Tax Rebate Efficient Furnace Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

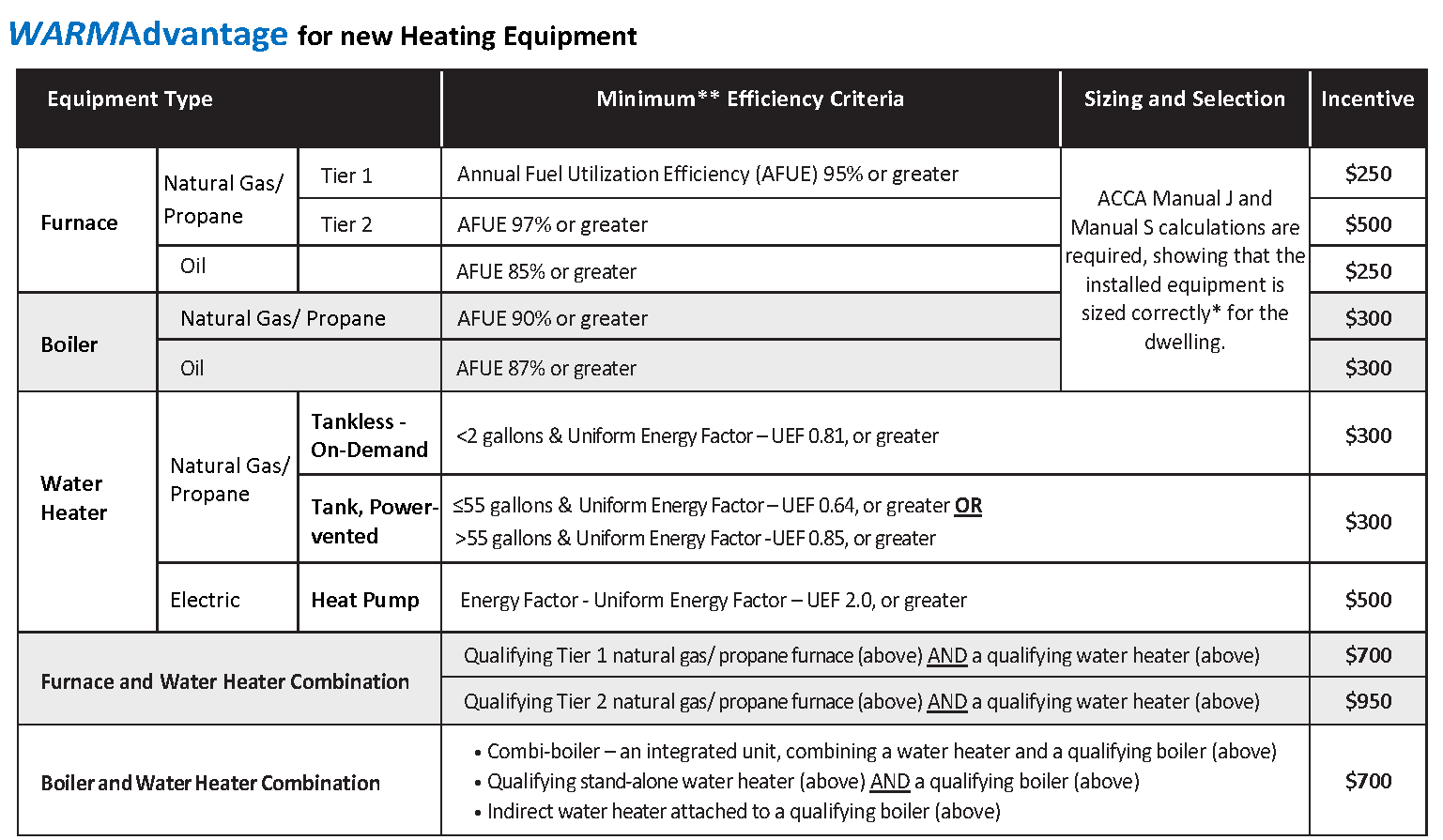

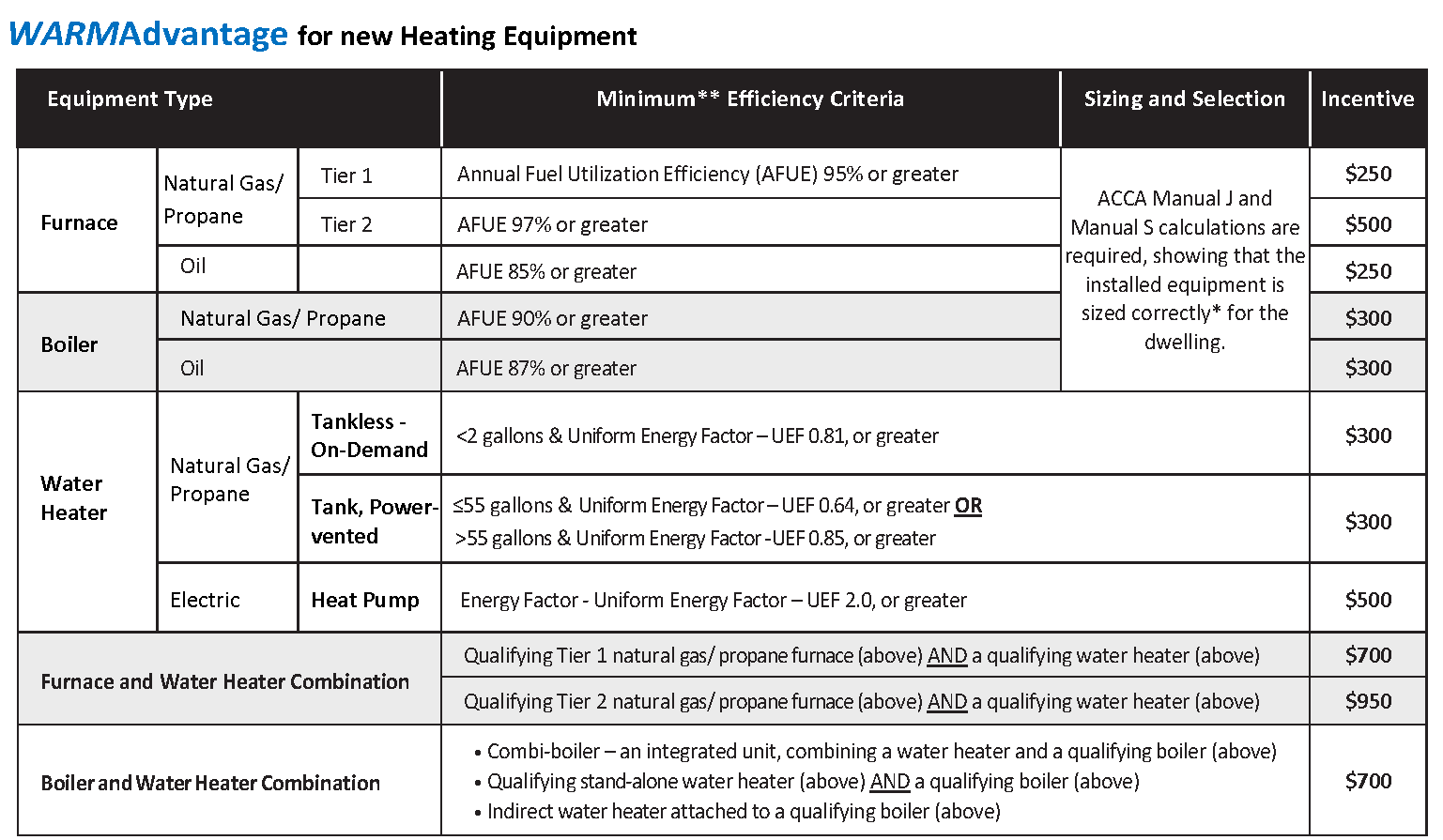

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Web FEDERAL INCENTIVES TAX CREDITS amp REBATES 2022 Heating amp Cooling Installations

