Tax Rebate For A Child Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under

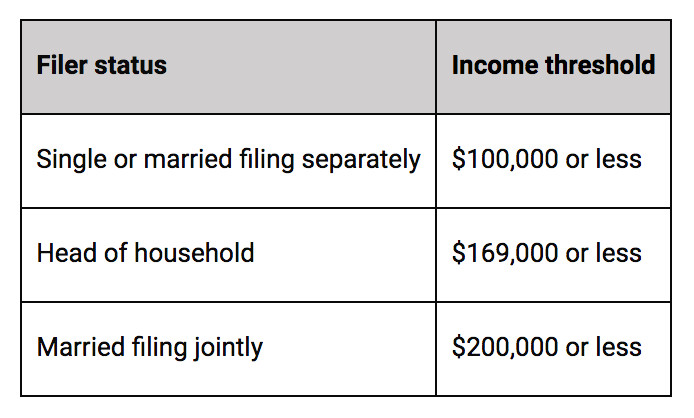

Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than Web 28 mars 2023 nbsp 0183 32 You can claim the full amount of the 2021 Child Tax Credit if you re eligible even if you don t normally file a tax return To claim the full Child Tax Credit file a

Tax Rebate For A Child

Tax Rebate For A Child

https://accessagency.org/wp-content/uploads/2022/06/Story-Get-your-2022-Child-Tax-Rebate.png

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

Web Le cr 233 dit d imp 244 t de garde d enfant sur les frais de cr 232 che s 233 l 232 ve 224 50 des frais de garde dans la limite de 1750 par enfant et par an Le montant d 233 clar 233 au fisc est 233 gal Web 24 janv 2023 nbsp 0183 32 The maximum tax credit per qualifying child you could receive for a child born last year went down to 2 000 from 3 600 for children five and under or 3 000

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a Web 18 mai 2021 nbsp 0183 32 It increases the existing tax benefit from 2 000 up to 3 600 for younger kids and 3 000 for older ones for the 2021 tax year It also broadens the umbrella of who s

Download Tax Rebate For A Child

More picture related to Tax Rebate For A Child

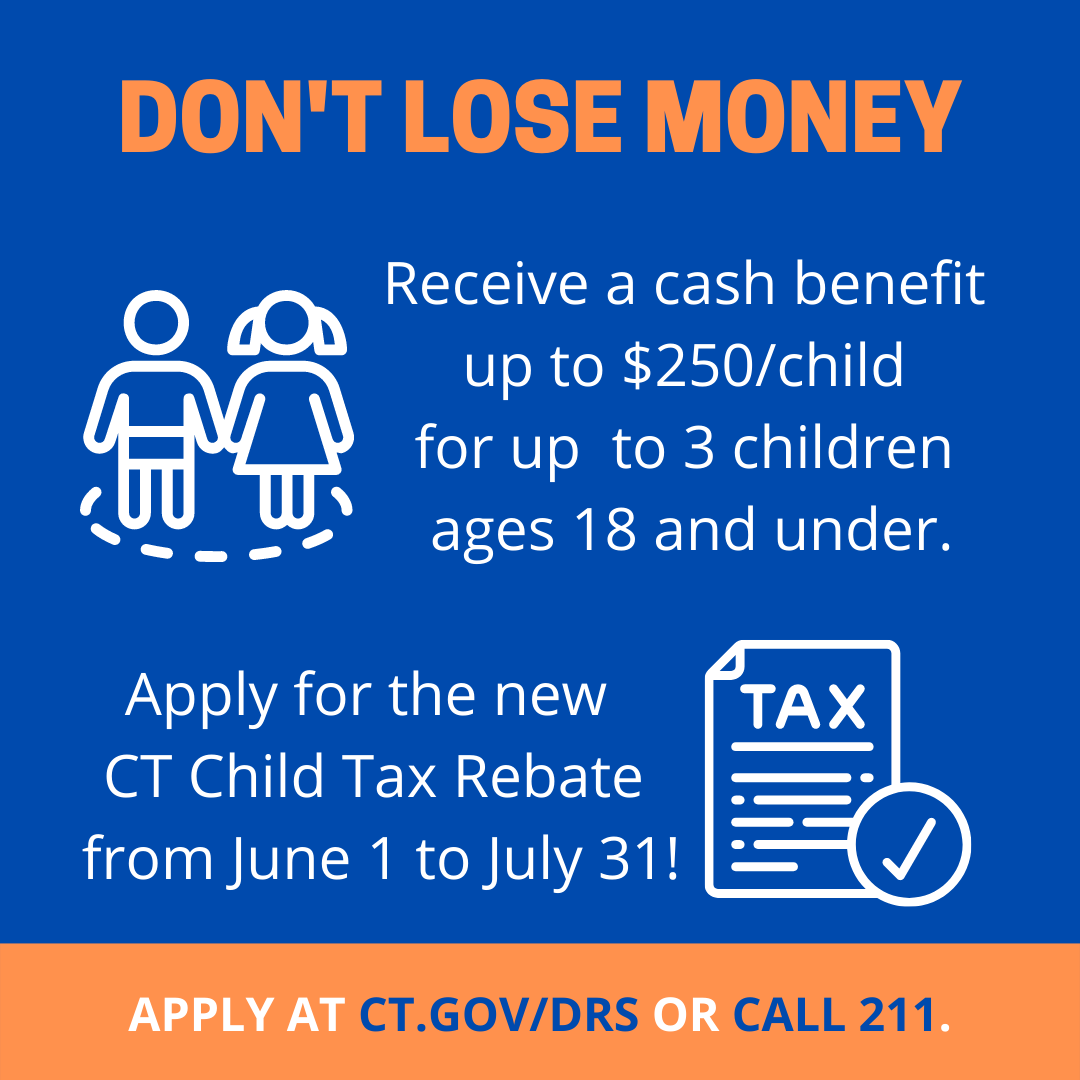

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022-768x644.png

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/gKQ2psaELuOBCeaQ8VxbmEjmLAI=/800x450/smart/filters:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg

2022 Child Tax Rebate

https://portal.ct.gov/-/media/DCF/SPOTLIGHT/2022/June/Child-Tax-Rebate.png?sc_lang=en&h=1080&w=1080&la=en&hash=71DF1F1C6E19B1AE7C1DCCD9E598E4C5

Web 28 avr 2021 nbsp 0183 32 The maximum amount of the credit is up to 8 000 per child 16 000 for two or more kids for qualifying expenses If you earn between 125 000 to 400 000 the Web 29 ao 251 t 2022 nbsp 0183 32 New York Eligible families can either claim 33 of the federal child tax credit and federal additional child tax credit for qualifying children or 100 for each

Web 7 sept 2023 nbsp 0183 32 The new limits include an increase from 5 000 to 8 000 in the first 13 weeks of enrollment in a qualifying educational program full time studies and from Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and

Child Care Tax Rebate 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/2022-child-tax-rebate-information-1.png?w=840&ssl=1

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

https://borgidacpas.com/wp-content/uploads/2022/06/CTCTRLOGOforweb.jpg

https://www.whitehouse.gov/child-tax-credit

Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than

Lamont Families Can Apply For The 2022 CT Child Tax Rebate Beginning

Child Care Tax Rebate 2022 2023 Carrebate

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Child Care Expenses Tax Credit Colorado Free Download

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

Tax Rebate Check Ny Rebate2022

Tax Rebate For A Child - Web Le cr 233 dit d imp 244 t de garde d enfant sur les frais de cr 232 che s 233 l 232 ve 224 50 des frais de garde dans la limite de 1750 par enfant et par an Le montant d 233 clar 233 au fisc est 233 gal