Tax Rebate Company Car Mileage Web 21 juil 2020 nbsp 0183 32 Reimburse employees for company car business travel If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the

Web 45p per mile for the first 10 000 miles you travel for work in a year After that the rate drops to 25p These are called Approved Mileage Allowance Payments AMAP If your Web 9 juin 2023 nbsp 0183 32 You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey UK mileage rates can differ however HMRC advisory fuel rates state that in most

Tax Rebate Company Car Mileage

Tax Rebate Company Car Mileage

https://www.xltemplates.org/wp-content/uploads/2015/11/mileage-log-with-reimbursement-log.png

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-1-1068x889.png

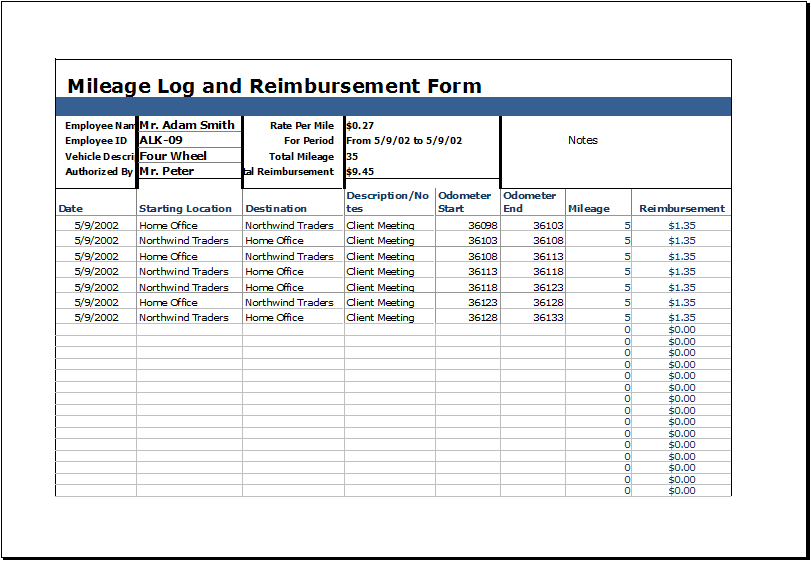

Vehicle Mileage Log With Reimbursement Form Word Excel Templates

https://www.wordexceltemplates.com/wp-content/uploads/2016/05/Mileage-log-with-reimbursement-form.png

