Tax Rebate Delays 2024 The maximum credit for the 2023 tax year is 7 430 up from 6 935 the prior year But Social Security beneficiaries may get hit with higher taxes Jaeger warned That s because the threshold

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 If you have a personal finance question for Washington Post columnist Michelle Singletary please call 1 855 ASK POST 1 855 275 7678 Last year that came to 3 167 on average The 2024 tax

Tax Rebate Delays 2024

Tax Rebate Delays 2024

https://i.inews.co.uk/content/uploads/2022/05/SEI_103019106.jpg

Thousands In South Kesteven Set For Council Tax Rebate Delays

https://cdn.apollo.audio/one/media/58a4/a2c6/7a0a/7f80/0e56/2b9a/council tax.jpg?quality=80&format=jpg&crop=96,0,2065,3500&resize=crop

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Jan 08 2024 Updated Jan 8 2023 2 09 pm ET The IRS has announced that it will start accepting and processing income tax returns on January 29 2024 The deadline to file returns in By accelerating the end of the COVID era Employee Retention Tax Credit and implementing proven tax policies from the 2017 GOP tax reform this act aims to save taxpayers over 70 billion while promoting American competitiveness and supporting working families

April 15 2024 is the filing deadline for taxes That s on a Monday this year What happens if I miss the tax deadline If you fail to file your federal tax return on time the standard Tax Day is Apr 15 2024 for most taxpayers Taxpayers in Maine or Massachusetts have until Apr 17 2024 due to the Patriot s Day and Emancipation Day holidays Taxpayers living in a

Download Tax Rebate Delays 2024

More picture related to Tax Rebate Delays 2024

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Most taxpayers get their refunds within 21 days which means that people who file their taxes on January 29 the earliest available day to file a return should get their payments by February 19 The IRS Tax Refund Calendar for 2024 outlines the key dates for tax return processing providing clarity to taxpayers For electronic filers refunds are typically received within 21 days

Doing taxes getty With just days to go in 2023 taxpayers are already looking ahead to the next year but some are still waiting on answers related to previous tax years The IRS acknowledges that An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

https://accessagency.org/wp-content/uploads/2022/06/Story-Get-your-2022-Child-Tax-Rebate.png

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

The maximum credit for the 2023 tax year is 7 430 up from 6 935 the prior year But Social Security beneficiaries may get hit with higher taxes Jaeger warned That s because the threshold

https://taxfoundation.org/blog/bipartisan-tax-deal-2024-tax-relief-american-families-workers-act/

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Income Tax Rebate Under Section 87A

