Tax Rebate Definition Investopedia Web 27 f 233 vr 2023 nbsp 0183 32 The term quot tax refund quot refers to a reimbursement made to a taxpayer for any excess amount paid in taxes to the federal or state government While taxpayers tend to look at a refund as a bonus or a

Web 24 nov 2003 nbsp 0183 32 The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which lower the amount of an individual s Web 4 sept 2021 nbsp 0183 32 Abatement is a taxation strategy usually used by various governments to encourage specific activities such as investments in capital equipment A tax incentive

Tax Rebate Definition Investopedia

Tax Rebate Definition Investopedia

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/49ffad666f6b73521ff1f422d34b4554/thumb_1200_1553.png

https://static.wixstatic.com/media/7d7e87_1b0cedc9d778442180a4f4a42e8c0d0c~mv2.jpg/v1/fill/w_980,h_655,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/7d7e87_1b0cedc9d778442180a4f4a42e8c0d0c~mv2.jpg

:max_bytes(150000):strip_icc()/upandin-5bfd683b46e0fb00263a410f-ed486c62e322424883431673dd30de85.jpg)

Rebate Barrier Option Definition

https://www.investopedia.com/thmb/5O1g2TNn25t9VkOZHZ5xVCxbMDY=/540x0/filters:no_upscale():max_bytes(150000):strip_icc()/upandin-5bfd683b46e0fb00263a410f-ed486c62e322424883431673dd30de85.jpg

Web 2 mars 2023 nbsp 0183 32 Tax relief refers to any government program or policy designed to help individuals and businesses reduce their tax burdens or resolve their tax related debts Tax relief may be in the form Web 12 janv 2023 nbsp 0183 32 The term tax benefit refers to any tax law that helps you reduce your tax liability Benefits range from deductions and tax credits to exclusions and exemptions They cover various areas

Web 17 ao 251 t 2022 nbsp 0183 32 The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021 If you Web 31 janv 2023 nbsp 0183 32 A drawback is a rebate on taxes or tariffs paid by businesses on goods that were imported into the United States and then exported out again The rebate from a drawback can include raw

Download Tax Rebate Definition Investopedia

More picture related to Tax Rebate Definition Investopedia

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

:max_bytes(150000):strip_icc()/TermDefinitions_wacc_final-626b8af9bfc741d6a9792fe0568242cd.png)

Weighted Average Cost Of Capital WACC Explained With Formula And Example

https://www.investopedia.com/thmb/P8oFGFnEhktVM1kE0UZvQ0qzj2Y=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_wacc_final-626b8af9bfc741d6a9792fe0568242cd.png

Investopedia Educating The World About Finance Irs Tax Tax Guide

https://i.pinimg.com/originals/34/57/e6/3457e6012dc88cbbc8ec972865759c20.jpg

Web 30 avr 2023 nbsp 0183 32 What Is a Tax Deduction A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single Web 15 juin 2022 nbsp 0183 32 A corporate tax is a tax on the profits of a corporation The taxes are paid on a company s taxable income which includes revenue minus cost of goods sold COGS

