Tax Rebate For Home Loan Interest Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than Web On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional

Tax Rebate For Home Loan Interest

Tax Rebate For Home Loan Interest

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Home Loan Interest Rates 2019 Mortgage Rule Change To Lower Home

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Web 5 sept 2023 nbsp 0183 32 Deduction can be claimed against home loan interest payment only What is Section 80EEA deduction limit The deduction limit is Rs 1 50 lakh per year What is the Web 26 oct 2021 nbsp 0183 32 The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b The new tax structure introduced in Budget 2020 does away with 70 odd tax deductions

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Download Tax Rebate For Home Loan Interest

More picture related to Tax Rebate For Home Loan Interest

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

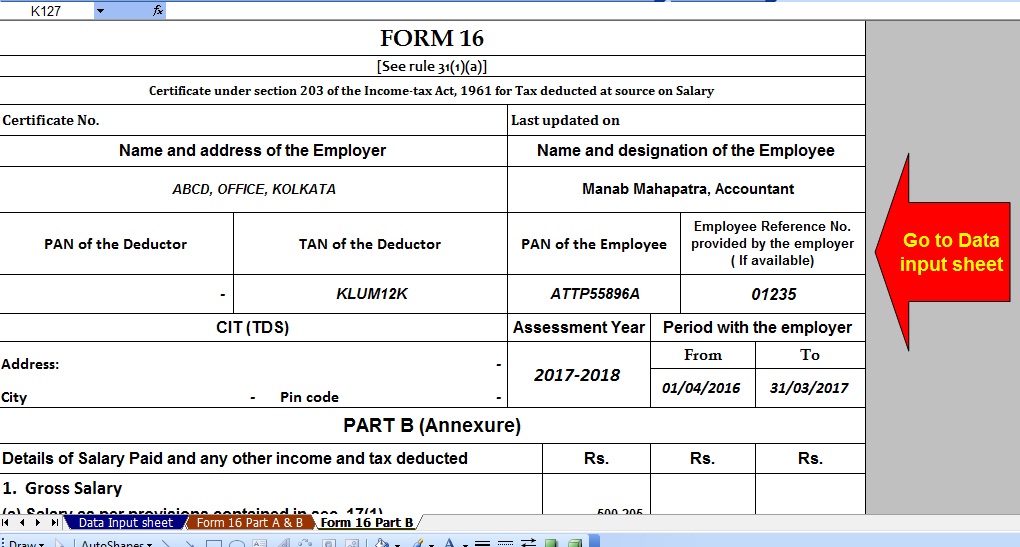

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

https://3.bp.blogspot.com/-pZ5VeMeXKq4/WFdWf7wSr7I/AAAAAAAADsQ/bmB9t4Yn_b8XW1PA-J15RmXGXB7kd0dEwCLcB/s1600/One%2Bby%2BOne%2BForm%2B16%2B4.jpg

Understanding Home Loan Refinance Interest Rates In 2023 Money

https://i.pinimg.com/originals/1b/66/fd/1b66fda37115a14cabf98db5215efe2d.jpg

Web Refund of home mortgage interest If you receive a refund of home mortgage interest that you deducted in an earlier year and that reduced your tax you must generally include Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up

Pin On Canada Home Tax Rebate

https://i.pinimg.com/originals/e9/39/8c/e9398cd21460fc812f7644a4047c23cc.png

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

Pin On Canada Home Tax Rebate

Tax Rebate Calculator On Home Loan TAXW

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

Rising Home Loan Interests Have Begun To Impact Homebuyers

How To Claim Interest On Home Loan Deduction While Efiling ITR

How To Claim Interest On Home Loan Deduction While Efiling ITR

Home Loans Interest Rates Current Interest Rates

Download Home Loan Interest Rates In India Home

Interest Rates Unsubsidized Student Loans Noviaokta Blog

Tax Rebate For Home Loan Interest - Web Deduction on the payment of interest The tax deduction on home loan also includes the interest paid on the loan Under section 24 of the Income Tax Act you are eligible for