Tax Rebate Calculation Example Web 22 janv 2022 nbsp 0183 32 Example of a Rebate Suppose a trader borrows 10 000 worth of stock ABC with the intention of shorting it The trader has agreed to a 5 simple interest rate on the trade settlement date

Web Some examples include Growth Rebates Paid out based on growth of either the group or individual members based on previous years spend For example grow between 1 5 and get 2 rebate either on all spend or Web FORMULA A B X C foreign taxable income A total taxable income B 215 normal tax on B C The example is as follows Mr A works for a South African mining company but was

Tax Rebate Calculation Example

Tax Rebate Calculation Example

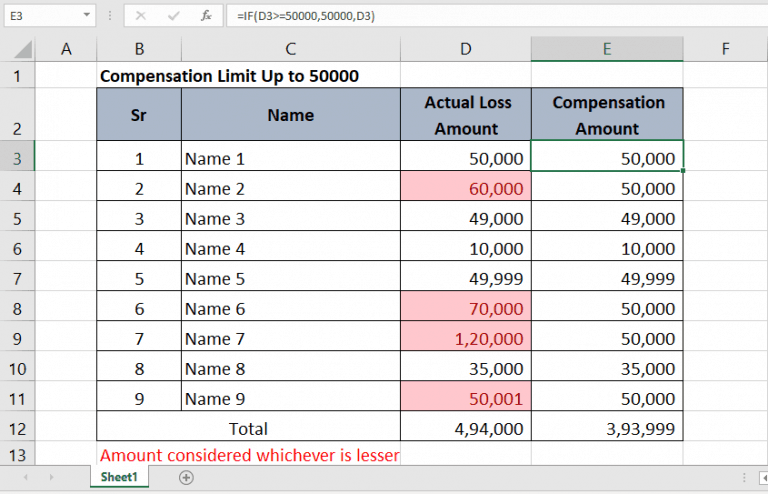

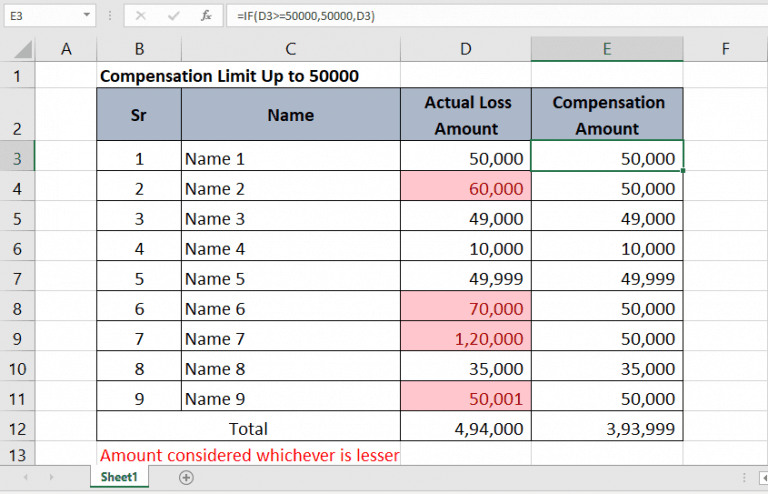

https://exceldesk.in/wp-content/uploads/2019/12/IF-2BFormula-2BValue-2BLimit-2BCalculation-768x494.png

