Tax Rebate 2024 Wisconsin Electronic filing for Wisconsin individual income tax returns and homestead credit claims will be available on January 29 2024 when the IRS begins accepting electronically filed returns Links to electronic forms will not be active until filing opens Individual Income Tax News Subscribe to E News Calendar

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both

Tax Rebate 2024 Wisconsin

Tax Rebate 2024 Wisconsin

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

You can quickly estimate your Wisconsin State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Wisconsin and for quickly estimating your tax commitments in 2024 Wisconsin State Tax Guide What You ll Pay in 2024 Wisconsin has one of the highest average property tax rates in the country but also one of the lowest average sales tax rates For older residents Wisconsin offers several benefits most notably the state does not tax Social Security The big picture Income tax 3 5 percent to 7 65 percent

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax Wisconsin Department of Revenue 2024 Individual Income Tax Forms wisconsin gov Agency Directory Visit the Prior Year Income Tax Forms webpage

Download Tax Rebate 2024 Wisconsin

More picture related to Tax Rebate 2024 Wisconsin

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Right now single filers who make between 14 320 and 28 640 and married joint filers who make between 19 090 to 38 190 fall in the second bracket That means they face a 4 4 tax rate Singles Wisconsin s second tax bracket would be dramatically expanded to cover a wide swath of earners under a package of bills Republicans proposed Tuesday including one that would also exempt up to 75 000 in retirement income from state taxes The proposals would reduce the state s total income tax revenue by 2 billion per year in fiscal 2024 25

January 24 2024 5 00 AM EST CBS News Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax refund check The federal federal allowance for Over 65 years of age Married separate Filer in 2024 is 1 550 00 Federal Head of Household Filer Tax Tables The federal standard deduction for a Head of Household Filer in 2024 is 21 900 00 The federal federal allowance for Over 65 years of age Head of Household Filer in 2024 is 1 550 00

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

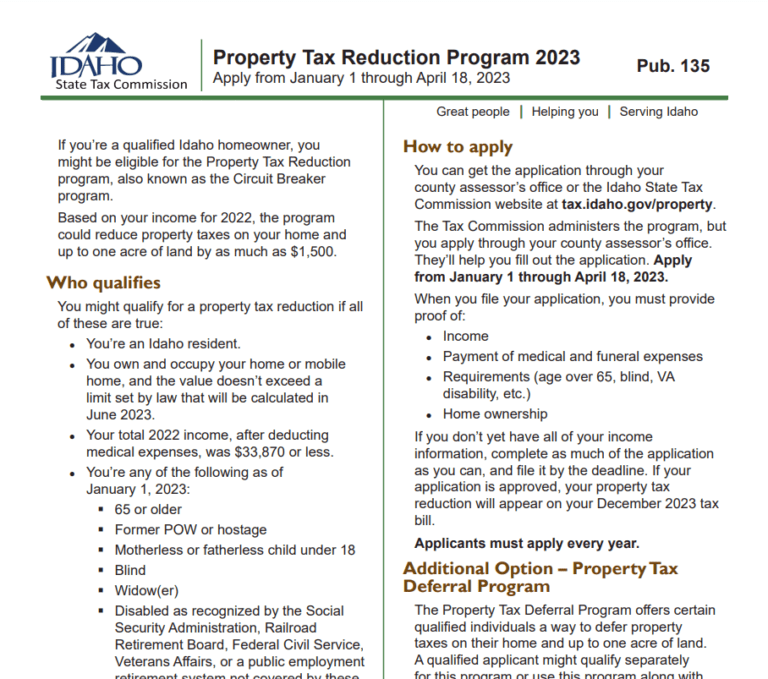

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

https://www.revenue.wi.gov/Pages/WisTax/home.aspx

Electronic filing for Wisconsin individual income tax returns and homestead credit claims will be available on January 29 2024 when the IRS begins accepting electronically filed returns Links to electronic forms will not be active until filing opens Individual Income Tax News Subscribe to E News Calendar

https://www.kiplinger.com/taxes/state-stimulus-checks

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

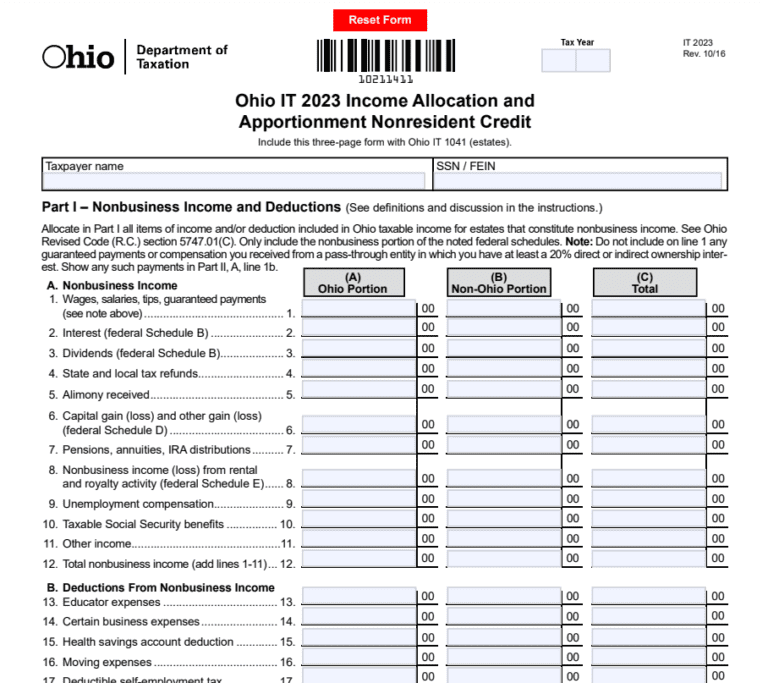

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Georgia Income Tax Rebate 2023 Printable Rebate Form

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Illinois Ev Tax Rebate 2023 Tax Rebate

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

Tax Rebate 2024 Wisconsin - 2024 Rebates for Heating and Cooling Equipment 2024 Wisconsin Focus on Energy TAS 2104 0124 Considering a federal tax credit Look for a unit that meets the above requirements and also includes a capacity ratio of either 58 at 17 F 47 F or 70 at 5 F 47 F