Tax Rebate For Everyday Purchase Web 22 ao 251 t 2022 nbsp 0183 32 Many countries offer a rebate on taxes paid for goods and services whereby tourists can be refunded some of the taxes paid during their trip Each program has a number of inclusion and exclusion criteria and people who make large purchases tend

Web 15 sept 2022 nbsp 0183 32 For example the VAT rate in France is 20 on most goods and the minimum purchase amount is 100 euros In Germany the VAT rate is 19 but the minimum purchase is only 50 euros The refund Web Get a refund directly from the shop where you make your purchase Request a VAT refund form have it stamped by a customs official when you leave the European Union then mail the stamped form back to the store assuming that the shop is willing to handle refunds

Tax Rebate For Everyday Purchase

Tax Rebate For Everyday Purchase

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

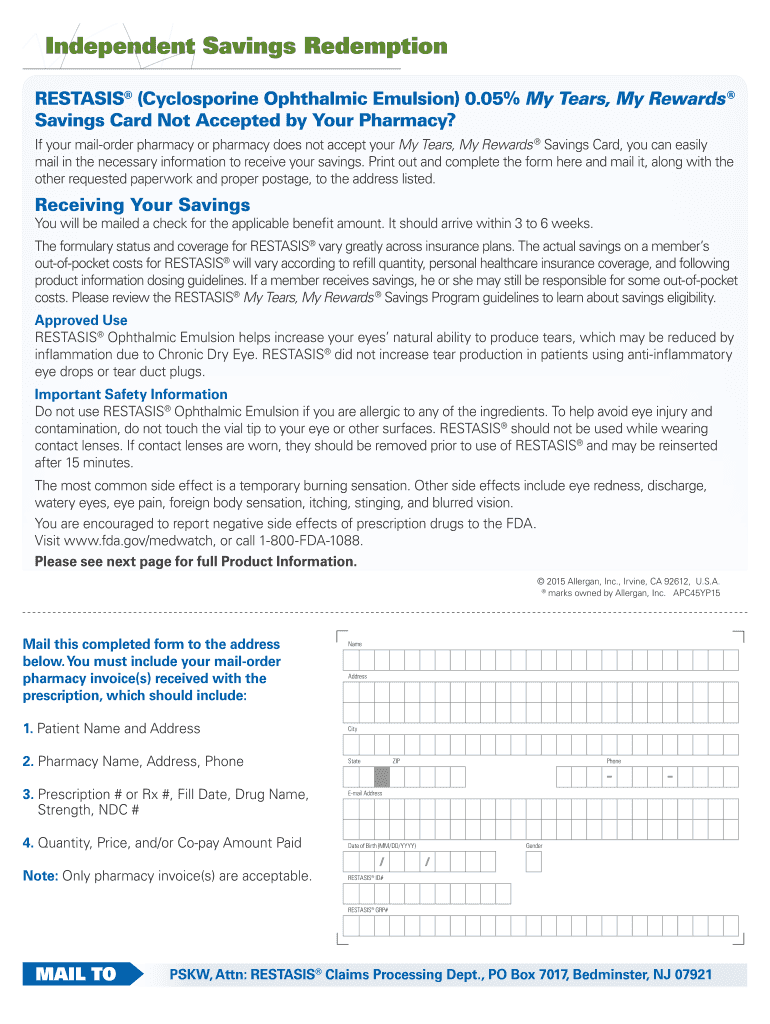

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/27/773/27773189/large.png

Tax Rebates Made Simple YouTube

https://i.ytimg.com/vi/EFZn93RDFJI/maxresdefault.jpg

Web To avoid administrative burdens over small value items there is a minimum value of EUR 175 or the equivalent in national currency outside the euro zone for the total purchase but EU countries may set lower thresholds The threshold applies to the total amount of Web 1 d 233 c 2022 nbsp 0183 32 Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 December 1 2022 09 19 AM OVERVIEW Tax rebates encourage taxpayers to make certain types of purchases

Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such as working Web 6 juin 2023 nbsp 0183 32 There are hundreds of itemized deductions and tax credits out there that you can claim on the taxes you file in 2023 Here are 20 popular tax breaks an explainer of how tax deductions work and

