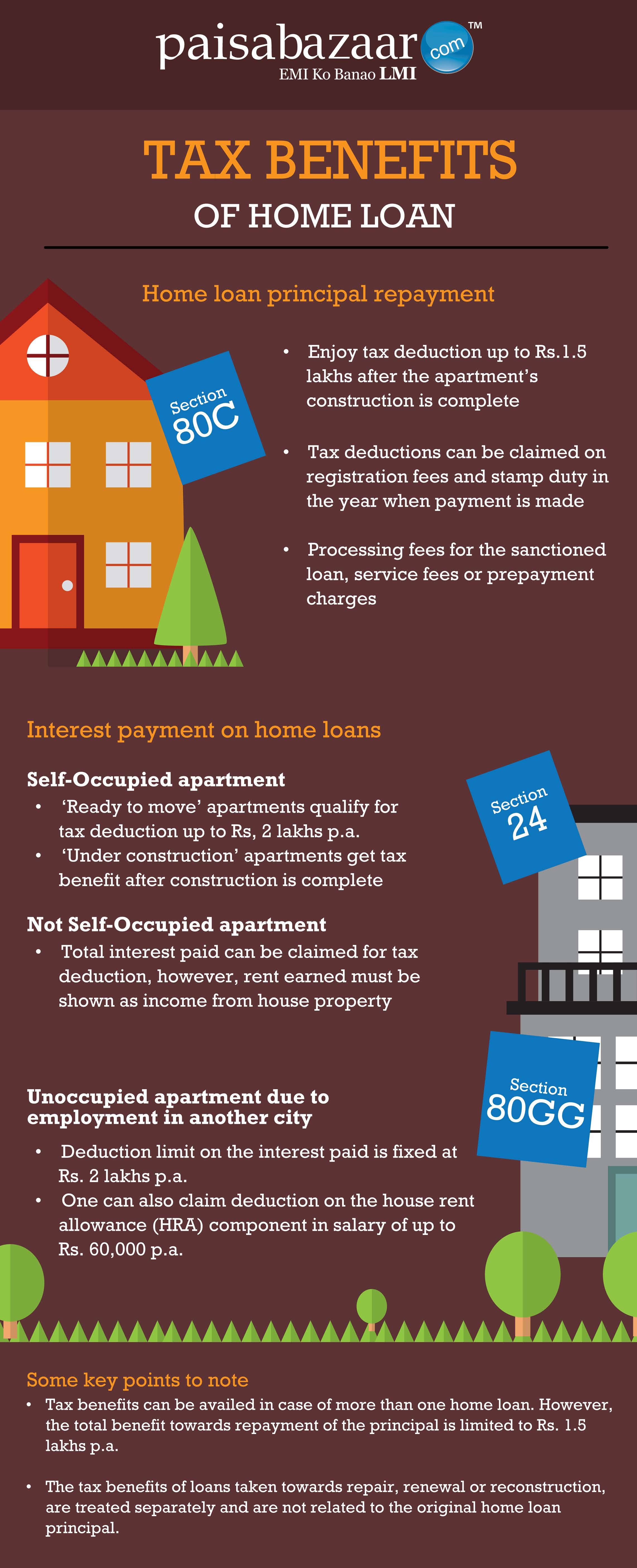

Tax Rebate And Mortgage Law Web 30 avr 2023 nbsp 0183 32 IRS Publication 936 A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest Mortgage interest

Web 4 ao 251 t 2023 nbsp 0183 32 However under the new bill eligible homebuyers can receive a tax credit of up to 10 percent of their home s purchase price to a maximum of 15 000 Purchase Web Publication 936 Introductory Material What s New Reminders Introduction

