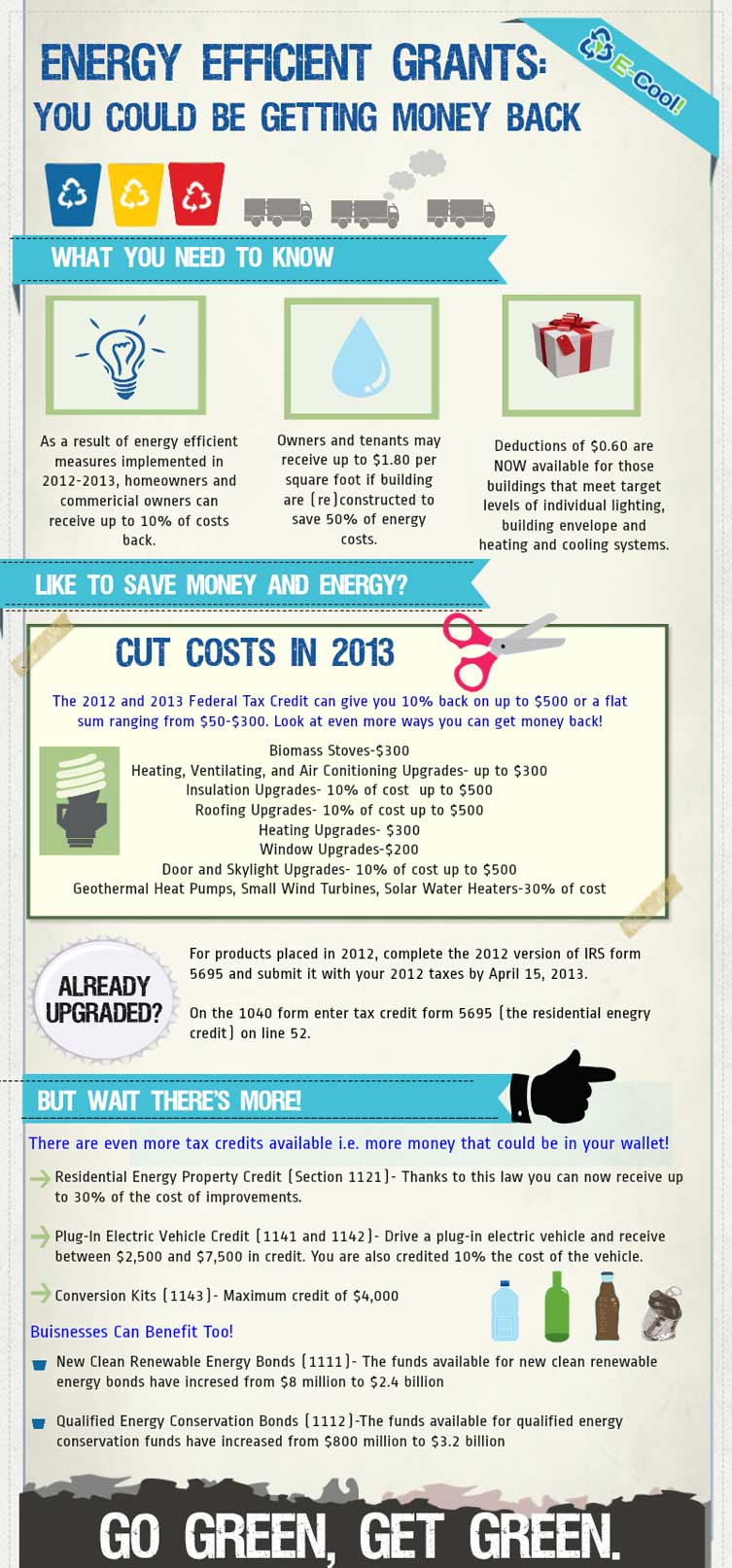

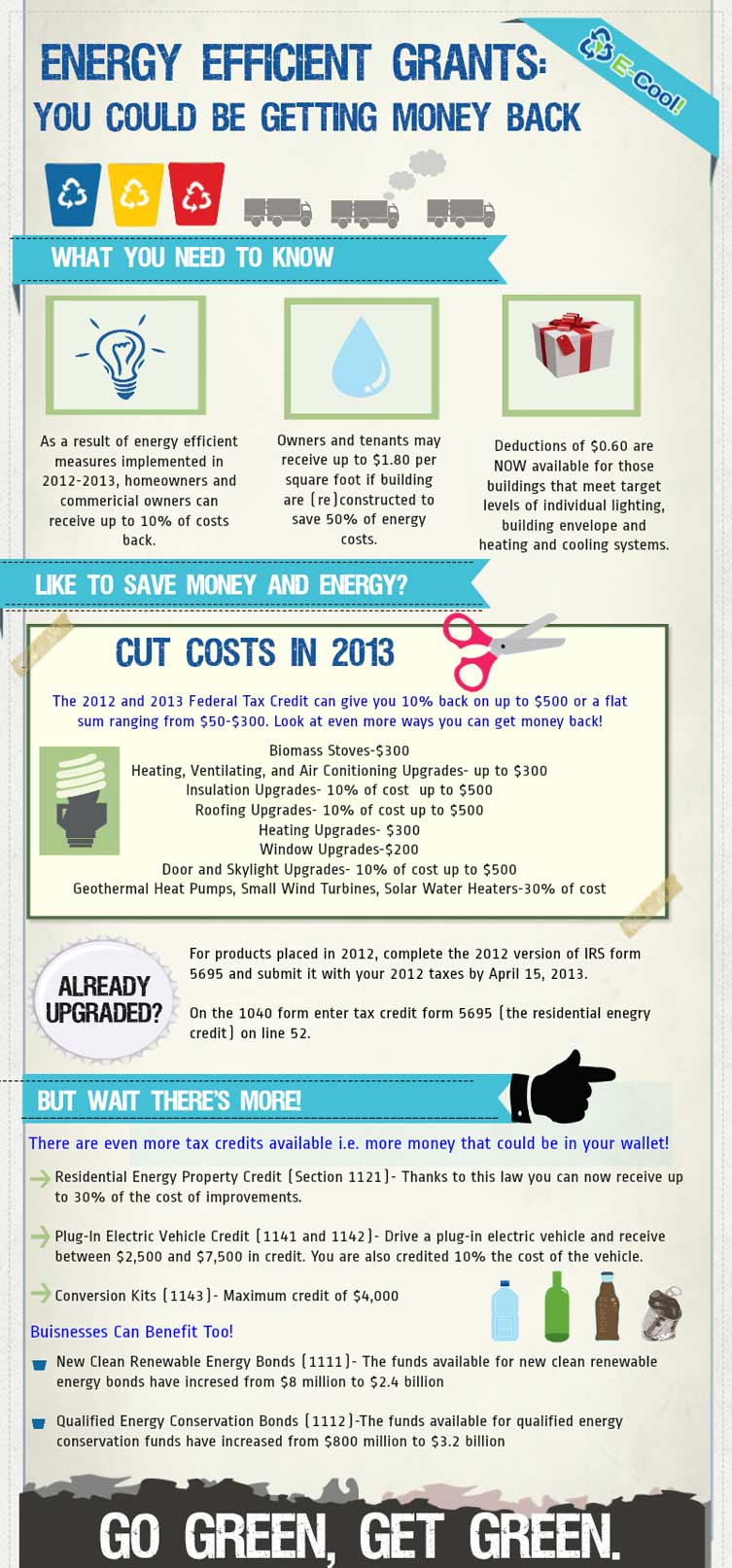

Tax Rebate For Energy Efficient Appliances Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat Web 12 ao 251 t 2022 nbsp 0183 32 August 12 2022 313 Photo Illustration Tim LaPalme Consumer Reports Getty Images The Inflation Reduction Act could soon help save you money if you re

