Tax Rebate Deceased Taxpayer Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 9 mars 2021 nbsp 0183 32 In 2020 after the CARES Act and the issuance of the first Economic Impact Payment the then Secretary of the Treasury Mnuchin instructed surviving taxpayers Web 27 avr 2020 nbsp 0183 32 Are Dead People Eligible For Coronavirus Recovery Rebates Can heirs keep a Coronavirus Recovery Rebate that the Internal Revenue Service sent to a dead

Tax Rebate Deceased Taxpayer

Tax Rebate Deceased Taxpayer

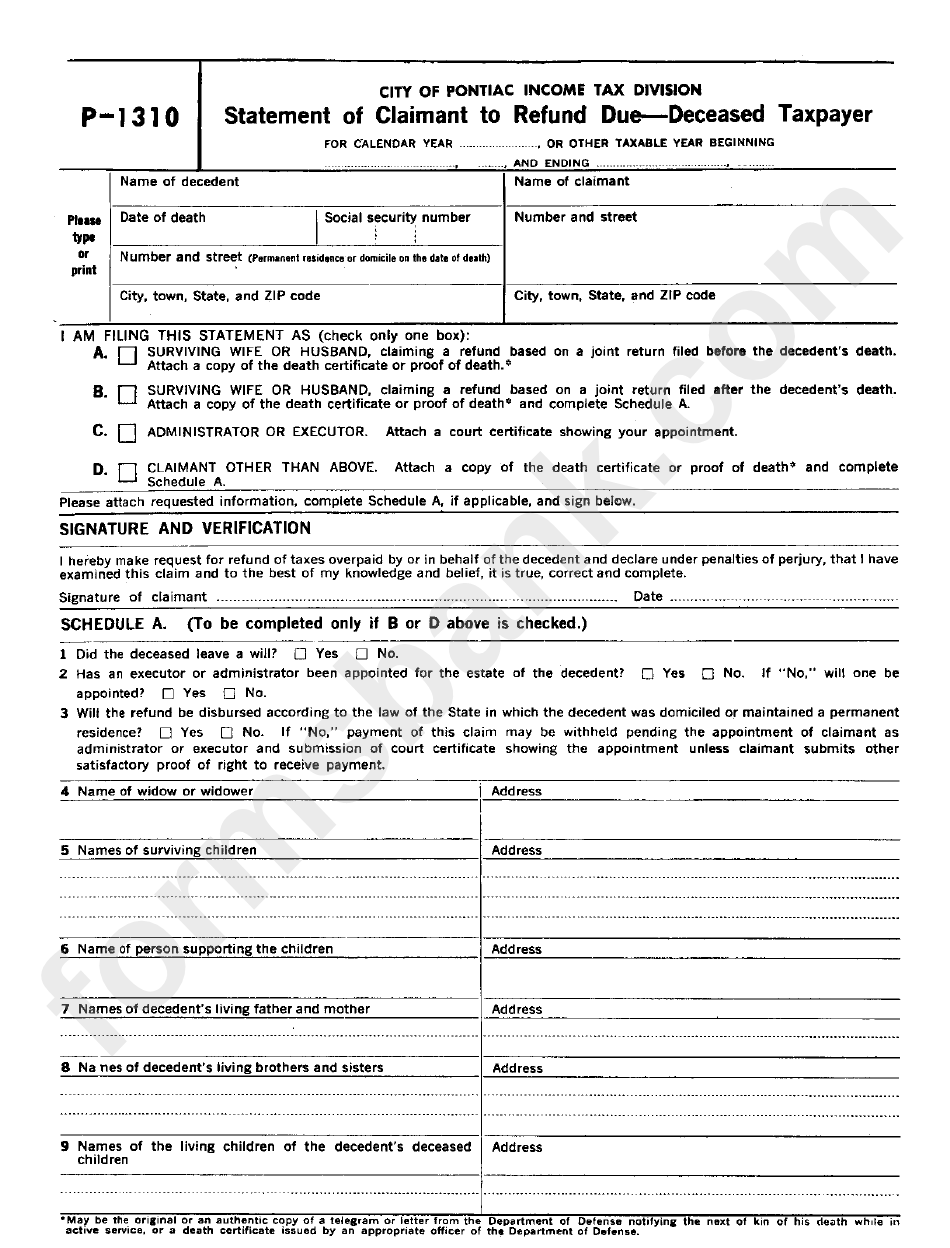

https://data.formsbank.com/pdf_docs_html/242/2425/242571/page_1_bg.png

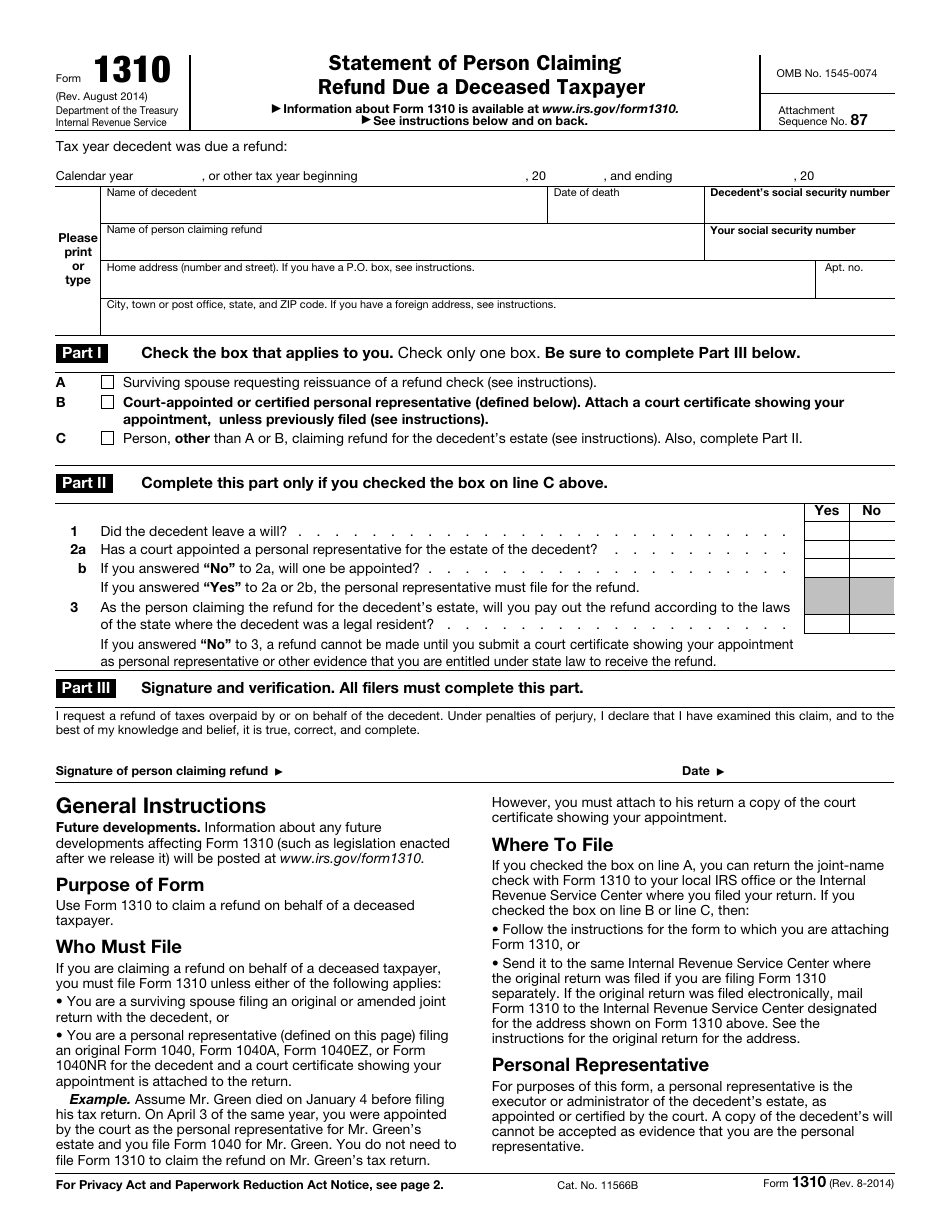

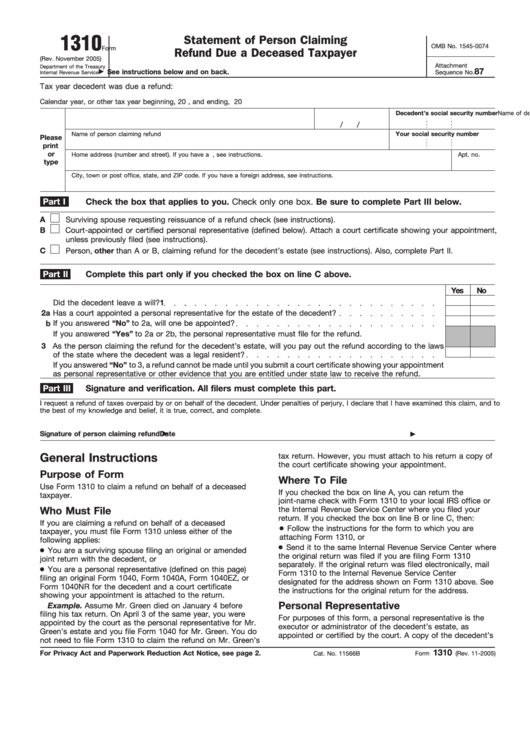

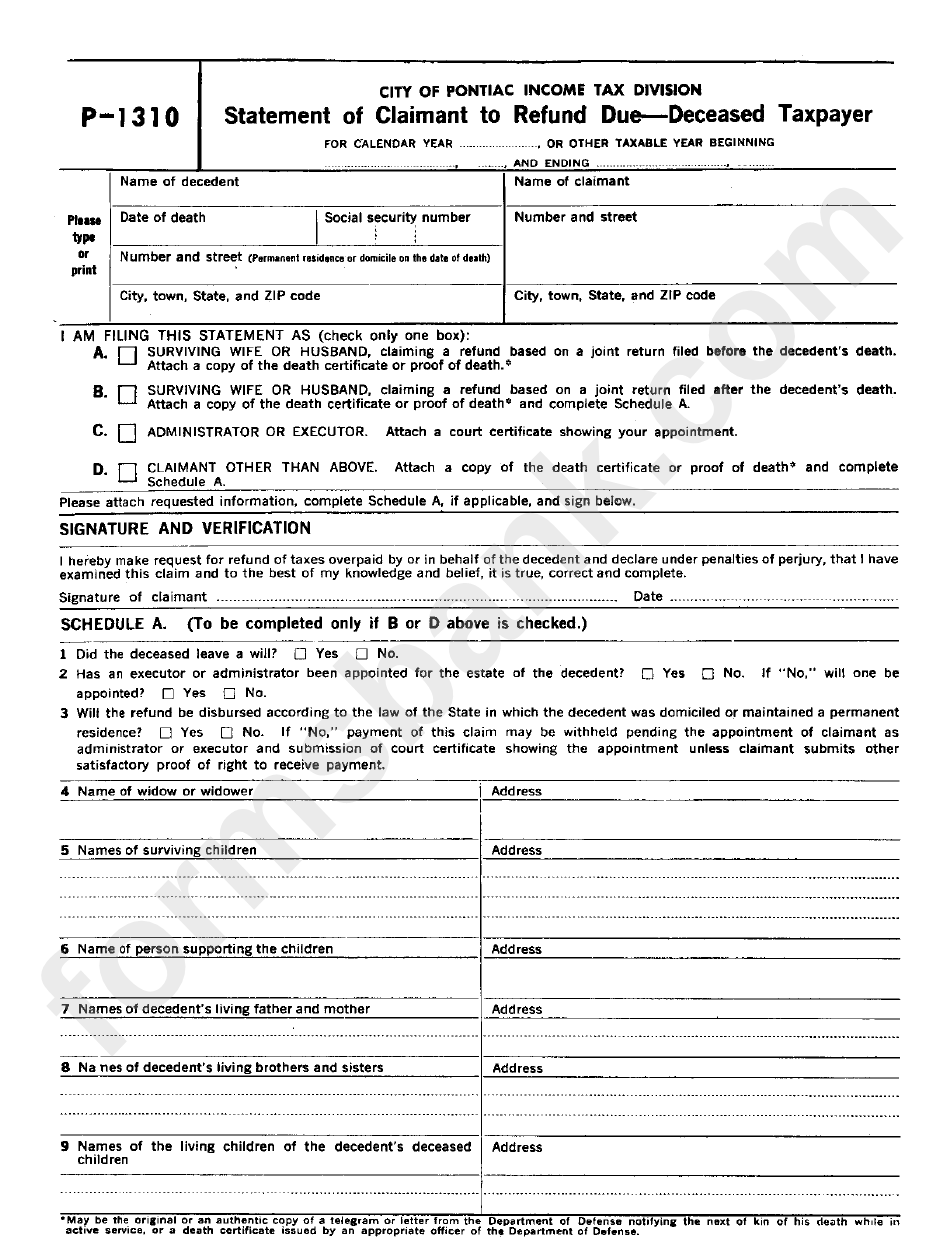

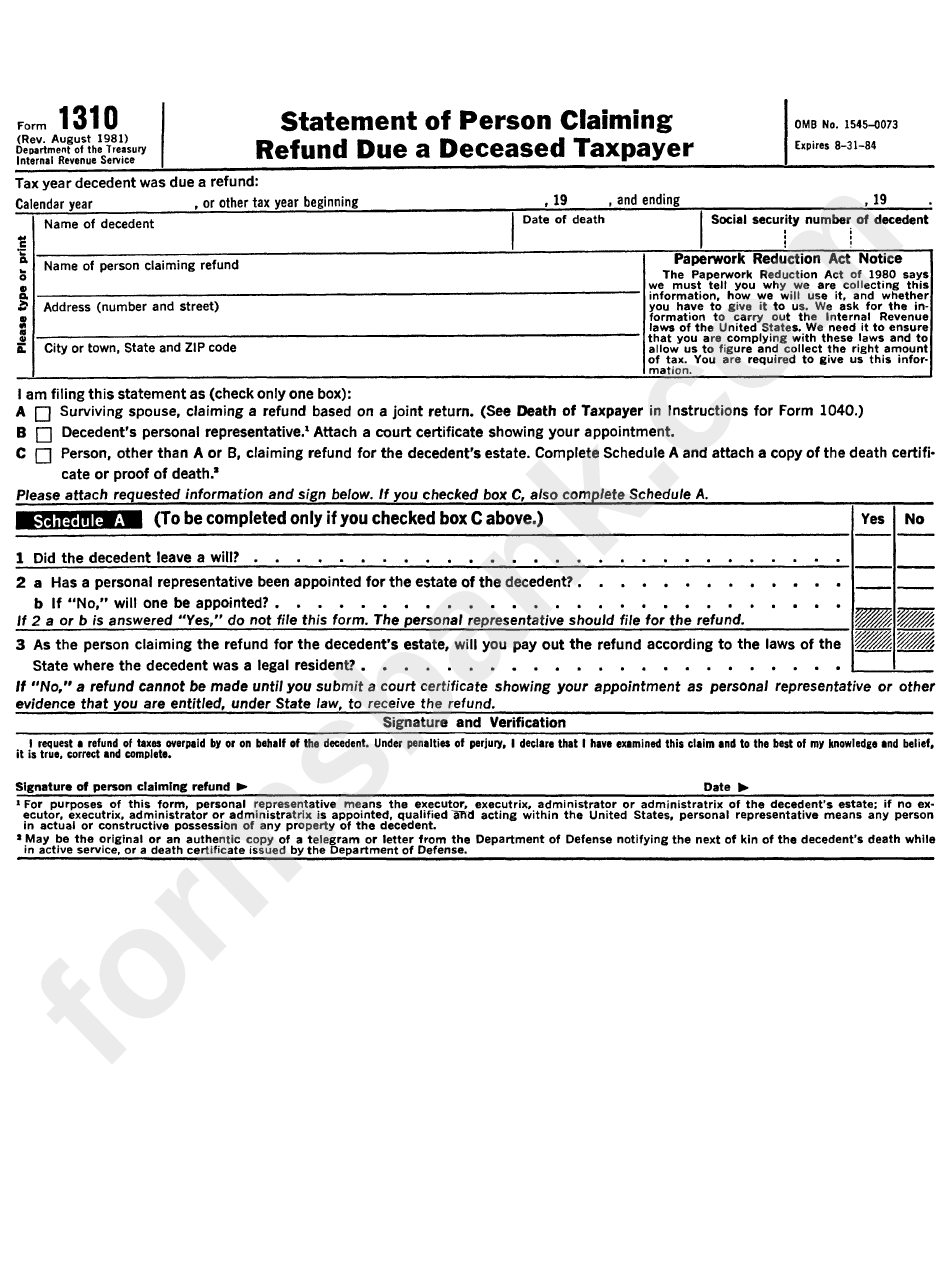

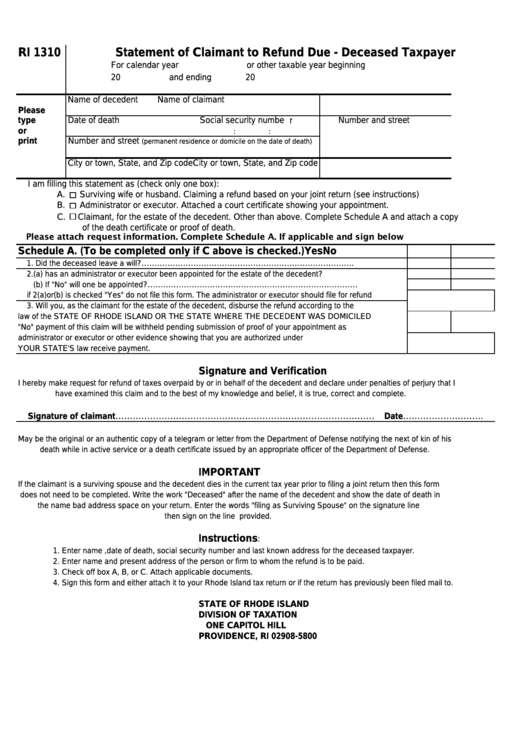

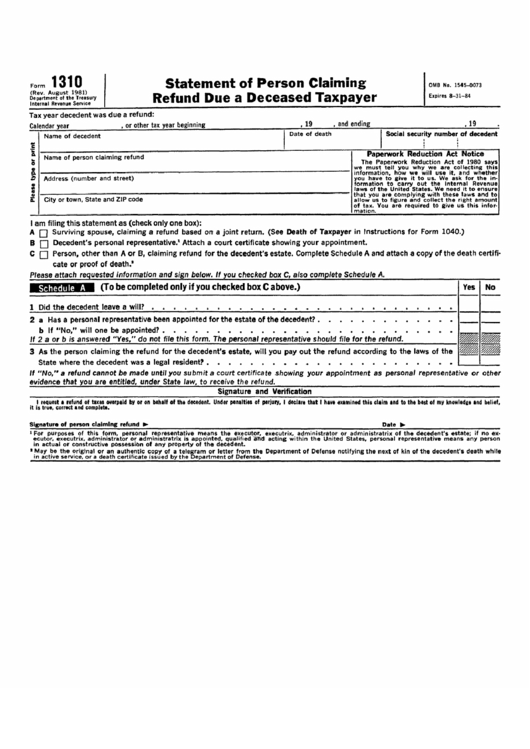

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

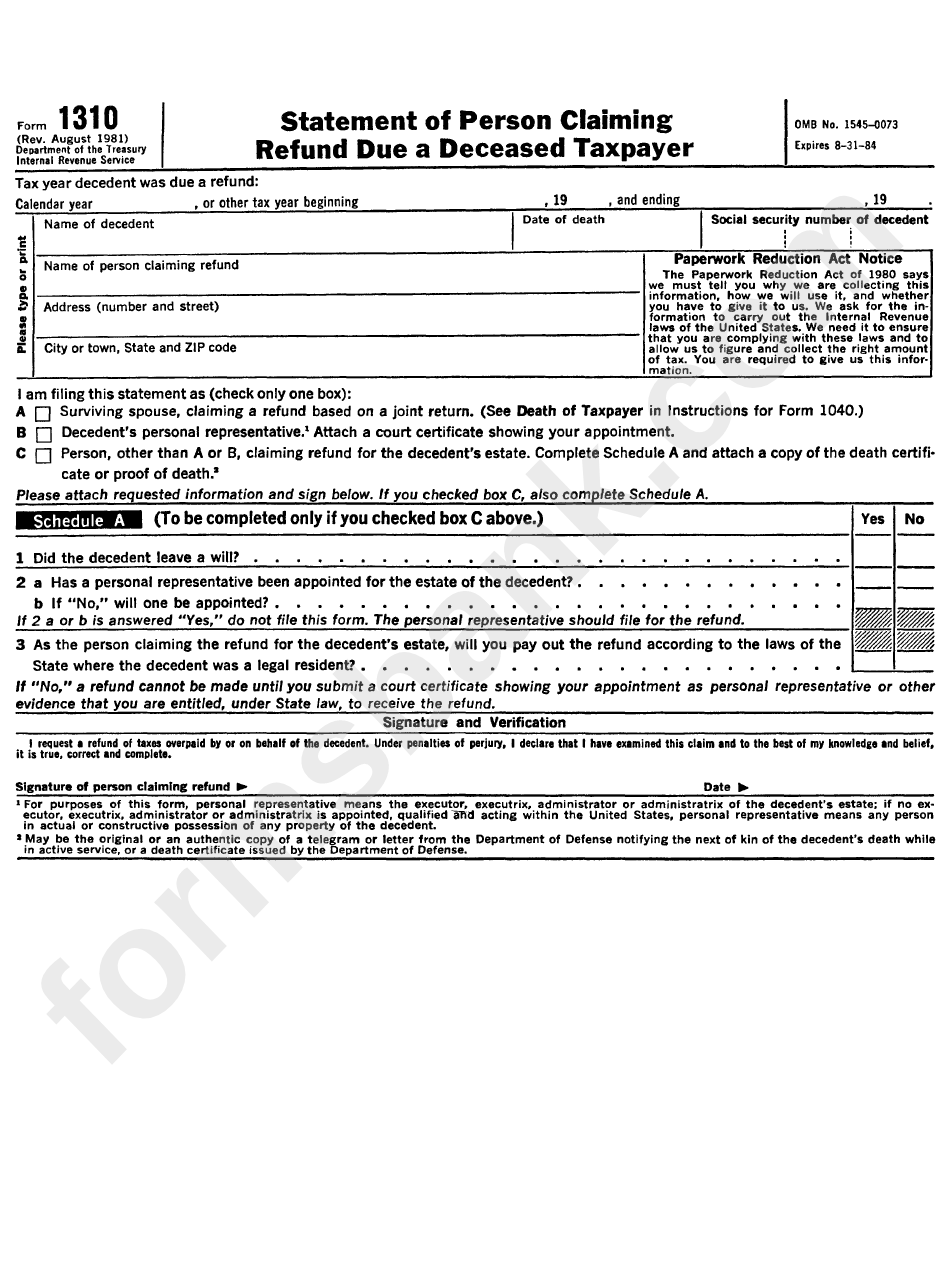

https://data.formsbank.com/pdf_docs_html/290/2909/290985/page_1_bg.png

IRS Form 1310 Download Fillable PDF Or Fill Online Statement Of Person

https://data.templateroller.com/pdf_docs_html/617/6179/617916/irs-form-1310-statement-person-claiming-refund-due-a-deceased-taxpayer_print_big.png

Web Les ayant droits du d 233 funt h 233 ritiers conjoint ne sont plus tenus de se rendre au centre des imp 244 ts dans les 6 mois qui suivent le d 233 c 232 s Il leur suffit de remplir une d 233 claration Web If the taxpayer died in 2021 meets the other requirements but did not receive the full amount of EIP 3 they are eligible for the Recovery Rebate Credit on their 2021 tax

Web 8 mars 2021 nbsp 0183 32 Recovery Rebate Credit for a deceased taxpayer 03 08 2021 12 30 PM I have had several returns this year where one spouse passed away in 2020 and where Web 14 avr 2023 nbsp 0183 32 For decedents with 2023 date of deaths the filing threshold is 12 920 000 The Form 706 instructions for the year of the decedent s death provide the filing

