Tax Rebate Amount In India Web 1 f 233 vr 2023 nbsp 0183 32 Next generation common IT form has been rolled out for MSMEs and professionals if their cash receipts is no more than 5

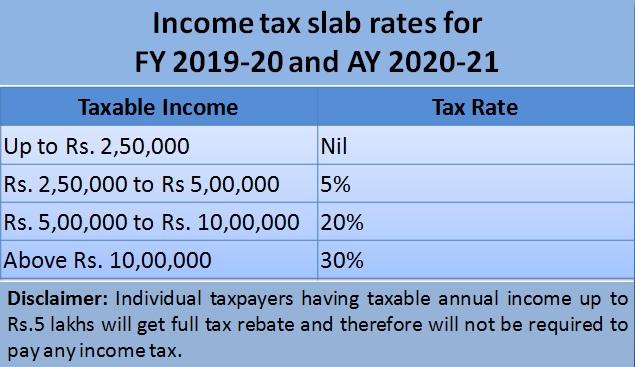

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Tax Rebate Amount In India

Tax Rebate Amount In India

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

Major Exemptions Deductions Availed By Taxpayers In India

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202002/new_income_tax_slabs-1200x1149.jpg?RA2r0ErOqnEHAPszFYqp_R3A8vlGK5kS

Web 1 f 233 vr 2023 nbsp 0183 32 The amount of rebate under Section 87A has been enhanced under the new tax regime to taxable income of Rs 7 lakh The tax Web Income tax rebate in India is made available for Hindu Undivided Families HUF and individuals who reside in India Taxpayer can claim tax rebates for Rs 40 000 or actual

Web 2 f 233 vr 2023 nbsp 0183 32 The limit of total income for rebate under section 87A of the Income tax Act 1961 has been increased from Rs 5 lakh to Rs 7 lakh for those opting for the new tax Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the income tax rebate has been extended on

Download Tax Rebate Amount In India

More picture related to Tax Rebate Amount In India

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Standard Deduction For 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Web 15 mars 2022 nbsp 0183 32 Section 87A If a resident and taxpayer s gross income after deduction is less than Rs 5 lakh the individual can claim tax relief The maximum amount available Web This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having