Tax Rebate For Energy Efficient Appliances

Tax Rebate For Energy Efficient Appliances

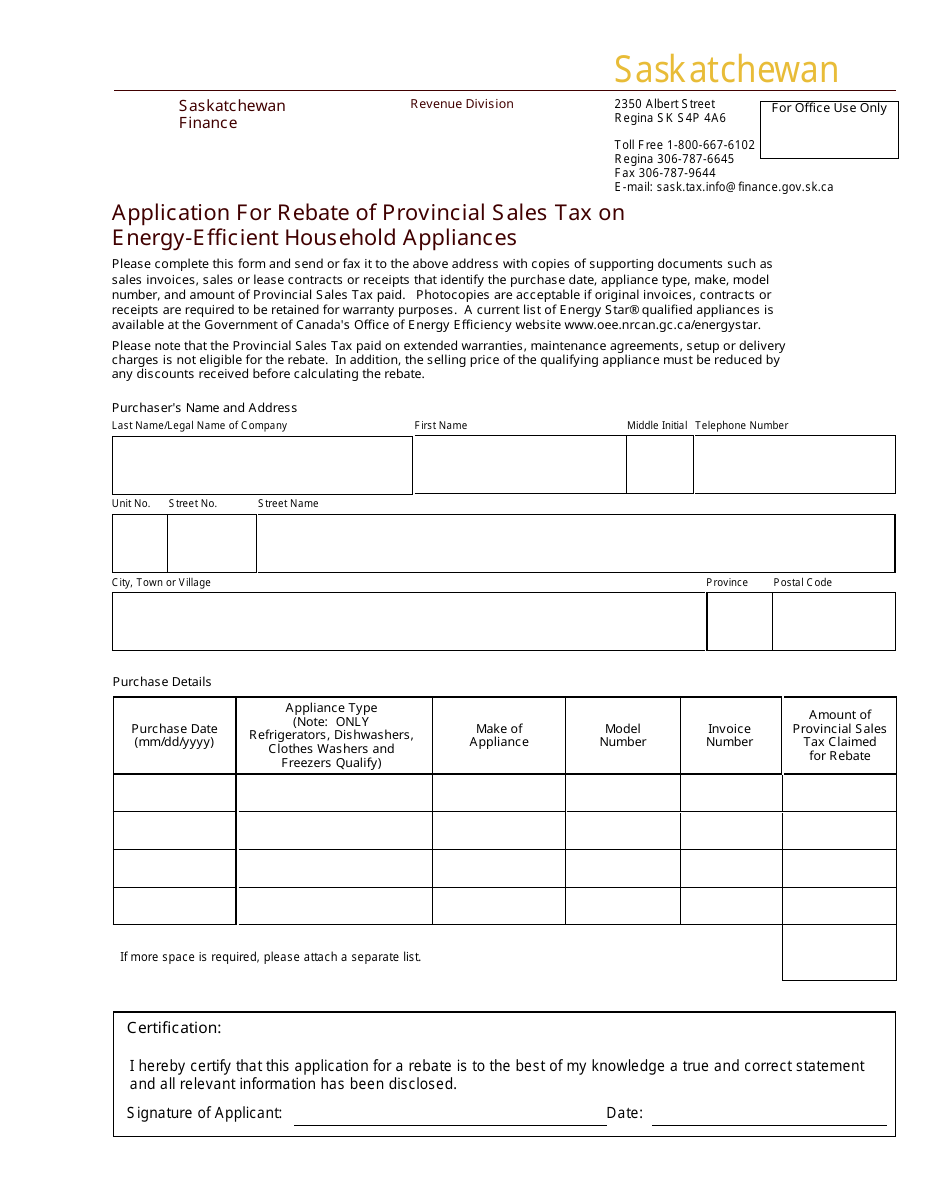

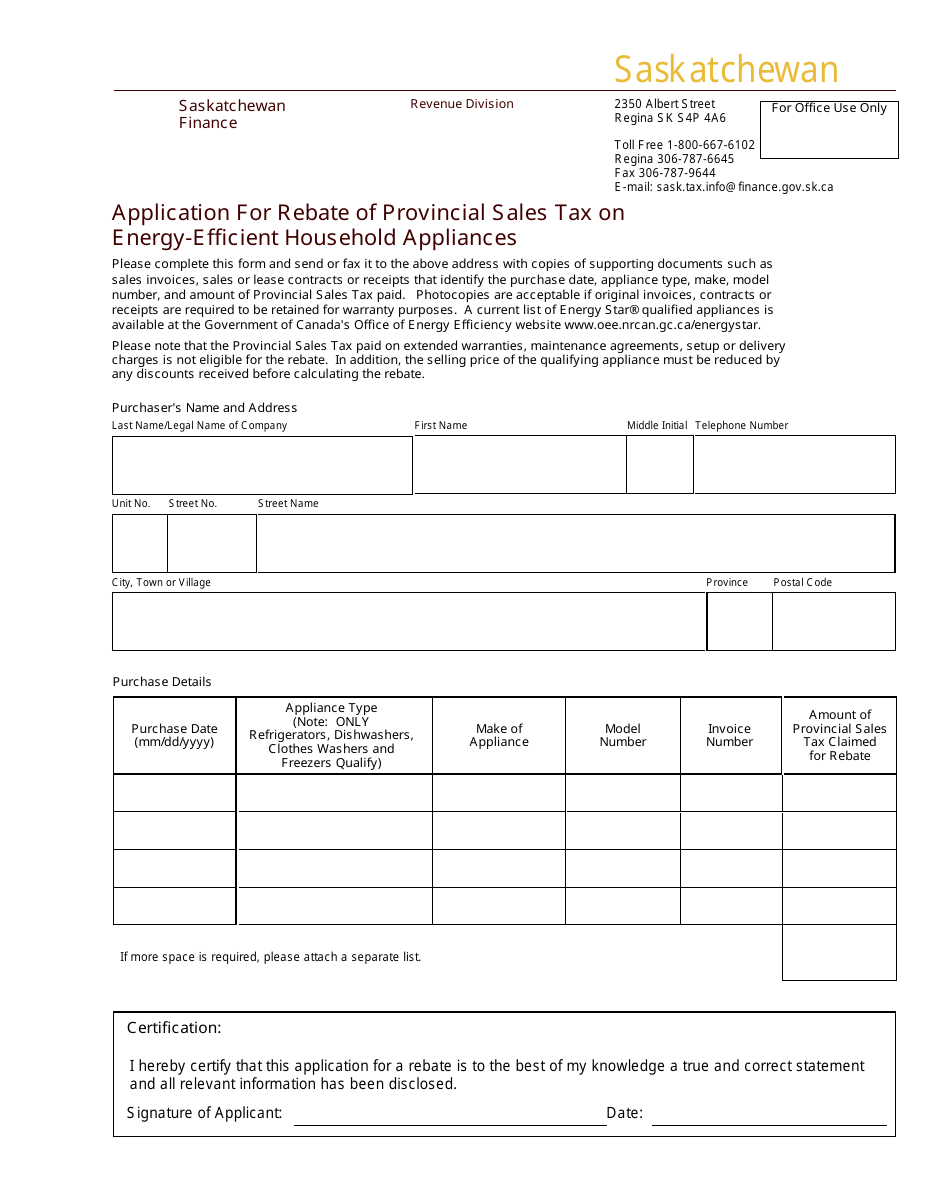

https://data.templateroller.com/pdf_docs_html/1872/18722/1872211/application-for-rebate-of-provincial-sales-tax-on-energy-efficient-household-appliances-saskatchewan-canada_print_big.png

What Are Rebates For Energy Efficient Appliances My Tax Incentive

https://www.mytaxincentive.com/wp-content/uploads/2019/10/Infographic-No-Logo.png

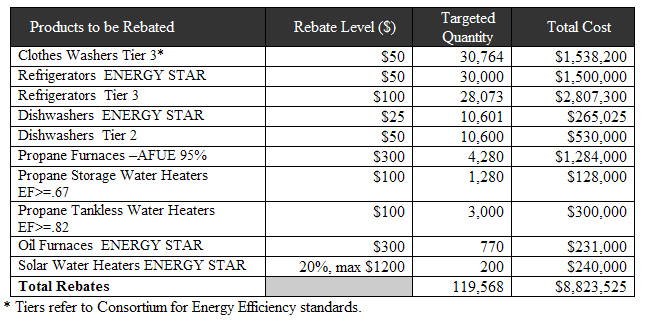

Rebates For Energy efficient Appliances Available In Massachusetts

https://www.masslive.com/resizer/bBMnesUEICg-VyJRAAhygvblUQE=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.masslive.com/home/mass-media/width2048/img/breakingnews/photo/2010/03/rebate0324jpg-51fe872f64c70f53.jpg