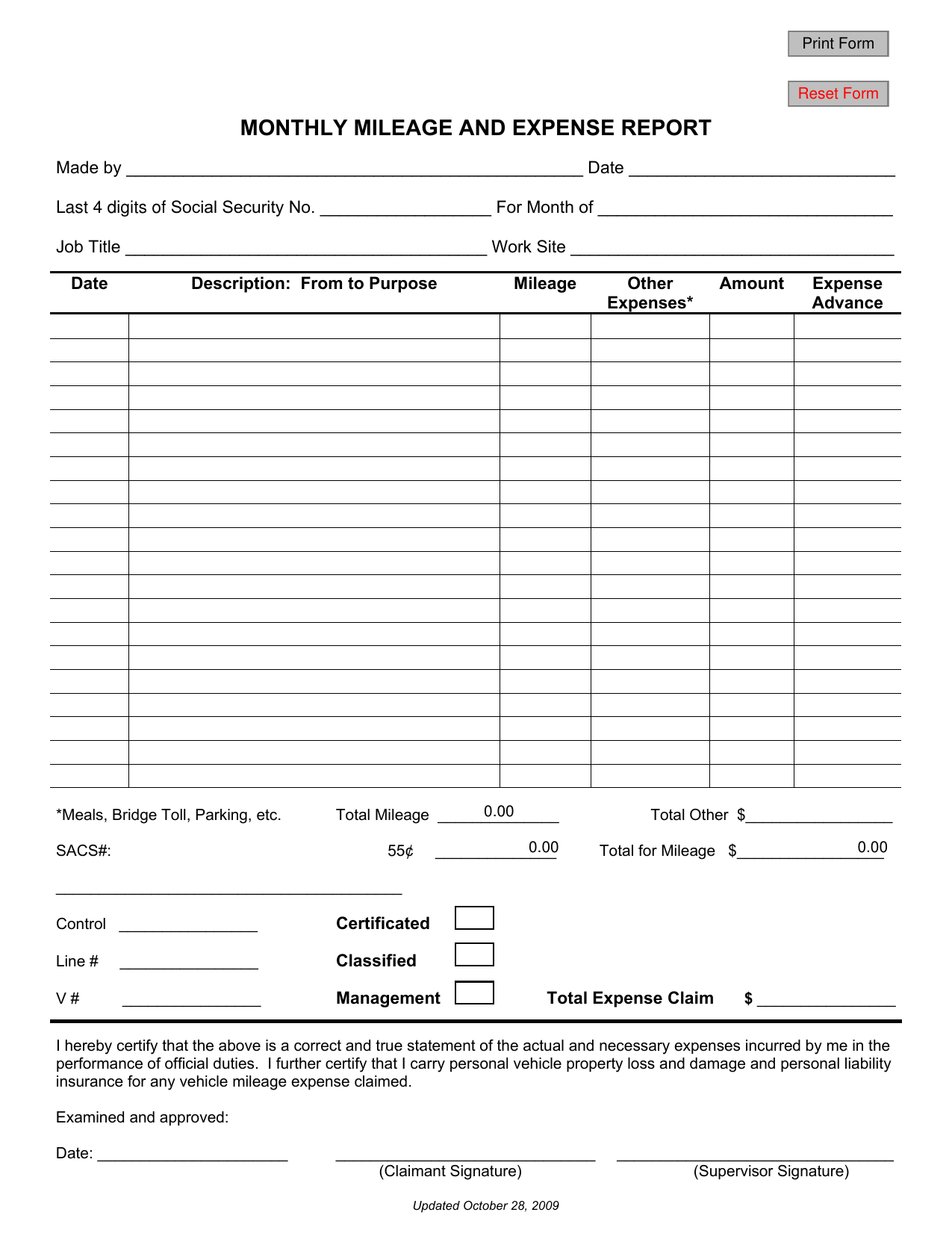

Web 1 ao 251 t 2023 nbsp 0183 32 To calculate your reimbursement you simply follow the below miles x rate 5 000 x 0 45 2250 GBP However do keep in mind that following HMRC s advisory rate Web Mileage Allowance Payments 480 Appendix 3 Work out the appropriate percentage for company car benefits 480 Appendix 2 Check how much tax relief you can claim for

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a Web 6 oct 2022 nbsp 0183 32 On 1 June 2022 HMRC issued the current advisory fuel rates which for example are 14p for petrol fueled cars with an engine size of 1 400cc or less Up to 25p per mile is possible depending on engine size

Download Tax Rebate Company Car Mileage

More picture related to Tax Rebate Company Car Mileage

![]()