Tax Rebate Efficient Furnace

Tax Rebate Efficient Furnace

https://alpinegreen.net/wp-content/uploads/2019/02/Furnaces-Rebate.png

Fortis Rebates For Furnaces 2020 TEK Climate Heating And Air Conditioning

https://tekclimate.ca/wp-content/uploads/2020/03/furnace-rebate-program.jpg

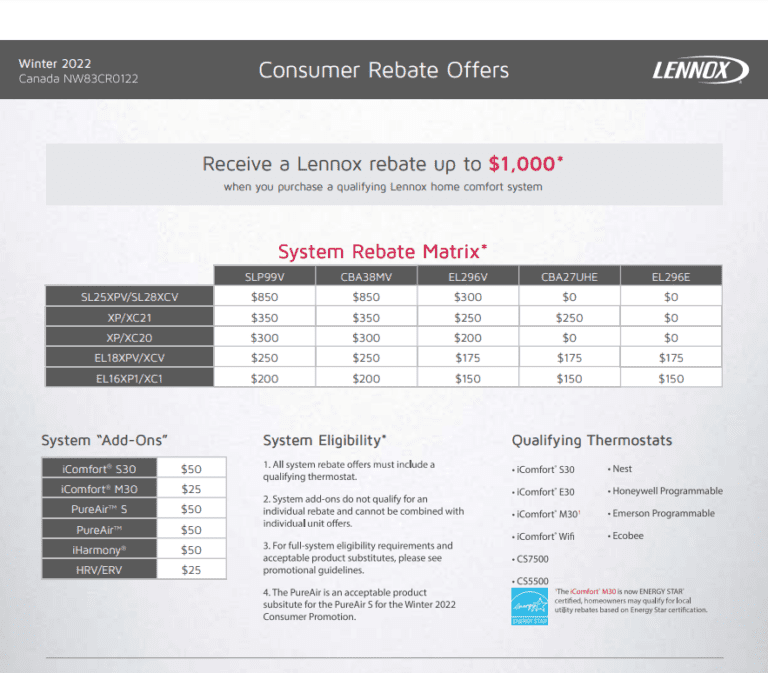

Top Energy Efficient Furnaces For 2023 Finding The Best HVAC Systems

https://cozycomfortplus.com/wp-content/uploads/2023/01/Lennox-rebate-up-to-1000-2022.jpg

Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

Web 16 mars 2023 nbsp 0183 32 Which home improvements qualify for the Energy Efficient Home Improvement energy tax credit Beginning January 1 2023 the credit becomes equal to Web The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

Download Tax Rebate Efficient Furnace

More picture related to Tax Rebate Efficient Furnace

Payment Plans Whitcher Plumbing Heating

https://images.squarespace-cdn.com/content/v1/570bb3a7c6fc08215d1159d3/1581010189059-XYCTYB4107R8XDPXK25I/Only+%2470+a+month+to+replace+your+furnace+and+air+conditioner+this+year.+Combine+with+tax+rebates+to+save+the+most+on+new+energy+efficient+heating+and+cooling

Promotional Offers Rebates HVAC And Plumbing Contractor MN

https://www.rumpcaservices.com/wp-content/uploads/2020/08/lennox-rebate-fall-2020-02.jpg

Achiever Series 80 AFUE Upflow Horizontal R801C Ruud Gas Furnaces

https://s3.amazonaws.com/RheemPublic/PublicDocuments/F653136E-4611-4123-BB29-3D082345AB7A.png

Web 3 f 233 vr 2023 nbsp 0183 32 There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30 Web 1 d 233 c 2022 nbsp 0183 32 Yes qualified energy efficient projects can receive both rebates and tax credits although the Energy Efficient Home Improvement Tax Credit and HEEHRA Rebates are two distinct incentives made

Web 21 d 233 c 2022 nbsp 0183 32 Other energy efficiency upgrades Oil furnaces or hot water boilers if they meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer Web Heat pumps can cut your energy costs by as much as 50 percent but run around 10 000 to 18 000 As noted above there will be a 2 000 tax credit for those starting in January

New Nicor Res Rebate Application Water Heating Furnace

https://imgv2-1-f.scribdassets.com/img/document/125772633/original/f2094c8b40/1589649594?v=1

Rebates For Replacing Furnace Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/Lennox-Rebate-Form-768x673.png

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.irs.gov/newsroom/irs-releases-frequently-asked-questions...

