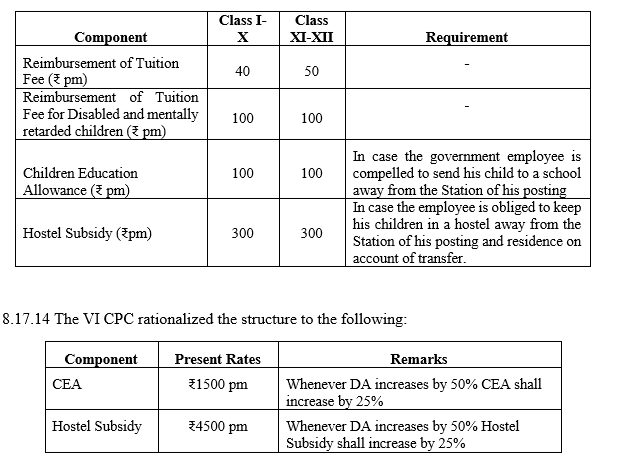

Tax Rebate Children S Education Allowance Web 14 avr 2017 nbsp 0183 32 Childrens Education Allowance INR 100 per month per child up to a maximum of 2 children Hostel Expenditure Allowance INR 300 per month per child up

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e Web 4 janv 2023 nbsp 0183 32 Montant de la r 233 duction d imp 244 t pour frais de scolarit 233 en 2023 61 d imp 244 t en moins par enfant au coll 232 ge 153 d imp 244 t en moins par enfant au lyc 233 e

Tax Rebate Children S Education Allowance

Tax Rebate Children S Education Allowance

https://1.bp.blogspot.com/-W2u0-CadP1s/XMG6u8XXNcI/AAAAAAAAWOA/umdl1GMaMVUjHicW58RWDDIL1sYzS6C4wCLcBGAs/s1600/CEA-Reimbursement-Format%2540potools_page_1.jpg

