Tax Rebate For Company Car Web 45p per mile for the first 10 000 miles you travel for work in a year After that the rate drops to 25p These are called Approved Mileage Allowance Payments AMAP If your

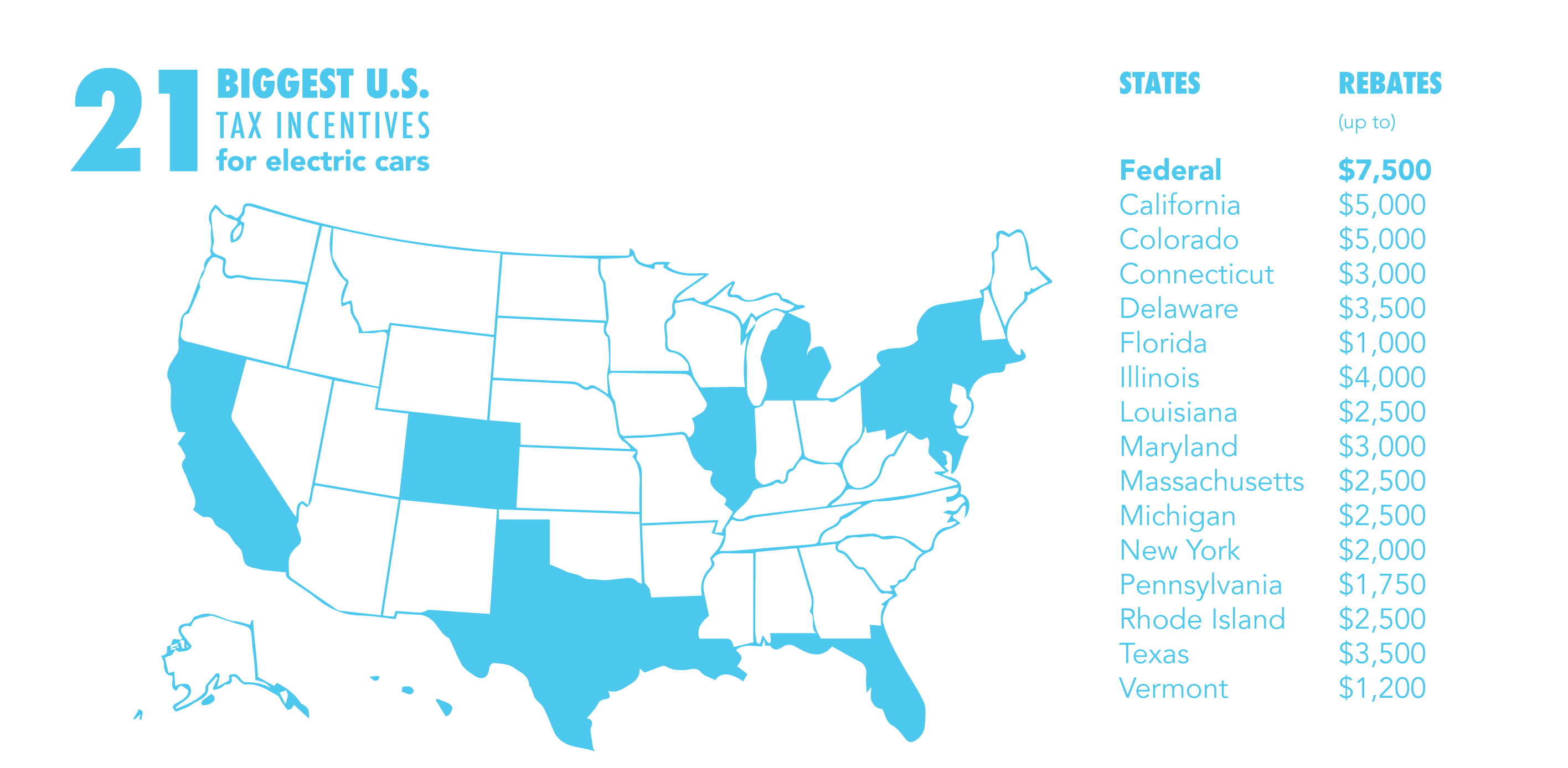

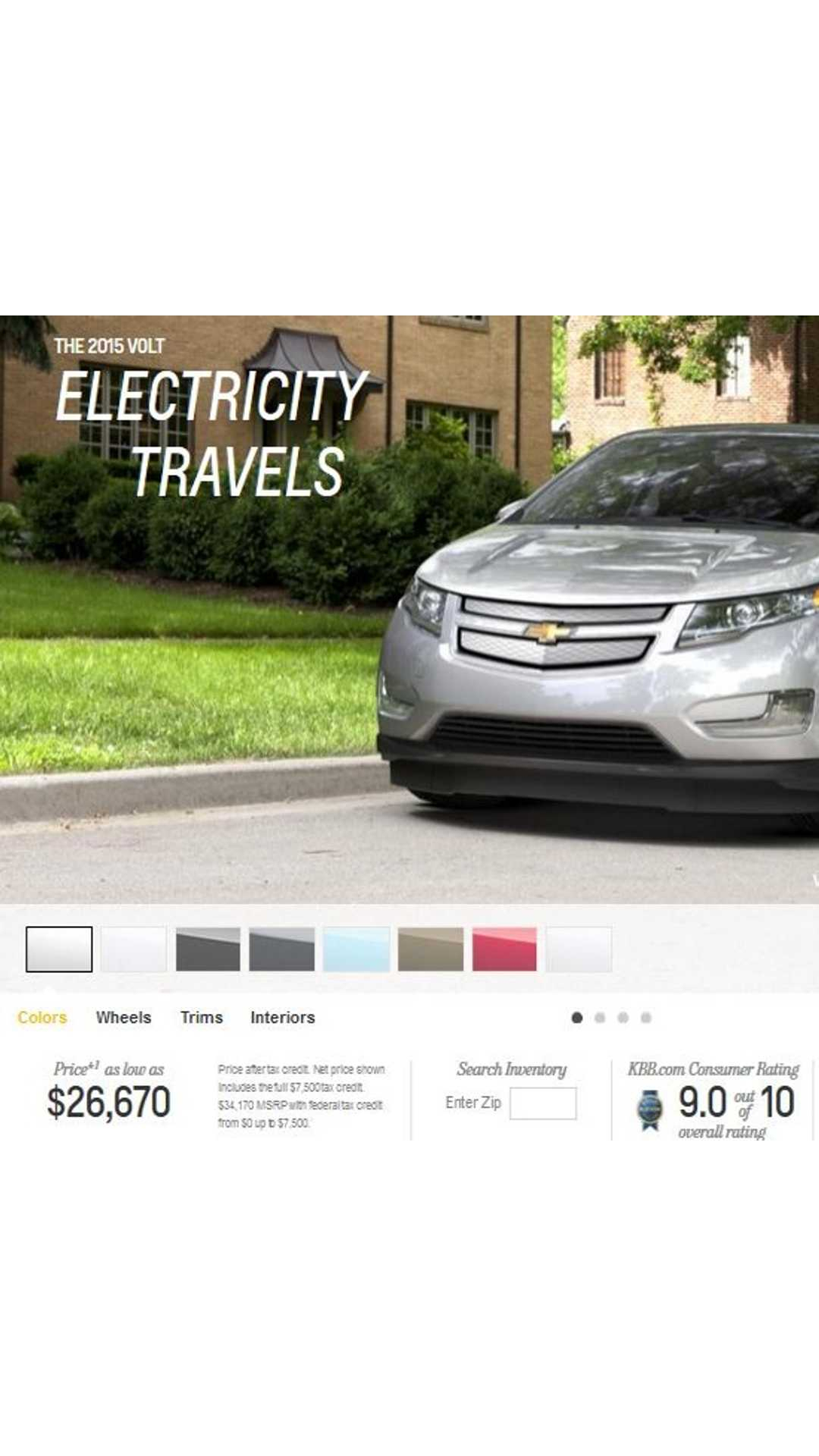

Web 21 oct 2022 nbsp 0183 32 Business owners will be able to avail themselves of a new tax credit