Tax Rebate Cis Web Quickly calculate how big your CIS tax rebate is and what expenses you can claim Sometimes you can claim expenses even without receipts

Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company and you ve Web 25 juin 2020 nbsp 0183 32 Wondering how to get a tax rebate as a Construction Industry Worker In this video Dan explains how it all works as a sole trader in the UK Dan covers questi

Tax Rebate Cis

Tax Rebate Cis

https://mysimplytax.com/assets/front/img/NICK.png

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner3.jpg

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner4.jpg

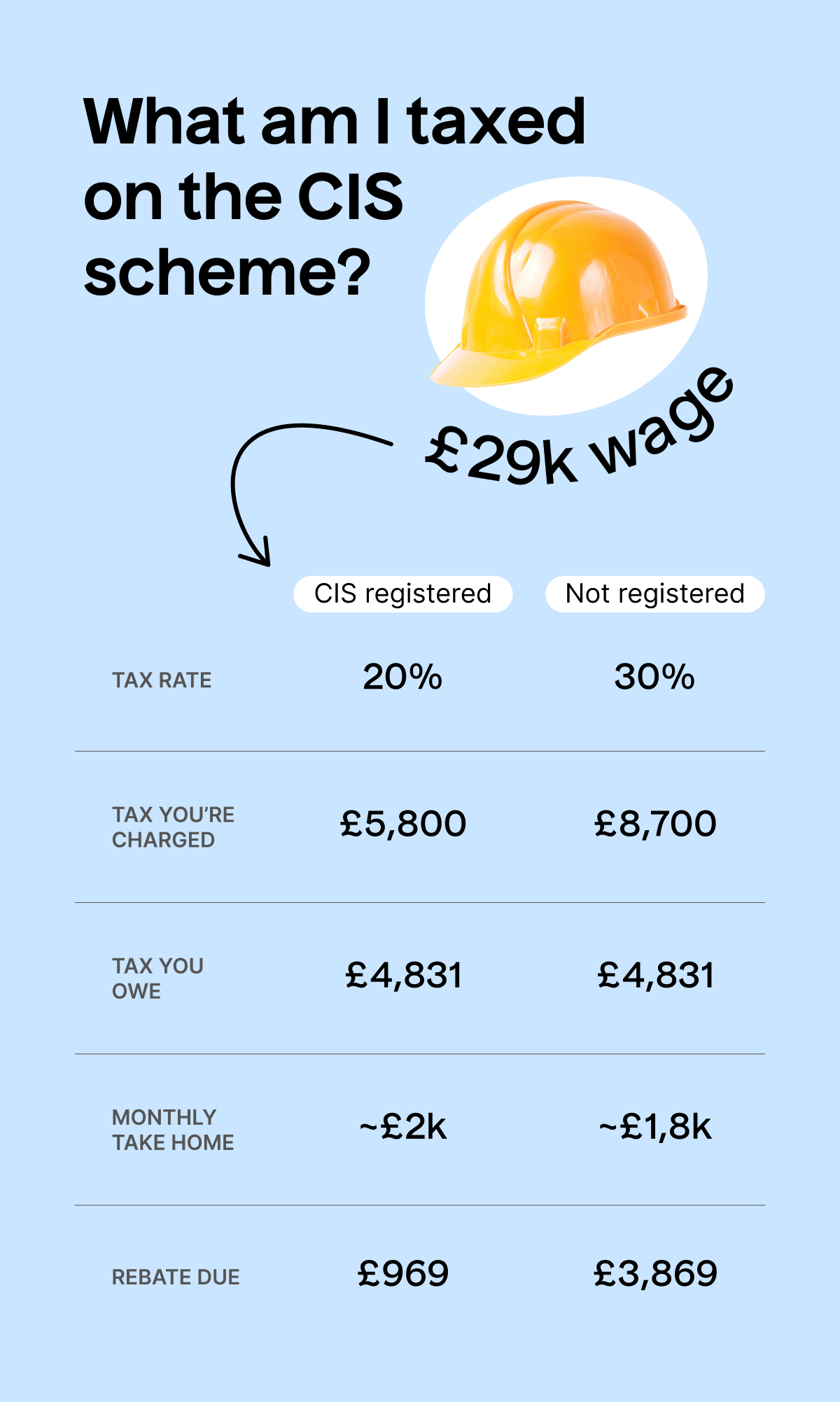

Web Construction Industry Scheme CIS Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue Web Under the CIS you will likely be entitled to a tax rebate as you will have had 20 tax deducted from your salary to contribute towards your tax and National Insurance

Web Calculate your Rebate Want to know how much your CIS tax rebate could be worth Use our online calculator to get an instant estimate If you work in the construction industry Web The CIS Tax rebate calculator will act as a rough indication of what your potentially Tax refund could be It will take into consideration your pay or gross income the Tax you have paid as well as details of the expenses

Download Tax Rebate Cis

More picture related to Tax Rebate Cis

Are You Due A Tax Rebate As A Construction Worker CIS Tax Rebates

https://i.ytimg.com/vi/15YyMso62Pg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgTChBMA8=&rs=AOn4CLASCPM38RGfKJdxMK3jSJV9qnVM9g

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

https://www.cis-taxlink.co.uk/wp-content/uploads/2015/03/home-banner2.jpg

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

https://www.mysimplytax.com/assets/front/img/hclient2.png

Web 9 f 233 vr 2023 nbsp 0183 32 Last updated 9 Feb 2023 If you re a self employed individual under the CIS Construction Industry Scheme luckily for you there are a few CIS deductions you can Web CLAIM BACK YOUR CIS TAX RETURNS NOW If you work in any type of construction or labouring job you will almost certainly be entitled to claim a Construction Industry

Web 4 janv 2022 nbsp 0183 32 Most CIS workers receive a tax refund rebate after they submit their Self Assessment tax return because they usually overpay towards their tax bill through CIS Web CIS Tax Rebates Those subcontracted in construction under CIS are often due annual Tax rebates This is mainly because too much Tax has been deducted from the sub

CIS Tax Rebate Service YouTube

https://i.ytimg.com/vi/BTIbVFWzP3A/maxresdefault.jpg

Why Am I Paying 30 Tax TaxScouts

https://taxscouts.com/wp-content/uploads/Infographic_CIS-1.jpg

https://taxscouts.com/calculator/cis-tax-rebate

Web Quickly calculate how big your CIS tax rebate is and what expenses you can claim Sometimes you can claim expenses even without receipts

https://www.gov.uk/guidance/claim-a-refund-of-construction-industry...

Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company and you ve

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

CIS Tax Rebate Service YouTube

Cis Tax Rebate Calculator CALCULATORSD

Cis Tax Rebate Calculator CALCULATORSD

Tax In 10 ish Seconds What Is The CIS Rebate YouTube

CIS Tax Rebates Get The Most From Your Tax Rebate Brian Alfred

CIS Tax Rebates Get The Most From Your Tax Rebate Brian Alfred

WHAT IS CIS TAX REBATE AND HOW TO CLAIM IT Personality Rights Database

CIS Construction Industry Scheme Rebate My Tax Ltd

Rebate My Tax Ltd Tax Refund Experts

Tax Rebate Cis - Web CANALITIX ACCOUNTANTS help CIS subcontractors to recover an average of 163 1 500 in overpaid income tax which is referred to as CIS tax rebate CIS rebates take