Tax Rebate For Defence Personnel Web 11 sept 2023 nbsp 0183 32 Government activity Departments Departments agencies and public bodies News News stories speeches letters and notices Guidance and regulation

Web 10 oct 2017 nbsp 0183 32 Those donating to such funds are also eligible for income tax deductions under Section 80G iiihc Provident funds being contributed Web 9 juil 2020 nbsp 0183 32 The average payment made will be 163 850 It follows a 2018 promise by defence that Scottish government tax hikes would not adversely affect serving personnel amid

Tax Rebate For Defence Personnel

Tax Rebate For Defence Personnel

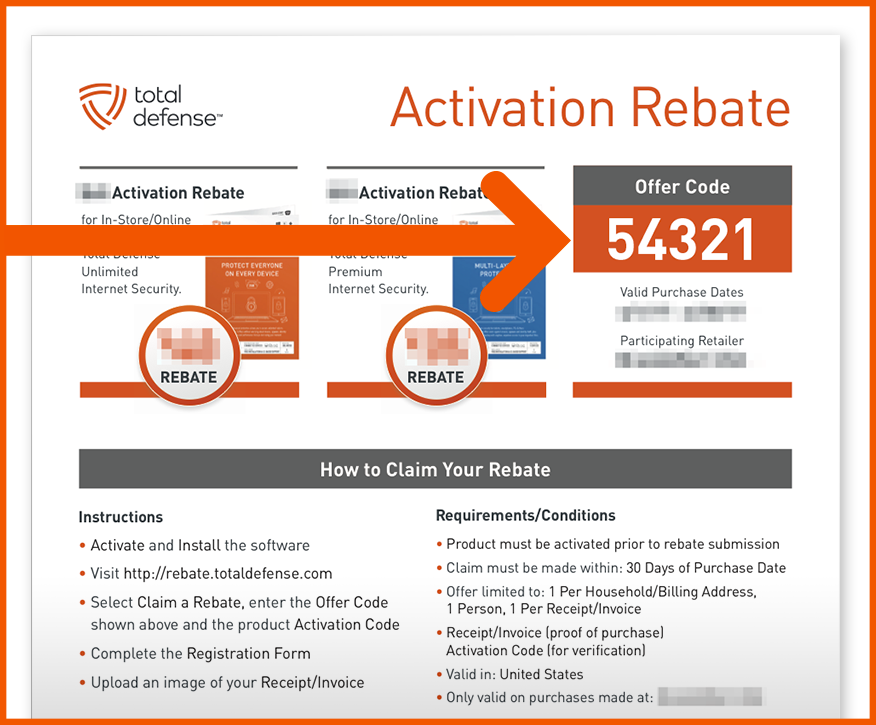

https://rebate.totaldefense.com/images/offer-code-diagram.png

Rebate Center Claim A Rebate Total Defense

https://rebate.totaldefense.com/images/offer-code-diagram_2019.png

Army Person Income Tax Return Filing For AY 2020 21 ITR 1 For Army

https://i.ytimg.com/vi/sRO-9X6lsvg/maxresdefault.jpg

Web LA R 201 MUN 201 RATION DES PERSONNELS MILITAIRES EN 2021 En 2021 le salaire net moyen des personnels militaires hors Gendarmerie est de 2 691 par mois Ce Web Military Active Duty and Veterans Financial Assistance What is Armed Forces Tax Benefits This law allows tax benefits or relief for special tax situations of active

Web In a gesture to in service military personnel and ex servicemen owning houses or vacant plots in the MUDA layouts the authorities have announced a 50 per cent rebate on Web 19 juil 2018 nbsp 0183 32 Thousands of troops set to be left out of pocket by tax rises recently announced by the Scottish Government will be protected by plans unveiled by Defence Secretary Gavin Williamson today