Download Tax Rebate Deceased Taxpayer

More picture related to Tax Rebate Deceased Taxpayer

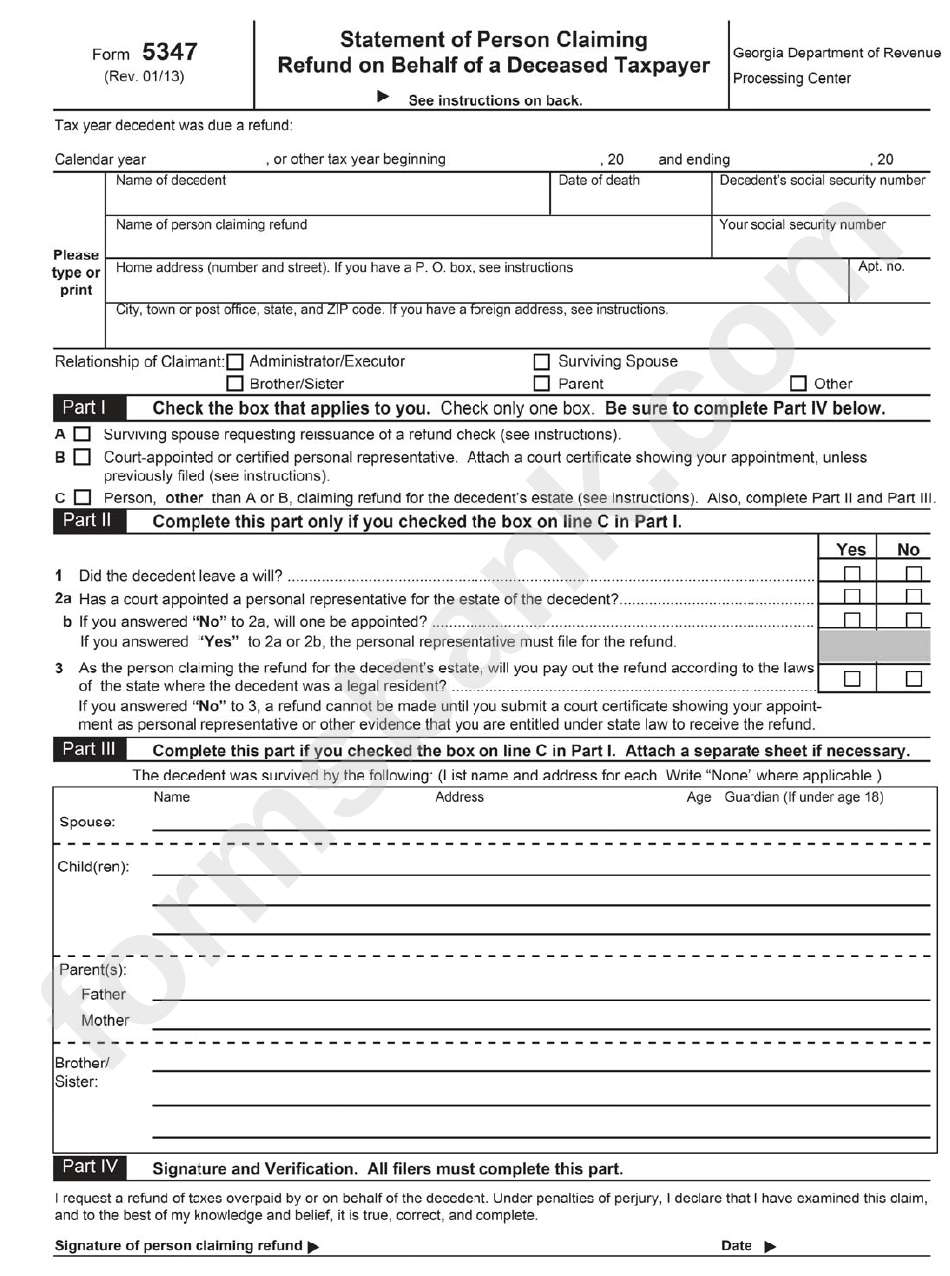

Form 5747 Statement Of Person Claiming Refund On Behalf Of A Deceased

https://data.formsbank.com/pdf_docs_html/283/2833/283392/page_1_bg.png

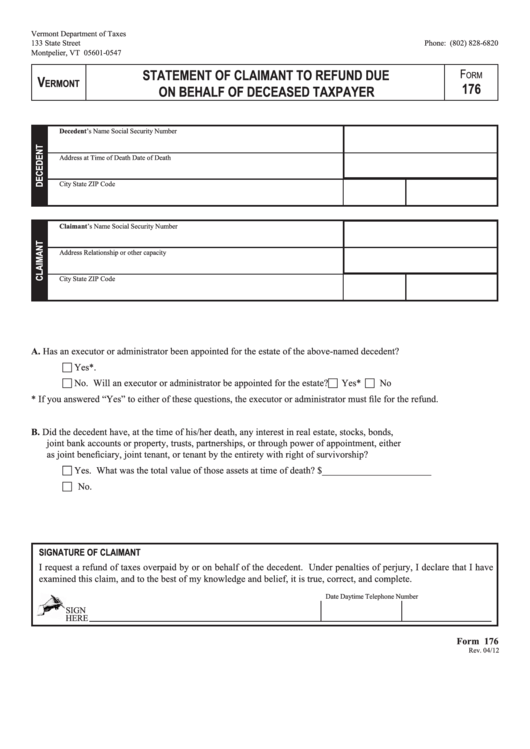

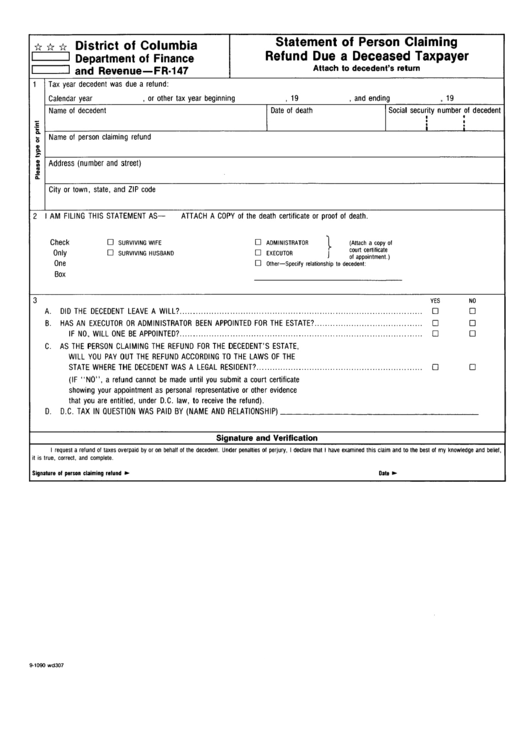

Form 176 Statement Of Claimant To Refund Due On Behalf Of Deceased

https://data.formsbank.com/pdf_docs_html/181/1815/181522/page_1_thumb_big.png

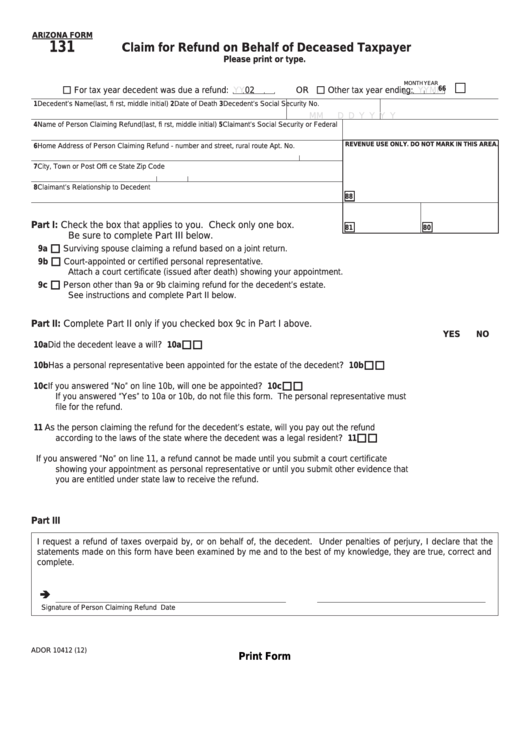

Fillable Form 131 Claim For Refund On Behalf Of Deceased Taxpayer

https://data.formsbank.com/pdf_docs_html/347/3479/347943/page_1_thumb_big.png

Web 23 juin 2022 nbsp 0183 32 Tax Tip 2022 96 June 23 2022 When someone dies their surviving spouse or representative files the deceased person s final tax return On the final tax Web 30 ao 251 t 2023 nbsp 0183 32 File the Final Income Tax Returns of a Deceased Person In general file and prepare the final individual income tax return of a deceased person the same way you

Web Bereavement Helpline Call HMRC for help with tax after someone dies if you re dealing with their Income Tax and Capital Gains Tax before they died estate in the Web 27 janv 2022 nbsp 0183 32 An estate tax return Form 706 must be filed if the gross estate of the decedent is valued at more than 12 06 million for 2022 or 12 92 million in 2023 The