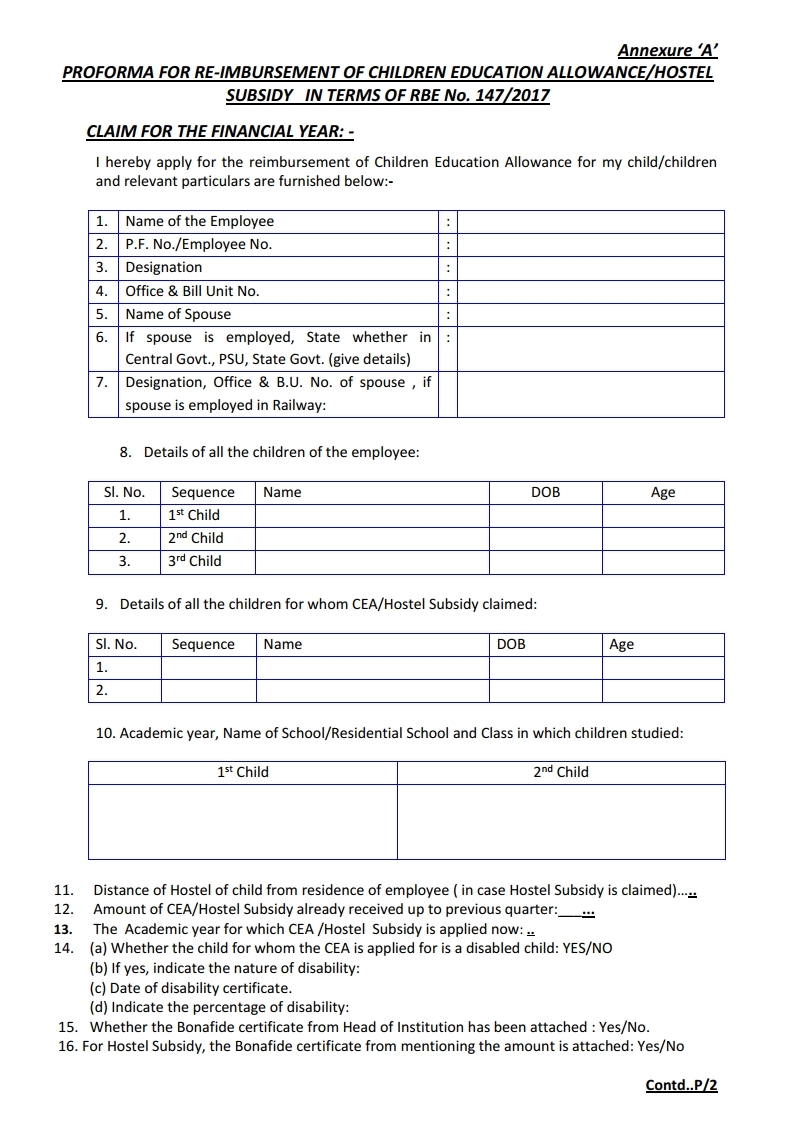

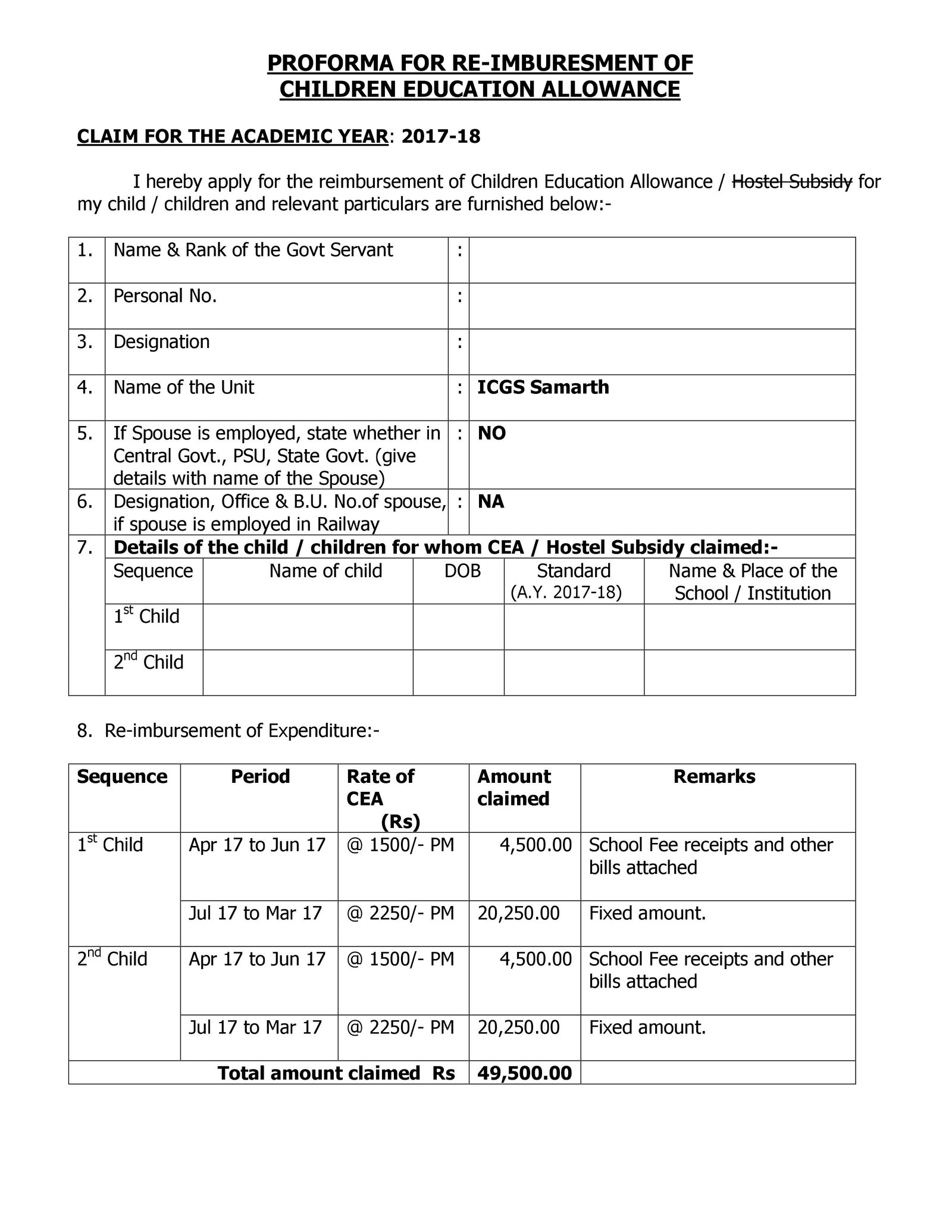

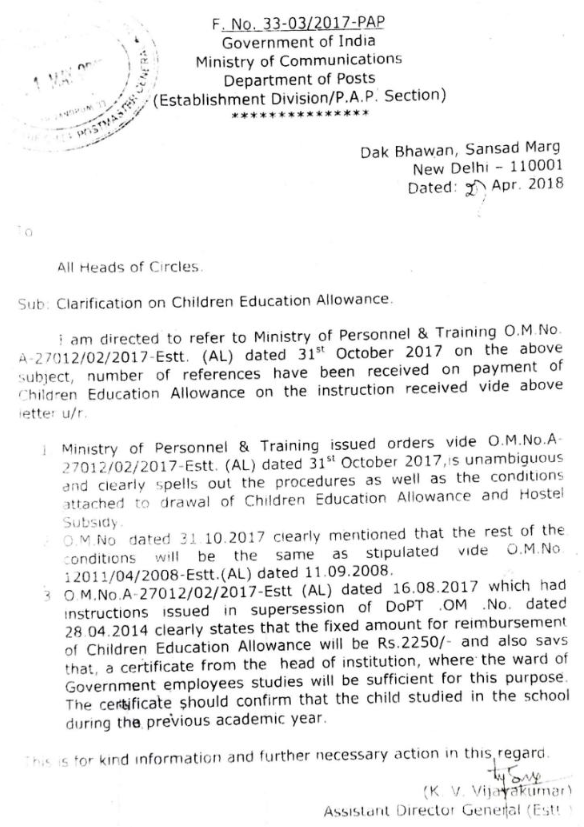

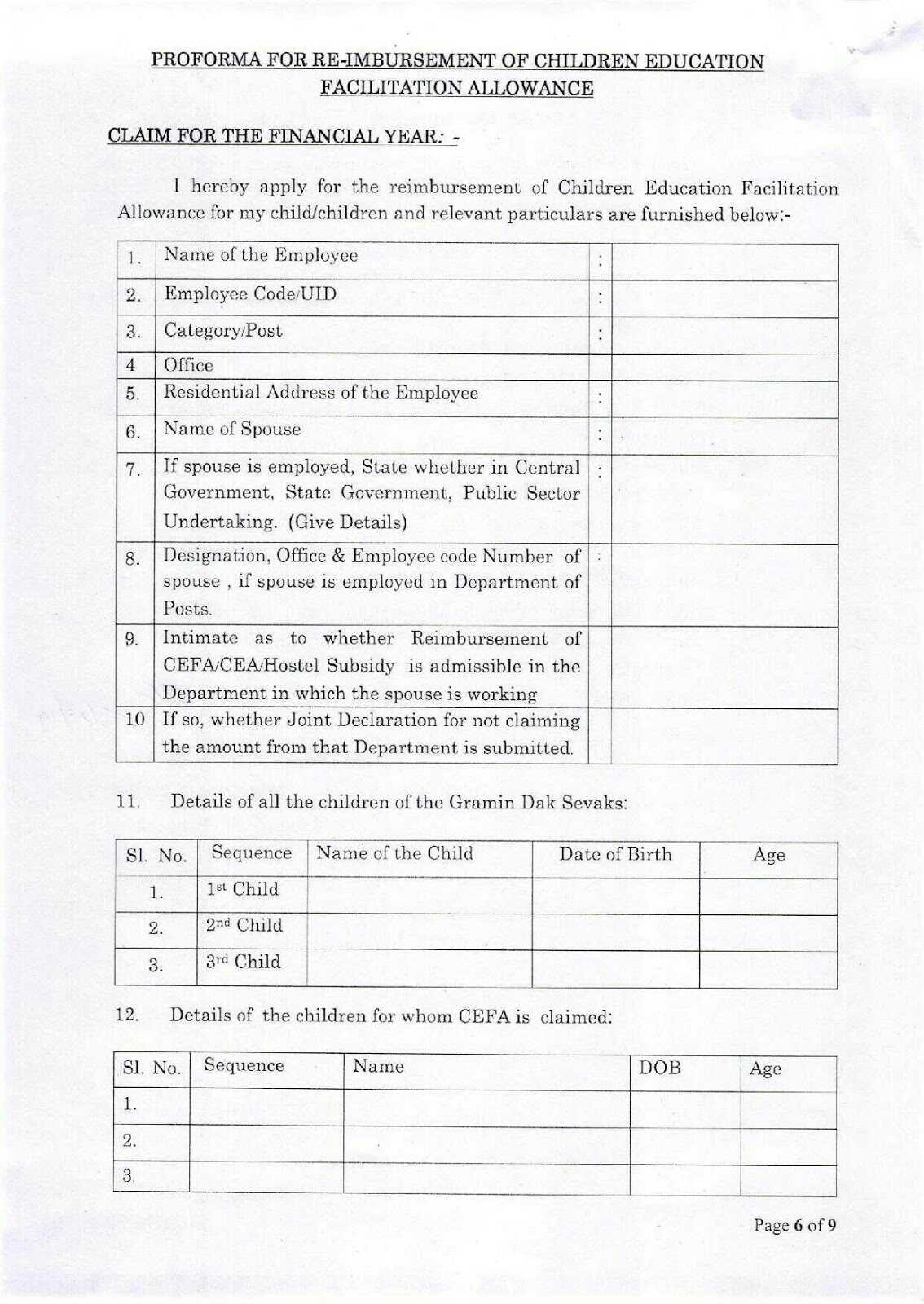

Children Education Allowance For The Year 2017 2018 Govtempdiary

https://govtempdiary.com/wp-content/uploads/2018/03/0006-2.jpg

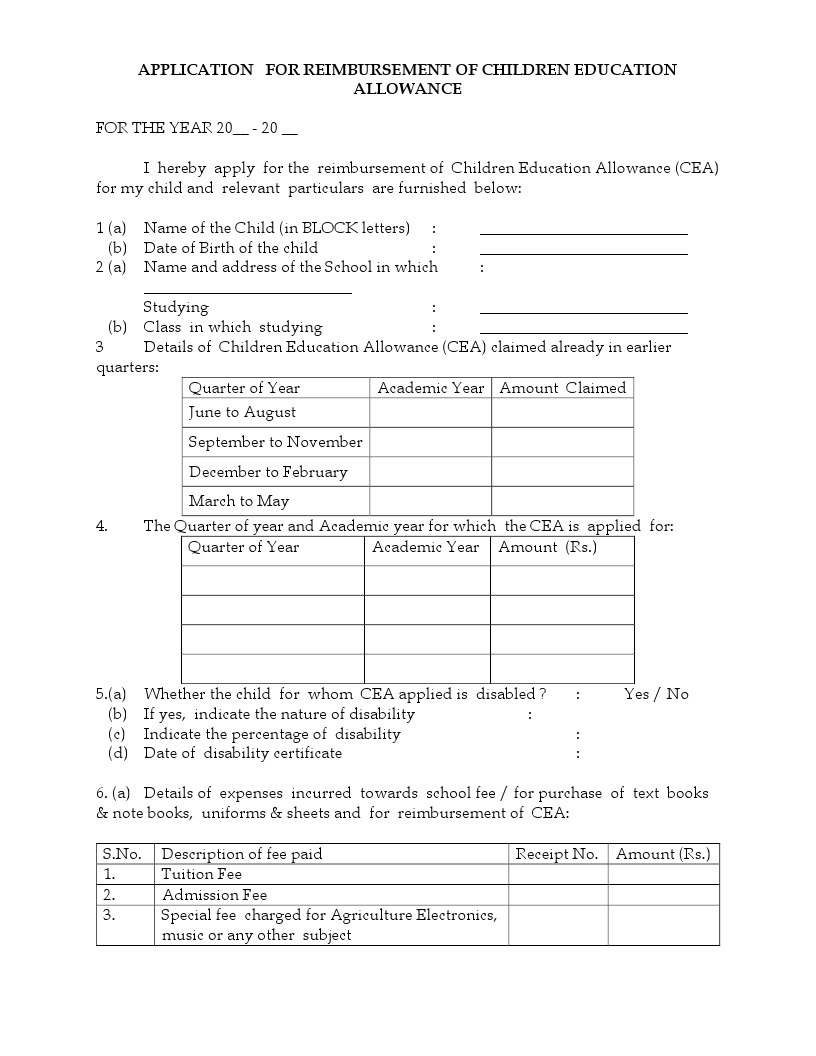

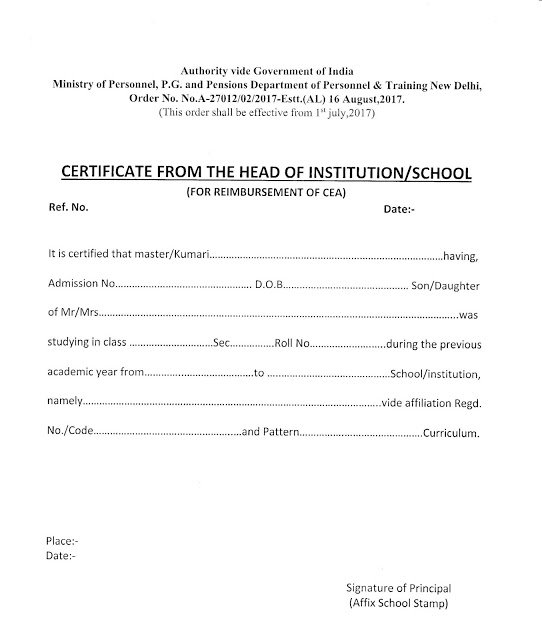

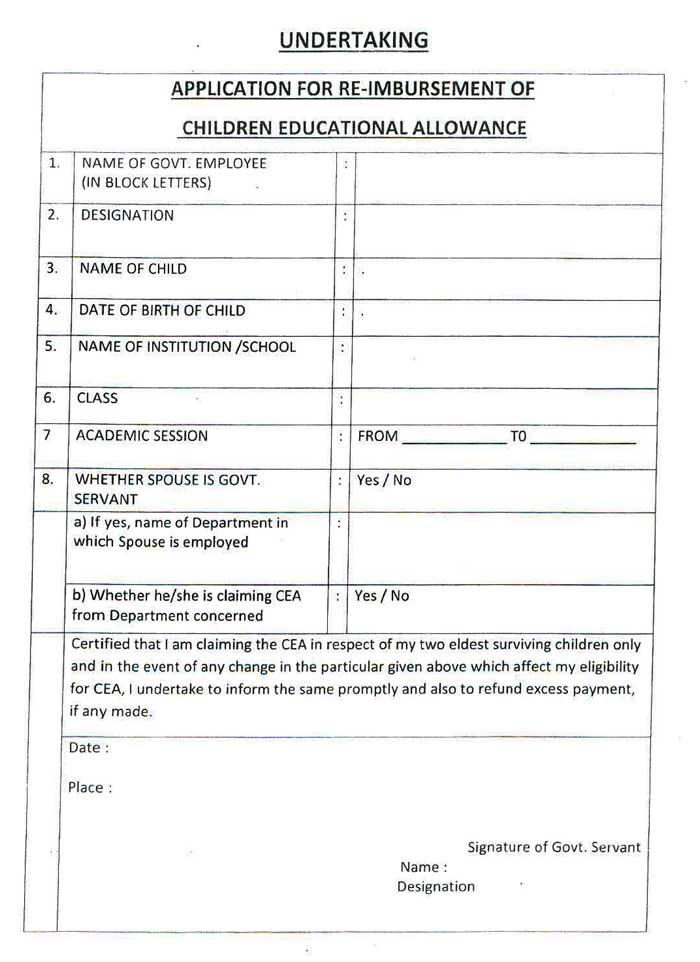

APPLICATION FOR REIMBURSEMENT OF CHILDREN EDUCATION ALLOWANCE SA POST

https://3.bp.blogspot.com/-9x-33NpUY6U/WNYGL4GSdWI/AAAAAAAAKY0/4qSYBrGnPg09EL8ZIaWni_HlN1WicgM6QCLcB/s1600/CEA.pdf_page_1.jpg

Web 22 juil 2019 nbsp 0183 32 Children s Educational Allowance An allowance of INR 100 per month is allowed per child for up to two children studying in an educational institution Hostel Web Education allowance This is fixed at Rs 