Tax Rebate And Mortgage Law

Tax Rebate And Mortgage Law

https://www.coursehero.com/qa/attachment/24027424/

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

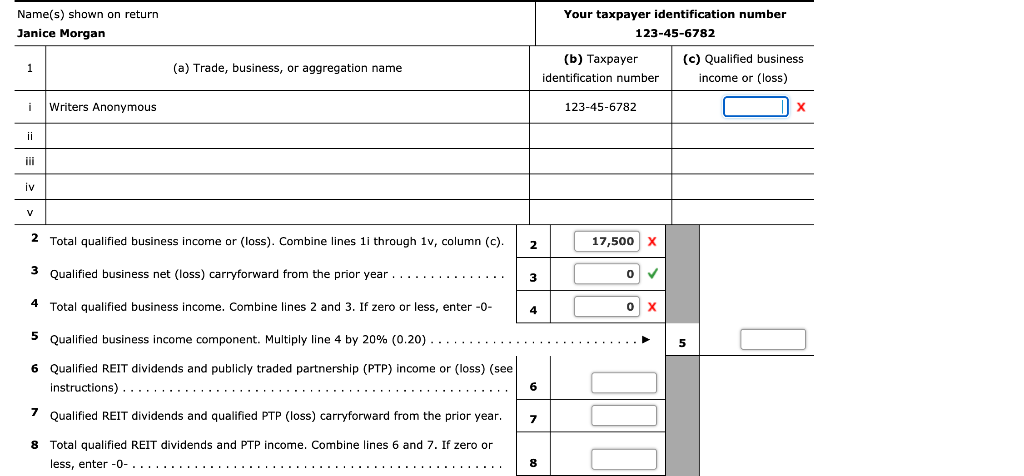

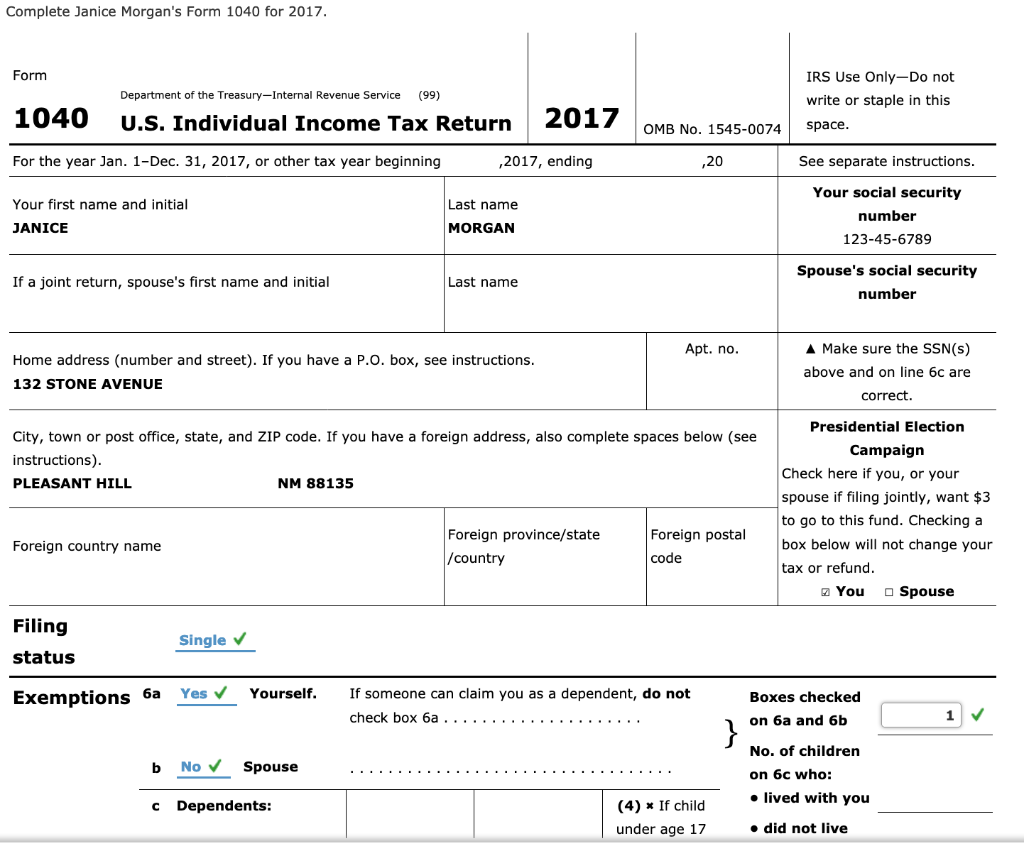

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

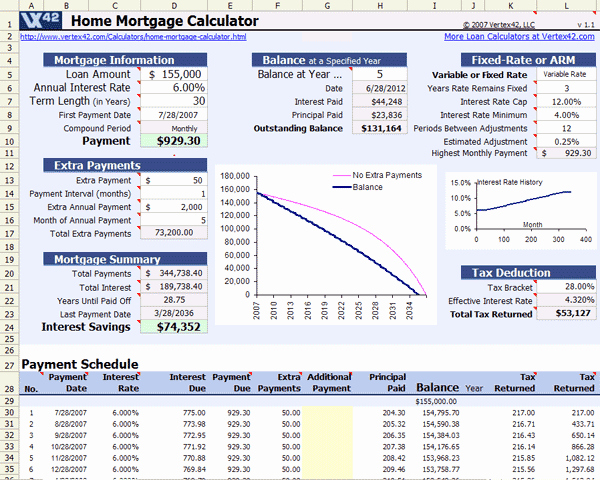

Web 14 juin 2021 nbsp 0183 32 The First Time Homebuyer Act amends the IRS tax code to grant first time home buyers up to 15 000 in refundable federal tax credits The First Time Homebuyer Tax Credit is known by several names which Web 18 juil 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records Web 14 juin 2022 nbsp 0183 32 For example imagine receiving a 100 000 home loan offer at a 4 interest rate and the lender charges you 995 for their fees this fee does not include the other

Download Tax Rebate And Mortgage Law

More picture related to Tax Rebate And Mortgage Law

Here s A Summary Of The Main Changes With The New Tax Law Passed Last

https://i.pinimg.com/originals/93/4f/d4/934fd4de3ab926969d15cd92e0c1e43c.jpg

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027465/

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web Tax Rebate And Mortgage Law The homeowner tax rebate credit can a one year scheme providing direkten property tax relief to regarding 2 5 mil eligible homeowners in 2022 If Web To homeowner duty rebate credit is a one year program providing direct eigentums tax relief to about 2 5 million eligible homeowners inbound 2022 If to qualify you don t need

Web In add on to of deductions below Virginia law allows for several subtractions from income that might reduce your tax liability Standard Deduction If you claimed the standard Web Mortgage Tax Rebate If your are an owner occupant of a property in the Netherlands you can get part of the financing costs refunded The rules for the refund are

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

https://www.investopedia.com/articles/mortgages-real-estate/11/...

Web 30 avr 2023 nbsp 0183 32 IRS Publication 936 A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest Mortgage interest

https://www.bankrate.com/mortgages/first-time-homebuyer-tax-credit

Web 4 ao 251 t 2023 nbsp 0183 32 However under the new bill eligible homebuyers can receive a tax credit of up to 10 percent of their home s purchase price to a maximum of 15 000 Purchase

Property Tax Rebate Application Printable Pdf Download

Illinois Tax Rebate Tracker Rebate2022

Military Journal Nm State Rebate 2022 According To The Department

50 Calculating Mortgage Payments In Excel Ufreeonline Template

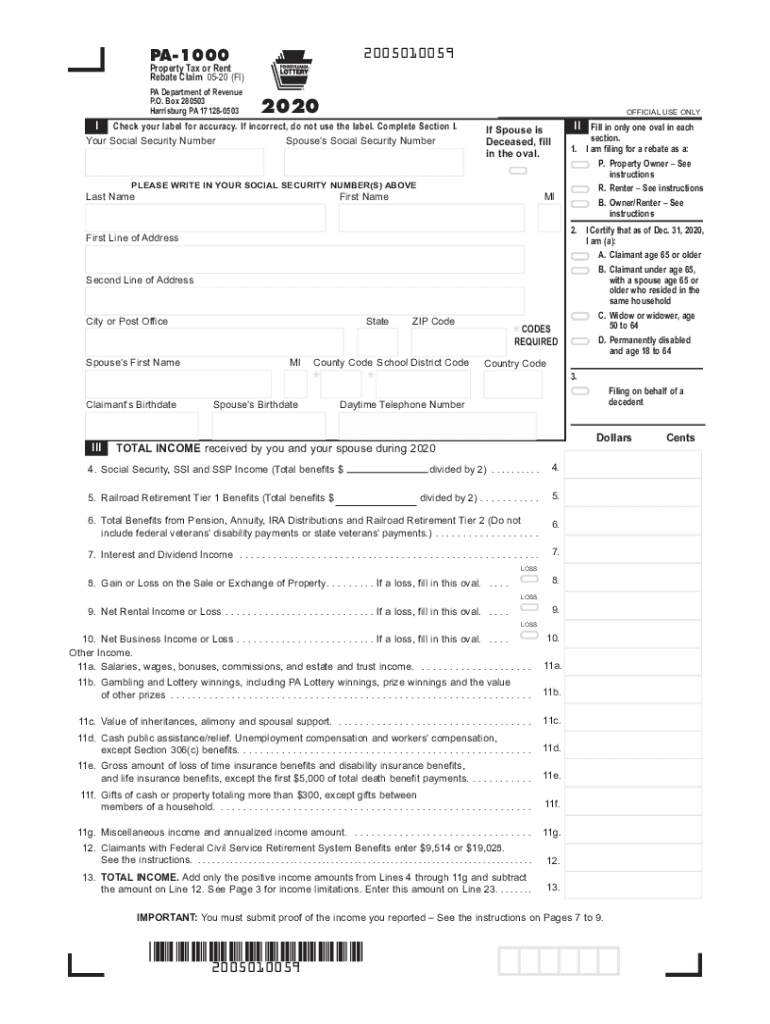

2020 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

PAcast

PAcast

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Anything To Everything Income Tax Guide For Individuals Including

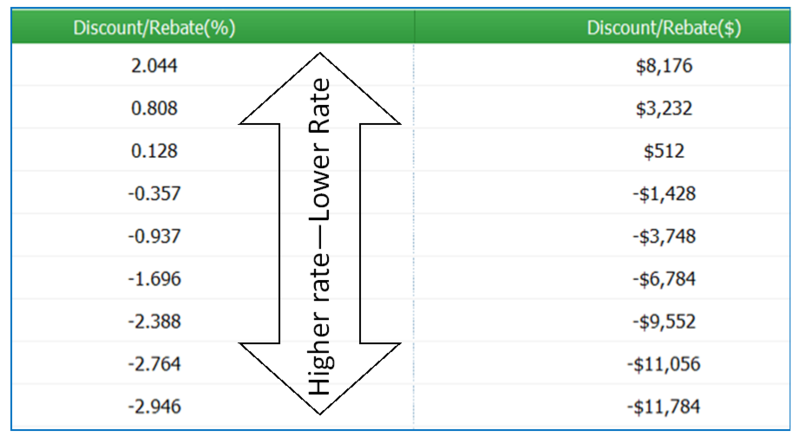

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Tax Rebate And Mortgage Law - Web Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return You will get money back from the