Tax Rebate Credit Unemployment Web 13 juil 2021 nbsp 0183 32 IR 2021 151 July 13 2021 WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million

Web 31 mars 2021 nbsp 0183 32 IR 2021 71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund Web 17 juin 2021 nbsp 0183 32 COVID Tax Tip 2021 87 June 17 2021 For eligible taxpayers this could result in a refund a reduced balance due or no change to tax Taxpayers may receive a

Tax Rebate Credit Unemployment

Tax Rebate Credit Unemployment

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

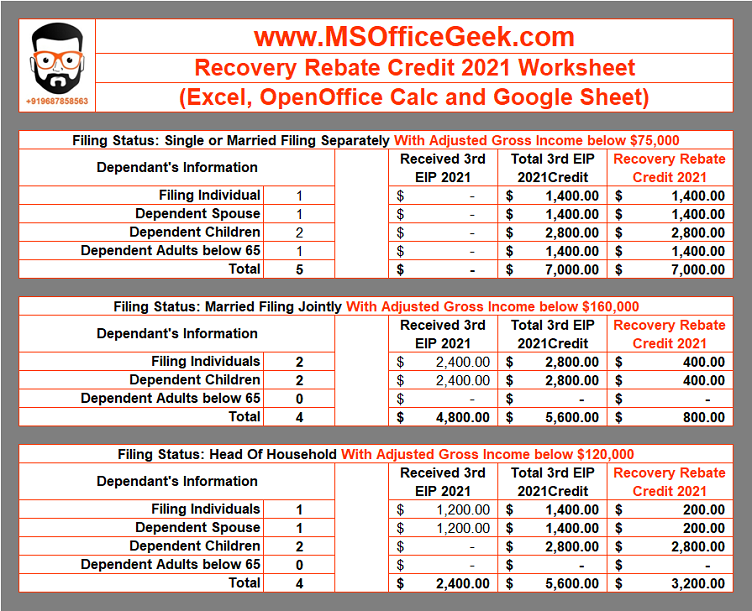

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

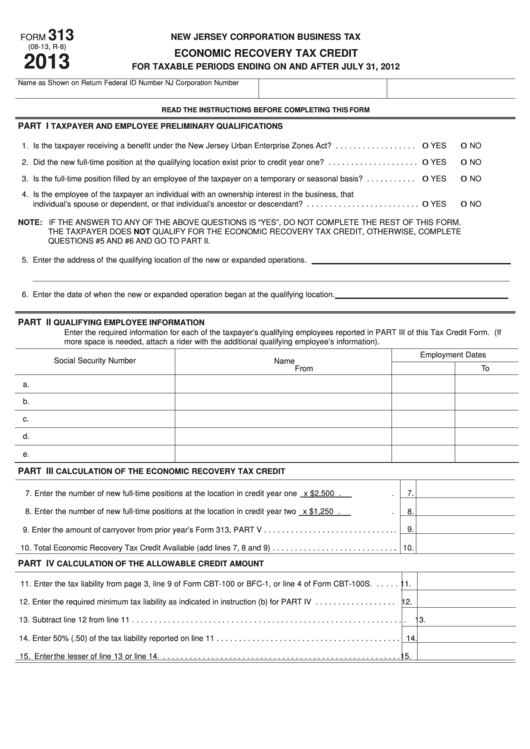

Form 313 Economic Recovery Tax Credit 2013 Printable Pdf Download

https://www.recoveryrebate.net/wp-content/uploads/2023/01/form-313-economic-recovery-tax-credit-2013-printable-pdf-download.png

Web 3 mai 2021 nbsp 0183 32 The American Rescue Plan waived federal tax on up to 10 200 of unemployment benefits per person collected last year The Covid pandemic created Web 8 avr 2021 nbsp 0183 32 The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the

Web 2 nov 2021 nbsp 0183 32 At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns The 10 200 tax break is the amount of income exclusion for single filers not Web 23 mars 2021 nbsp 0183 32 The American Rescue Plan waives federal tax on up to 10 200 of unemployment benefits collected last year per person But the 1 9 trillion Covid relief