100 each month for each child Note that the exemption is limited only to 2 children If CEA is applied for a 3rd child it will not be

Web 27 juin 2018 nbsp 0183 32 The deduction on payments made towards tuition fee can be claimed up to Rs 150 000 Rs 1 00 000 upto A Y 2014 15 together with deduction in respect of Web The Section 10 of the Income Tax Act has the details but popular allowances include House Rent Allowance HRA Children Education Allowance Gratuity and Leave

Download Tax Rebate Children S Education Allowance

More picture related to Tax Rebate Children S Education Allowance

Children Education Allowance CEA Recommended By 7th Pay Commission

https://gservants.com/wp-content/uploads/2015/11/CEA-in-7th-pay-commission.png

Children Education Allowance Certificate Format 7Th CPC Children

http://www.govtempdiary.com/wp-content/uploads/2018/02/7th-CPC-Children-education-allowance-form.jpg

Child Education Allowance Form

https://1.bp.blogspot.com/-3Eno4oLEv-0/XiBMrznpHAI/AAAAAAAADdg/5u890YCGJZwQTBUEmQeprNJs1BpC2obOQCLcBGAsYHQ/s1600/cea4.jpg

Web Save taxes on tuition fees You can claim a deduction of up to Rs 1 5 Lakh under Section 80C of the Income Tax Act on your child s school or college fees and reduce your Web 11 juil 2017 nbsp 0183 32 1 House Rent Allowance HRA If you are receiving HRA as part of your salary and also pay rent for residential accommodation then you can claim the HRA paid

Web 27 f 233 vr 2023 nbsp 0183 32 Children Education Allowance Fixed education allowance received from the employer is tax exempt upto Rs 100 per month per child upto a maximum of 2 Web Taxable Children education allowance Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct

