Tax Rebate Check 2024 Nc TAX SEASON 2024 UPDATES If a check date is older than six months you should mail a letter along with the refund check to NC Department of Revenue Attn Customer Service P O Box 1168 Raleigh NC 27602 1168 Your check will be re validated and re mailed to you My spouse has passed away and my tax refund check was issued in both

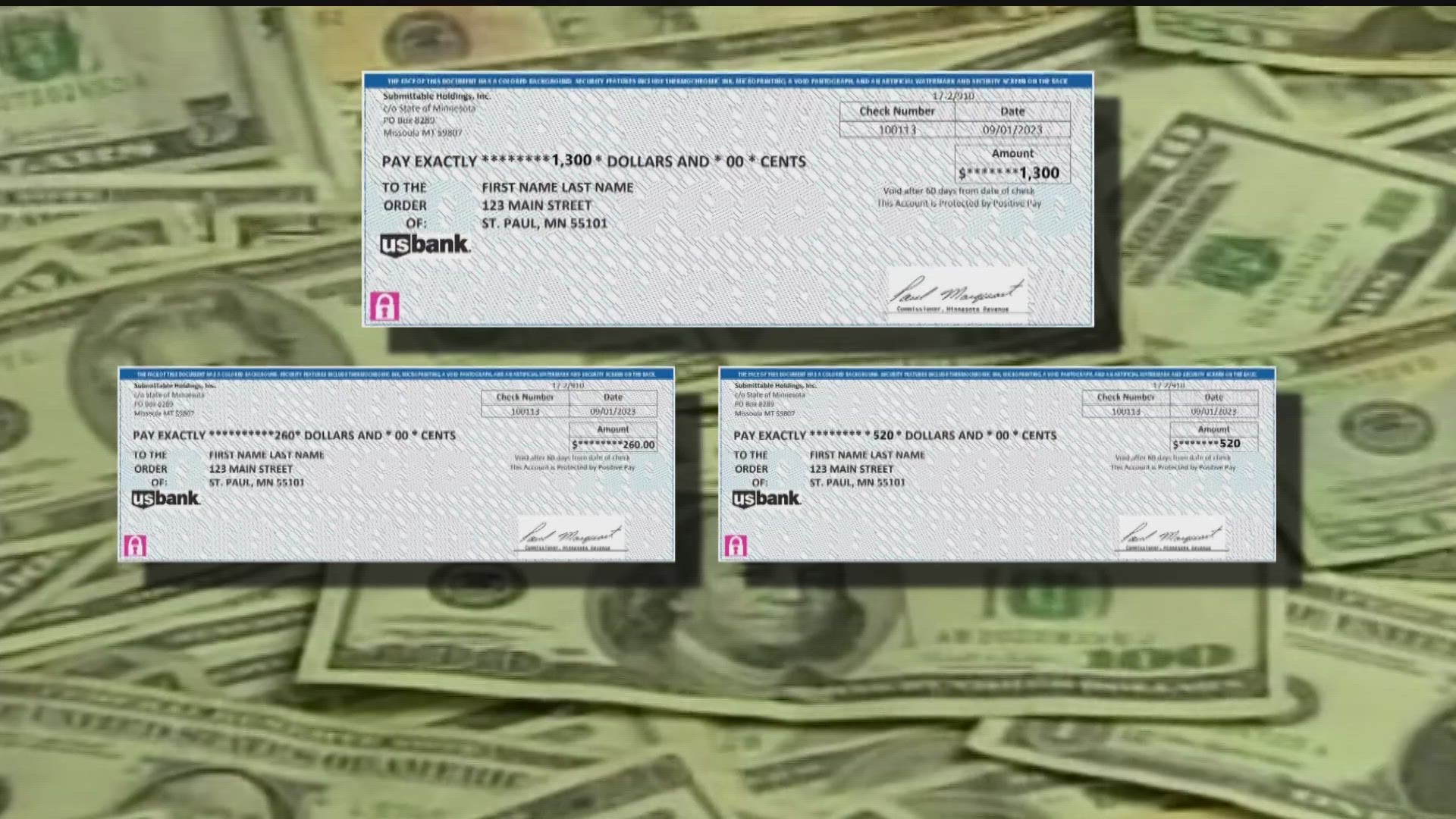

TAX SEASON 2024 UPDATES The NCDOR funds public services benefiting the people of North Carolina The NCDOR administers the tax laws and collects the taxes due in an impartial consistent secure and efficient manner PO Box 25000 Raleigh NC 27640 0640 General information 1 877 252 3052 Individual income tax refund inquiries 1 877 Minnesota rebate checks were sent beginning in mid August of last year to about 2 5 million Minnesota households The one time payments of up to 1 300 sometimes called Walz checks or

Tax Rebate Check 2024 Nc

Tax Rebate Check 2024 Nc

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

MN Tax Rebate Check Proof DocumentCloud

https://s3.documentcloud.org/documents/23911077/pages/mn-tax-rebate-check-proof-p1-normal.gif?ts=1692207775832