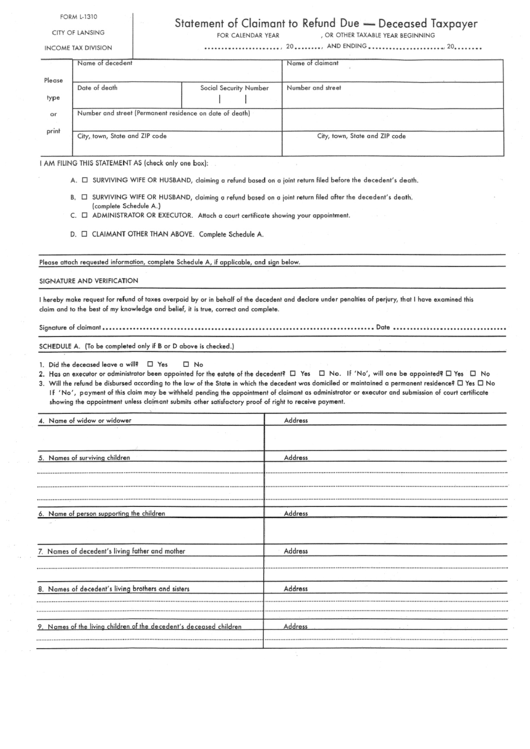

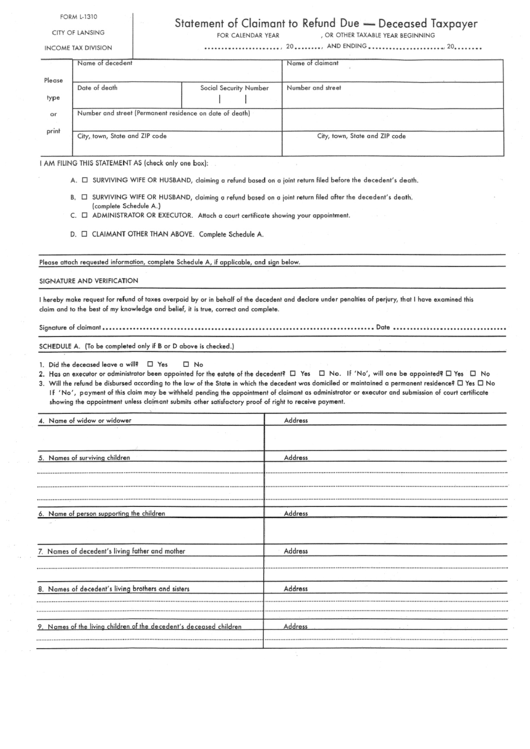

Form L 1310 Statement Of Claimant To Refund Due Deceased Taxpayer

https://data.formsbank.com/pdf_docs_html/228/2280/228001/page_1_thumb_big.png

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

https://data.formsbank.com/pdf_docs_html/338/3388/338836/page_1_thumb_big.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.nstp.org/article/Update Regarding Deceased Taxpayers

Web 9 mars 2021 nbsp 0183 32 In 2020 after the CARES Act and the issuance of the first Economic Impact Payment the then Secretary of the Treasury Mnuchin instructed surviving taxpayers

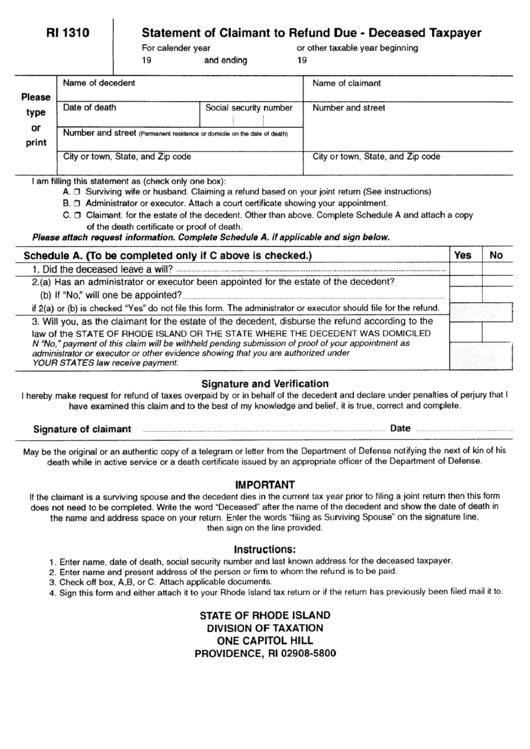

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

Form L 1310 Statement Of Claimant To Refund Due Deceased Taxpayer

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Form Ri 1310 Statement Of Claimant To Refund Due Deceased Taxpayer