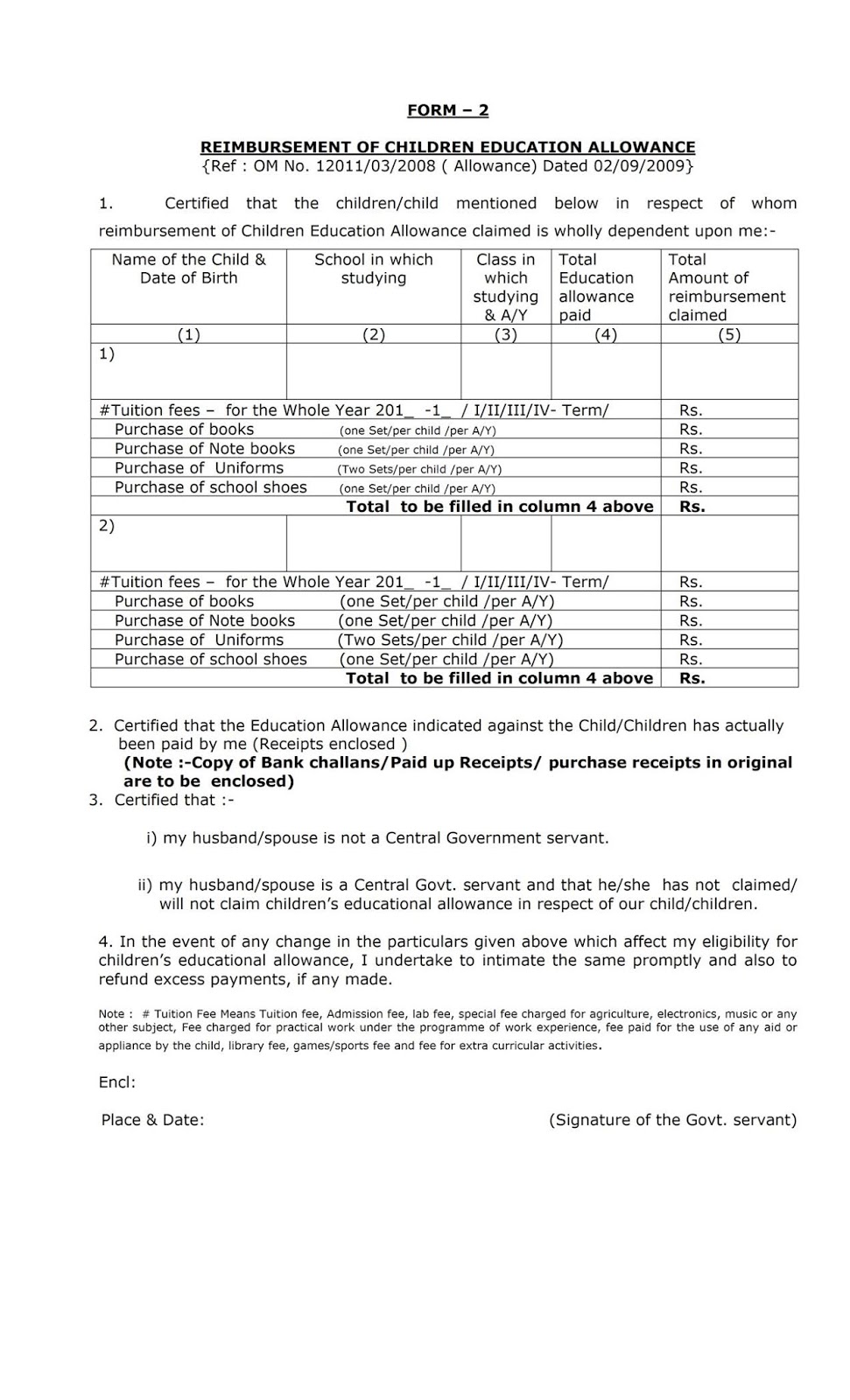

Children Education Allowance Claim Form Fee Tuition Payments

https://imgv2-2-f.scribdassets.com/img/document/134845349/original/4d847bfb60/1566144965?v=1

PDF Children Education Allowance Form Download Here Govtempdiary

https://govtempdiary.com/wp-content/uploads/2018/04/0002.jpg

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 Childrens Education Allowance INR 100 per month per child up to a maximum of 2 children Hostel Expenditure Allowance INR 300 per month per child up

https://www.toutsurmesfinances.com/impots/frais-de-scolarite-quel-a...