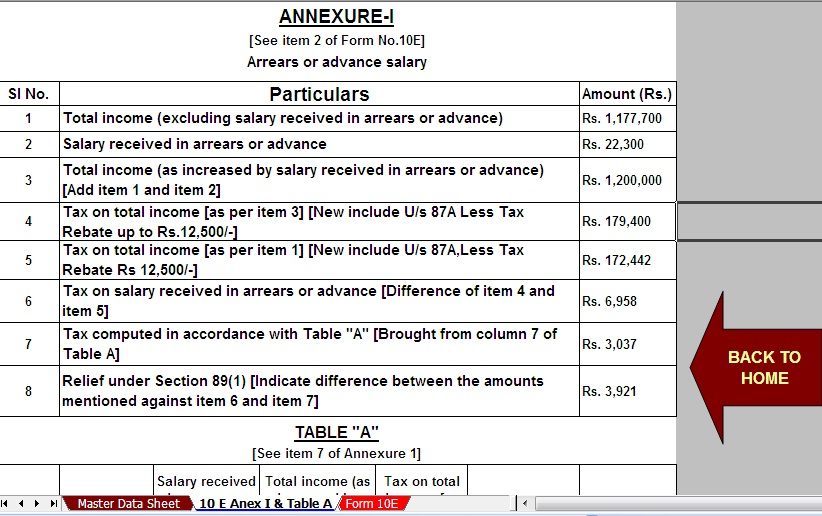

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

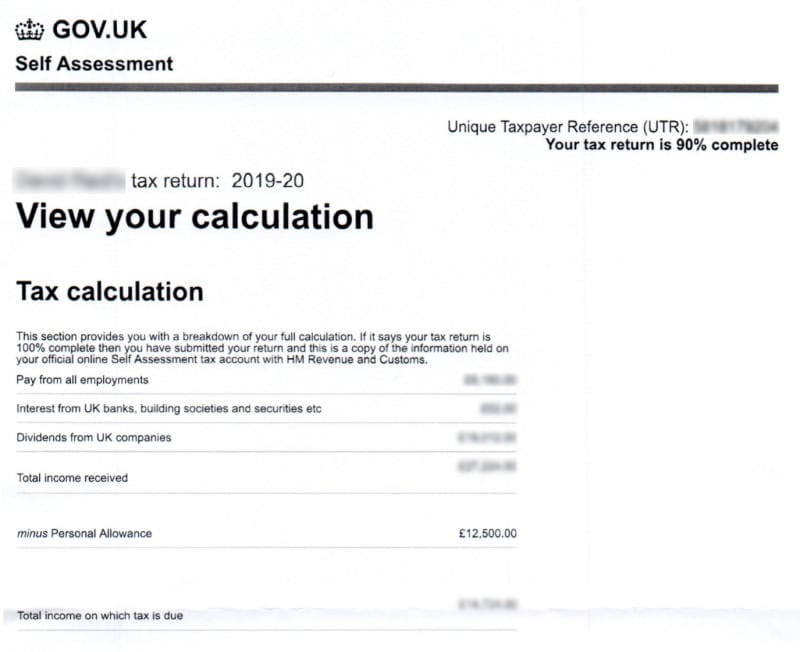

HMRC Tax Refunds Tax Rebates 3 Options Explained

https://www.ratednearme.com/wp-content/uploads/employee-tax-calculation.jpg

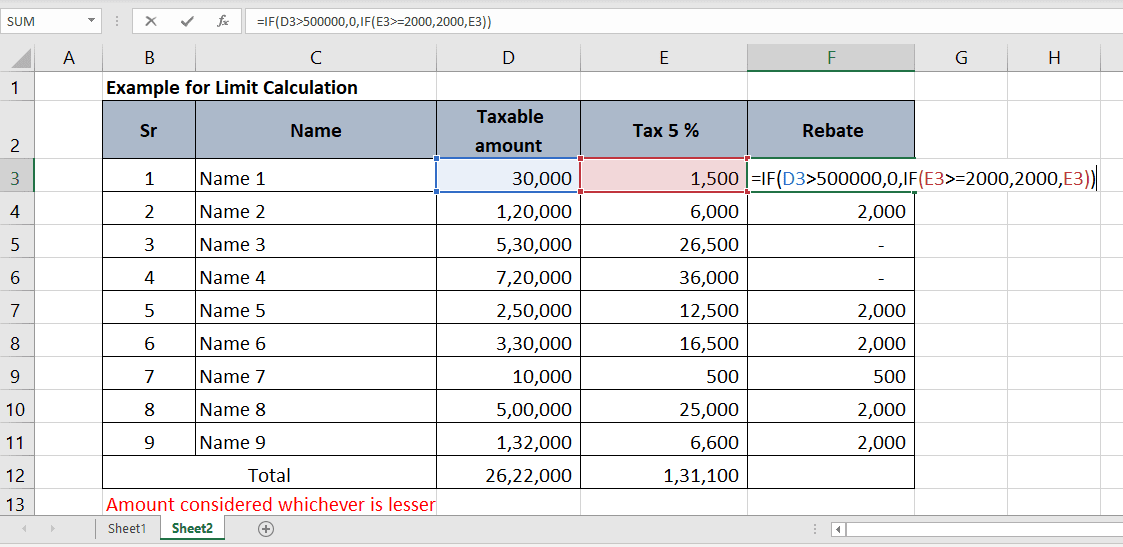

Web Home Money and tax Income Tax Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need Web Your overall income after taking deductions into consideration is less than Rs 5 lakh The maximum amount of rebate that can be claimed is Rs 12 500 So if your total tax liability

Web 6 f 233 vr 2023 nbsp 0183 32 How to calculate income tax rebate The following is the step by step process to calculate the available amount u s 87A To calculate rebate first add up income from all sources like salary Web 2 f 233 vr 2023 nbsp 0183 32 We will see these with the help of income tax calculation examples how tax rebate will make you pay no income tax with 7 lakh income and new tax regime selected how much

Download Tax Rebate Calculation Example

More picture related to Tax Rebate Calculation Example

Tds Slab Rate For Ay 2019 20

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

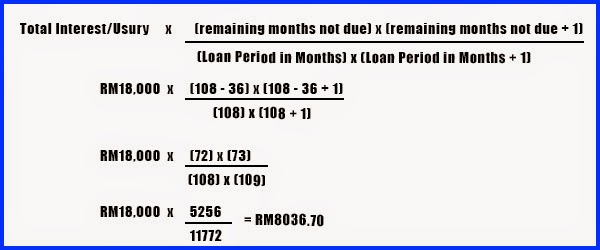

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Web 4 f 233 vr 2023 nbsp 0183 32 So let us know how tax rebate is calculated through an example Think A person s monthly income is 50 000 TK Then his total income in 12 months is 600 000 TK Think his annual bonus is 50 000 TK Web 18 ao 251 t 2017 nbsp 0183 32 As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now your tax rebate will

