Tax Rebate Dates 2024 IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

The maximum credit for the 2023 tax year is 7 430 up from 6 935 the prior year But Social Security beneficiaries may get hit with higher taxes Jaeger warned That s because the threshold What s New Extended due date for residents of Maine and Massachusetts Individuals who live in Maine and Massachusetts have until April 17 2024 to file their 2023 Form 1040 because April 15 2024 is Patriots Day and April 16 2024 is Emancipation Day Pub 51 was discontinued after 2023

Tax Rebate Dates 2024

Tax Rebate Dates 2024

https://matricbseb.com/wp-content/uploads/2023/11/Carbon-Tax-Rebate-2023-2024-What-is-it-Cheque-Dates-and-Everything-you-need-to-know-1024x683.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP 2024 Tax Deadline Monday April 15 2024 The IRS does not release a calendar but continues to issue guidance that most filers should receive their refund within 21 days They also remind filers that many tax software programs allow you to submit your taxes before the start of tax season

To find out the status of your refund you ll need to contact your state tax agency or visit your state s Department of Revenue website The deadline to submit your and pay your tax bill is April 15 2024 For those who were unable to meet the for the year there was an option to file for a six month extension Key 2024 filing season dates January 12 IRS Free File opens January 16 Due date for 2023 fourth quarter estimated tax payments January 26 Earned Income Tax Credit Awareness Day January 29 Filing season start date for individual tax returns April 15 Due date of filing a tax return or to request an extension for most of the nation

Download Tax Rebate Dates 2024

More picture related to Tax Rebate Dates 2024

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

https://www.the-sun.com/wp-content/uploads/sites/6/2022/04/kc-gov-little-comp.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

September 16 Third Quarter Estimated Taxes Due The third estimated tax payment is due on Sept 16 2024 This is for taxes on money you earned from June 1 through Aug 31 The deadline is 2024 IRS tax calendar Use the calendar below to track the due dates for IRS tax filings each month Unless otherwise noted the dates are when the forms are due to be submitted to the IRS Download our complete 2024 Tax Calendar to keep your tax filing on track January January 2 Form 730 Monthly Tax Return for Wagers Nov 2023

The IRS Tax Refund Calendar for 2024 outlines the key dates for tax return processing providing clarity to taxpayers For electronic filers refunds are typically received within 21 days Tax Day is Apr 15 2024 for most taxpayers Taxpayers in Maine or Massachusetts have until Apr 17 2024 due to the Patriot s Day and Emancipation Day holidays Taxpayers living in a

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

https://images.ctfassets.net/ifu905unnj2g/5KwPoo8zZu1ZPIrfn2FdSo/94bf8ce97dc0bc624b3626de0e452578/Screenshot_110422_105531_AM.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

The maximum credit for the 2023 tax year is 7 430 up from 6 935 the prior year But Social Security beneficiaries may get hit with higher taxes Jaeger warned That s because the threshold

Carbon Tax Rebate Cheque Dates 2023 Comparewise

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Carbon Tax Rebate Cheque Dates For 2023 Snappy Rates

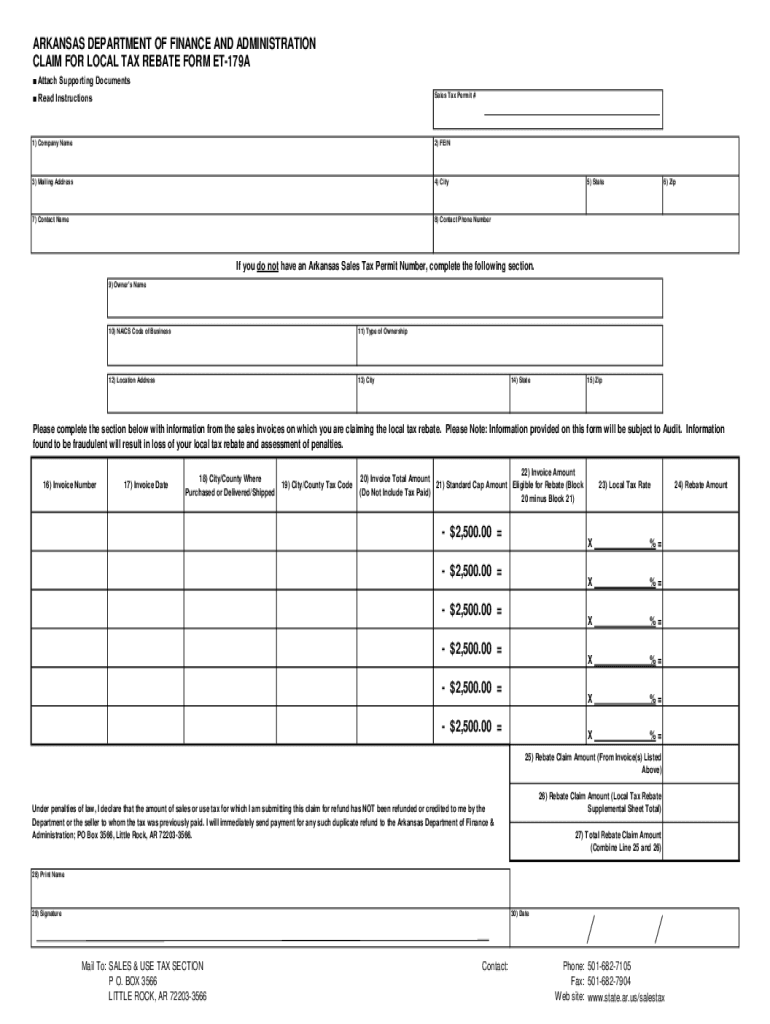

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Tax Rebate Rebate Update 2021

Tax Rebate Rebate Update 2021

Ga State Refund Cycle Chart 2023 Printable Forms Free Online

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

Council Tax Rebate Fury As Millions Of Pensioners Missing Out On 150 Personal Finance

Tax Rebate Dates 2024 - Most taxpayers get their refunds within 21 days which means that people who file their taxes on January 29 the earliest available day to file a return should get their payments by February 19