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

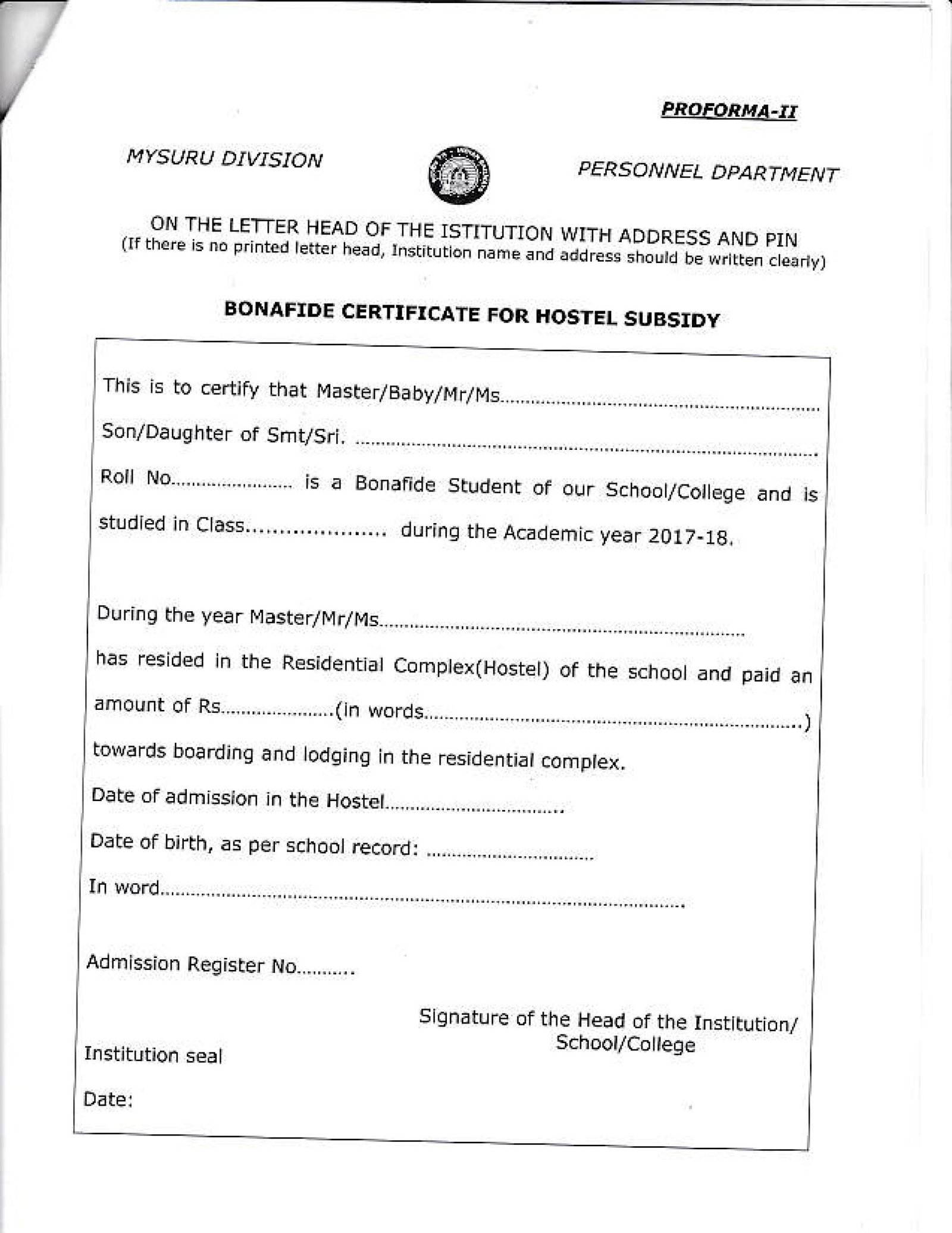

Children Education Allowance For Postal Employees With Fixed Amount Of

Children Education Allowance Claim Form Fee Tuition Payments

Reimbursement Of Children Education Allowance Will Be Rs 2250 Per

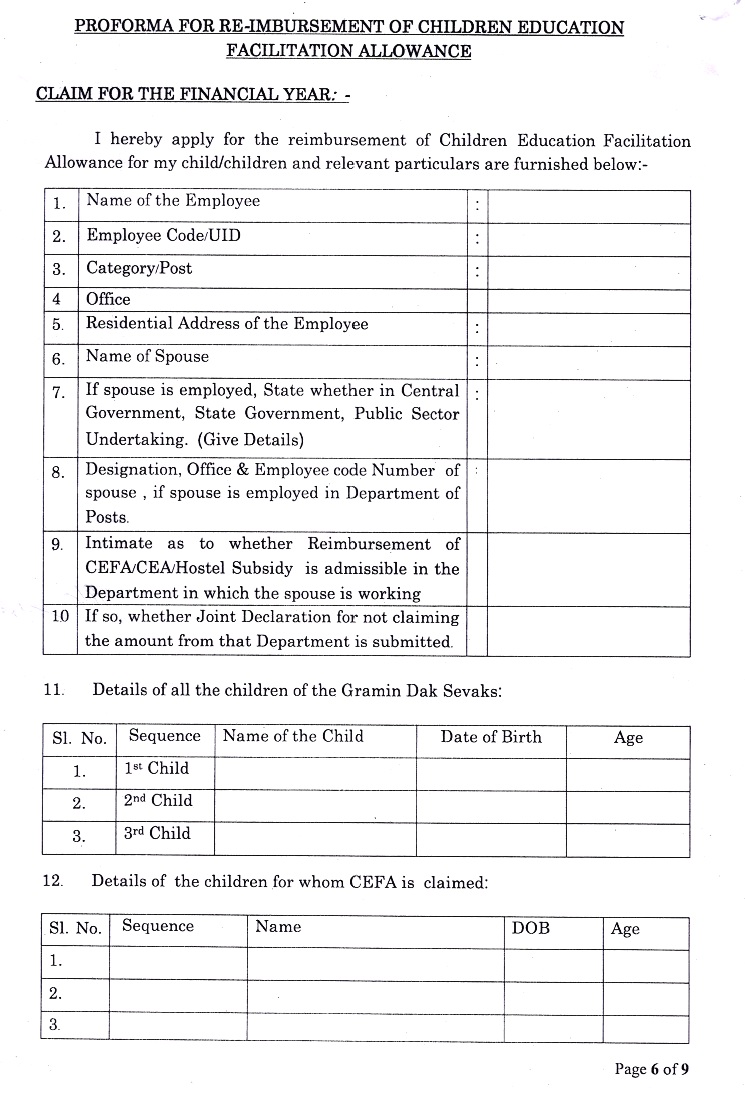

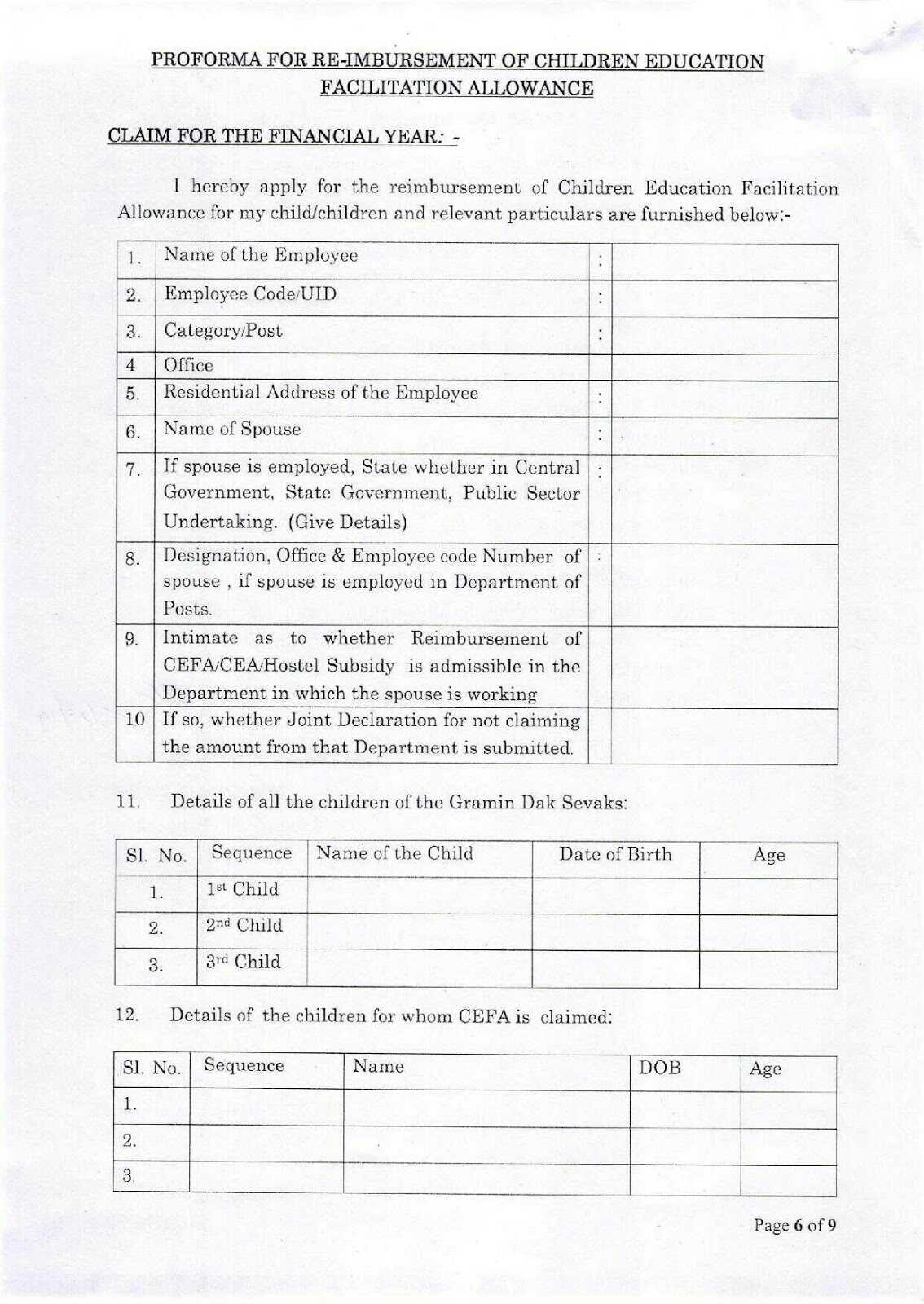

