Tax Rebate 2024 Working From Home Georgie Frost Editor at large Updated October 19 2023 Important information Tax treatment depends on your individual circumstances and may be

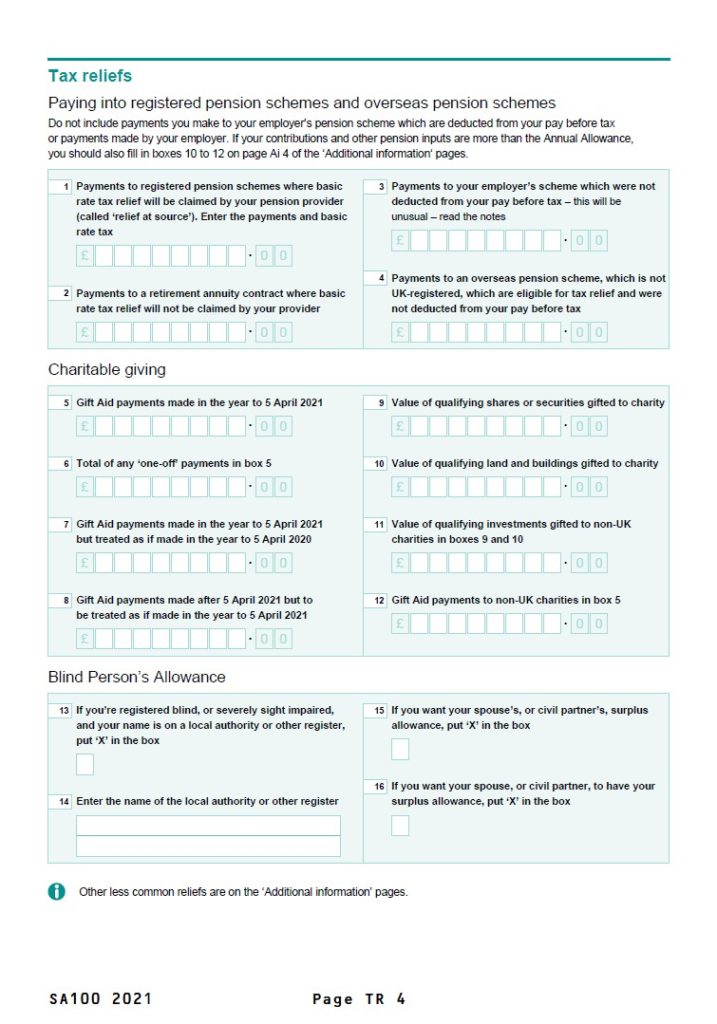

If you re self employed If you work from home rather than from a business premises you can either add work related expenses when you file your 2022 23 tax return or you may be able to claim by using 13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000

Tax Rebate 2024 Working From Home

Tax Rebate 2024 Working From Home

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Rupert Jones Sat 14 May 2022 04 00 EDT A popular tax break for working from home that gave many people s finances a small boost during the pandemic has become harder to claim and most Published 29 June 2021 Since April almost 800 000 employees who have been working from home during the pandemic have already claimed tax relief on household related

The amount that can be claimed is 6 per week 26 per calendar month or actual evidenced amounts incurred on electricity and gas relating to the work area For the 2020 21 and 2021 22 tax years HMRC specifically confirmed that claims from employees working at home due to coronavirus measures if their usual workplace was

Download Tax Rebate 2024 Working From Home

More picture related to Tax Rebate 2024 Working From Home

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Can You Still Claim Working from Home Tax Relief in 2024 Author Samuel Beckingham Updated Jan 01 2024 7 minutes read Criteria for claiming working from home tax relief How much work from Eligible employees who worked from home in 2023 will be required to use the detailed method to claim home office expenses The temporary flat rate method does

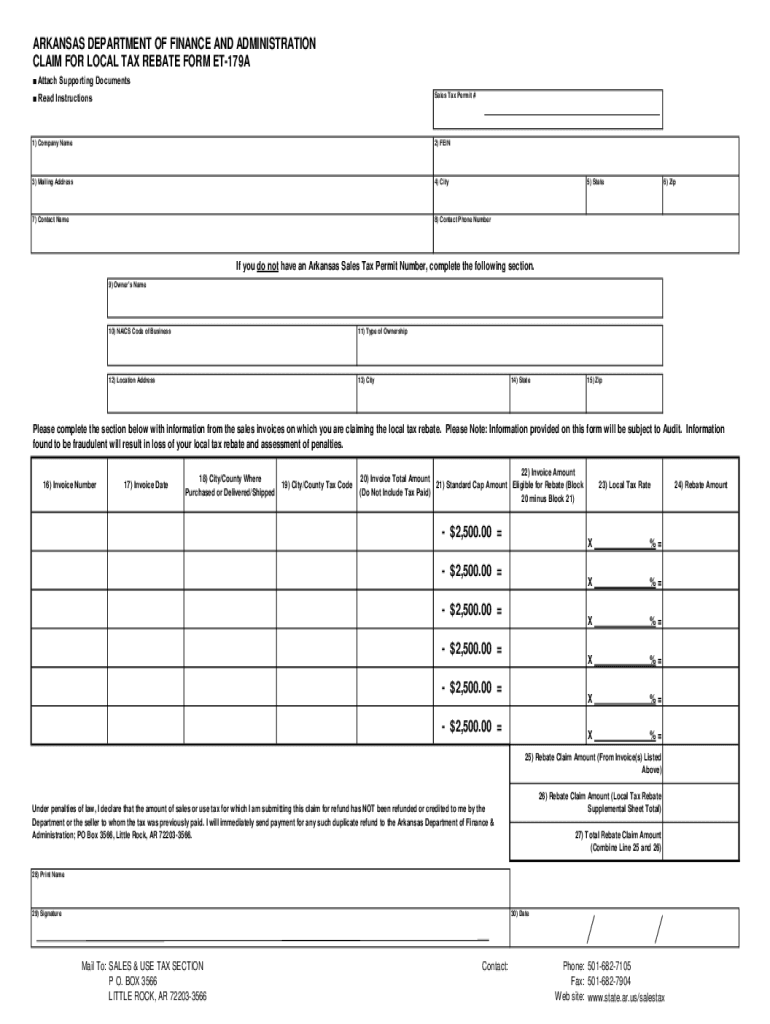

Steps Confirm you are eligible You must meet the eligibility criteria Detailed method to claim your home office expenses Fill in the applicable form Tip How to Claim Work From Home Deductions Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their

Tax Rebate Taxbuddi

https://taxbuddi.co.uk/public/uploads/pagecontent/4f649bd0904fe28dc9a2ec8f71e11cda.png

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

https://www.the-sun.com/wp-content/uploads/sites/6/2022/04/kc-gov-little-comp.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

https://www.thetimes.co.uk/money-mentor/income...

Georgie Frost Editor at large Updated October 19 2023 Important information Tax treatment depends on your individual circumstances and may be

https://www.which.co.uk/news/article/can-y…

If you re self employed If you work from home rather than from a business premises you can either add work related expenses when you file your 2022 23 tax return or you may be able to claim by using

Working From Home Tax Rebate Form PrintableRebateForm

Tax Rebate Taxbuddi

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Income Tax Rebate Under Section 87A

Homeowner Renters District 16 Democrats

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Working From Home Tax Rebate

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Tax Rebate 2024 Working From Home - If you re a regular employee working from home you can t deduct any of your related expenses on your tax return In the past you could claim an itemized deduction