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Lennox ML180V Furnace

New Nicor Res Rebate Application Water Heating Furnace

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

The Chicago Real Estate Local Get A Rebate On Your New Furnace HVAC

Rebates Incentives Advanced Technology Heating Cooling Systems

Government Rebate For Furnaces Printable Rebate Form

Government Rebate For Furnaces Printable Rebate Form

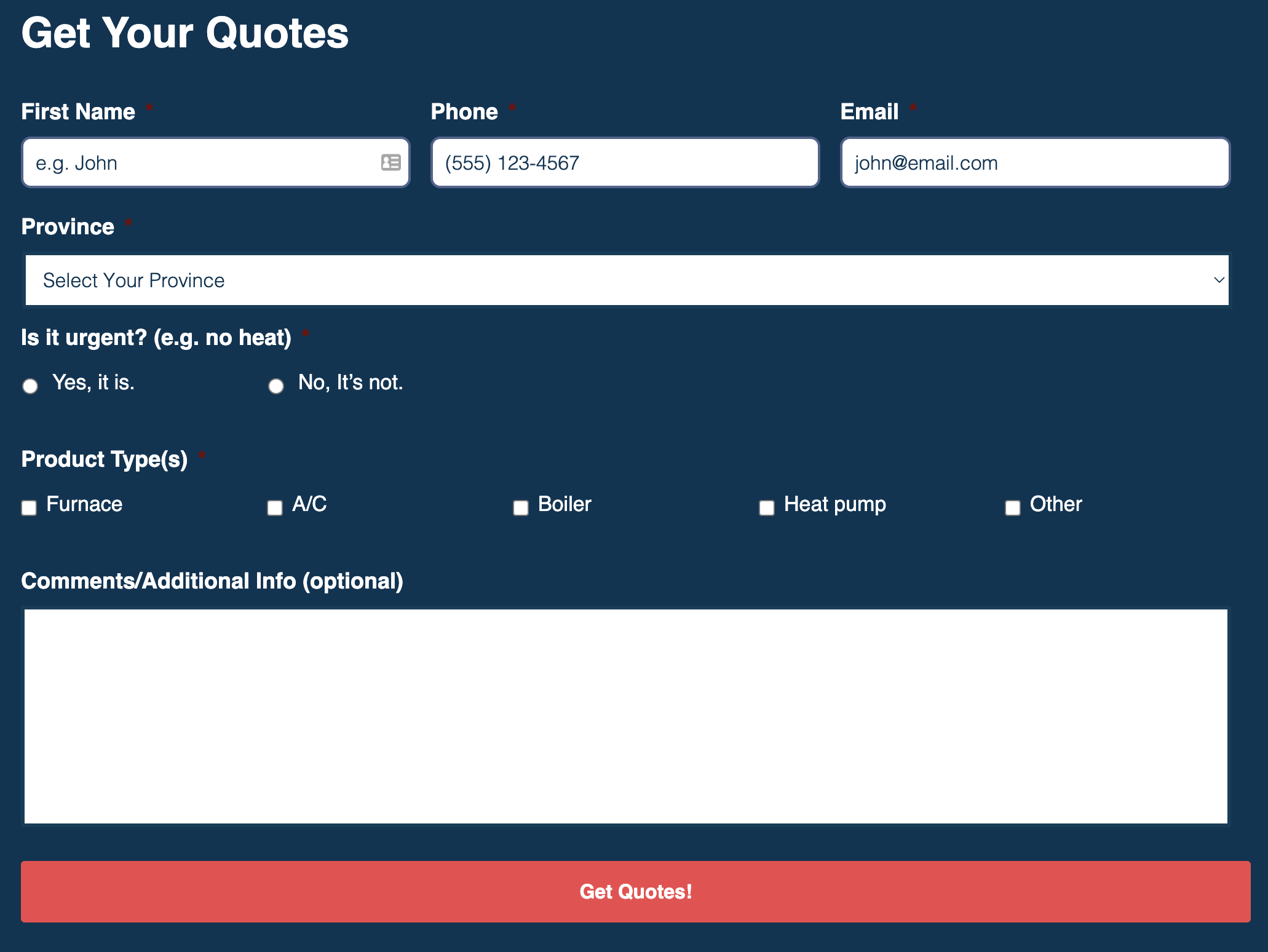

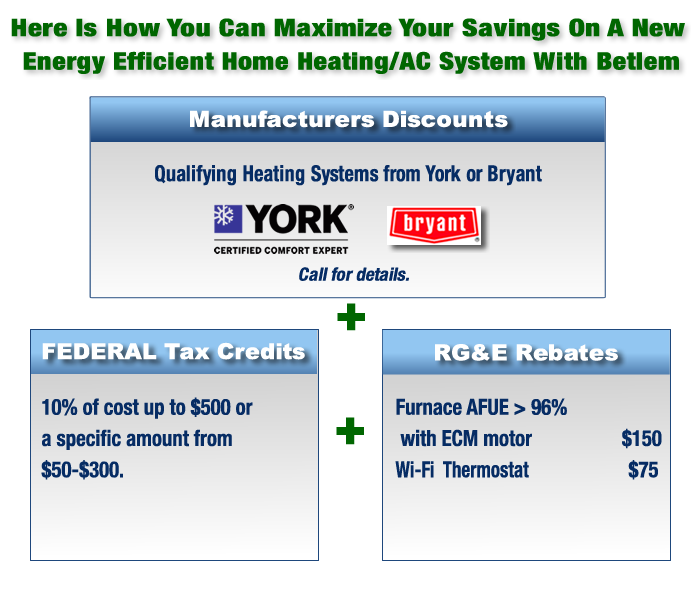

Rebates Tax Credits On Energy Efficient HVAC Equipment BETLEM

Tax Rebate On Energy Efficient Air Conditioners AirRebate

High efficiency Furnaces Can Save You Money Provide Tax Credit Mlive

Tax Rebate Efficient Furnace - Web 16 f 233 vr 2023 nbsp 0183 32 Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies energy efficient products in over 75 categories which meet