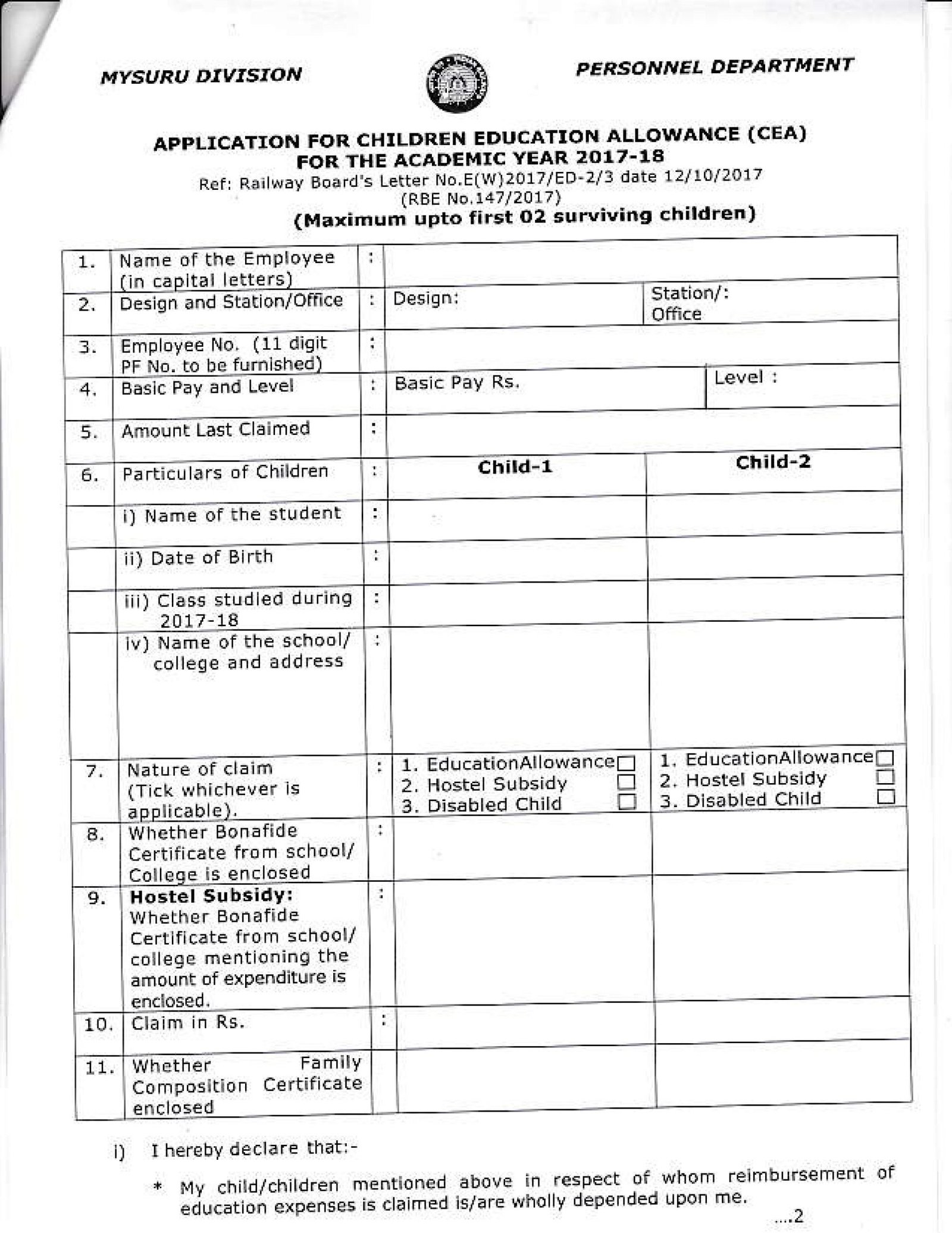

Introduction Of Children Education Facilitation Allowance For GDS

CEA Reimbursement Form 7th CPC Child Education Allowance Form For

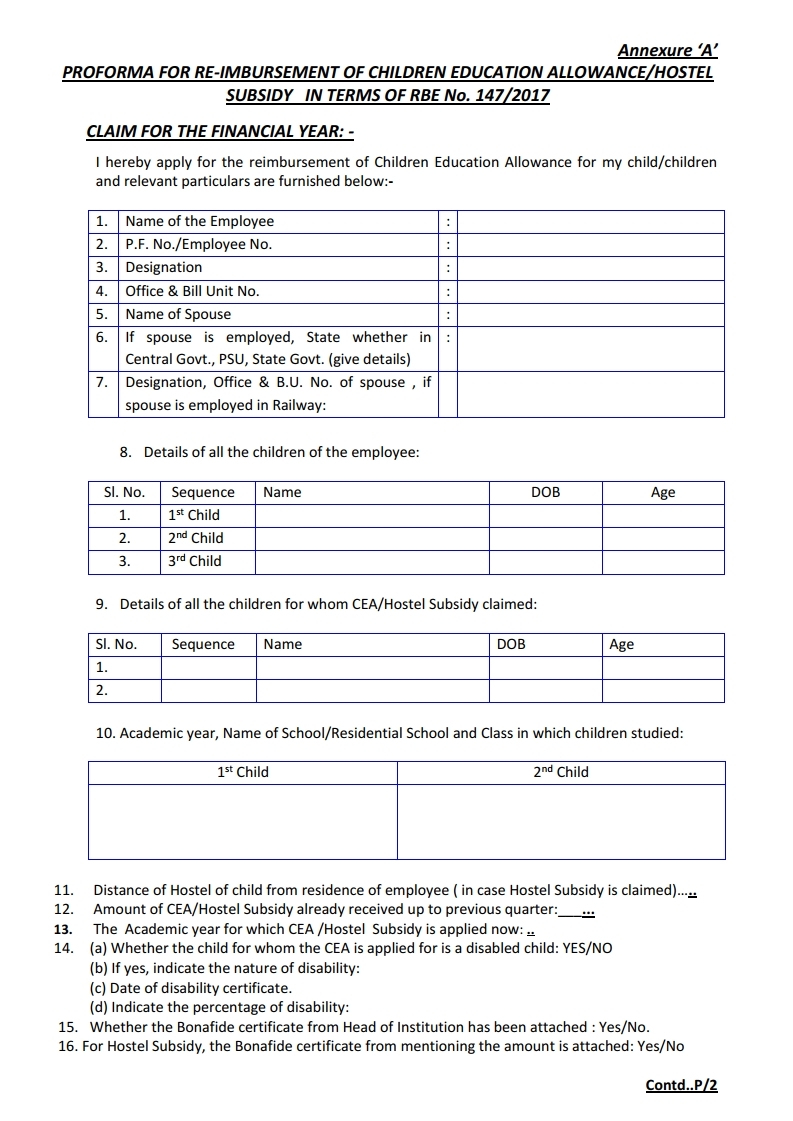

Proforma For Re imbursement Of Children Education Facilitation

Proforma For Re imbursement Of Children Education Facilitation

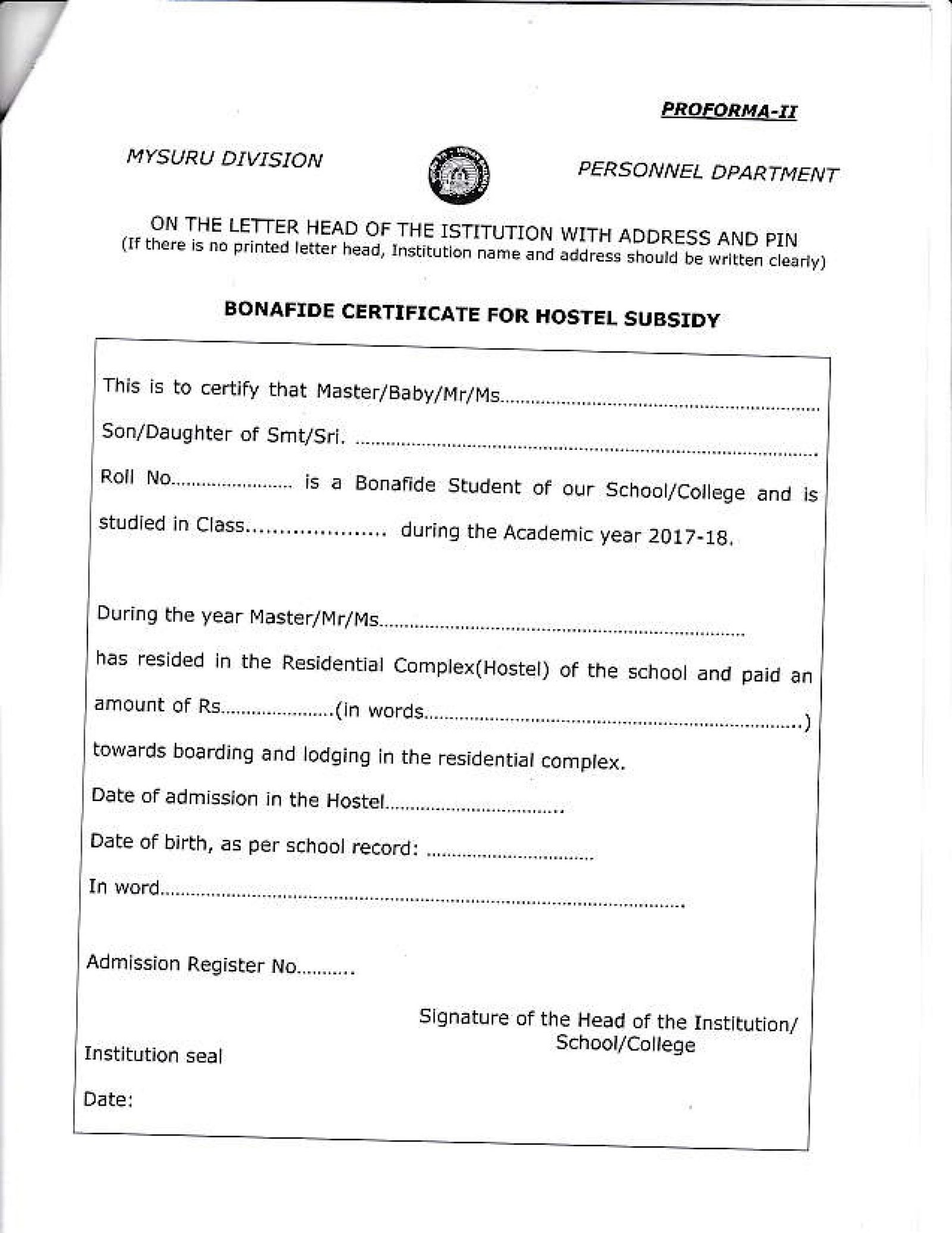

Children Education Allowance For The Year 2017 2018 Govtempdiary

Children Education Allowance For The Year 2017 2018 Central

GDS Children Education Allowance Application Form PDF

Tax Rebate Children S Education Allowance - Web The Family Tax Benefit Part A is paid for dependent children up to 20 years of age and for dependent full time students up to the age of 24 who are not getting Youth Allowance