for electric vehicles starting next year and it should be easier to get than a similar tax Web 11 avr 2023 nbsp 0183 32 In the current 2023 24 tax year all fully electric cars are eligible for a 2 BiK rate and this is set to stay the same until it changes in April 2025 This is a huge subsidy

Tax Rebate For Company Car

Tax Rebate For Company Car

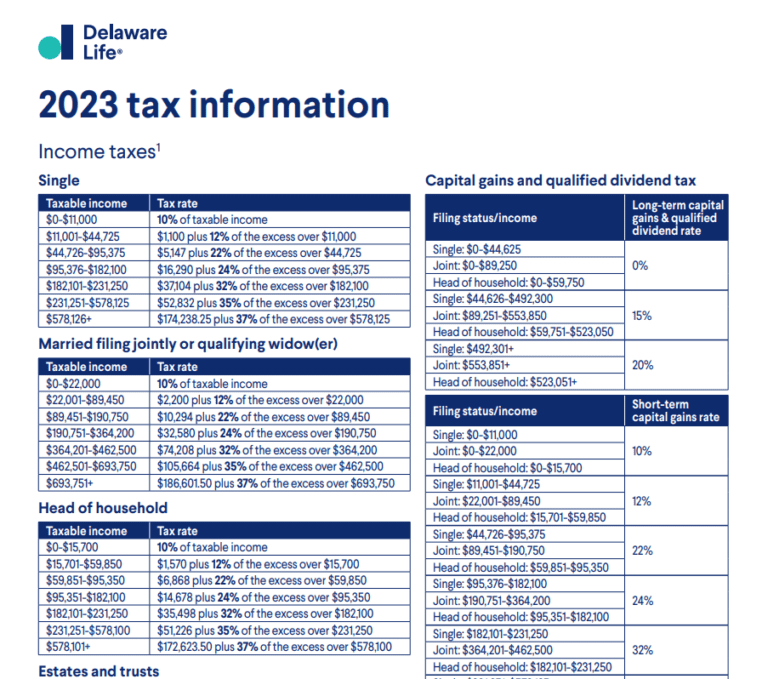

https://printablerebateform.net/wp-content/uploads/2023/03/Delaware-Tax-Rebate-2023-768x679.png

Electric Car Rebates Washington State 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ma-tax-rebates-electric-cars-2022-carrebate-2.jpg?w=358&h=537&ssl=1

Tax Rebates Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/21-biggest-us-tax-incentives-for-electric-cars.png