Fillable Form Fr 147 Statement Of Person Claiming Refund Due A

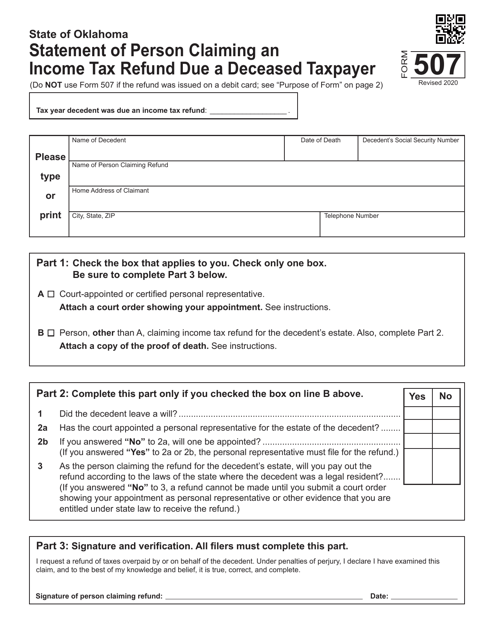

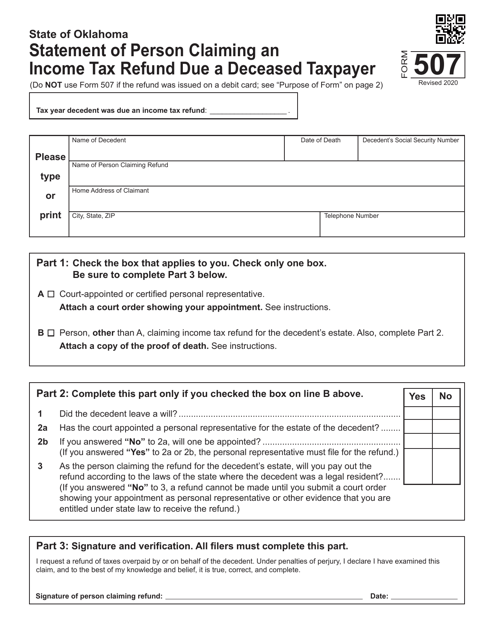

Form 507 Download Fillable PDF Or Fill Online Statement Of Person

Form 507 Download Fillable PDF Or Fill Online Statement Of Person

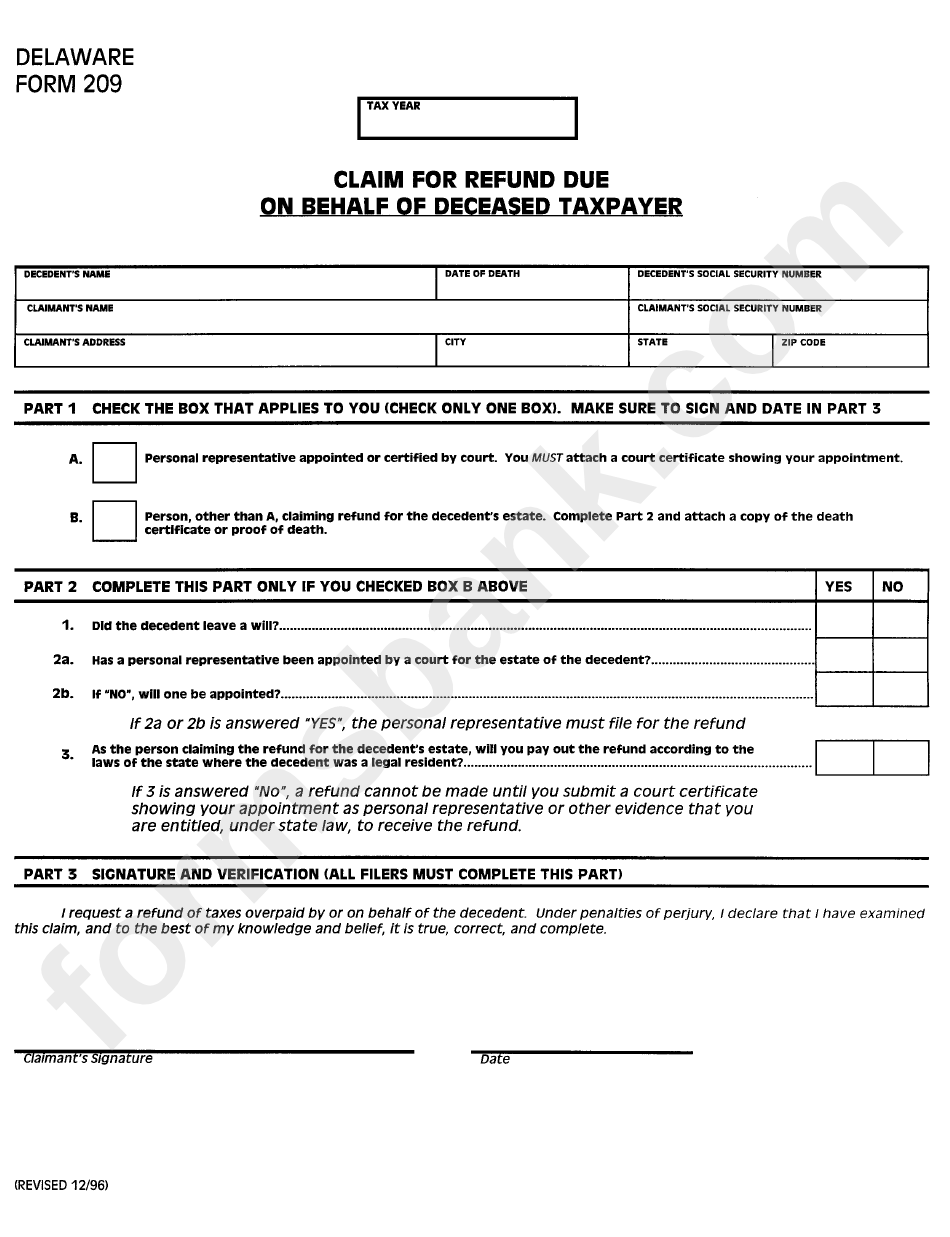

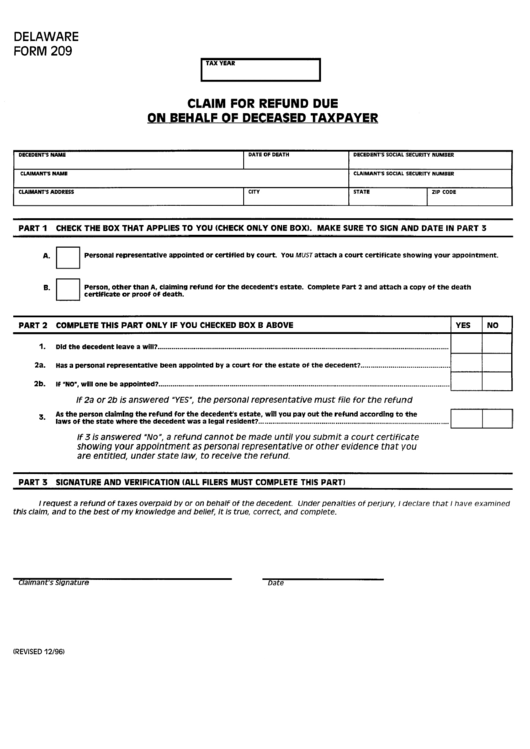

Fillable Form 209 Claim For Refund Due On Behalf Of Deceased Taxpayer

Fillable Form 209 Claim For Refund Due On Behalf Of Deceased Taxpayer

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Tax Rebate Deceased Taxpayer - Web If the taxpayer died in 2021 meets the other requirements but did not receive the full amount of EIP 3 they are eligible for the Recovery Rebate Credit on their 2021 tax