Download Tax Rebate For Defence Personnel

More picture related to Tax Rebate For Defence Personnel

ITR 1 Filing Online For Army Personnel And Defence Personnel Income

https://i.ytimg.com/vi/HbfNLACKOz8/maxresdefault.jpg

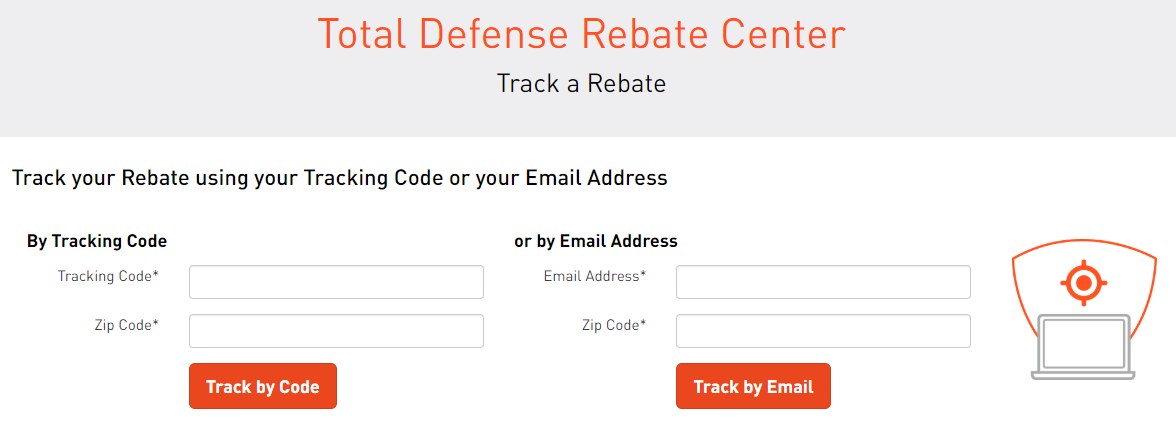

How To Track An Existing Rebate Claim What Can We Help You With

https://support.totaldefense.com/hc/article_attachments/360013568114/2018-09-26_15_49_49-Rebate_Center___Track_a_Rebate___Total_Defense_-_Opera.png

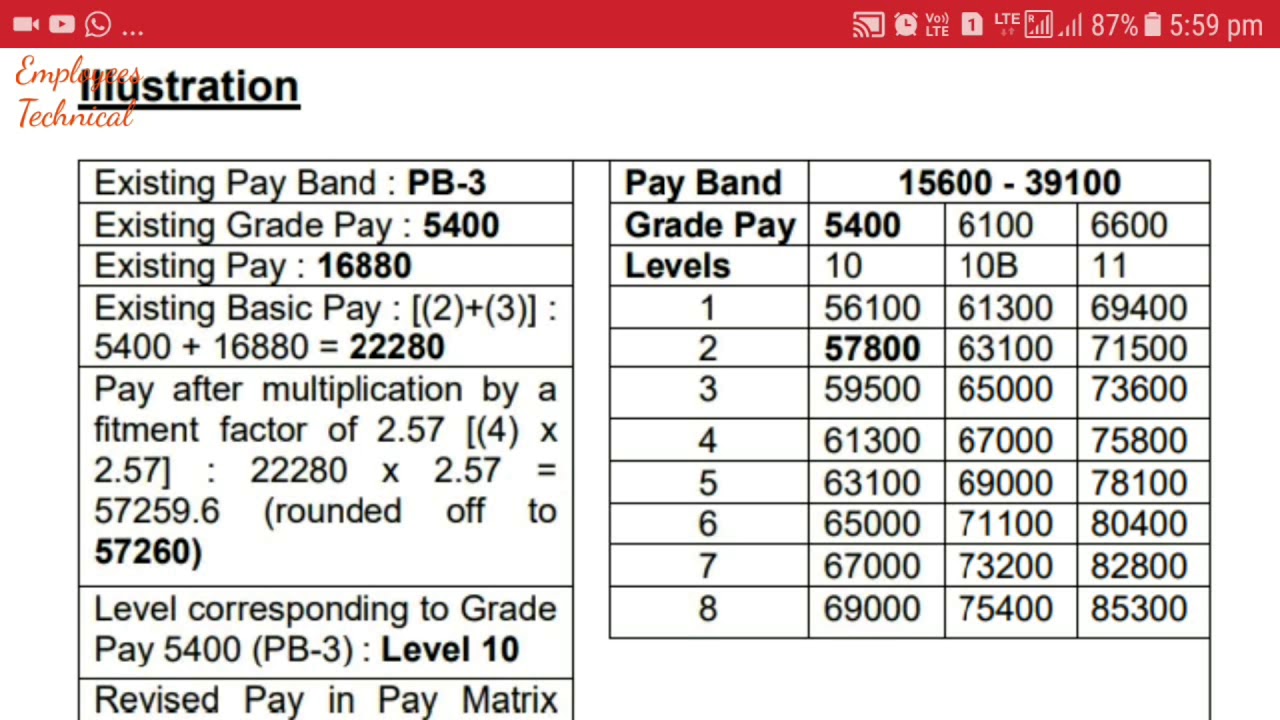

Revised Pay For Defence Personnel 7th Pay Commission YouTube

https://i.ytimg.com/vi/J-cIdzf1D44/maxresdefault.jpg

Web 11 mars 2021 nbsp 0183 32 The Finance Bill of 2021 states that the interest on contribution made by a person exceeding 2 5 lakhs towards provident fund will be liable for taxation at their slab rates Web 19 juin 2019 nbsp 0183 32 IRS Tax Tip 2019 79 June 19 2019 Members of the military and their families often qualify for special tax benefits For example members of the armed forces