Web Get Federal Tax Savings and Other Rebates for Energy Efficiency Home Upgrades The Inflation Reduction Act will make it more affordable for families to purchase energy efficient equipment when they need to Web 30 d 233 c 2022 nbsp 0183 32 Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available

Web 17 mars 2023 nbsp 0183 32 The program which was added by the Inflation Reduction Act will provide rebates to low and middle income families who purchase energy efficient electric appliances To qualify for a rebate Web 19 ao 251 t 2022 nbsp 0183 32 Tax Rebates for Buying New Energy Efficient Appliances While various regulations still need to be sorted out taxpayers may qualify for up to 8 000 off the

Download Tax Rebate For Energy Efficient Appliances

More picture related to Tax Rebate For Energy Efficient Appliances

Tax Rebate On Energy Efficient Air Conditioners AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/tax-rebate-on-energy-efficient-air-conditioners.jpeg?resize=791%2C1024&ssl=1

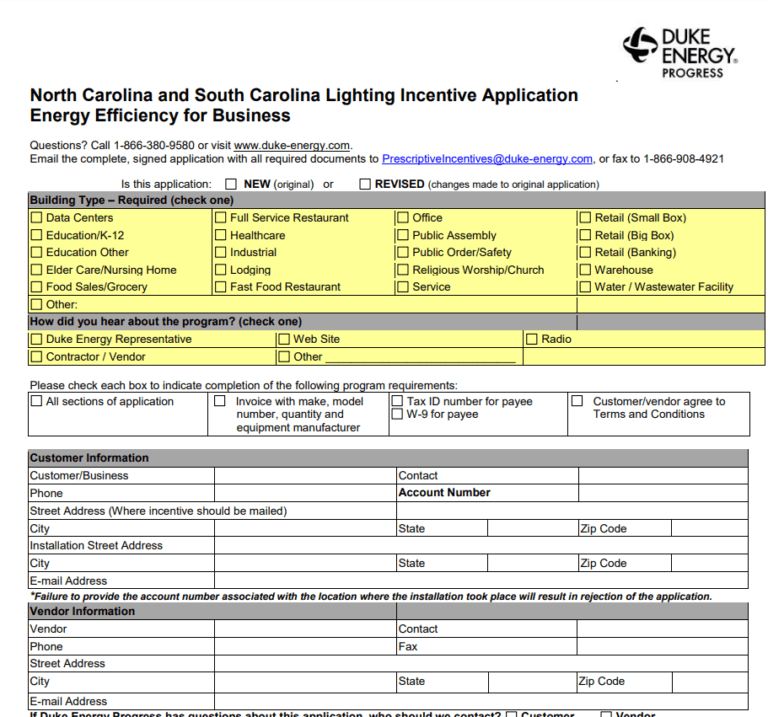

Duke Energy Rebate Form Air Conditioner Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Duke-Energy-Rebate-Form-768x717.png

How To Claim Your 50 Energy Star Refrigerator Rebate Solar Appliance

https://www.solarappliance.net/wp-content/uploads/2019/11/rebate-for-energy-efficient-refrigerator.png

Web The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit o insulation materials or systems and air sealing materials or Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Web 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME Web 3 f 233 vr 2023 nbsp 0183 32 There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30

Utility Company Rebates And Government Tax Incentives AEE

http://www.aee-inc.com/images/2017-dte-rebates.png

How To Save On Your Energy Bills In 2022 Your Energy Saving Solutions

https://yess.net.au/wp-content/uploads/2022/02/198597a5-1d34-4236-b938-5c6abd0bcbd5.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Union Gas Home Reno Rebate Program Great Northern Insulation

Utility Company Rebates And Government Tax Incentives AEE

Consumers Energy Co Appliance Rebates Rebate Marketing Payments

PPL Rebates Appliances Printable Rebate Form

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

Energy Efficiency Tax Rebates Infographic

Energy Efficiency Tax Rebates Infographic

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

Save Money On Air conditioners With The Energy Efficient Appliance Rebate

Michigan Appliance Rebate Program GreeningDetroit

Tax Rebate For Energy Efficient Appliances - Web Get Federal Tax Savings and Other Rebates for Energy Efficiency Home Upgrades The Inflation Reduction Act will make it more affordable for families to purchase energy efficient equipment when they need to