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax North Carolina residents who earned less than 59 187 from wages income from a job where the employer didn t withhold tax or money made from self employment including owning and operating a business or farm last year may qualify for the EITC and might not know it Those who don t claim the credit are missing a tax benefit they have earned

Here s when you can get the federal and North Carolina return plus how to avoid being scammed 10 57 AM EST January 4 2024 most state refund checks go out within about four weeks S everal states are expected to send out stimulus checks to residents in 2024 with payments ranging from a few hundred dollars to over 1 000 Many are issuing property tax rebates or using money

Download Tax Rebate Check 2024 Nc

More picture related to Tax Rebate Check 2024 Nc

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

https://media.kare11.com/assets/KARE/images/c6c0f926-4792-46a8-9d55-d297c077d911/c6c0f926-4792-46a8-9d55-d297c077d911_1920x1080.jpg

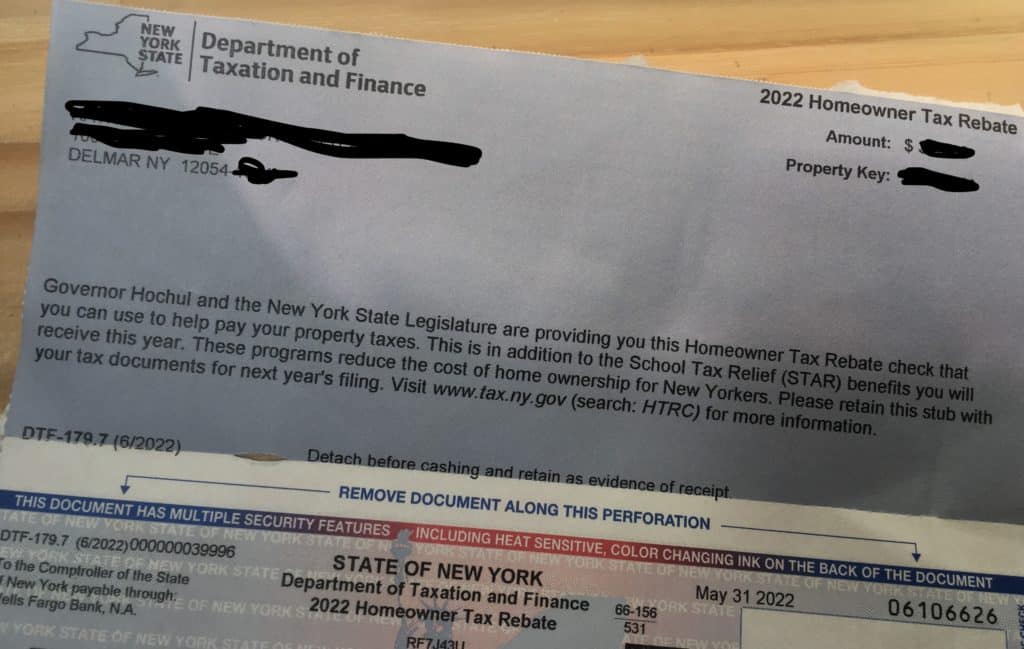

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger tax

The IRS has provided the following estimated direct deposit tax refund dates for 2024 If the IRS accepts an e filed return by January 29 2024 the direct deposit refund may be sent as early as February 9 2024 Potential refund dates for those who filed between January 23 and January 28 include February 17 for direct deposit IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.ncdor.gov/refund

