Tax Rebate And Income Web 6 avr 2023 nbsp 0183 32 You can get a refund on any taxable income you ve paid taxes on including pay from your current or previous job pension payments income from a life or pension

Web 1 f 233 vr 2023 nbsp 0183 32 Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions and gratuity help in taxation Tax Deduction vs Exemption vs Tax Rebate Web 17 f 233 vr 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax

Tax Rebate And Income

Tax Rebate And Income

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

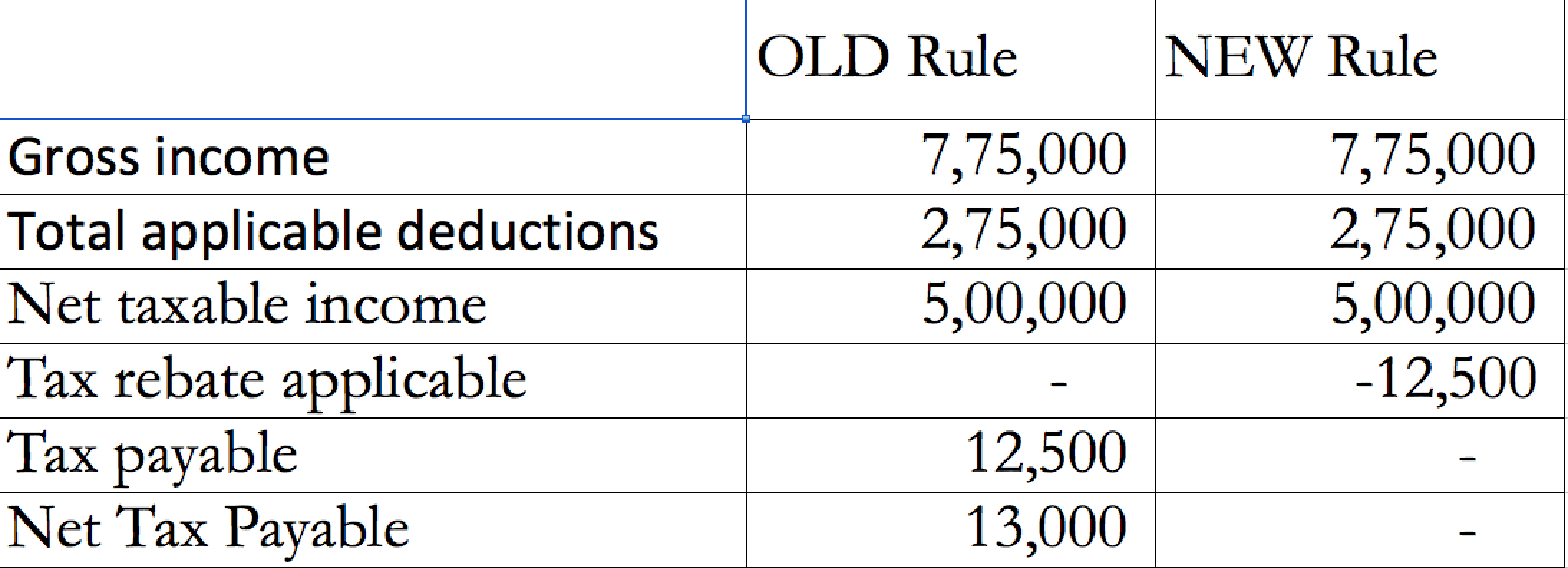

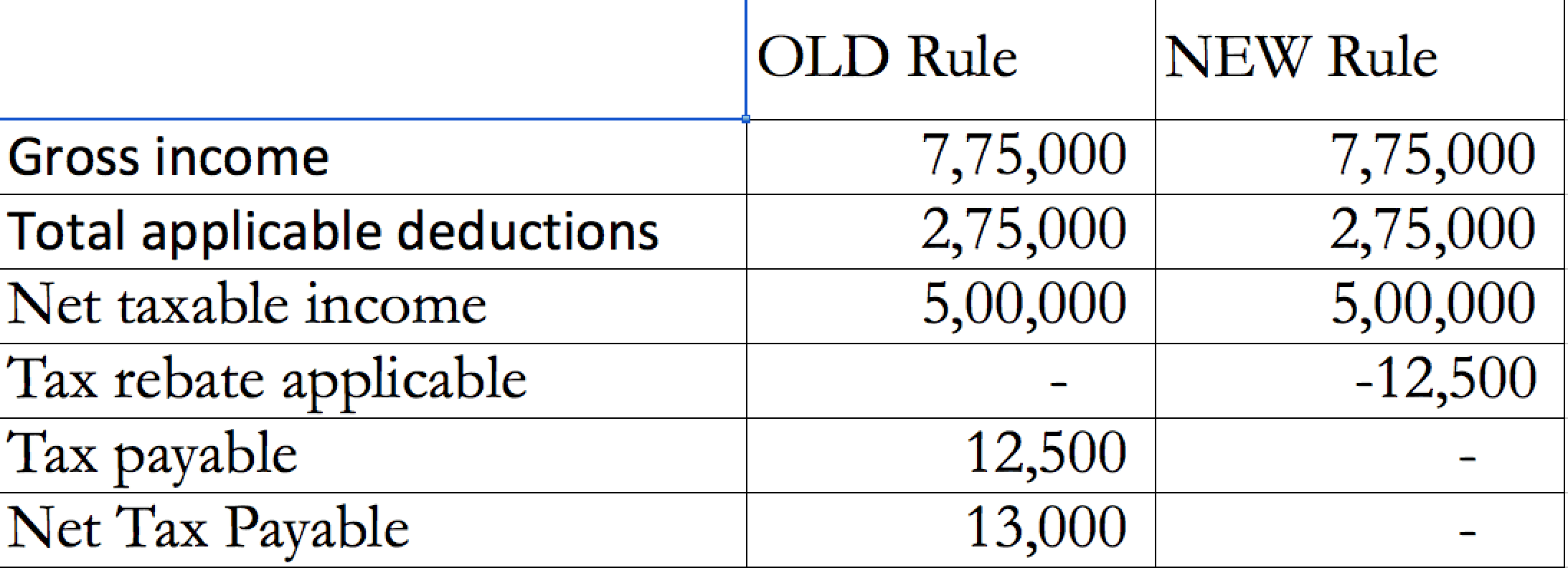

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.46.44-AM.png

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how Web 13 janv 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax

Web 9 sept 2023 nbsp 0183 32 If you itemize deductions on your federal income tax return and receive a state tax refund or special payment the IRS says you might need to include it in your Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Download Tax Rebate And Income

More picture related to Tax Rebate And Income

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Web 13 sept 2023 nbsp 0183 32 In addition to the income limit expansion the new law increases the maximum standard rebate from 650 to 1 000 For those just below the new 45 000 Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue

Web Il y a 1 jour nbsp 0183 32 New Income Tax Act of 2023 replaced the 1984 Ordinance in June It s been praised but there are concerns among finance professionals about compliance Web 23 ao 251 t 2023 nbsp 0183 32 The most common reason for a tax rebate is that you have paid too much income tax If you earn more than the 163 12 570 personal tax free allowance you will

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://inews.co.uk/inews-lifestyle/money/tax-rebate-claim-2023...

Web 6 avr 2023 nbsp 0183 32 You can get a refund on any taxable income you ve paid taxes on including pay from your current or previous job pension payments income from a life or pension

https://www.tomorrowmakers.com/tax-plannin…

Web 1 f 233 vr 2023 nbsp 0183 32 Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions and gratuity help in taxation Tax Deduction vs Exemption vs Tax Rebate

What s The Distinction Between PMI And Home Loan Defense Insurance

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

How To Choose Between The New And Old Income Tax Regimes Chandan

How To Choose Between The New And Old Income Tax Regimes Chandan

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

2007 Tax Rebate Tax Deduction Rebates

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate And Income - Web 12 janv 2023 nbsp 0183 32 Tax Benefit A tax benefit is an allowable deduction on a tax return intended to reduce a taxpayer s burden while typically supporting certain types of commercial