Tax Rebate Checks For 2024 On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

Tax Rebate Checks For 2024

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/sfr/FRU7GQK56FAIDJP25Y35QNSPJI.jpg)

Tax Rebate Checks For 2024

https://www.sfreporter.com/resizer/PR9B5j4E9yZ9PLzsEFmAuc4WJYY=/1600x0/filters:format(jpg):quality(70)/cloudfront-us-east-1.images.arcpublishing.com/sfr/FRU7GQK56FAIDJP25Y35QNSPJI.jpg

When Is Alabam Initiating Distribution 300usd Tax Rebate Checks

https://www.lamansiondelasideas.com/wp-content/uploads/2023/08/Alabama-Tax-Rebate-Checks.jpg

Ny Property Tax Rebate Checks 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/tax-rebate-checks-come-early-this-year-yonkers-times-7.jpg

The Bulletin Privacy Policy Direct Payments Are Still Available However just because federal stimulus checks aren t likely doesn t mean Americans can t grab new direct payments Depending on the With an Online Account individuals can also View their tax owed and payment history and schedule payments Request tax transcripts View or apply for payment plans See digital copies of some IRS notices View key data from their most recently filed tax return including adjusted gross income

Many are issuing property tax rebates or using money from leftover COVID 19 recovery funds to pay their citizens States set to issue payments in 2024 are New York Maryland New Mexico Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Download Tax Rebate Checks For 2024

More picture related to Tax Rebate Checks For 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

