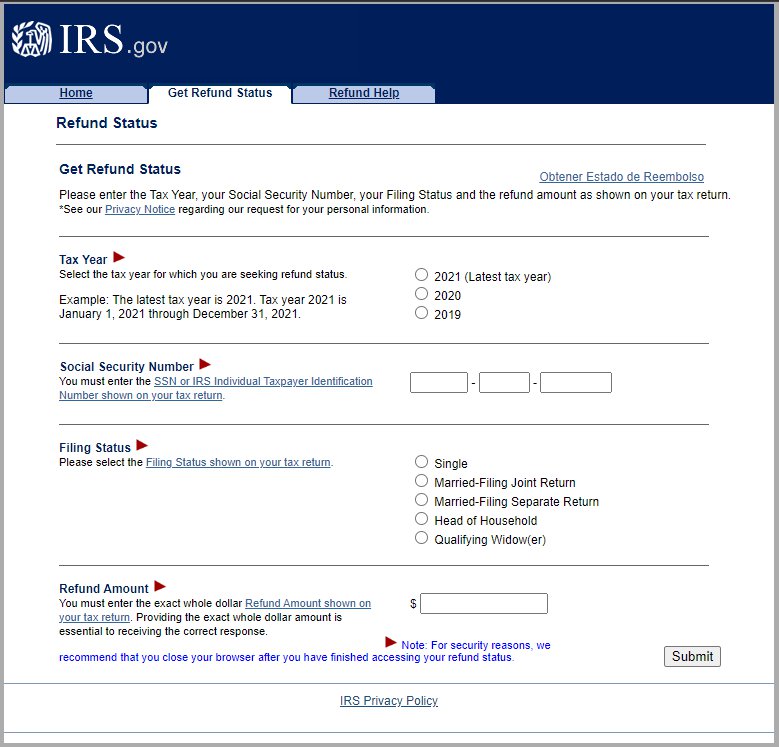

Tax Rebate Amount 2024 24 IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger

Tax Rebate Amount 2024 24

Tax Rebate Amount 2024 24

https://images.ctfassets.net/ifu905unnj2g/5KwPoo8zZu1ZPIrfn2FdSo/94bf8ce97dc0bc624b3626de0e452578/Screenshot_110422_105531_AM.jpg

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility The AMT exemption rate is also subject to inflation The AMT exemption amount for tax year 2024 for single filers is 85 700 and begins to phase out at 609 350 in 2023 the exemption amount for

The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Last quarterly payment for 2023 is due on Jan 16 2024 For the 2023 tax year the Earned Income Tax Credit EITC will increase to 7 430 for qualifying taxpayers who have three or more qualifying children a 495 gain from 6 935 for the 2022 tax year The IRS provides a table with the maximum EITC amount for other categories income thresholds and phase outs in its revenue procedure

Download Tax Rebate Amount 2024 24

More picture related to Tax Rebate Amount 2024 24

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

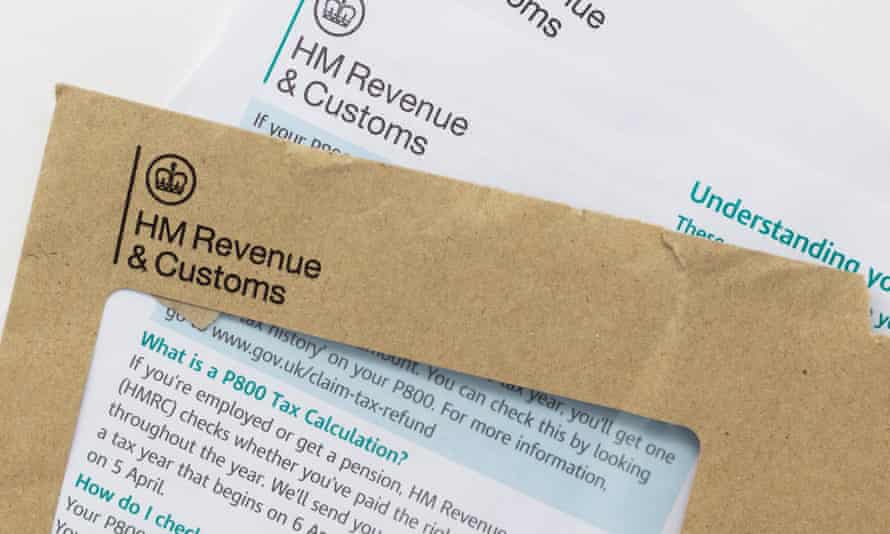

HMRC Paid My Tax Rebate Into Someone Else s Bank Account Consumer Affairs The Guardian

https://i.guim.co.uk/img/media/d6b4235d7c4d4e3715bcf9e3786605d2554b014b/575_1246_4591_2754/master/4591.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=86afad64dcb566da22db6377996e0dcd

Best Tax Rebate Calculator In UK 2022 Business Lug

https://businesslug.com/wp-content/uploads/2022/07/Tax-Rebate-Calculator.jpg

For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child

Estimate your 2023 refund taxes you file in 2024 with our tax calculator by answering simple questions about your life and income Terms of Service Loading tax calculator Be tax ready all year long with these free tax calculators TaxCaster Tax Calculator Estimate your tax refund and see where you stand I m a TurboTax customer I m a new user Tax Calculator Return Refund Estimator for 2023 2024 H R Block How to estimate your tax refund Answer a few simple questions Most Americans are required to pay federal income taxes but the amount you owe depends on a few factors

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

https://www.the-sun.com/wp-content/uploads/sites/6/2022/04/kc-gov-little-comp.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Tax Rebate Taxbuddi

https://taxbuddi.co.uk/public/uploads/pagecontent/4f649bd0904fe28dc9a2ec8f71e11cda.png

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

How To Increase The Chances Of Getting A Tax Refund CherishSisters

PPI Tax Rebate Tax Rebate On PPI Claim Rebate Gateway

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

P55 Tax Rebate Form Business Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

Council Tax Rebate Fury As Millions Of Pensioners Missing Out On 150 Personal Finance

Tax Rebate Rebate Update 2021

Tax Rebate Amount 2024 24 - According to the IRS the required contribution percentage is 8 39 down from 9 12 for 2023 and 9 61 for 2022 The IRS on Aug 23 announced 2024 indexing adjustments for important percentages