Tax Rebate Definition Australia Web Information about the tax allowances and rebates payable in Australia All taxpayers can claim allowances from their taxable income and rebates in addition to a credit for tax

Web 9 mai 2022 nbsp 0183 32 What Are Tax Offsets And Rebates Tax offsets and rebates directly reduce the amount of tax payable on your taxable income and are applied after tax has been Web 27 mai 2021 nbsp 0183 32 May 27 2021 Rebate income is made up of the total of all the following details from your tax return Taxable income if a loss then zero Reportable employer

Tax Rebate Definition Australia

Tax Rebate Definition Australia

https://www.hyndburnbc.gov.uk/wp-content/uploads/2022/03/council-tax-rebate.png

What Is Australian Government Rebate On Private Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Article-35-PrivateHealthInsuranceTax_v2_3.png

Tips To Finding Tax Rebates Without The Hassle

https://cdn.techgyd.com/tax-rebate.jpg

Web In some circumstances a person may be eligible for a senior and pensioner tax offset but their income amount means the tax offset is reduced to zero Example couple with spouse eligible for SAPTO and rebate income above the threshold Web 29 mars 2022 nbsp 0183 32 The pre election budget will see the government increase the Low and Middle Income Tax Offset LMITO which is a temporary tax cut for Australians

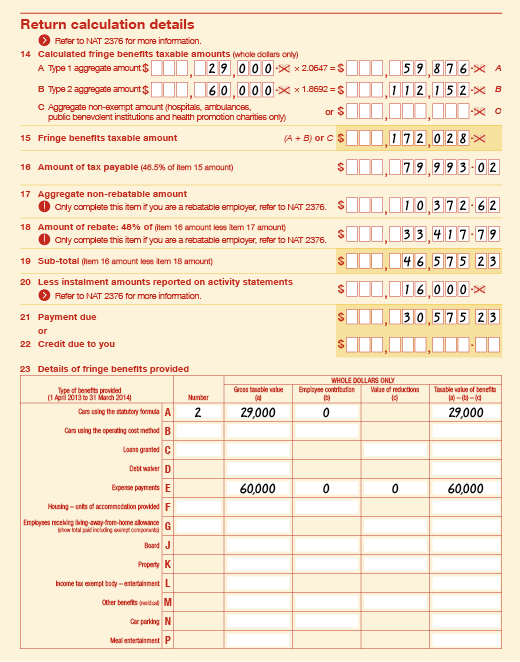

Web If you provide services to your supplier and they give you a rebate as payment for your services then you are making a sale and must pay GST on that sale Generally you Web What is fringe benefits tax Fringe benefits tax FBT is a tax paid by employers on certain benefits provided to their employees or to their employees family or other associates FBT is separate to income tax It s calculated on the taxable value of the fringe benefit

Download Tax Rebate Definition Australia

More picture related to Tax Rebate Definition Australia

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig2/AS:433972418224137@1480478495792/Western-Australias-average-daily-maximum-temperature-for-January-Source-Australian_Q640.jpg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

How To Register For The Australian Government Rebate YouTube

https://i.ytimg.com/vi/Z_E2guERPNY/maxresdefault.jpg

Web Individuals Income deductions offsets and records Tax offsets Tax offsets Check whether you will receive a tax offset and how to calculate it About tax offsets Find out how tax Web 30 juin 2021 nbsp 0183 32 Overview of the R amp D Tax Incentive The Research and Development Tax Incentive R amp DTI offers a tax offset for companies conducting eligible R amp D activities It

Web 6 mai 2022 nbsp 0183 32 In the 2022 federal budget Treasurer Josh Frydenberg announced a one off 420 cost of living tax offset for more than 10 million low and middle income earners Web 26 juin 2023 nbsp 0183 32 Lorsque tu as gagn 233 plus de 1 sur le sol australien tu as l obligation de lodg 233 tes taxes see https www ato gov au individuals international tax for individuals coming to australia paying tax and lodging

