Tax Rebate Check 2024 Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP

Tax Rebate Check 2024

Tax Rebate Check 2024

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

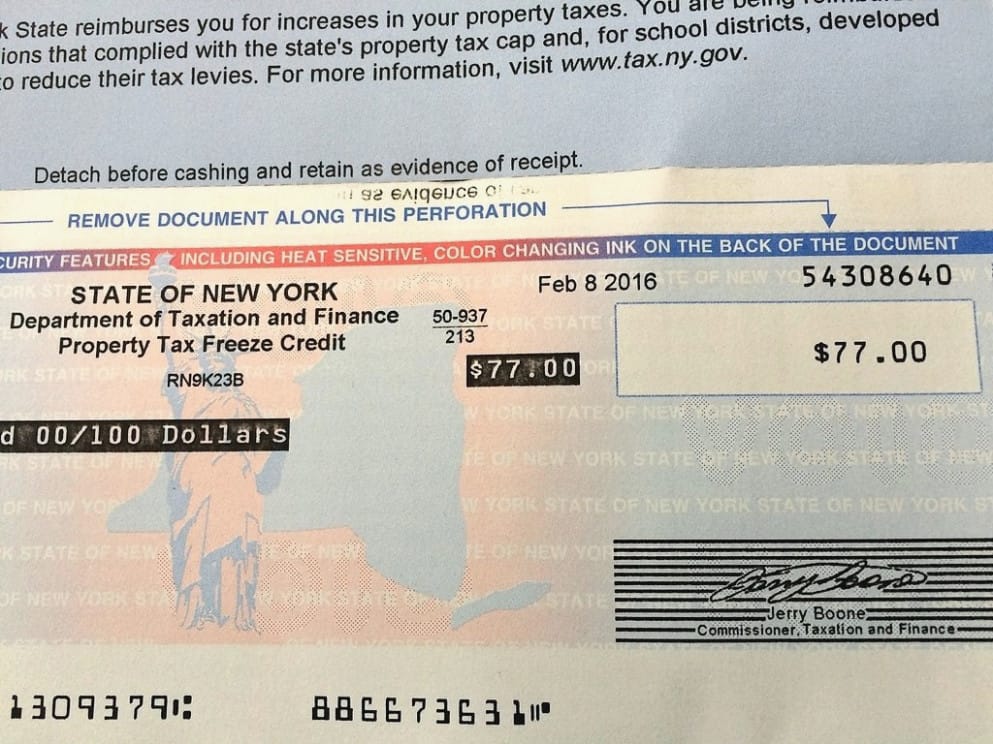

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Explore the child tax credit and other provisions in the 2024 bipartisan tax deal Tax Relief for American Families and Workers Act of 2024 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need

The 2024 tax season officially opens Monday meaning the IRS will begin accepting and processing returns for the 2023 tax year The deadline to file is April 15 How do I check on the status Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