Web If you ve paid too much tax in the last 4 years whether you ve been travelling in your own vehicle or by public transport you could have a tax rebate claim worth over 163 3k on Web As Australian Defence Force ADF members still pay income tax on salaries and allowances members of the military in Australia can claim a wide range of tax

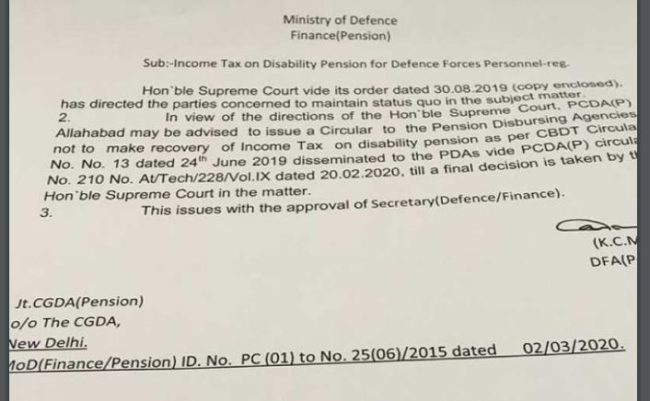

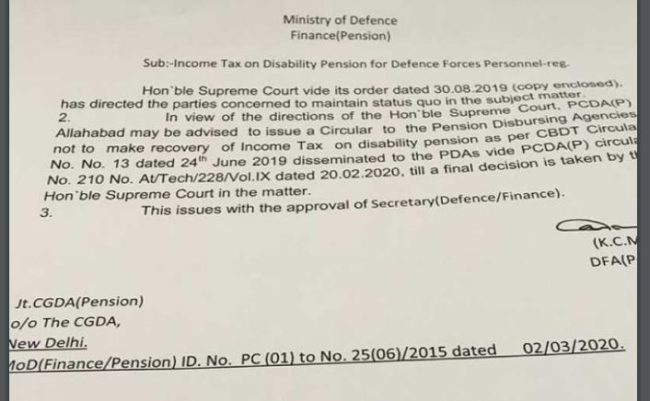

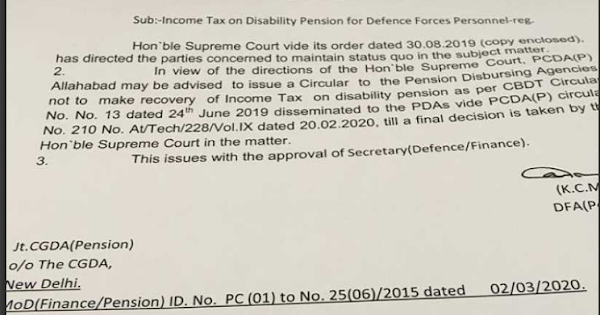

Income Tax On Disability Pension For Defence Forces Personnel Status

https://www.staffnews.in/wp-content/uploads/2020/03/mod-finance-Pension-id-no-pc-01-to-no-25-06-2015-dated-02-03-2020-650x401.jpg

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

https://www.gov.uk/government/collections/support-services-for...

Web 11 sept 2023 nbsp 0183 32 Government activity Departments Departments agencies and public bodies News News stories speeches letters and notices Guidance and regulation

https://blog.allindiaitr.com/income-tax-exemptions-for-defe…

Web 10 oct 2017 nbsp 0183 32 Those donating to such funds are also eligible for income tax deductions under Section 80G iiihc Provident funds being contributed