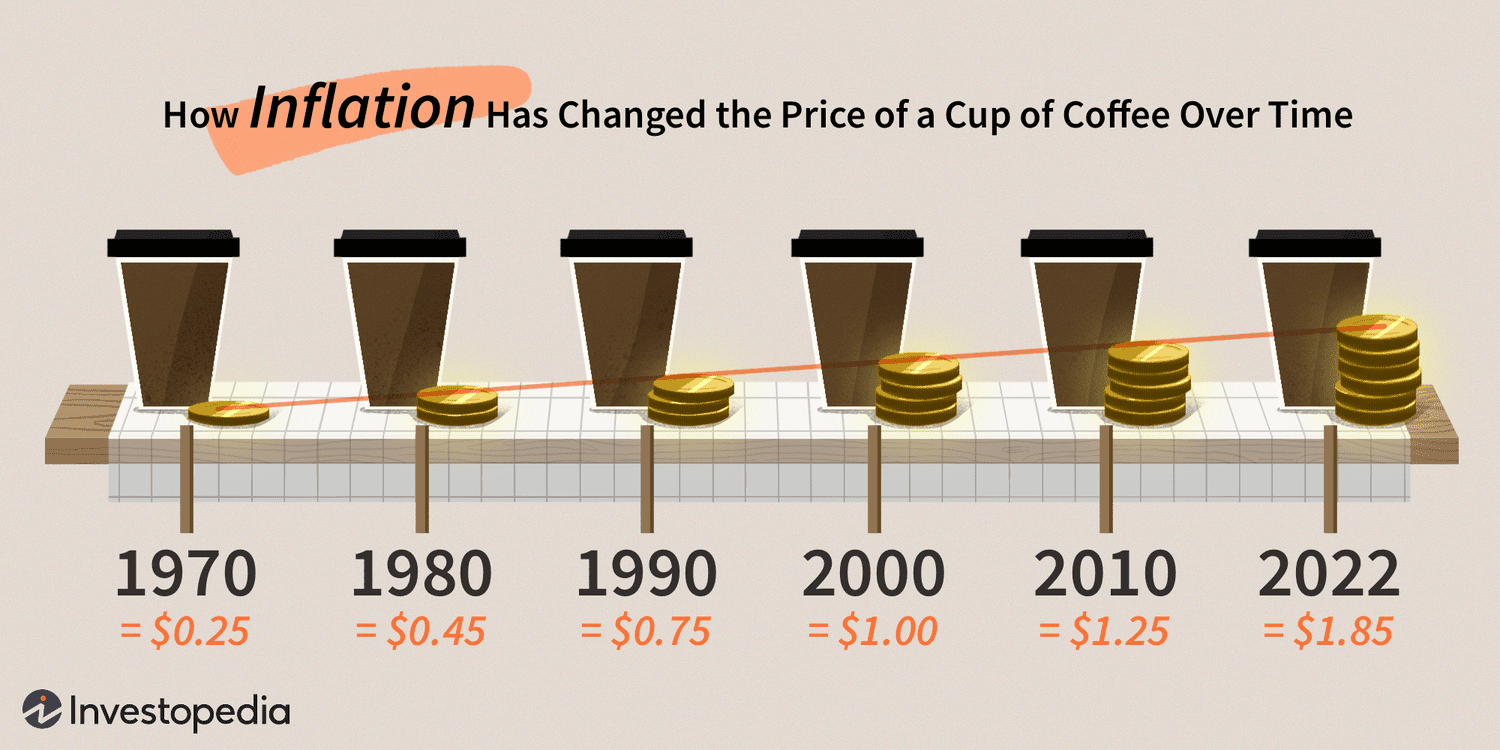

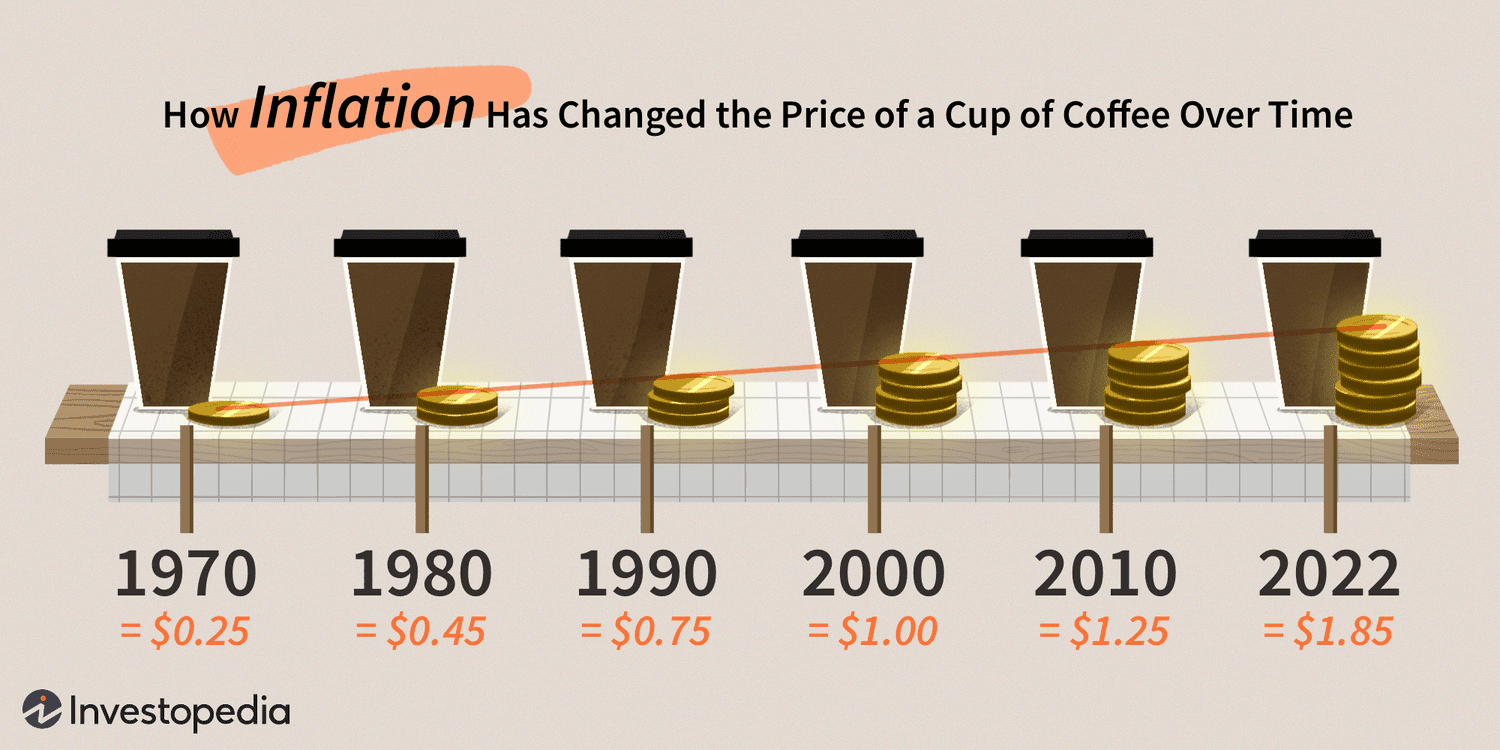

Web 31 mars 2023 nbsp 0183 32 Investopedia Joules Garcia What Are Taxes Taxes are mandatory contributions levied on individuals or corporations by a government entity whether local regional or national Tax Web 31 mars 2023 nbsp 0183 32 Value added tax VAT is a consumption tax on goods and services that is levied at each stage of the supply chain where value is added from initial production to

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

2022 1040 Schedule A

https://www.investopedia.com/thmb/aowua7jbYSBEmgUjaoA8i7nyEb4=/812x812/smart/filters:no_upscale()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

https://www.investopedia.com/terms/t/tax-ref…

Web 27 f 233 vr 2023 nbsp 0183 32 The term quot tax refund quot refers to a reimbursement made to a taxpayer for any excess amount paid in taxes to the federal or state government While taxpayers tend to look at a refund as a bonus or a

https://www.investopedia.com/terms/t/taxcre…

Web 24 nov 2003 nbsp 0183 32 The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which lower the amount of an individual s

:max_bytes(150000):strip_icc()/dotdash-INV-final-Rebate-Barrier-Option-May-2021-01-3bb9f7473625446a9bf419f8bc7ea49d.jpg)

Rebate Barrier Option Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

2022 1040 Schedule A

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Income Statement How To Read And Use It 2023

Council Tax Rebate Energy

IRS Payroll Tax Rebates For 2020 2021 2022 Free ERTC Eligibility Test

M V Ch u u au u V L m Ph t Cao Ng t Ng ng Trung Qu c V n b nh

M V Ch u u au u V L m Ph t Cao Ng t Ng ng Trung Qu c V n b nh

Secret Rebate Definition What Does Secret Rebate Mean

Pin On Tigri

Tax Rebate When Can Georgia Residents Expect A Rebate Check

Tax Rebate Definition Investopedia - Web rebate retroactive refund or credit given to a buyer after he has paid the full list price for a product or for a service such as transportation Rebating was a common pricing tactic