Download Tax Rebate Check 2024

More picture related to Tax Rebate Check 2024

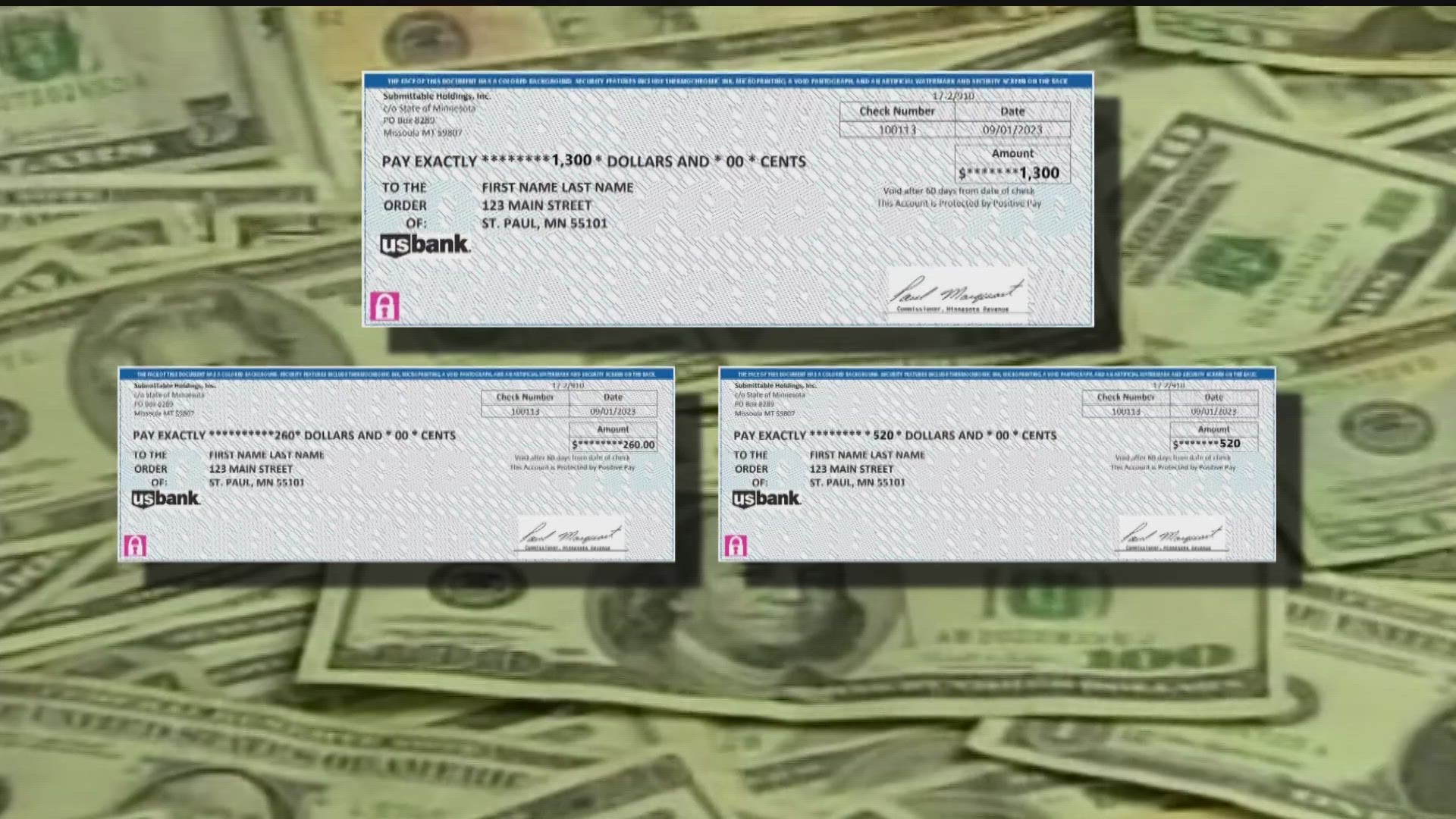

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

https://media.kare11.com/assets/KARE/images/c6c0f926-4792-46a8-9d55-d297c077d911/c6c0f926-4792-46a8-9d55-d297c077d911_1920x1080.jpg

Gas stimulus Check 800 Tax Rebate Payout Could Go To Couples In This State To Help With

https://www.the-sun.com/wp-content/uploads/sites/6/2022/03/AB-PUMP-COMP.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

MN Tax Rebate Check Proof DocumentCloud

https://s3.documentcloud.org/documents/23911077/pages/mn-tax-rebate-check-proof-p1-normal.gif?ts=1692207775832

Tax Tip 2024 03 Jan 22 2024 IRS Free File is now available for the 2024 filing season With this program eligible taxpayers can prepare and file their federal tax returns using free tax software from trusted IRS Free File partners 2024 IRS Tax Refund Calendar Estimate When You Will Get Your Tax Refund The IRS says most e filed tax refunds are direct deposited into taxpayer bank accounts in as little as 10 days

As part of the state s 2024 fiscal budget an estimated 743 000 Arizona residents can expect to benefit from a new stimulus check program The Arizona Families Tax Rebate announced in November The IRS aims to process electronic tax returns within 21 days in 2024 This means that for those filing from January 23 to 28 potential refund dates include February 17 for direct deposit and

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Property Tax Rebate Pennsylvania LatestRebate

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

One time Tax Rebate Checks For Idaho Residents KLEW

Property Tax Rebate Check 2023 PropertyRebate

Property Tax Rebate Check 2023 PropertyRebate

Tax Rebate Checks Shaila Chamberlain

Tax Rebate Payments Begin Republic Times News

Are You Owed A Tax Rebate Check Your Personal Tax Account Which News

Tax Rebate Check 2024 - The 2024 tax season officially opens Monday meaning the IRS will begin accepting and processing returns for the 2023 tax year The deadline to file is April 15 How do I check on the status