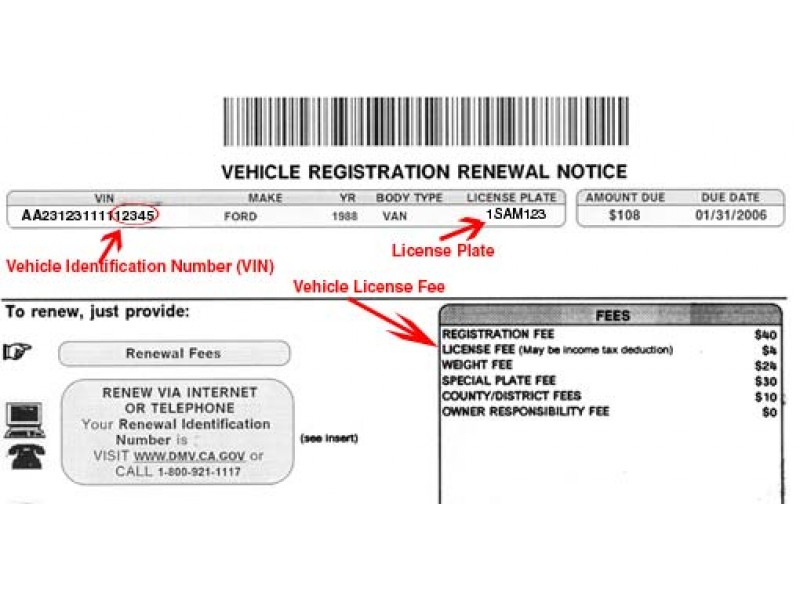

Web 10 ao 251 t 2023 nbsp 0183 32 Because not every company car tax rebate is the same the amount of tax you pay will be determined by factors Such as the vehicle s list price on the day it was Web 9 juin 2023 nbsp 0183 32 You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey UK mileage rates can differ however HMRC

Web 1 juin 2022 nbsp 0183 32 37 The tables outline how to work out the percentage benefit for both petrol powered cars and hybrid powered cars The figures for the 2022 23 tax year will be Web 7 sept 2023 nbsp 0183 32 California is eliminating its popular electric car rebate program which often runs out of money and has long waiting lists to focus on providing subsidies only to

Download Tax Rebate For Company Car

More picture related to Tax Rebate For Company Car

Tax Rebates On New Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/electric-car-tax-credits-and-rebates-charged-future-1.jpeg

Tax Rebates For Electric Cars Michigan 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/electric-vehicle-rebate-available-until-3-31-mcleod-cooperative-power-11.png

Irs Rebate For Electric Cars 2022 ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/2022-tax-rebate-for-electric-cars-2022-carrebate-1.jpg

Web 30 d 233 c 2019 nbsp 0183 32 Example 1 A car with a list price including standard accessories VAT number plates and delivery of 163 17 960 is made available to an employee It s supplied Web Company car fuel tax rebate A company car mileage tax rebate can be claimed if you have to pay for the fuel for work mileage and you aren t reimbursed the full advisory fuel

Web The tax cost to the employee depends on their tax rate For example for a car with a list price of 163 20 000 and a rate of 30 based on emissions the benefit in kind would be Web The company car tax on electric cars is currently at a rate of 2 The rate is also known as the benefit in kind BIK rate and is used to work out how much tax is payable on an

Federal Tax Rebate For Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2023/05/federal-tax-rebate-for-electric-cars-osvehicle-3.jpg