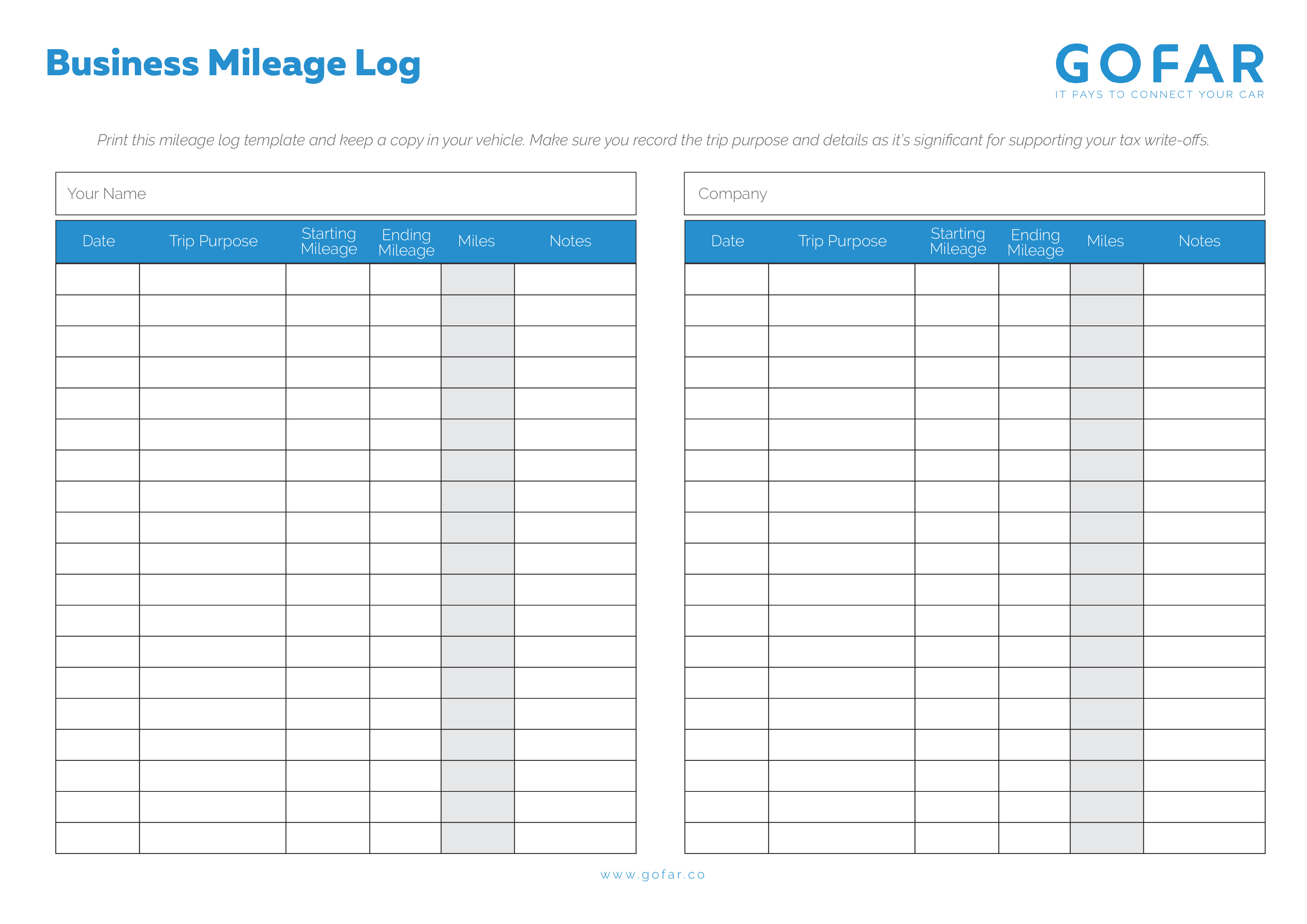

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

https://wssufoundation.org/wp-content/uploads/2020/11/editable-25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-word-scaled-2048x1449.jpg

