Tax Rebate For Ev Cars Web 17 avr 2023 nbsp 0183 32 The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than in

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Web 5 janv 2023 nbsp 0183 32 Bonus 233 cologique voiture ou camionnette r 232 gles en 2022 V 233 rifi 233 le 05 janvier 2023 Direction de l information l 233 gale et administrative Premi 232 re ministre Cette

Tax Rebate For Ev Cars

Tax Rebate For Ev Cars

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

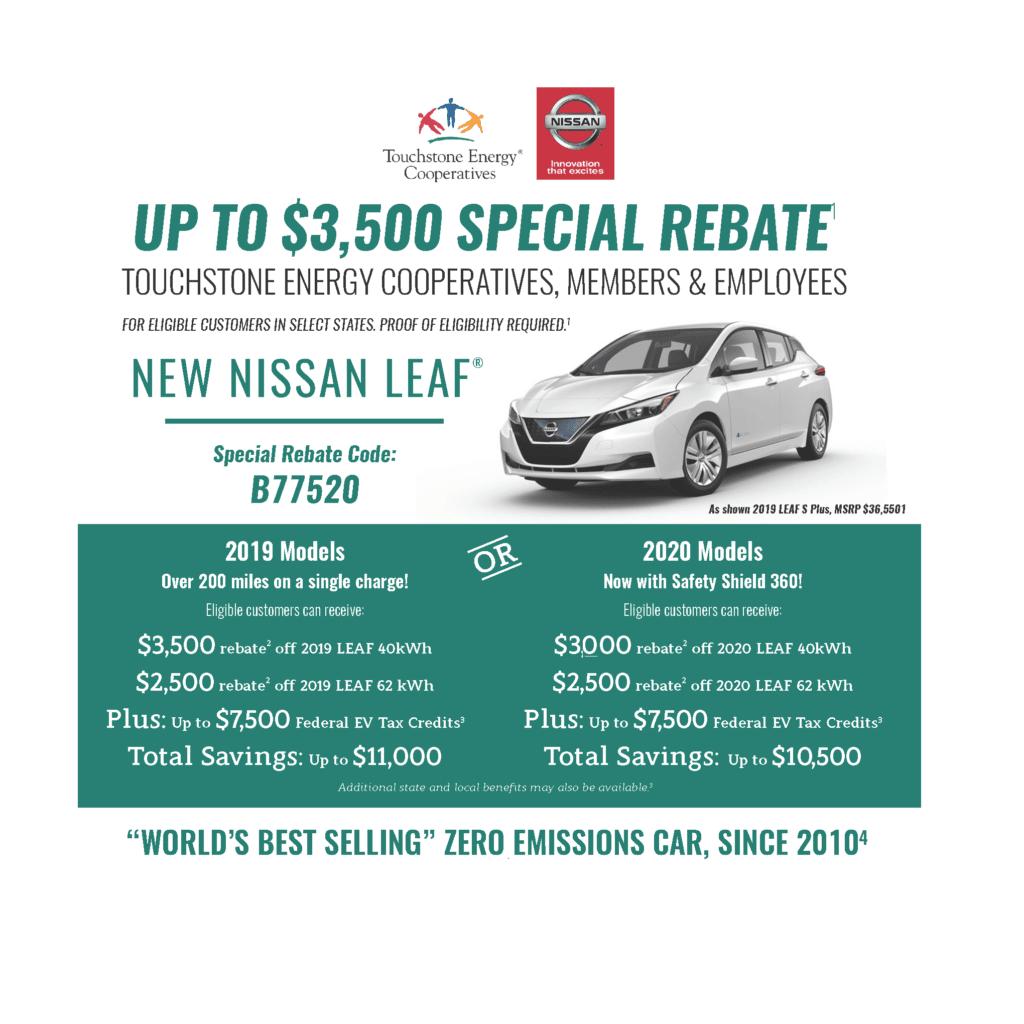

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

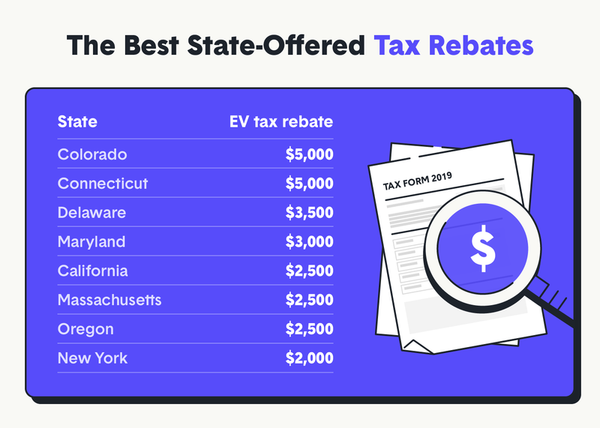

These Eight States Offer The Best Electric Vehicle Incentives

https://cdn.shopify.com/s/files/1/0196/5170/files/tax-incentives.width-800_grande.png?v=1554490687