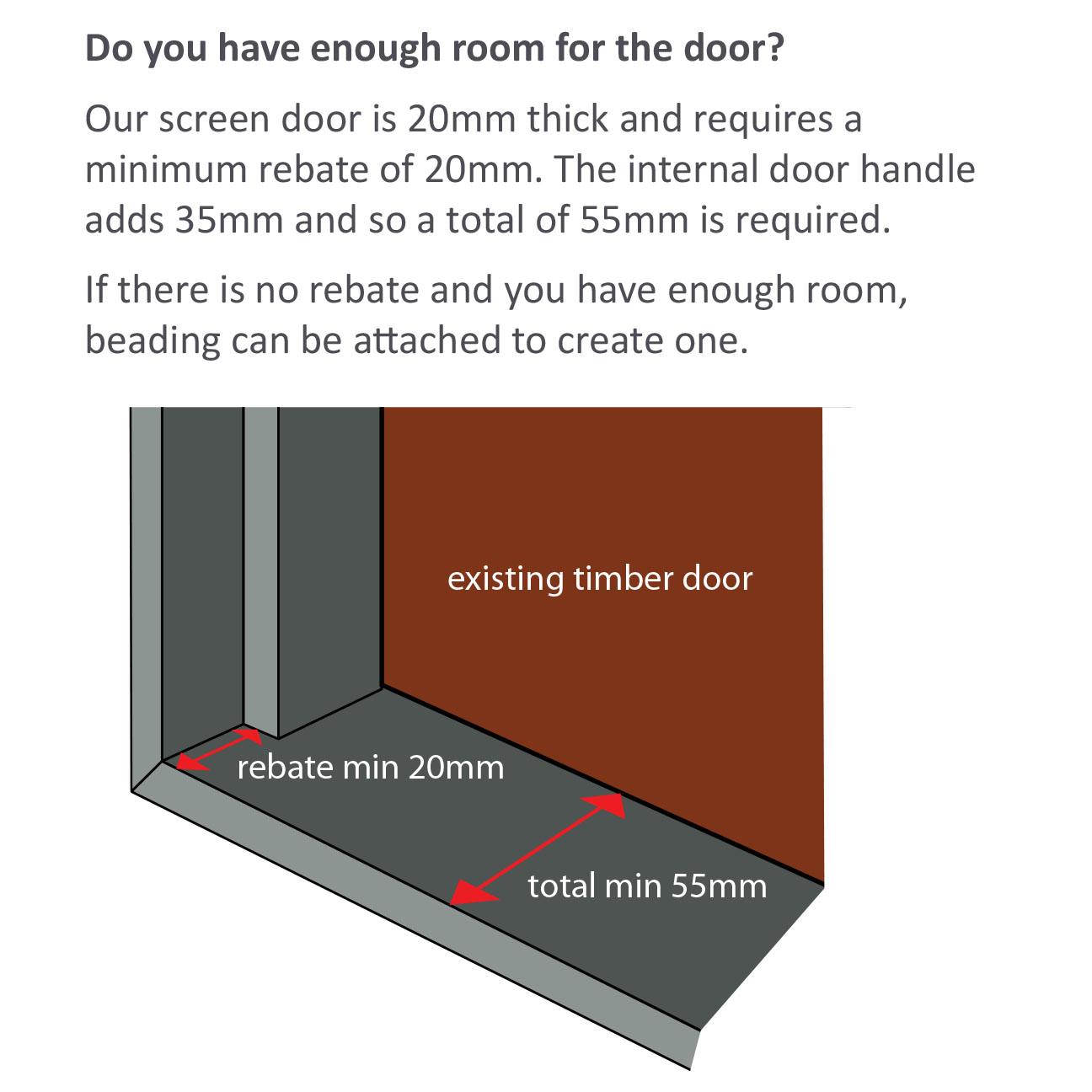

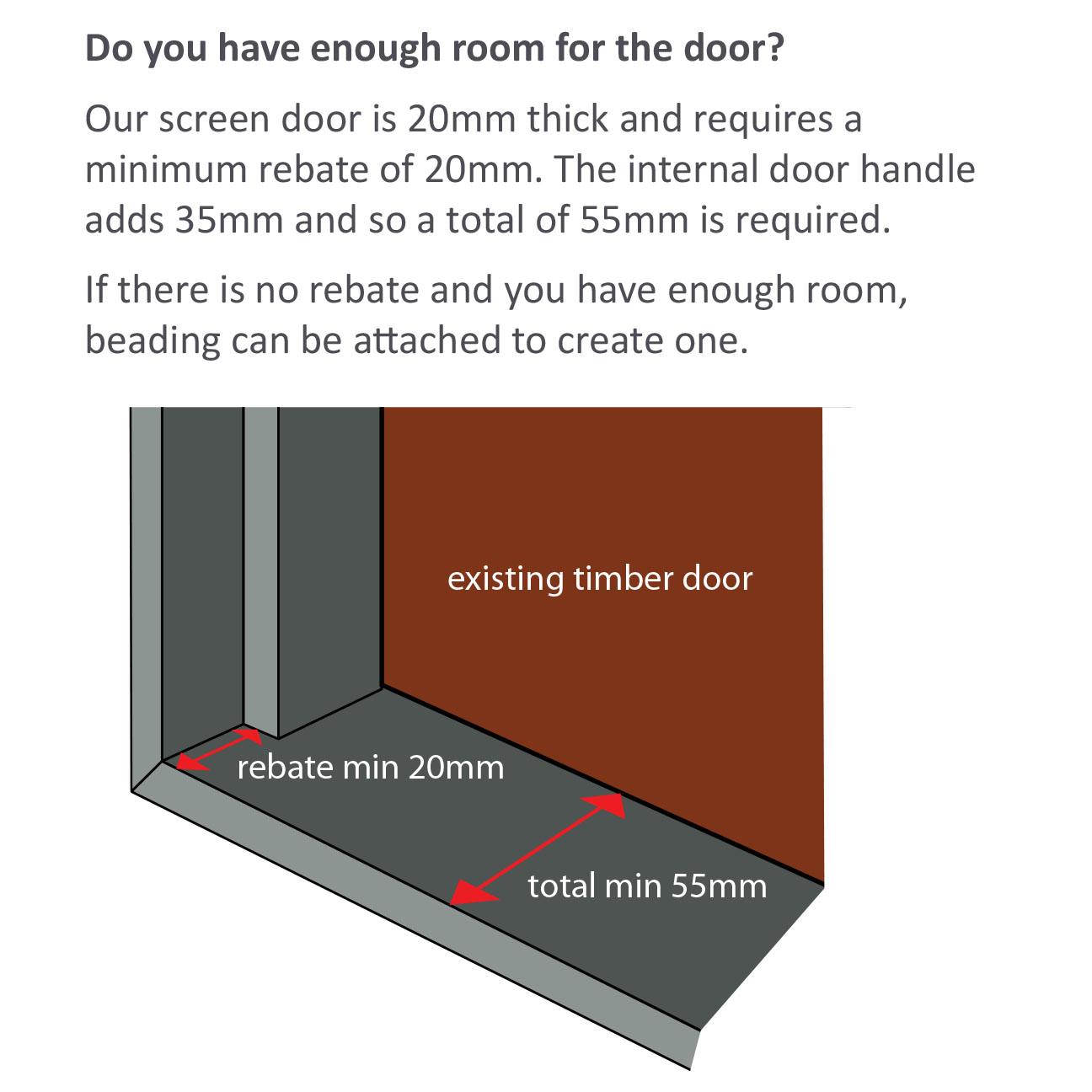

What Is A Rebate Seconline

https://www.seconline.com.au/media/1193/rebate_diagram_2.jpg?width=239&height=239

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig1/AS:433972418224133@1480478495629/Map-of-Australia-illustrating-the-2006-Remoteness-Structure-Source-ABS-the-2006_Q640.jpg

https://www.angloinfo.com/how-to/australia/money/income-tax/allowances...

Web Information about the tax allowances and rebates payable in Australia All taxpayers can claim allowances from their taxable income and rebates in addition to a credit for tax

https://itp.com.au/income-tax-offsets-rebates-2022

Web 9 mai 2022 nbsp 0183 32 What Are Tax Offsets And Rebates Tax offsets and rebates directly reduce the amount of tax payable on your taxable income and are applied after tax has been

Tax Elements

What Is A Rebate Seconline

CE Consumer Expenditure Survey Results On The 2008 Economic Stimulus

Have You Received Your 150 Council Tax Rebate

NSW Government Demands PM To Scrap Carbon Tax And Give Rebates

Beneficiary Tax Offset What You Need To Know The Grenfell Record

Beneficiary Tax Offset What You Need To Know The Grenfell Record

Rebatable Employers Australian Taxation Office

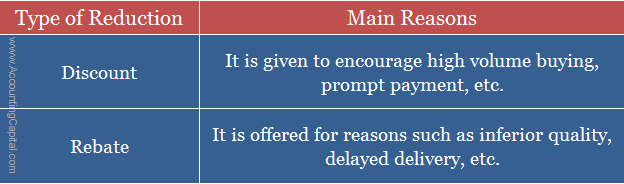

Difference Between Discount And Rebate with Example

Rebate Or Rip Off

Tax Rebate Definition Australia - Web Taxable income of individuals is taxed at progressive rates from 0 to 45 plus a Medicare levy of 2 while income derived by companies is taxed at either 30 or