Download Tax Rebate For Everyday Purchase

More picture related to Tax Rebate For Everyday Purchase

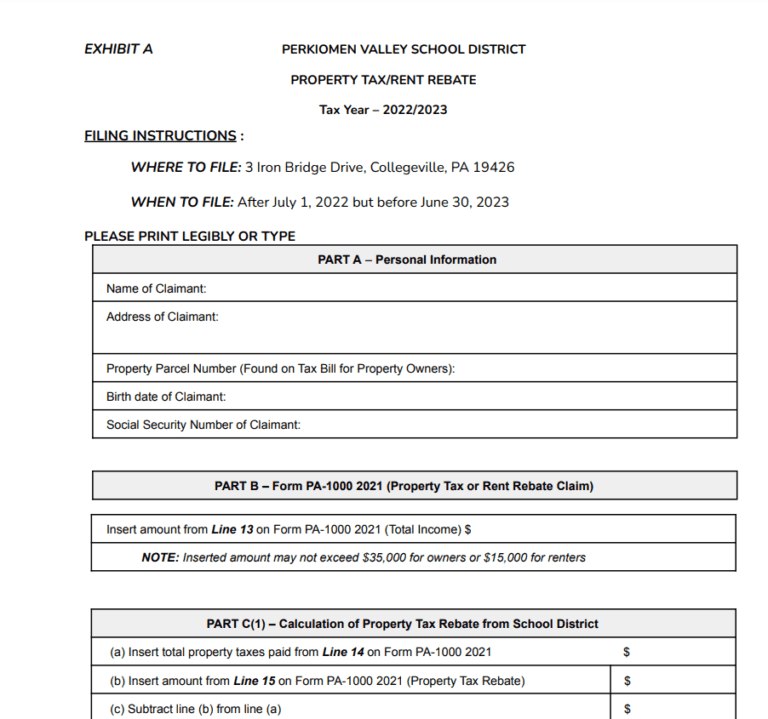

Working From Home Tax Rebate Form 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A.jpg?ssl=1

Rebate Form Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/485/448/485448276/large.png

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed once in a Web Rebates Vs Discounts Which One Will You Choose Rebates and discounts can both be effective price incentives for businesses looking to boost sales but rebates have their own benefits and a unique

Web 12 ao 251 t 2022 nbsp 0183 32 By Paul Hope August 12 2022 313 Photo Illustration Tim LaPalme Consumer Reports Getty Images The Inflation Reduction Act could soon help save you money if you re replacing a kitchen appliance Web However if your employer requires you to wear suits which can be worn as everyday wear you cannot deduct their cost even if you never wear the suits outside of work You can fully deduct small tools with a useful life of less than one year Deduct them the year

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

https://i1.wp.com/struggleville.net/wp-content/uploads/2019/10/MenardsPriceAdjustmentRebate8502.jpg

Turbo Tax Rebate Info Questions Tesla Motors Club

https://i.imgur.com/cugEMRL.jpg

https://princeoftravel.com/guides/eu-tax-refunds-save-money-on...

Web 22 ao 251 t 2022 nbsp 0183 32 Many countries offer a rebate on taxes paid for goods and services whereby tourists can be refunded some of the taxes paid during their trip Each program has a number of inclusion and exclusion criteria and people who make large purchases tend

https://www.fodors.com/world/europe/experie…

Web 15 sept 2022 nbsp 0183 32 For example the VAT rate in France is 20 on most goods and the minimum purchase amount is 100 euros In Germany the VAT rate is 19 but the minimum purchase is only 50 euros The refund

Have You Received Your 150 Council Tax Rebate

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

2007 Tax Rebate Tax Deduction Rebates

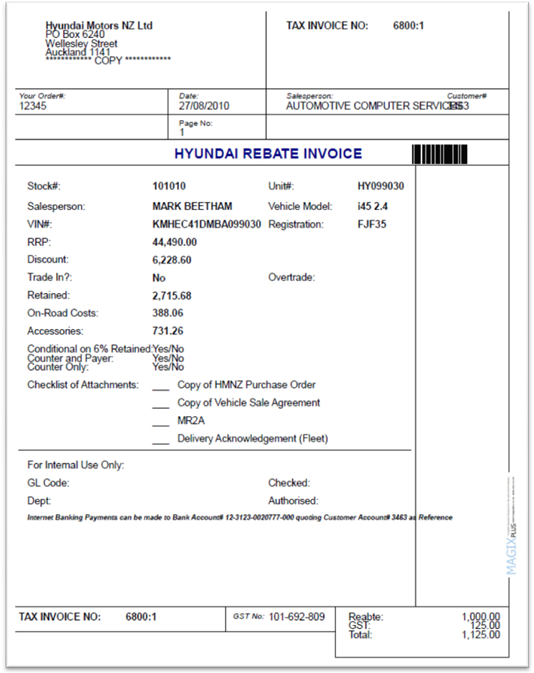

Hyundai Rebate Invoices

Save On 2020 Taxes Fi Life

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

What Are The Best Ways To Manage Tax Rebates

Ptr Tax Rebate Libracha

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tax Rebate For Everyday Purchase - Web Example of Rebate Goods worth 10 000 were sold by Unreal Corp to ABC Corp but some of the goods were of poor quality therefore after a mutual agreement Unreal Corp allowed a rebate of 1 000 i e 10 Discount A seller grants it to the buyer in two