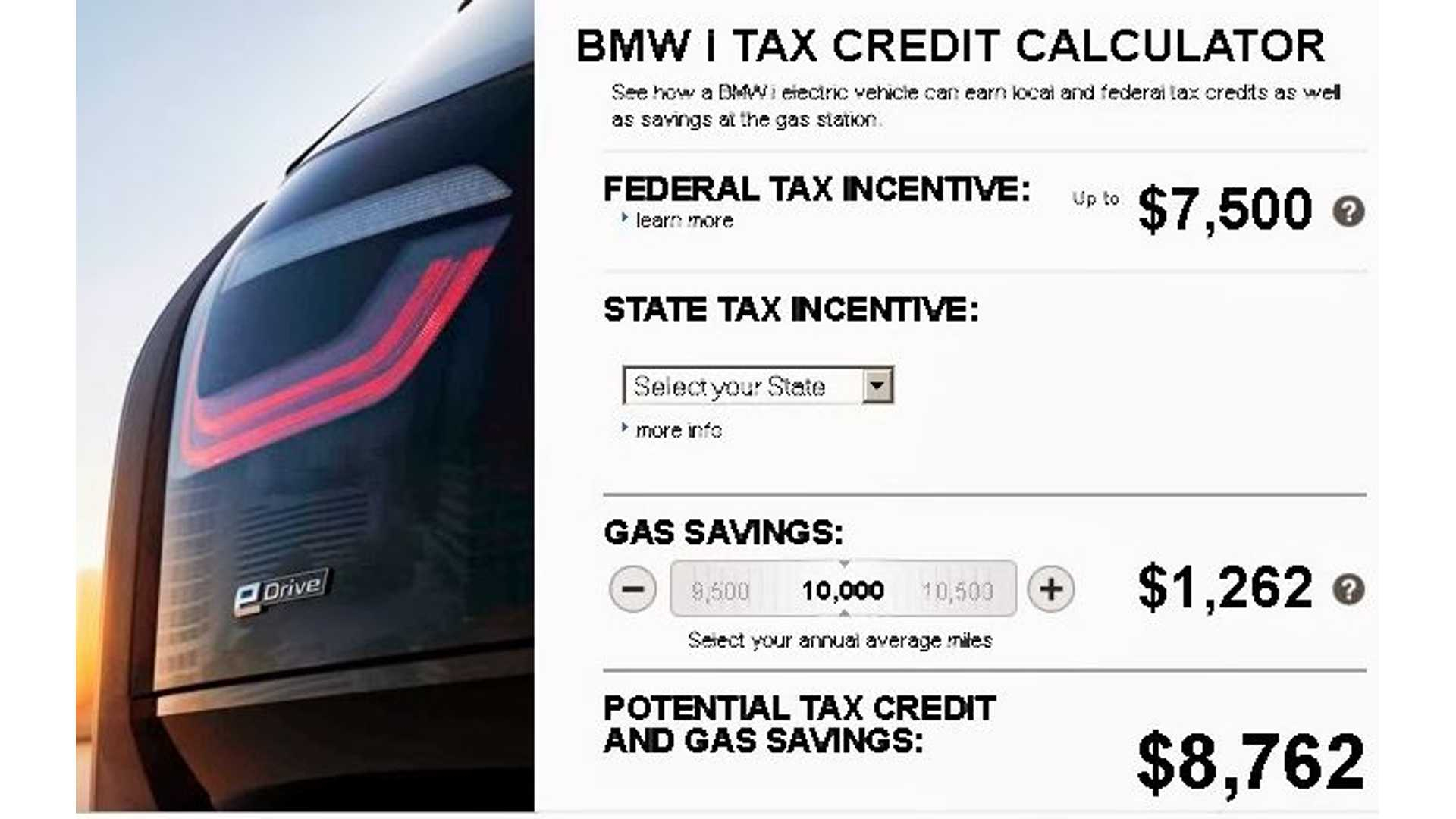

Tax Rebate For Hybrid Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits Web 25 janv 2022 nbsp 0183 32 Several states and even some eco minded cities offer their own incentives for EV and plug in hybrid buyers that typically take the form of either a tax credit or a

Tax Rebate For Hybrid

Tax Rebate For Hybrid

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-7.jpg?resize=840%2C473&ssl=1

Government Tax Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/are-the-tax-rebates-for-electric-and-hybrid-cars-worth-it-lionsgate-7.png?w=567&h=378&ssl=1

Rebates For Hybrid Cars In California 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-rebates-for-hybrid-cars-2022-2022-carrebate-7.jpg?w=467&h=554&ssl=1