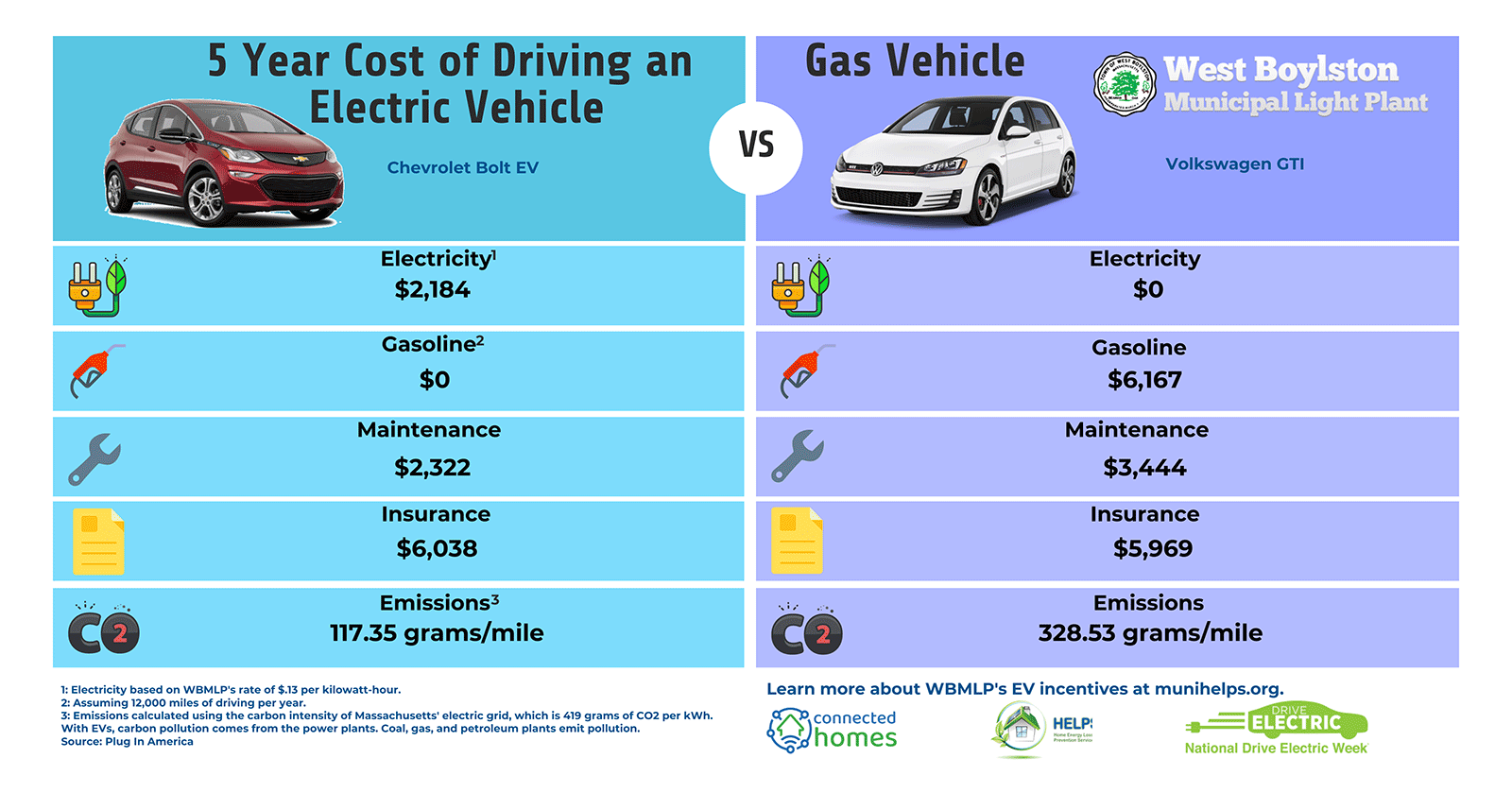

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in

Web 22 ao 251 t 2022 nbsp 0183 32 The big climate and health care bill signed into law by President Biden has what at first sight looks like a big incentive for those shopping for a car a revamped Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Download Tax Rebate For Ev Cars

More picture related to Tax Rebate For Ev Cars

Tax Credits For Electric Vehicles TaxProAdvice

https://img.taxproadvice.com/wp-content/uploads/electric-vehicle-tax-credits-what-you-need-to-know-doty-pruett-and.jpeg

California Electric Car Rebate EV Tax Credit Incentives Eligibility

https://8billiontrees.com/wp-content/uploads/2022/12/California-EV-Maximum-Rebate-Amount-700x394.png

Tax Credits For Electric Cars TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/tax-rebates-for-electric-cars-michigan-2022-carrebate-net.png

Web 7 sept 2023 nbsp 0183 32 The IRS says the manufacturers of the following EVs and PHEVs indicated that they re currently eligible for a full tax credit of 7 500 provided other requirements Web 6 juin 2023 nbsp 0183 32 Starting Jan 1 the new law increased the minimum battery size to 7 kilowatt hours and set new price caps for vehicles to qualify 55 000 for cars wagons and