How To Increase The Chances Of Getting A Tax Refund CherishSisters

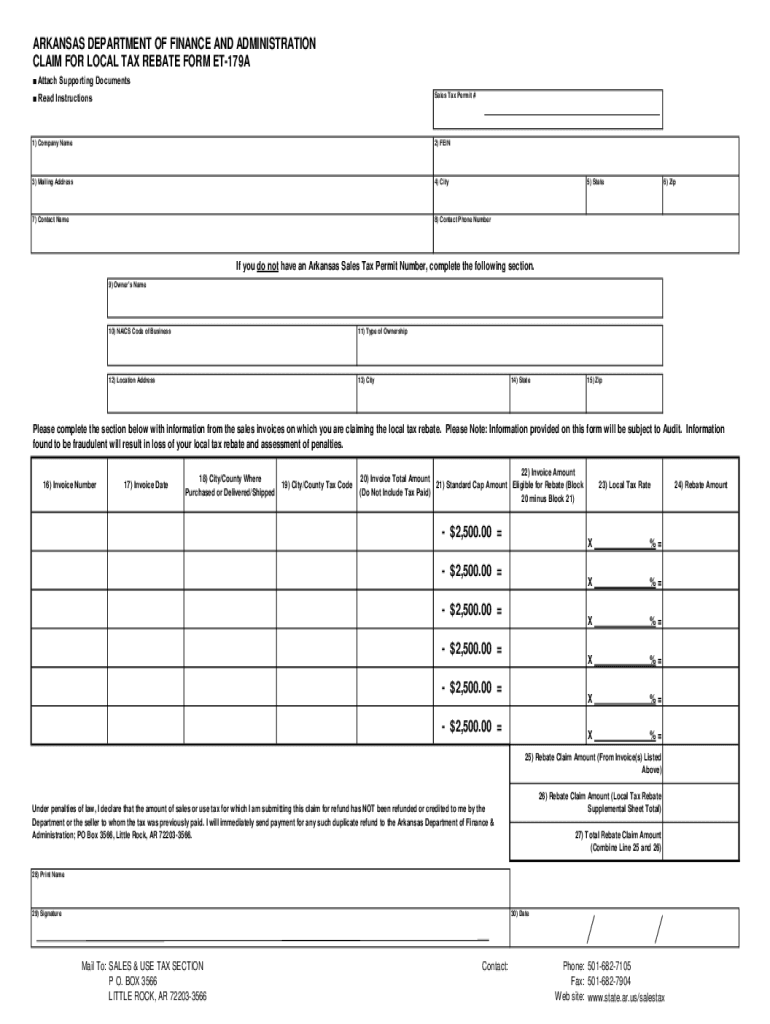

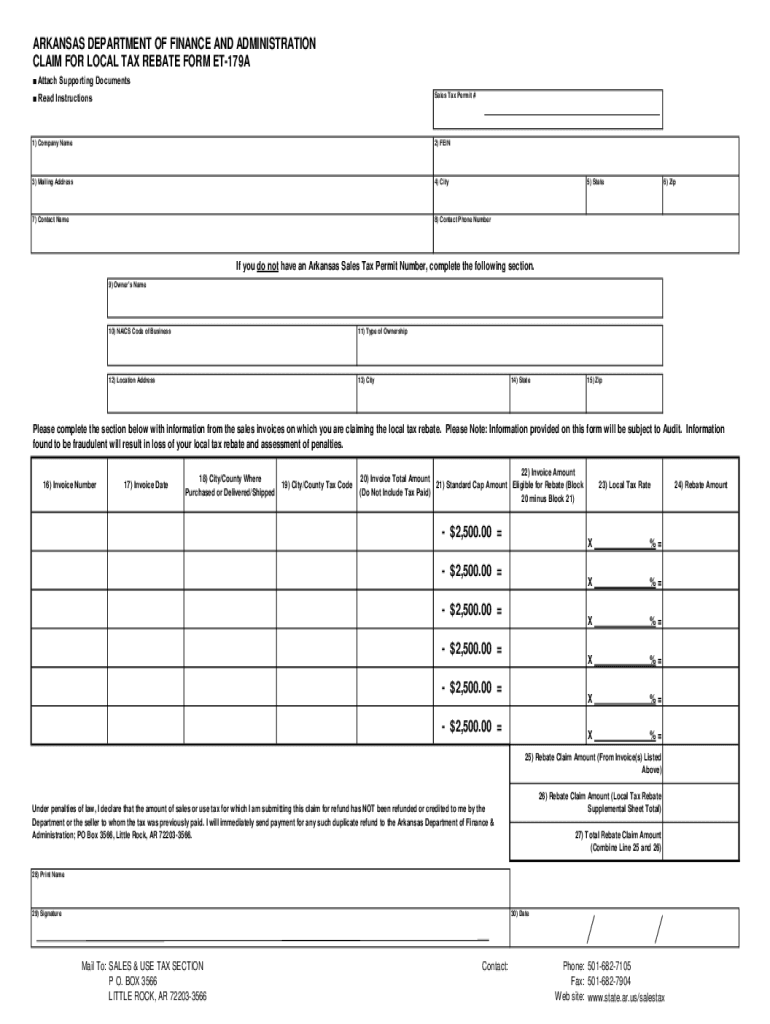

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

How Should You Claim HMRC Tax Rebate After Losing Your Job

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

P55 Tax Rebate Form Business Printable Rebate Form

Tax Rebate Delays 2024 - April 15 2024 is the filing deadline for taxes That s on a Monday this year What happens if I miss the tax deadline If you fail to file your federal tax return on time the standard