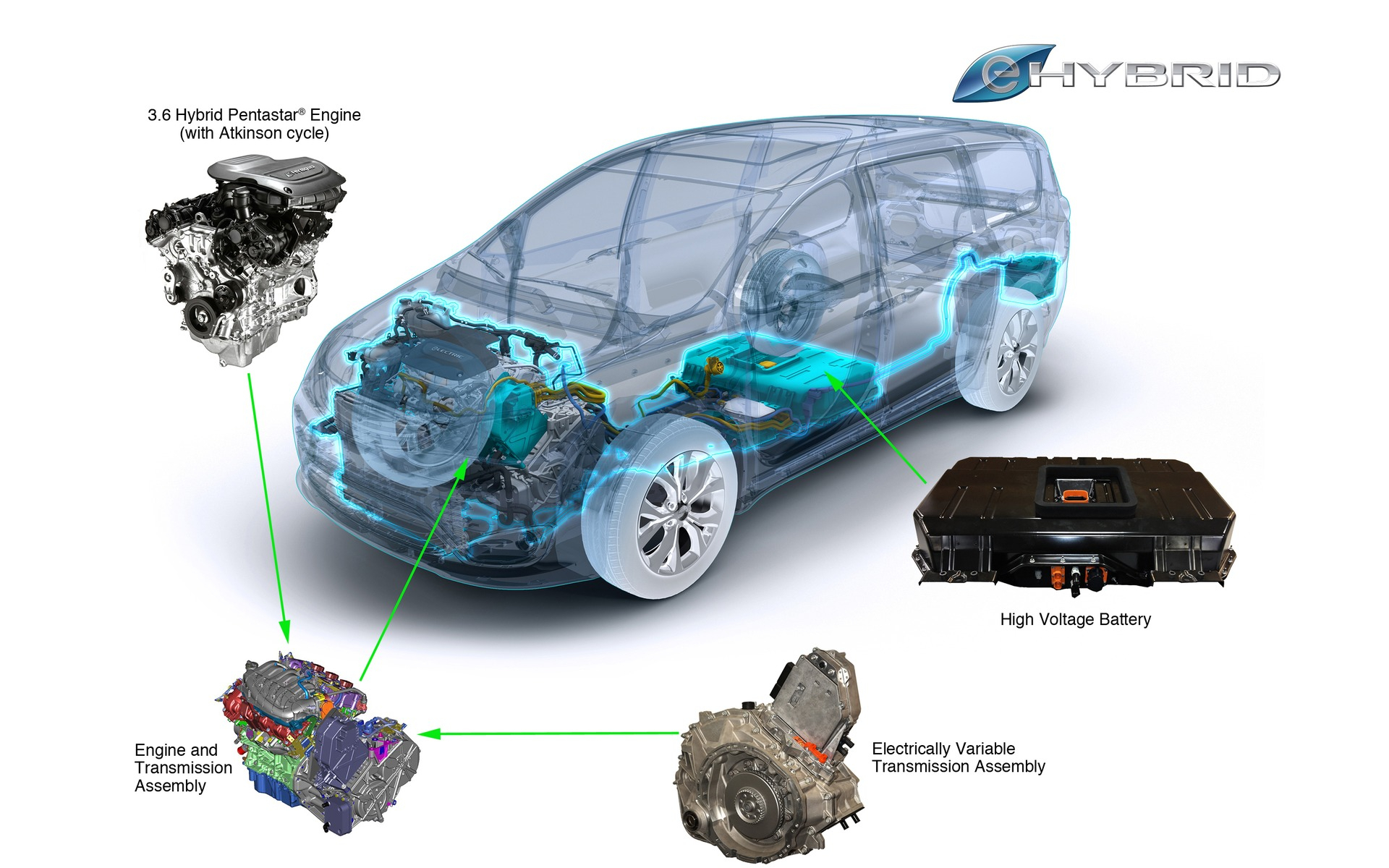

Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S Web 18 ao 251 t 2022 nbsp 0183 32 Only EVs and plug in hybrids built at plants in the U S Mexico or Canada now qualify for the federal tax credit incentive Domestics Still Eligible in 2022 General Motors and Tesla both lost

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount Web 17 oct 2022 nbsp 0183 32 Some Hybrids Are Eligible for the Revised 7 500 EV Tax Credit The 7 500 tax credit is an attractive incentive but is your hybrid vehicle you re eyeing even eligible See which EVs and

Download Tax Rebate For Hybrid

More picture related to Tax Rebate For Hybrid

Tax Rebates For Electric Cars Michigan 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/michigan-increases-taxes-to-fund-road-repairs-hybrids-and-electrics-1-scaled.jpg

Hybrid EV Tax Incentives In CA Community Chevrolet BURBANK

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/hybrid-ev-tax-incentives-in-ca-community-chevrolet-burbank.jpg?w=1759&ssl=1

Tax Rebates For Toyota Avalon Hybrid Car 2022 Carrebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/tax-rebates-for-toyota-avalon-hybrid-car-2022-carrebate.jpg?fit=2560%2C1700&ssl=1

Web Yes hybrid and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return You may be able to get a maximum of 7 500 back on your tax Web Rules and Regulations For EV PHEV and Hybrid Tax Credits Popular Vehicles That Qualify for Federal EV Tax Credits in 2022 FAQs One of the benefits of buying a

Web For more on electric vehicles see how many charging stations there are in your state and lay your eyes on the first hybrid Corvette What are the requirements for the EV tax Web 21 juil 2023 nbsp 0183 32 July 21 2023 by tamble If you are looking for Tax Rebate For Hybrid you ve come to the right place We have 34 rebates about Tax Rebate For Hybrid including

Tax Rebates For Electric Cars Michigan 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/michigan-increases-taxes-to-fund-road-repairs-hybrids-and-electrics.jpg

Evaluating Tax Rebates For Hybrid Vehicles

https://s2.studylib.net/store/data/011615042_1-d7f725f183e7220ea0463a8b9d05dc3d-768x994.png

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits

PDF Green Drivers Or Free Riders An Analysis Of Tax Rebates For

Tax Rebates For Electric Cars Michigan 2022 Carrebate

Rebate For Hybrid Car 2023 Carrebate

Electric Cars Tax Breaks Incentives And Rebates In The Us 2023

What Car Rebates Are Available For Hybrids 2023 Carrebate

Tax Rebat Electric Cars Business 2022 Carrebate

Tax Rebat Electric Cars Business 2022 Carrebate

Tax Rebat Electric Cars Business 2022 Carrebate

Tax Rebate On Electric Cars 2022 2023 Carrebate

Pg e Rebate For Hybrid Cars 2022 Carrebate

Tax Rebate For Hybrid - Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S