TAX SEASON 2024 UPDATES If a check date is older than six months you should mail a letter along with the refund check to NC Department of Revenue Attn Customer Service P O Box 1168 Raleigh NC 27602 1168 Your check will be re validated and re mailed to you My spouse has passed away and my tax refund check was issued in both

https://www.ncdor.gov/news/press-releases/2024/01/25/ncdor-announces-opening-individual-income-tax-season

TAX SEASON 2024 UPDATES The NCDOR funds public services benefiting the people of North Carolina The NCDOR administers the tax laws and collects the taxes due in an impartial consistent secure and efficient manner PO Box 25000 Raleigh NC 27640 0640 General information 1 877 252 3052 Individual income tax refund inquiries 1 877

Are You Owed A Tax Rebate Check Your Personal Tax Account Which News

Income Tax Rebate Under Section 87A

One time Tax Rebate Checks For Idaho Residents KLEW

Tax Rebate Checks Shaila Chamberlain

Tax Returned

Is Your State Sending Out A Tax Rebate Check In November South Carolina Taxpayers Will Soon Get

Is Your State Sending Out A Tax Rebate Check In November South Carolina Taxpayers Will Soon Get

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

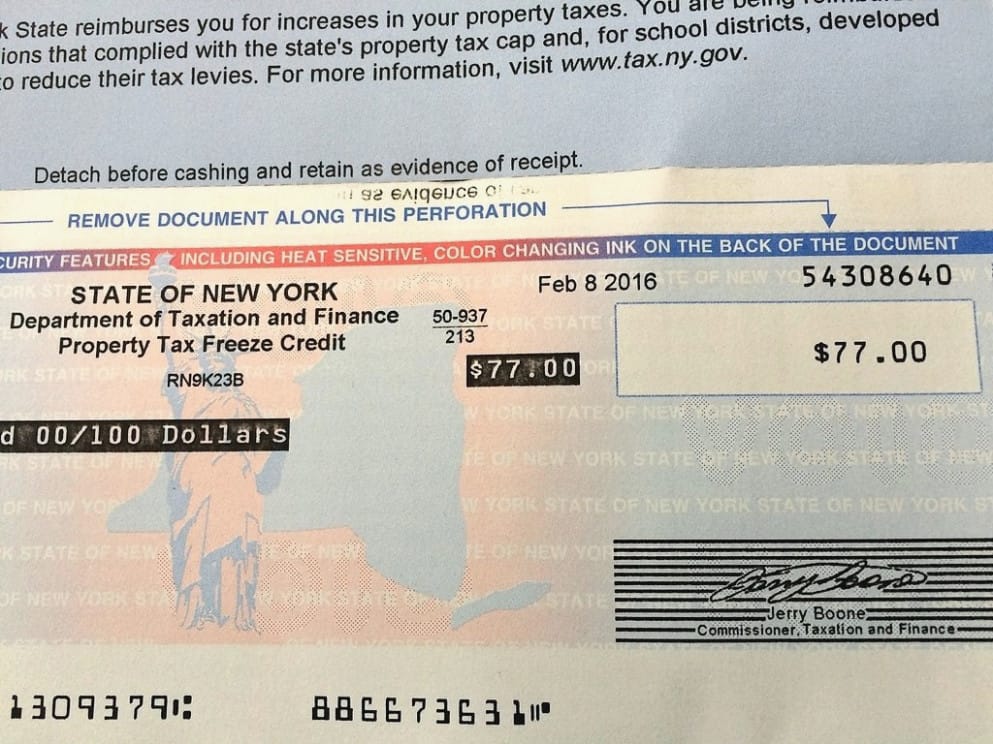

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Tax Rebate Check 2024 Nc - S everal states are expected to send out stimulus checks to residents in 2024 with payments ranging from a few hundred dollars to over 1 000 Many are issuing property tax rebates or using money