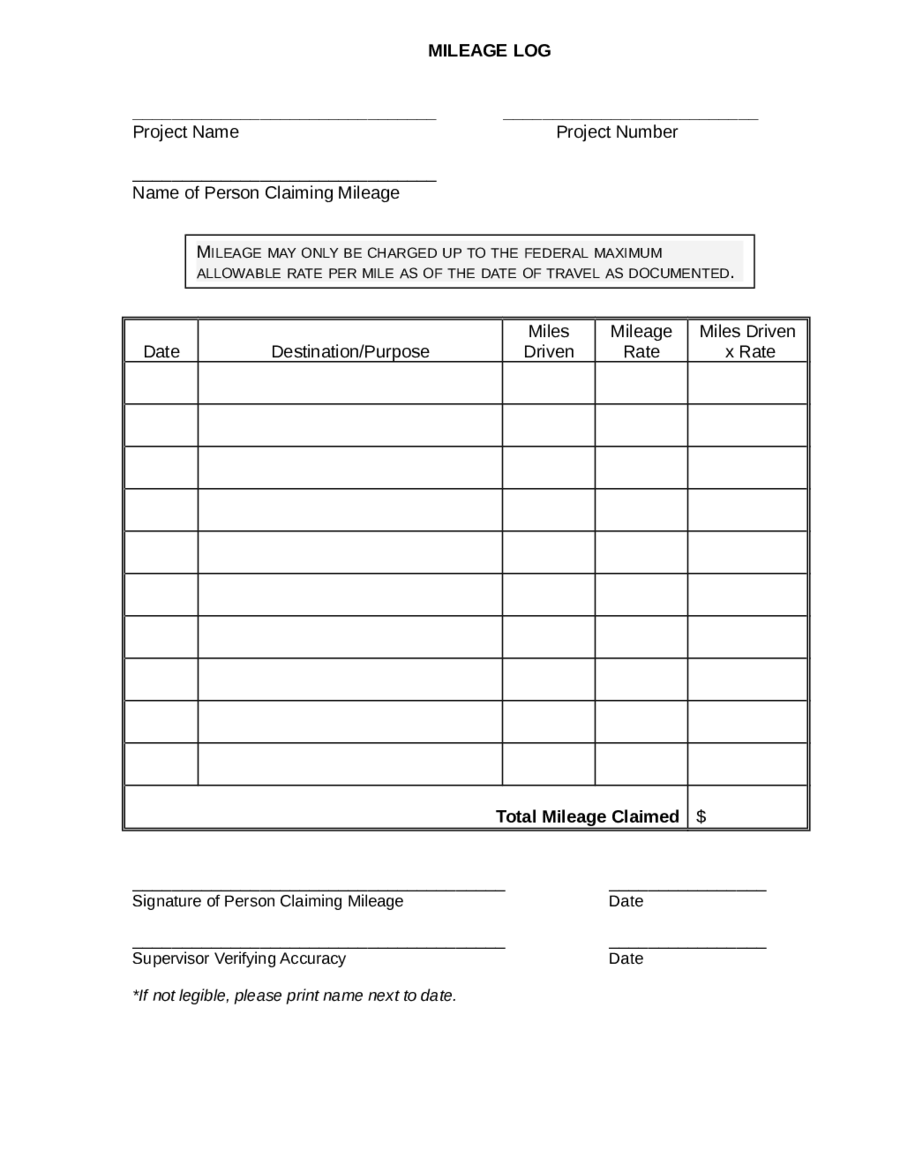

2023 Mileage Log Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/yum/mileage-log-form-0266145.png

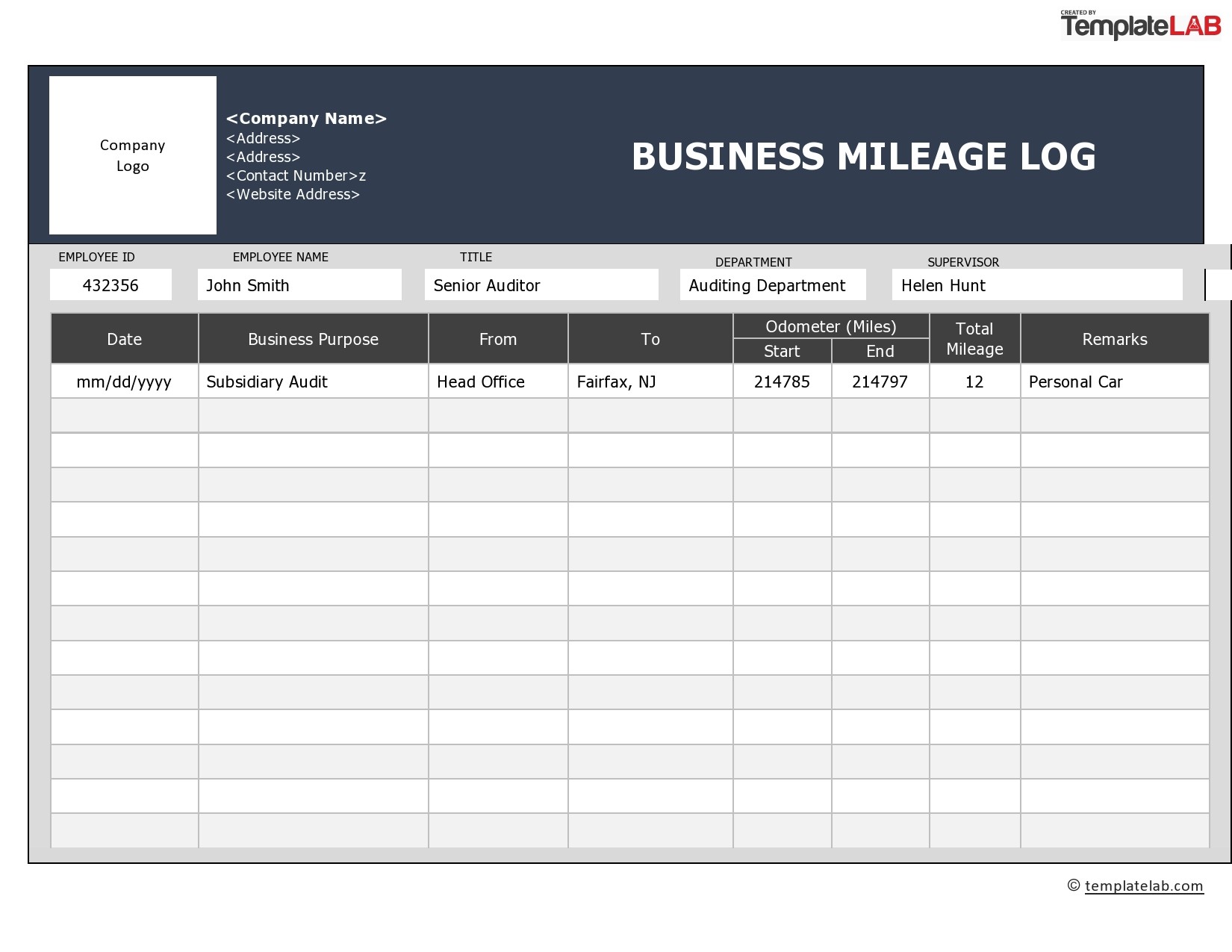

31 Printable Mileage Log Templates Free TemplateLab

http://templatelab.com/wp-content/uploads/2020/02/Business-Mileage-Log-TemplateLab.com_.jpg

Web The following table summarizes the optional standard mileage rates for employees self employed individuals or other taxpayers to use in computing the deductible costs of Web 21 mars 2023 nbsp 0183 32 Getty Images Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their travel

Web Depending on your employer you might already be getting a mileage allowance to help with the costs If you re not or if you re getting