Property Tax Rebate For Serving And Retired Personnel Of Defence

Income Tax On Disability Pension For Defence Forces Personnel Status

Income Tax On Disability Pension For Defence Forces Personnel Status

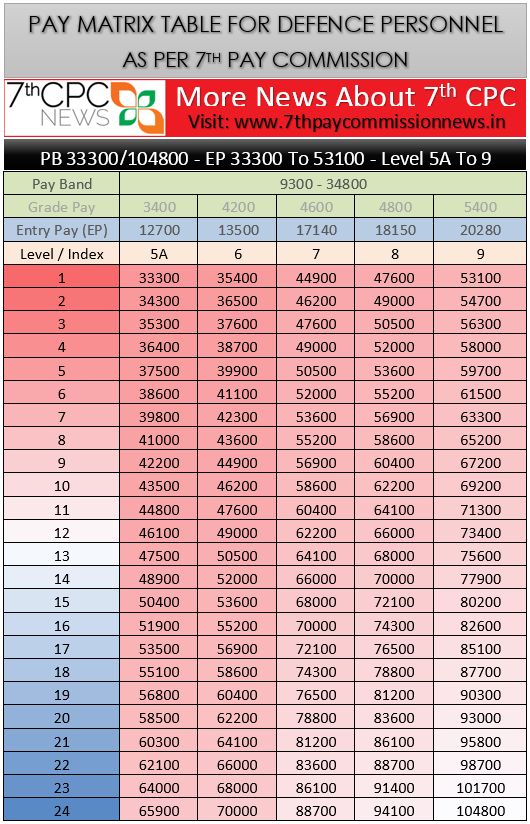

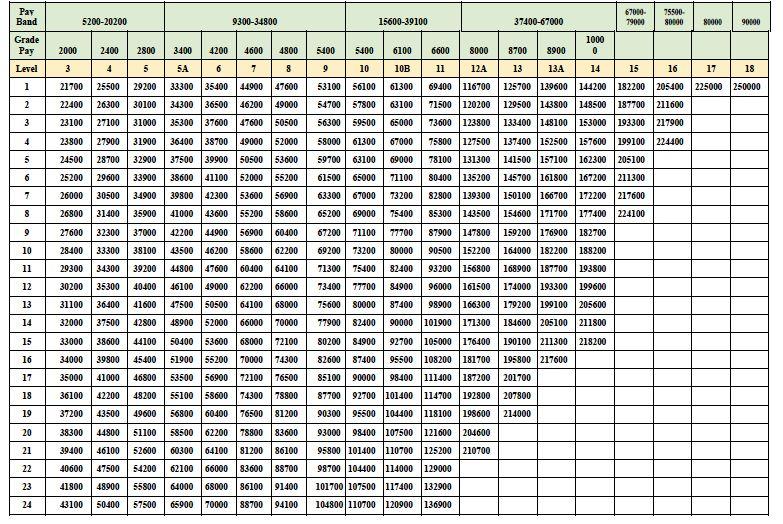

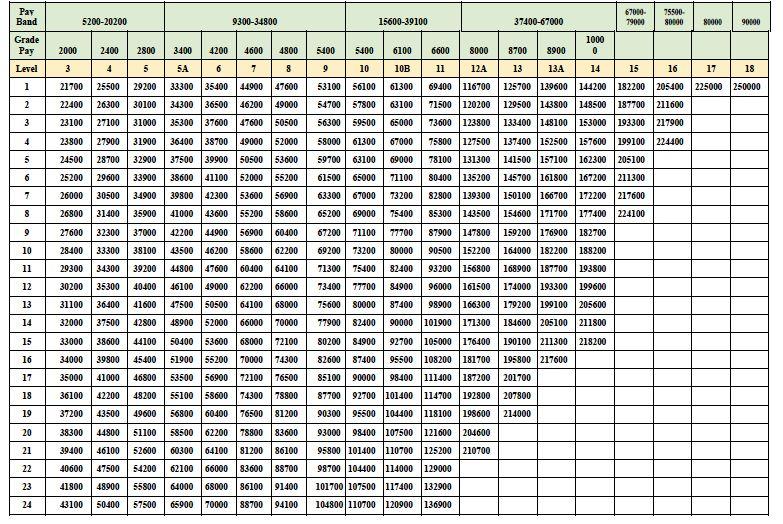

7th Pay Commission Pay Scale For Defence Personnel As Per Pay Matrix

Rebate Center Claim A Rebate Total Defense

New Pay Matrix For Defence Personnel

New Pay Matrix For Defence Personnel

Income Tax On Disability Pension For Defence Forces Personnel PCDA

Rebate Center Claim A Rebate Total Defense

RE REGISTRATION CHARGES AND LIFE TAX EXEMPTION FOR RETIRED DEFENCE

Tax Rebate For Defence Personnel - Web I am in receipt of Property Tax Assessment cum Notice 2021 2022 Copy Att raising an arrears of Rs As per Haryana Government notification Defence Personal Ex