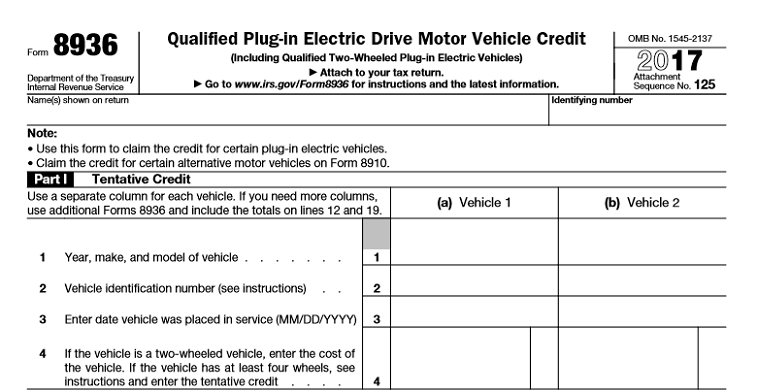

Web 17 janv 2023 nbsp 0183 32 You won t get a refund check for the remaining 4 500 in possible tax credit How Do I Claim the EV Tax Credit In order to claim an EV tax credit buyers need to Web 12 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell

Irs Rebate For Electric Cars 2022 ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/2022-tax-rebate-for-electric-cars-2022-carrebate-1.jpg

Tax Rebates On New Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/electric-car-tax-credits-and-rebates-charged-future-1.jpeg

https://www.cnn.com/2023/04/17/cars/ev-tax-credits-2023-which-cars-cli…

Web 17 avr 2023 nbsp 0183 32 The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than in

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

UPDATED Budget 2020 EV Rebate Singapore How It Affects You

Irs Rebate For Electric Cars 2022 ElectricRebate

Tax Rebates Electric Cars 2023 Carrebate

Electric Vehicle EV Incentives Rebates

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Is It Possible To Claim Another Federal And State Tax Rebate For

Ma Tax Rebates Electric Cars 2023 Carrebate

Rebates And Incentives For Electric Cars 2023 Carrebate

Tax Rebate For Ev Cars - Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell