Fiscal YE 10 31 2023 2 15 2024 Franchise Excise Tax Due Date Annual filers with Fiscal YE 10

Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP Up to 50 percent of your benefits will be taxed if you file an individual tax return and make 25 000 to 34 000 in total income or if you file jointly and as a couple make 32 000 to 44 000 in total income

Download Tax Rebate 2024 Tennessee

More picture related to Tax Rebate 2024 Tennessee

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

The 2024 tax season begins Jan 29 according to the IRS The federal agency will begin accepting and processing tax returns that day When are 2023 taxes due in 2024 a In general Paragraph 6 of section 24 h of the Internal Revenue Code of 1986 is amended 1 by striking credit Subsection and inserting credit A I N GENERAL Subsection and 2 by adding at the end the following new subparagraphs B R ULE FOR DETERMINATION OF EARNED INCOME i I N GENERAL In the case of a taxable year beginning after 2023

There is a maximum rebate of 14 000 per building with percentage caps varying by income and building type Tax Credits The federal federal allowance for Over 65 years of age Married Joint Filer in 2024 is 1 550 00 Tennessee Residents State Income Tax Tables for Married Joint Filers in 2024 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 10

Tennessee Tax Rebate 2023 A Comprehensive Guide PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/05/Tennessee-Tax-Rebate-2023-768x638.png

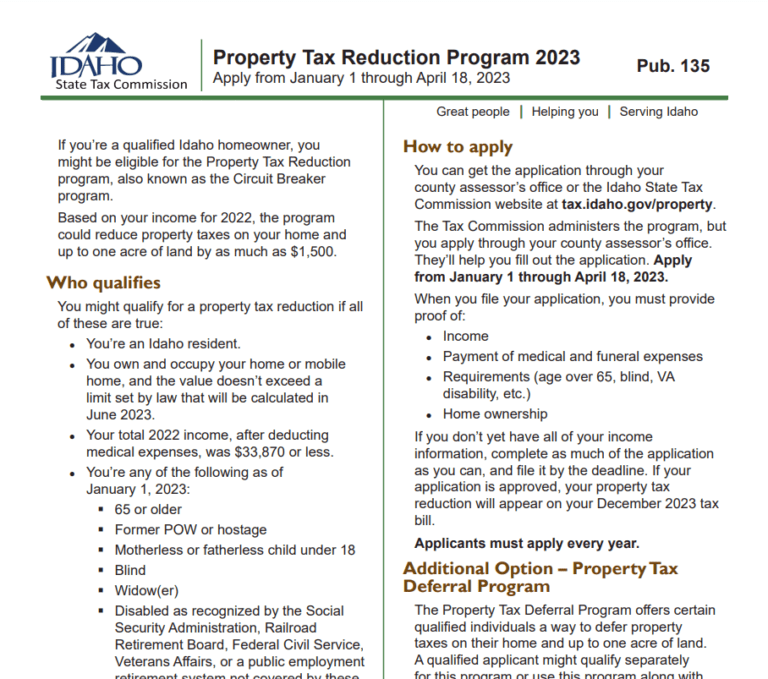

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-impacted-by-severe-storms-and-tornadoes-in-tennessee

TN 2023 06 The Internal Revenue Service announced today tax relief for individuals and businesses in parts of Tennessee affected by severe storms and tornadoes that began on Dec 9 These taxpayers now have until June 17 2024 to file various federal individual and business tax returns and make tax payments

https://www.kiplinger.com/taxes/state-stimulus-checks

Image credit Getty Images Jump to category Alabama Rebate Checks Arizona Family Rebates California Stimulus Colorado TABOR Refunds Georgia Tax Rebates Maine Energy Relief Payments

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Tennessee Tax Rebate 2023 A Comprehensive Guide PrintableRebateForm

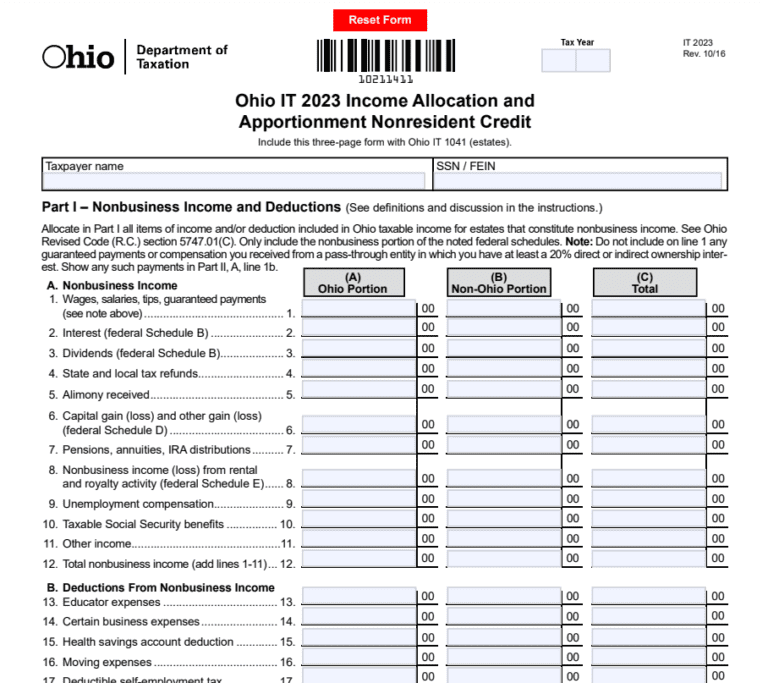

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

2023 Tax Rebate Ev Printable Rebate Form

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Georgia Income Tax Rebate 2023 Printable Rebate Form

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

Tax Rebate 2024 Tennessee - Request a Refund Get My Tax Questions Answered Legislation Among Largest Tax Cuts in Tennessee History Tax Webinar 1 30 TN Business Tax Basics Click here for more information 2 15 2024 Business Tax Due Date Annual filers with Fiscal YE 10 31 2023 2 15 2024 Franchise Excise Tax Due Date Annual filers with Fiscal YE 10