Tax Rebate For Heat Pump 2024 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

The rebates depend on income Specifically If your household income is less than 80 percent of your state s median household income you are eligible for 100 percent of the rebates available Home energy tax credits Internal Revenue Service Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Tax Rebate For Heat Pump 2024

Tax Rebate For Heat Pump 2024

https://constanthomecomfort.com/wp-content/uploads/2023/03/Screenshot-2023-03-20-105450.png

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

https://www.achrnews.com/ext/resources/2022/04-April/Heat-Pump-Tax-Credit.jpg?1649877799

Heat Pump Tax Credit Magic Touch Mechanical

https://airconditioningarizona.com/wp-content/uploads/2023/03/Heat_Pump_Tax_Credit_2023.jpg

The good news is that rebates worth up to 14 000 to slash the cost of decarbonizing a home are expected to be available for years to come at least until the budget runs out The bad news is How to Qualify for HVAC Tax Rebates How to Claim Your HVAC Energy Credit American Brands That Qualify for Federal Tax Credit How to Maximize Your HVAC Tax Credit People Also Ask FAQs Save Money on Taxes with the Best HVAC Systems What Is the Energy Efficient Home Improvement Credit

Federal Tax Credit for HVAC Systems 2024 Today s Homeowner Home HVAC Federal Tax Credit for HVAC Systems Author Sarah Horvath Reviewer Roxanne Downer Updated On December 31 2023 Why You Can Trust Us Air Source Heat Pumps Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years

Download Tax Rebate For Heat Pump 2024

More picture related to Tax Rebate For Heat Pump 2024

Heat Pump Rebate 2023 W2023H

https://i2.wp.com/constanthomecomfort.com/wp-content/uploads/2022/12/Copy-of-How-do-I-find-a-business-idea.jpg

Heat Pump Tax Credits And Rebates Now Available For Homeowners Moneywise

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

Tax Credits On Electric Cars Heat Pumps Will Help Low Income PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/tax-credits-on-electric-cars-heat-pumps-will-help-low-income.jpeg?fit=2048%2C1361&ssl=1

Home Blog Winter Heating GUIDE 2024 Federal Tax GUIDE 2024 Federal Tax Credits for HVAC Systems Posted on December 21 2023 by Spurk HVAC Nothing disrupts daily life like an unexpected breakdown of your home s heating or cooling system How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related Resources How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032

2023 2032 federal heat pump rebates for low to moderate income households max out at 8 000 for an electric heat pump HVAC system 1 750 for a heat pump water heater 4 000 for an electric panel upgrade if needed to support heat pump upgrades 2 500 for an electric wiring upgrades if needed to support heat pump upgrades The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Inflation Reduction Act Summary What It Means For New HVAC Systems

https://www.ecicomfort.com/hubfs/IRA Heat Pump Rebates %26 Tax Credits-png.png

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.consumerreports.org/appliances/heat-pumps/heat-pump-federal-tax-credits-and-state-rebates-a5223992000/

The rebates depend on income Specifically If your household income is less than 80 percent of your state s median household income you are eligible for 100 percent of the rebates available

Mitsubishi Heat Pump Rebates 2022 PumpRebate

Inflation Reduction Act Summary What It Means For New HVAC Systems

Inflation Reduction Act Heat Pump Rebate Novak Heating

California Rebate Heat Pump PumpRebate WaterRebate

Heat Pump Government Grant Or Rebate Aire One

Heat Pump Water Heater Rebate Program La Plata Electric Association

Heat Pump Water Heater Rebate Program La Plata Electric Association

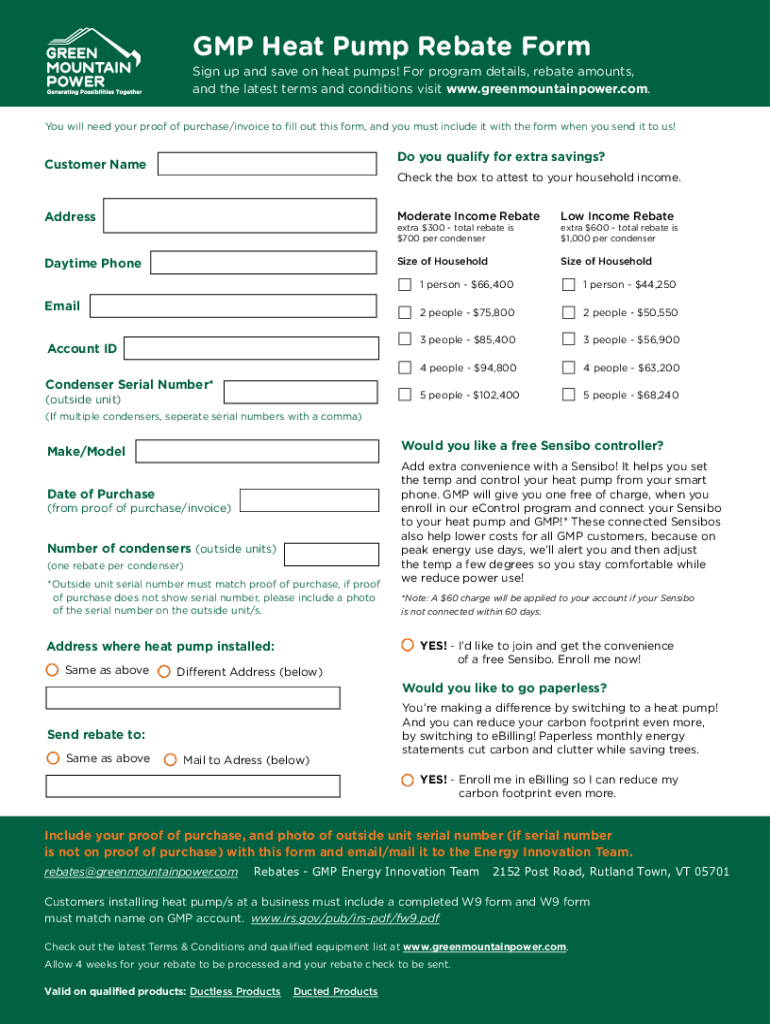

Fillable Online GMP Heat Pump Rebate Form Fax Email Print PdfFiller

2023 Heat Pump Rebate For Texas HEEHRA

Take Charge Nl Heat Pump Rebate PumpRebate

Tax Rebate For Heat Pump 2024 - Federal Tax Credits for Heat Pumps 2023 2024 Neeeco make a payment Mass Save Home Energy Assessment The Mass Save Program Mass Save Commercial Energy Assessment Mass Save HEAT Loan Financing Mass Save FAQs Energy Saving Services Insulation Commercial Insulation Air Sealing Heating Cooling Windows Solar About Us Who We Are Testimonials