less than the AMAP rates you can claim some Web 9 juin 2021 nbsp 0183 32 Using a company car Since April 2015 UK taxpayers have been able to claim Work Mileage Tax Allowance also known as Work Mileage Relief for business travel

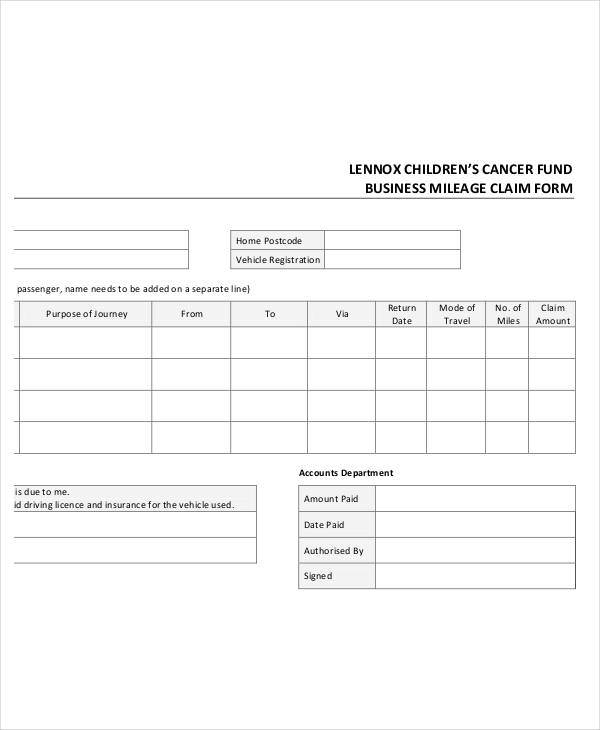

FREE 47 Claim Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2017/03/Monthly-Car-Mileage-Claim-Form.jpg

FREE 49 Claim Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2017/04/Car-Mileage-Claim-Form.jpg

https://www.gov.uk/guidance/advisory-fuel-rates

Web 21 juil 2020 nbsp 0183 32 Reimburse employees for company car business travel If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the

https://www.riftrefunds.co.uk/tax-rebates/claim-tax-back/company-cars...