Download Tax Rebate Credit Unemployment

More picture related to Tax Rebate Credit Unemployment

Taxes Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-3.png?w=696&h=696&crop=1&ssl=1

Track Your Recovery Rebate With This Worksheet Style Worksheets

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

https://www.expatforum.com/attachments/1633512360704-png.100433/

Web 31 mars 2021 nbsp 0183 32 The American Rescue Plan Act which was enacted in March exempts up to 10 200 of unemployment benefits received in 2020 20 400 for married couples filing jointly from federal income tax Web 15 nov 2021 nbsp 0183 32 FAQs G8 and G9 note that taxpayers might receive a CP08 or CP09 notice from the IRS advising that they did not claim the additional child tax credit or earned

Web 2 d 233 c 2022 nbsp 0183 32 The IRS is no longer automatically correcting your 2020 account and recalculating any credit or deduction that was claimed on the original return impacted by Web 14 d 233 c 2021 nbsp 0183 32 The American Rescue Plan Act waived federal tax on up to 10 200 of 2020 unemployment benefits per person President Joe Biden signed the pandemic relief law

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

https://specials-images.forbesimg.com/imageserve/5f3ed6a781053fc5c2f9ef85/960x0.jpg?fit=scale

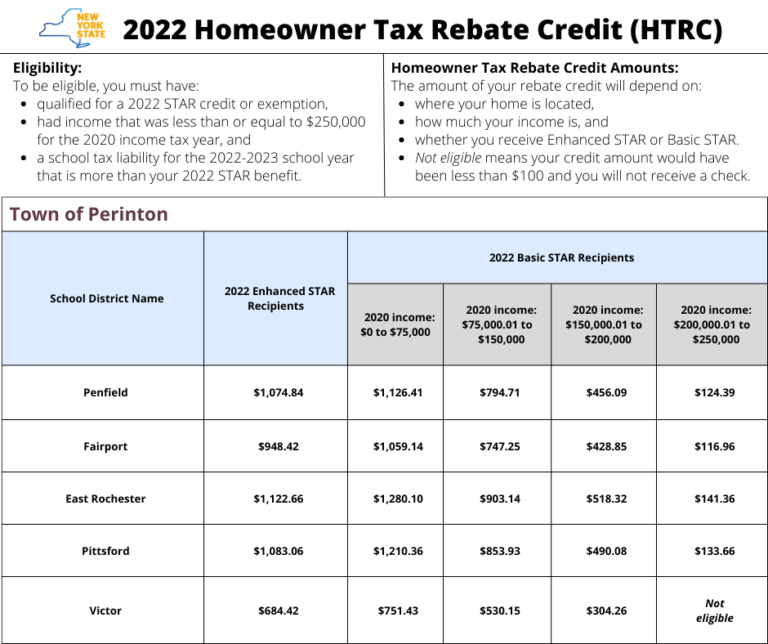

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://www.powerrebate.net/wp-content/uploads/2023/05/nys-homeowner-tax-rebate-credit-htrc-info-town-of-perinton.png

https://www.irs.gov/newsroom/irs-readies-nearly-4-million-refunds-for...

Web 13 juil 2021 nbsp 0183 32 IR 2021 151 July 13 2021 WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million

https://www.irs.gov/newsroom/irs-to-recalculate-taxes-on-unemployment...

Web 31 mars 2021 nbsp 0183 32 IR 2021 71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund

Taxpayer Need More Time To Finish 2023 Return How To Get An Extension

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

The Recovery Rebate Credit Calculator MollieAilie

Pin On Tigri

Illinois Unemployment 941x Fill Out Sign Online DocHub

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Recovery Rebate Credit 2020 Calculator KwameDawson

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

How Do I Claim The Recovery Rebate Credit On My Ta

Tax Rebate Credit Unemployment - Web 3 janv 2023 nbsp 0183 32 The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10 200 of unemployment compensation they received in tax year 2020