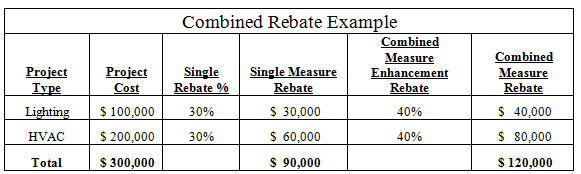

Web 1 d 233 c 2022 nbsp 0183 32 For example the City of Long Beach CA offered rebates of up to 500 to encourage the purchase of solar water heaters tank less water heaters energy efficient doors windows and skylights that have Web 13 janv 2022 nbsp 0183 32 IRS Statements and Announcements These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get the full amount of

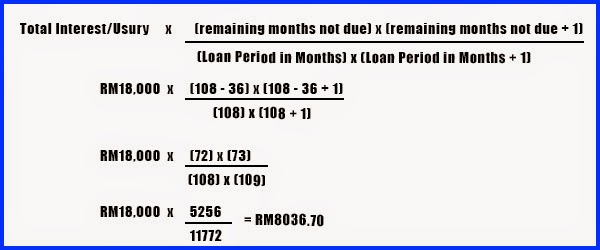

Debt Tales The Bank And You 2014

http://2.bp.blogspot.com/-MMnp0L2hMbY/VE4R6FSCmiI/AAAAAAAAAdQ/xvrYLxYfEAo/s1600/rebatecalcenglish.jpg

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

https://www.investopedia.com/terms/r/rebate.…

Web 22 janv 2022 nbsp 0183 32 Example of a Rebate Suppose a trader borrows 10 000 worth of stock ABC with the intention of shorting it The trader has agreed to a 5 simple interest rate on the trade settlement date

https://enable.com/blog/rebate-calculations-…

Web Some examples include Growth Rebates Paid out based on growth of either the group or individual members based on previous years spend For example grow between 1 5 and get 2 rebate either on all spend or

Health Care Tax Rebate Calculator 2022 Carrebate

Debt Tales The Bank And You 2014

EPAct 179D Tax Savings For Supermarkets Energy Tax Savers

Income Tax HRA

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

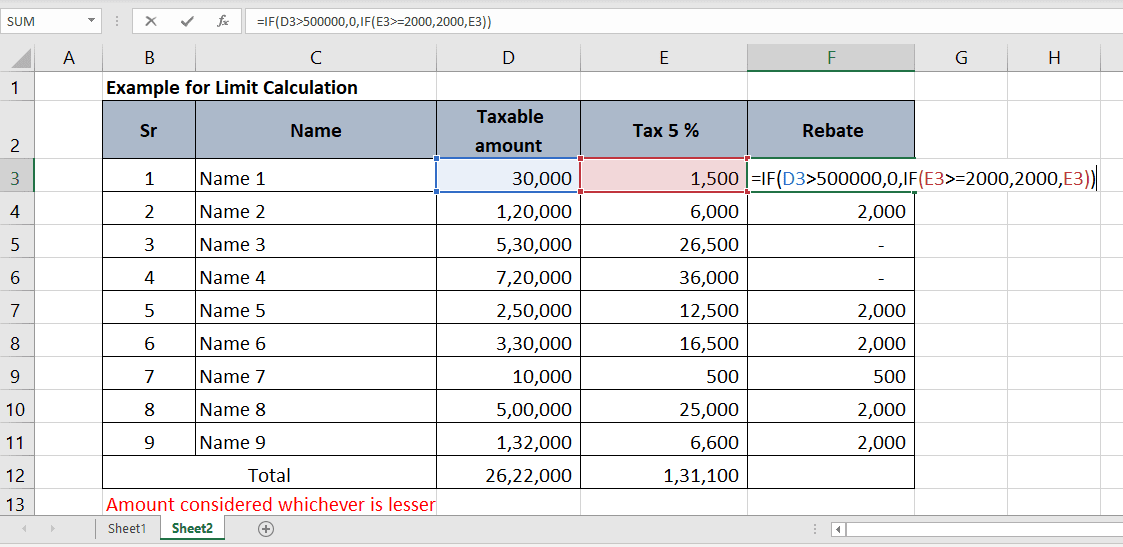

Calculate According To The Maximum Range Of Values From The Excel IF

Calculate According To The Maximum Range Of Values From The Excel IF

Canadian Simple Tax Calculator Shop Discounts Save 49 Jlcatj gob mx

Retirement Income Tax Rebate Calculator Greater Good SA

Tax Rebate Calculator Hmrc CALCULATORUK FTE

Tax Rebate Calculation Example - Web Your overall income after taking deductions into consideration is less than Rs 5 lakh The maximum amount of rebate that can be claimed is Rs 12 500 So if your total tax liability