Web 45p per mile for the first 10 000 miles you travel for work in a year After that the rate drops to 25p These are called Approved Mileage Allowance Payments AMAP If your

A Guide To Company Car Tax For Electric Cars CLM

FREE 47 Claim Forms In PDF

Hmrc Private Mileage Claim Form Erin Anderson s Template

Printable Mileage Log Templates In Excel Format Artofit

Blank Mileage Form Mileage Log Printable Mileage Templates

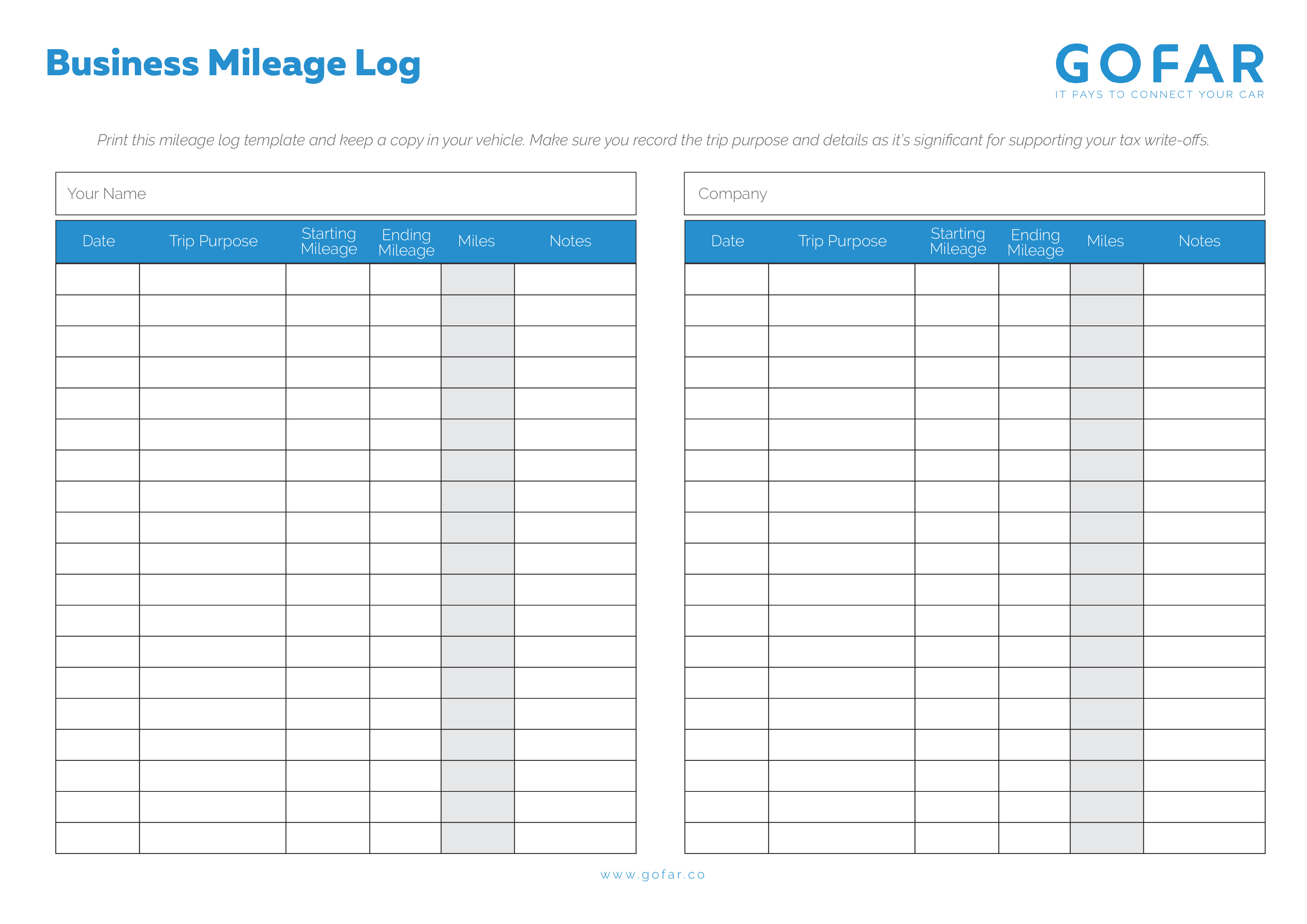

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

20 Printable Mileage Log Templates Free TemplateLab

Download Mileage Expense Report Form PDF FreeDownloads

FREE 32 Claim Form Templates In PDF Excel MS Word

Tax Rebate Company Car Mileage - Web Company car I drive a company car Can I still claim Yes you can Although the rates for company cars are different but if you re paying mileage expenses yourself you could be