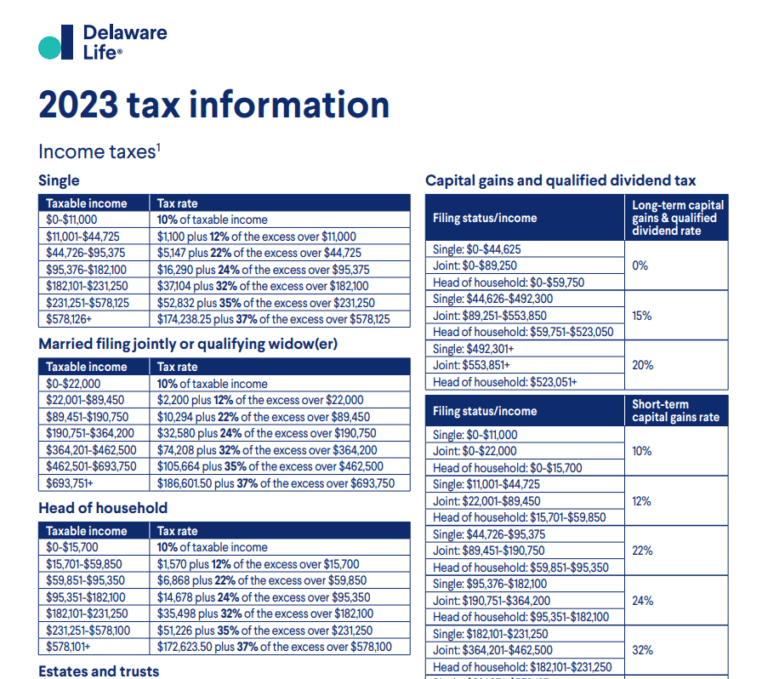

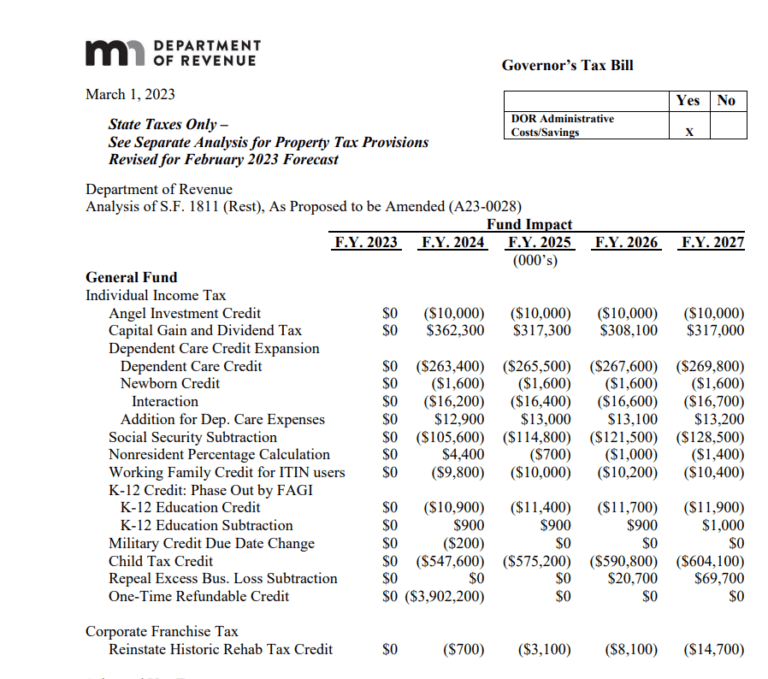

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

https://www.riftrefunds.co.uk/tax-rebates/claim-tax-back/company-cars...

Web 45p per mile for the first 10 000 miles you travel for work in a year After that the rate drops to 25p These are called Approved Mileage Allowance Payments AMAP If your

https://www.cnbc.com/2022/10/21/why-an-electric-vehicle-tax-credit-for...

Web 21 oct 2022 nbsp 0183 32 Business owners will be able to avail themselves of a new tax credit for electric vehicles starting next year and it should be easier to get than a similar tax

The Florida Hybrid Car Rebate Save Money And Help The Environment

Federal Tax Rebate For Electric Cars 2023 Carrebate

Government Tax Rebates For Hybrid Cars 2023 Carrebate

Is It Possible To Claim Another Federal And State Tax Rebate For

New Car Rebate Part Of Tax 2022 Carrebate

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

Company Car Tax Guide Recent Changes You Need To Know

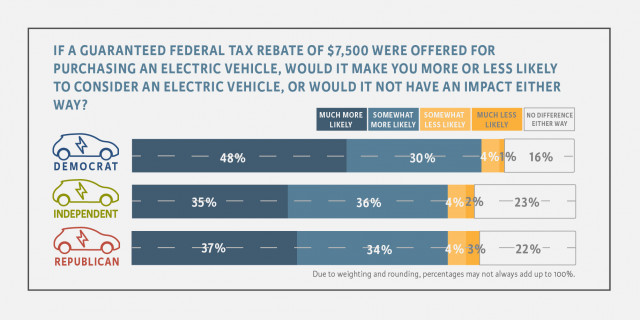

EV Tax Credit Support Climate Nexus May 2019

Tax Rebat Electric Cars Business 2022 Carrebate

Tax Rebate For Company Car - Web How to claim Business cars You can claim capital allowances on cars you buy and use in your business This means you can deduct part of the value from your profits before you