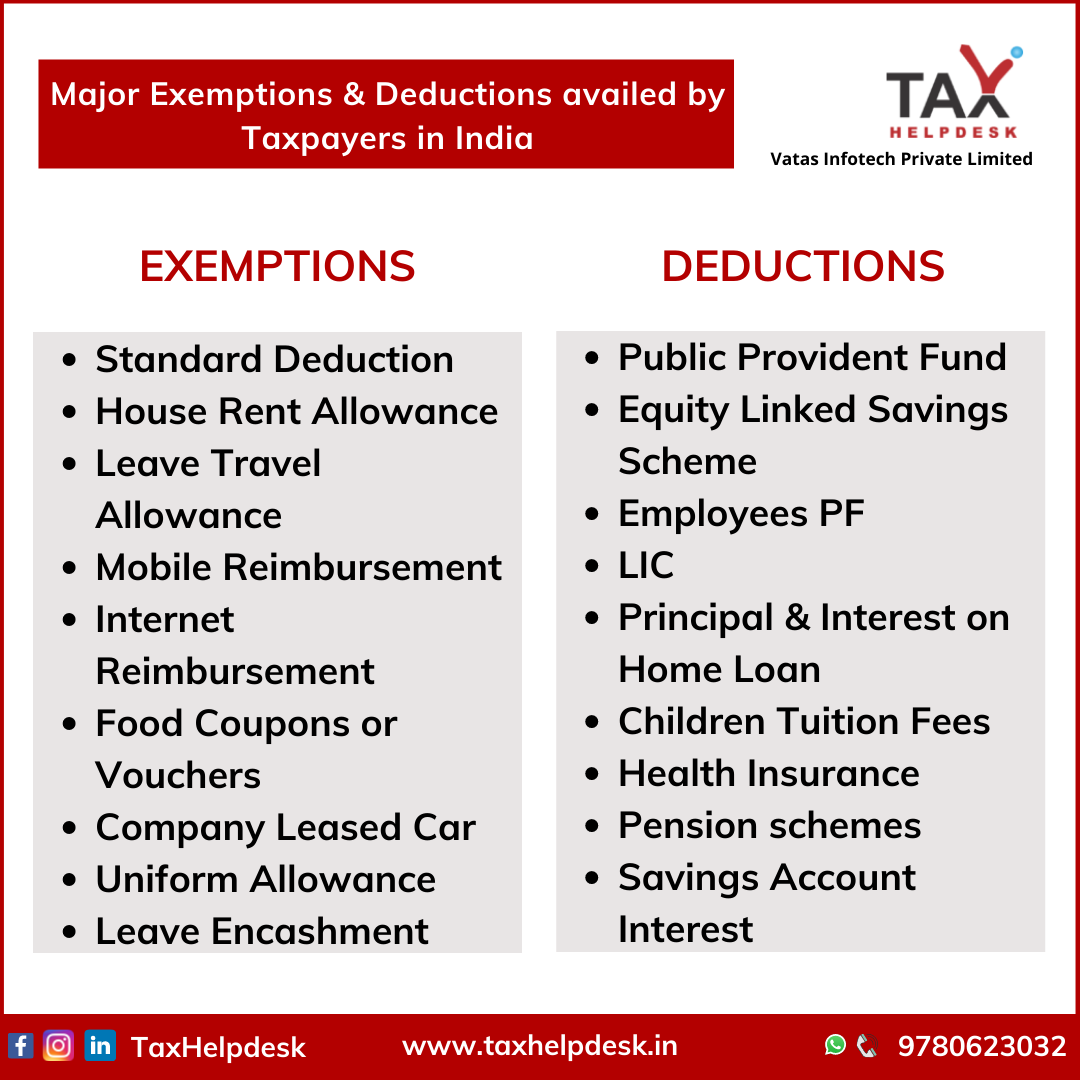

Web 13 juin 2023 nbsp 0183 32 House rent allowance Allowance under which incomes that do not form part of the total income of the Income tax Act except certain prescribed allowances Web 3 f 233 vr 2023 nbsp 0183 32 Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

https://1.bp.blogspot.com/-e7M8q_wmnrg/V24ELtVM3WI/AAAAAAAAGaI/tPaf_vkBm-gAVt0-4k8bDqVODrYOTlkawCLcB/s1600/Tax%2BBenefit%2Bof%2BBuying%2BHealth%2BInsurance%2Bin%2BIndia%2BNRI.png

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

https://economictimes.indiatimes.com/img/74504675/Master.jpg

https://www.businesstoday.in/union-budget/pe…

Web 1 f 233 vr 2023 nbsp 0183 32 Next generation common IT form has been rolled out for MSMEs and professionals if their cash receipts is no more than 5

https://indianexpress.com/article/explained/ex…

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

How The Drive Clean Rebate Works NYSERDA

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Bonus Tax Rate 2018 Museumruim1op10 nl

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

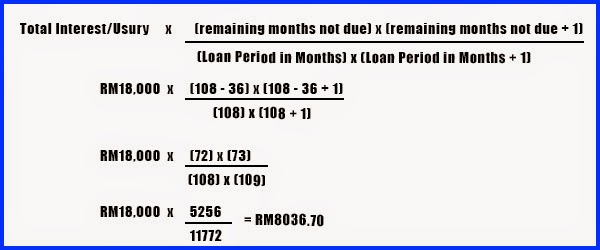

Debt Tales The Bank And You 2014

Tax Rebate On Income Upto 5 Lakh Under Section 87A

2022 Deductions List Name List 2022

Tax Rebate Amount In India - Web 1 f 233 vr 2023 nbsp 0183 32 The amount of rebate under Section 87A has been enhanced under the new tax regime to taxable income of Rs 7 lakh The tax