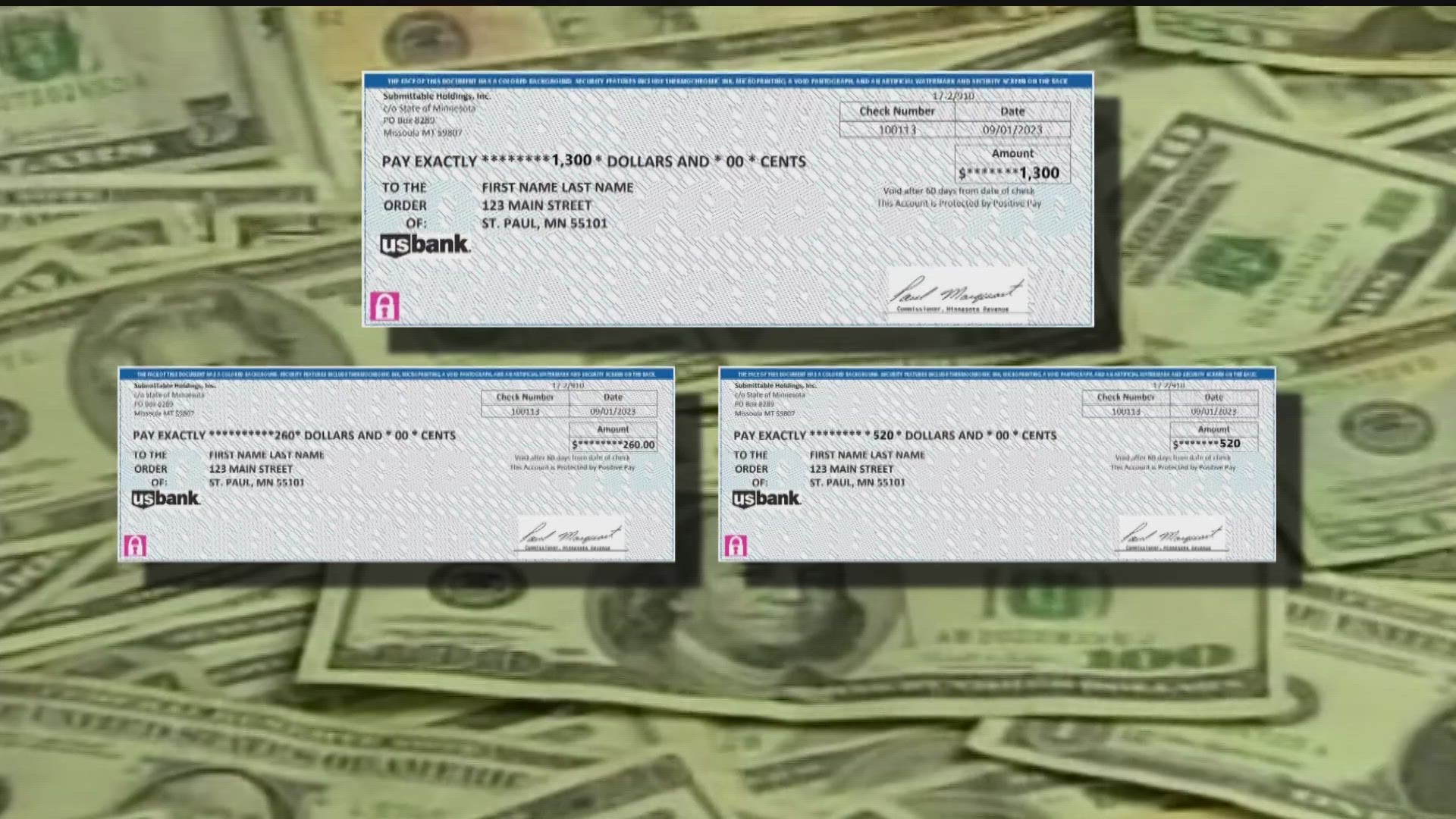

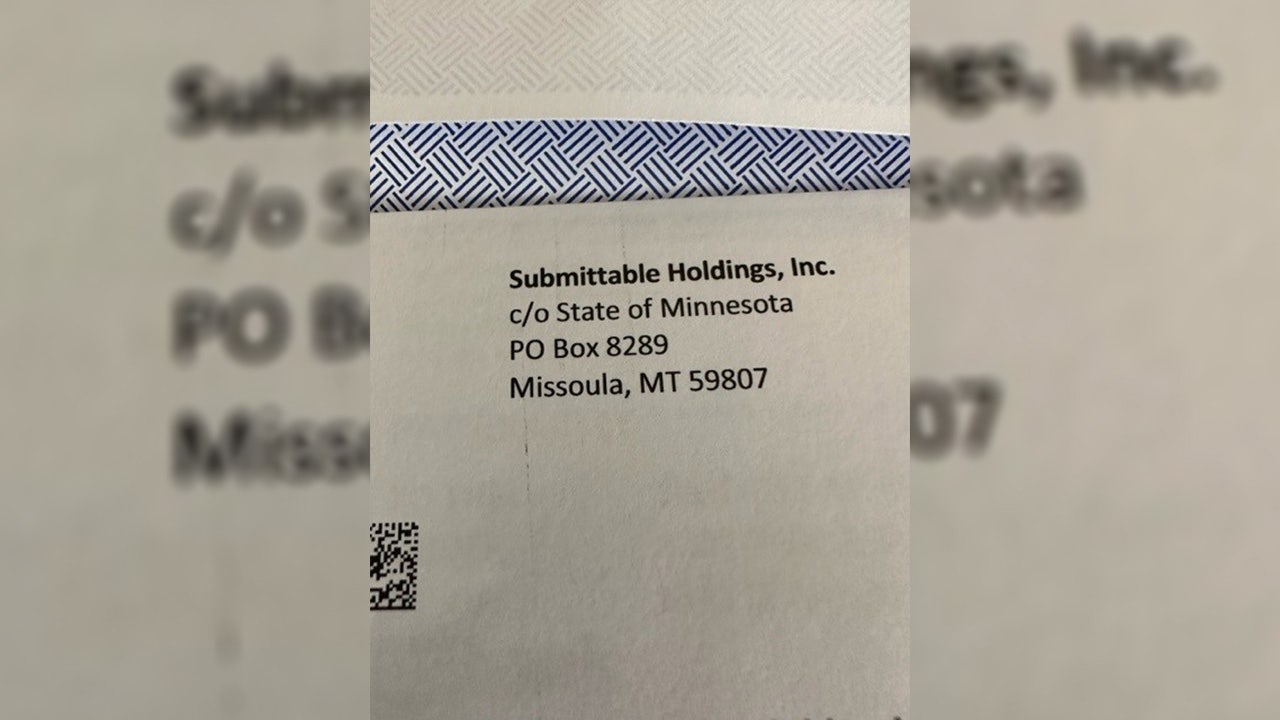

Minnesota Rebate Checks And Child Tax Credit In 2023

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U.jpg

500 Virginia Tax Rebate Checks You Still Have 10 Days To Claim It TrendRadars

https://247wallst.com/wp-content/uploads/2022/08/imageForEntry40-38F.jpg

Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the

If your IRS income tax refund is delayed after you ve filed ask your tax professional or simply use the Where s My Refund tool on the IRS website to check the status of your More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

https://phantom-marca.unidadeditorial.es/b9913983e500a2b2e16ff626ec92fde2/crop/0x0/1320x743/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/14/16394824903699.jpg

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

https://media.kare11.com/assets/KARE/images/c6c0f926-4792-46a8-9d55-d297c077d911/c6c0f926-4792-46a8-9d55-d297c077d911_1920x1080.jpg

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/sfr/FRU7GQK56FAIDJP25Y35QNSPJI.jpg?w=186)

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Minnesota Tax Rebate Checks May Look Like Junk Mail

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

Property Tax Rebate Pennsylvania LatestRebate

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Nys Property Tax Rebate Checks 2023 Eligibility Application Process Tax Rebate

500 Tax Rebate Checks In The Mail Starting Friday Video NJ Spotlight News

500 Tax Rebate Checks In The Mail Starting Friday Video NJ Spotlight News

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

Tax Rebate Checks For 2024 - Many are issuing property tax rebates or using money from leftover COVID 19 recovery funds to pay their citizens States set to issue payments in 2024 are New York Maryland New Mexico