Tax Rebate For Education Expenses Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e aux parents qui ont un ou plusieurs enfants 224 charge au coll 232 ge au lyc 233 e ou 224 l universit 233 A condition de bien remplir sa d 233 claration de revenus

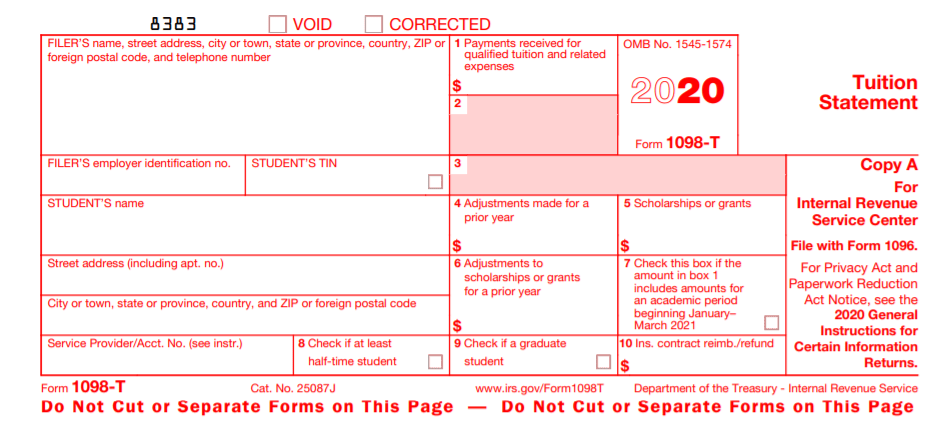

Web A refund of qualified education expenses may reduce adjusted qualified education expenses for the tax year or require repayment recapture of a credit claimed in an earlier year Some tax free educational assistance received after 2022 may be treated as a refund See Tax free educational assistance earlier Web Find out if you can claim eligible tuition and other fees paid to an eligible education institution or fees paid for examination All deductions credits and expenses Find a list of all deductions credits and expenses you may

Tax Rebate For Education Expenses

Tax Rebate For Education Expenses

https://i.pinimg.com/originals/2c/b9/3a/2cb93a8b9f545987e06cae214219c354.jpg

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2023/01/Irish-Tax-Rebates-36-1.jpg?resize=727%2C1024&ssl=1

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-768x576.jpg

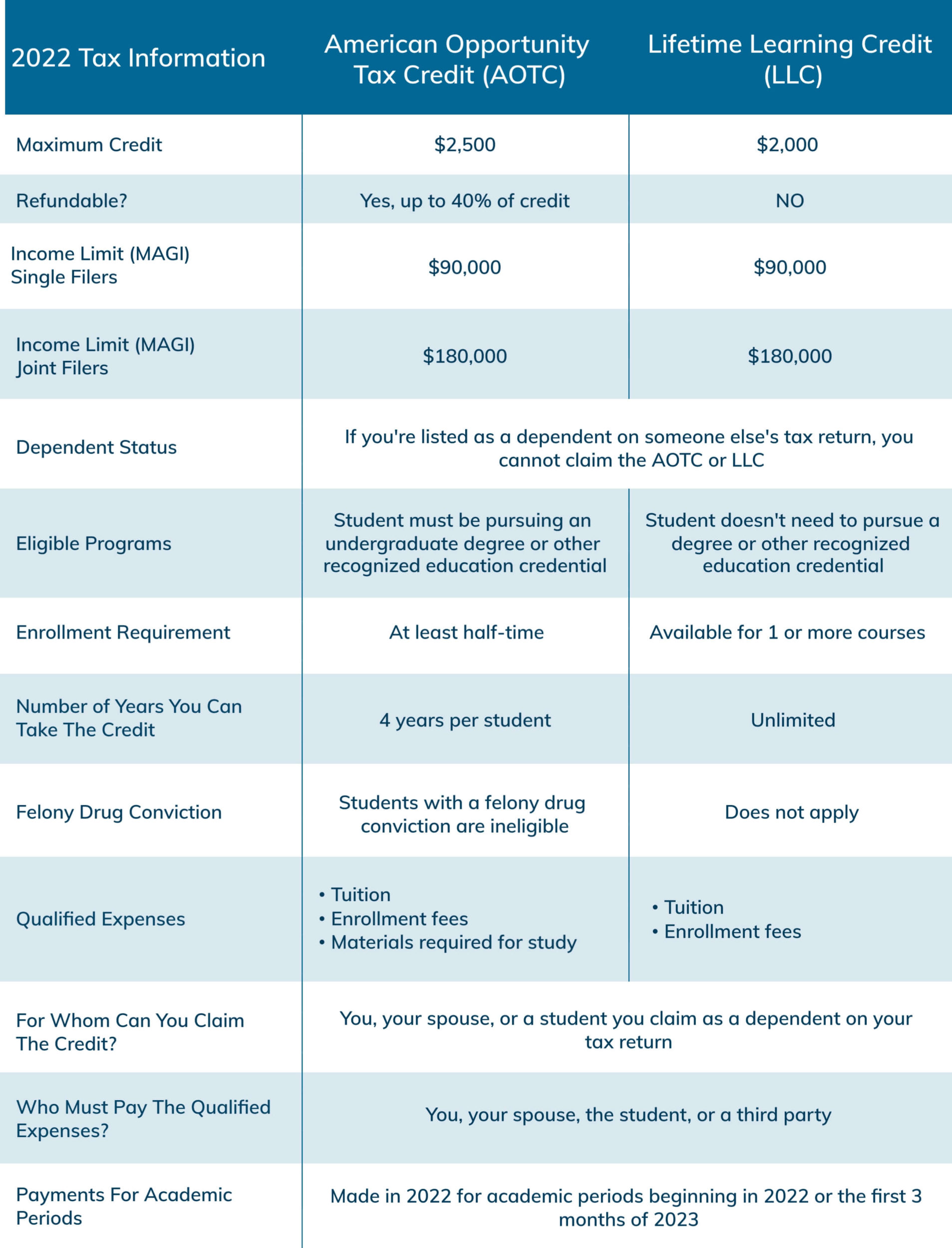

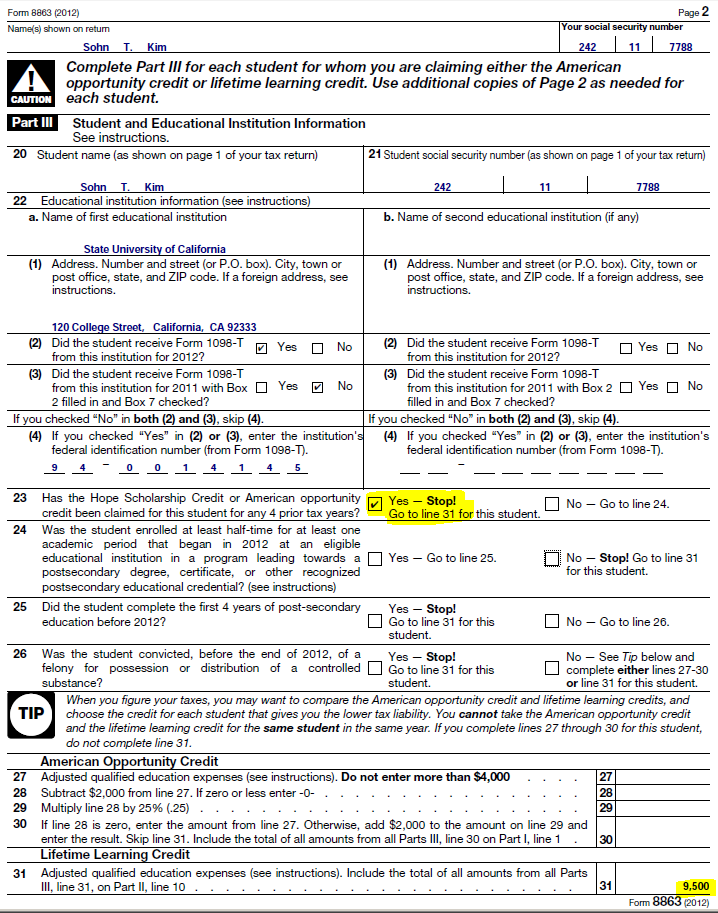

Web 13 f 233 vr 2023 nbsp 0183 32 Several tax breaks can help you cover the cost of education and new laws expand some benefits By Kimberly Lankford Edited by Barri Segal Feb 13 2023 at 9 36 a m Educational Tax Web 29 ao 251 t 2023 nbsp 0183 32 Credits An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit

Web 31 mai 2023 nbsp 0183 32 The American Opportunity Credit can save you up to 2 500 in tax for the education expenses of each eligible student To qualify the student must pursue a degree at a school that is eligible to participate in the federal student aid program Web You may claim the actual course fees incurred by yourself up to a maximum of 5 500 each year regardless of the number of courses seminars or conferences you have attended Any amount paid or reimbursed by your employer or any other organisations including the use of SkillsFuture Credit cannot be claimed as Course Fees Relief

Download Tax Rebate For Education Expenses

More picture related to Tax Rebate For Education Expenses

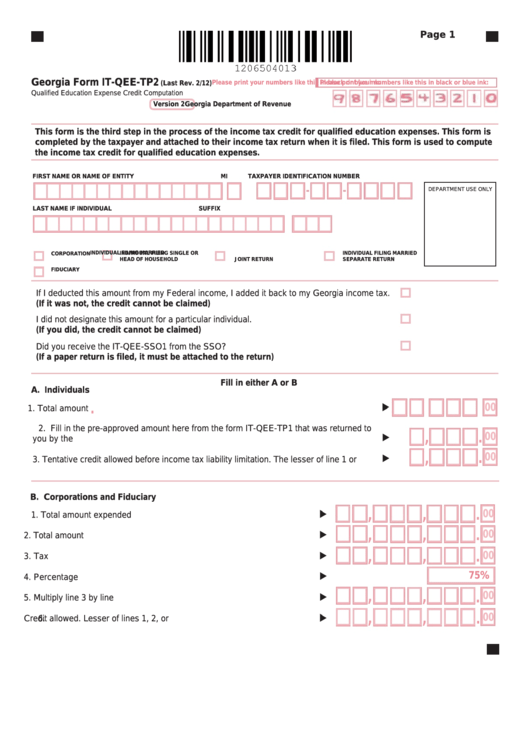

Fillable Form It Qee Tp2 Qualified Education Expense Credit

https://data.formsbank.com/pdf_docs_html/344/3442/344289/page_1_thumb_big.png

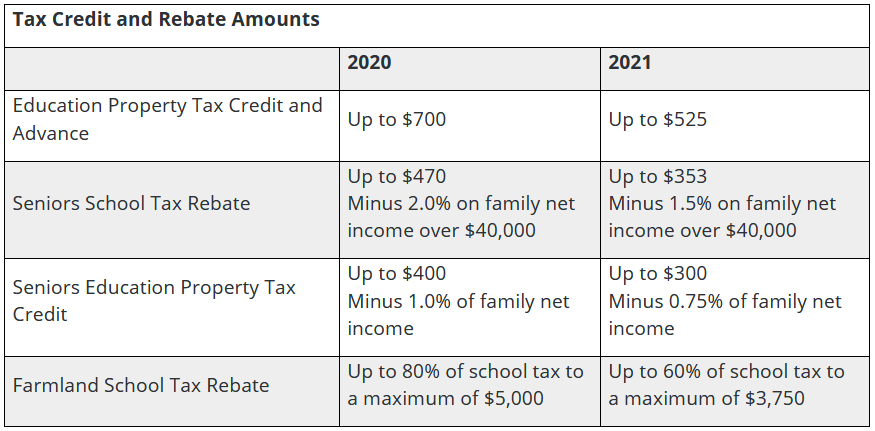

Provincial Education Property Tax Rebate Roll Out Rural Municipality

https://rmofstclements.com/wp-content/uploads/2021/04/image.png

Education Expenses Tax Deduction TECHNONEWPAGE

https://i2.wp.com/www.madammoney.com/wp-content/uploads/2015/03/TaxTipsVisualCorpComm_FNL.jpg?resize=791%2C1024

Web 27 janv 2023 nbsp 0183 32 In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary educational institutions including colleges universities and trade schools Web The official tax receipt or form you received from your educational institution will indicate the amount of eligible tuition fees that you paid for that calendar year To qualify the fees you paid to attend each educational institution must be more than 100

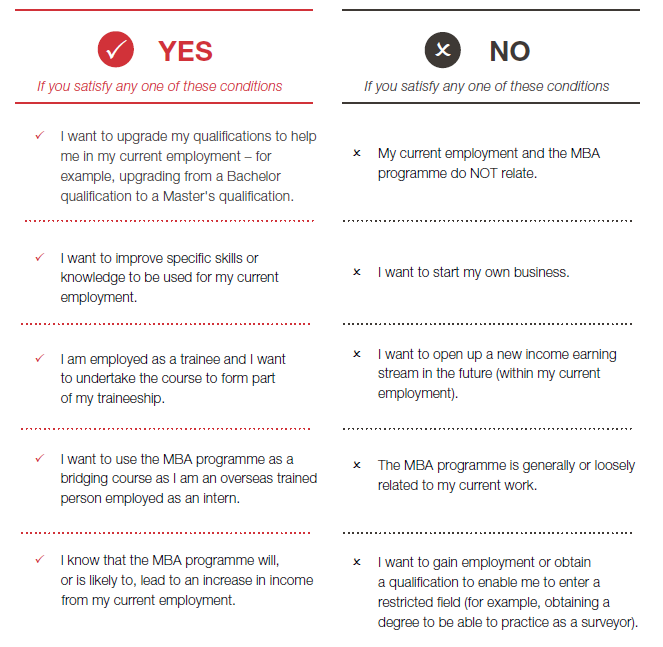

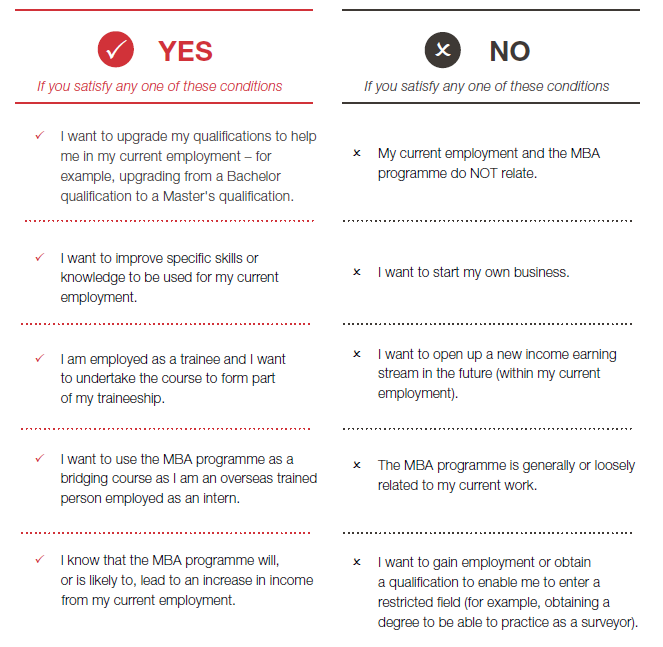

Web 15 juin 2023 nbsp 0183 32 Help Frequently Asked Questions Education amp Work Related Expenses Education amp Work Related Expenses May I claim my job related education expenses as an itemized deduction or an education credit on my tax return My employer reimbursed me for my graduate school tuition and included it on my W 2 as wages Web 23 nov 2022 nbsp 0183 32 Up to 1 000 40 of the tax credit may be refunded except to certain taxpayers who are under age 24 as of the end of the tax year The AOTC is limited to the first four years of postsecondary

How To Claim Self Education Expenses At Tax Time Australian Institute

https://www.aib.edu.au/wp-content/uploads/2019/03/self-education.png

2019 2023 Form Canada T778 E Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/536/408/536408955/large.png

https://www.toutsurmesfinances.com/impots/frais-de-scolarite-quel-a...

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e aux parents qui ont un ou plusieurs enfants 224 charge au coll 232 ge au lyc 233 e ou 224 l universit 233 A condition de bien remplir sa d 233 claration de revenus

https://www.irs.gov/publications/p970

Web A refund of qualified education expenses may reduce adjusted qualified education expenses for the tax year or require repayment recapture of a credit claimed in an earlier year Some tax free educational assistance received after 2022 may be treated as a refund See Tax free educational assistance earlier

2022 Education Tax Credits Are You Eligible

How To Claim Self Education Expenses At Tax Time Australian Institute

What Is A 1098 T Form Used For Full Guide For College Students The

Education Irish Tax Rebates

Education Credit 4 Form 8863 Lifetime Learning Credit

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Child Care Rebate Income Tax Return 2022 Carrebate

How To Enter 1099 MISC Fellowship Income Into TurboTax Evolving

Deferred Tax And Temporary Differences The Footnotes Analyst

Tax Rebate For Education Expenses - Web This calculator will check your eligibility to claim a deduction and helps you to estimate the deduction you can claim for work related self education expenses It can be used for the 2013 14 to 2022 23 income years The results of this calculator are based on the information you provide