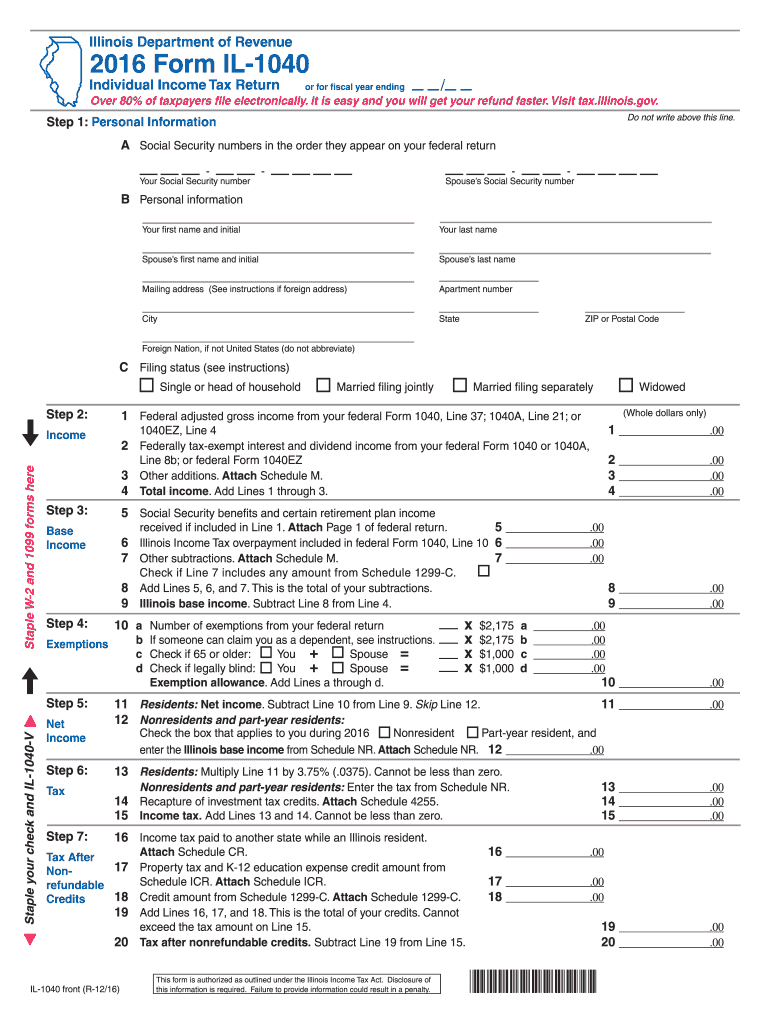

Tax Rebate For Illinois Web 8 d 233 c 2022 nbsp 0183 32 The 2022 Illinois property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return up to a maximum of 300 To qualify for the rebate you must be an Illinois

Web 21 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid Web 17 oct 2022 nbsp 0183 32 The income tax rebate is for Illinois residents who filed individually in 2021 and earned under 200 000 or filed jointly and

Tax Rebate For Illinois

Tax Rebate For Illinois

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

Income Tax Rebate 2023 Illinois LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/retirees-need-to-take-action-for-latest-property-tax-rebate-npr-illinois-1-1536x836.png

Web If you have already filed your 2021 IL 1040 Illinois Individual Income Tax Return and Schedule ICR Illinois Credits you do not have to take any action Your rebates will be issued based upon the information you included on these forms Certain income restrictions apply see tax illinois gov rebates for more information Web 30 juin 2022 nbsp 0183 32 Tax filers will also receive 100 per dependent they claimed on their 2021 taxes up to three dependents Property tax rebates for eligible homeowners will be issued up to 300

Web 31 ao 251 t 2022 nbsp 0183 32 In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if filing jointly or 200 000 if Web 30 sept 2022 nbsp 0183 32 A maximum of a 300 property tax rebate or the equivalent of a 2021 qualified property tax credit can go to those reporting a gross income of 500 000 or less if filing jointly or 250 000 if

Download Tax Rebate For Illinois

More picture related to Tax Rebate For Illinois

Tax Rebate Illinois Check Status Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/tax-rebate-payments-begin-for-millions-of-illinoisans-1.jpg

2017 Form IL DoR IL 1040 X Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/453/14/453014487/large.png

2022 State Of Illinois Tax Rebates Kakenmaster Tax Accounting

https://images.squarespace-cdn.com/content/v1/5c1eaa01266c07c75d02f75d/1663866031393-BZ5N0TOHL8NXCZPZEIB8/unsplash-image-H_KabGs8FMw.jpg

Web 30 juin 2022 nbsp 0183 32 An income tax rebate of 50 per individual with income below 200 000 a year or 100 for couples filing jointly with income below 400 000 a year plus 100 per dependent child up to three children A suspension of the 1 percent sales tax on groceries through June 2023 Web 1 juil 2022 nbsp 0183 32 An income tax rebate of 50 per individual with income below 200 000 a year or 100 for couples filing jointly with income below 400 000 a year plus 100 per dependent child up to three children A suspension of the 1 percent sales tax on groceries through June 2023 A suspension of the scheduled inflationary increase in the motor fuel

Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020 and 2021 and your adjusted gross income on the 2021 Form IL 1040 must be under 250 000 for single filers and 500 000 for joint filers Web 7 avr 2022 nbsp 0183 32 As part of the state of Illinois new budget agreement for fiscal year 2023 millions of taxpayers will be eligible for direct payment checks with lawmakers saying that the payments will be made

Loughran Cappel backed Measure Sends Tax Rebates To Illinois Families

https://www.senatorloughrancappel.com/images/taxrebategrpahic.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

https://www.kiplinger.com/taxes/illinois-tax-rebate-stimulus-checks

Web 8 d 233 c 2022 nbsp 0183 32 The 2022 Illinois property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return up to a maximum of 300 To qualify for the rebate you must be an Illinois

https://www.nbcchicago.com/news/local/did-you-get-your-2022-illinois...

Web 21 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

Loughran Cappel backed Measure Sends Tax Rebates To Illinois Families

Illinois Tax Rebate Check Status Rebate2022

Illinois Income And Property Tax Rebates Will Be Issued Starting Monday

Illinois Form Tax 2016 Fill Out Sign Online DocHub

Did You Get Your 2022 Illinois Tax Rebates Less Than A Month Left To

Did You Get Your 2022 Illinois Tax Rebates Less Than A Month Left To

Illinois Electric Vehicle Rebate PaymentGrant Refund Cheque Funny

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Illinois Unemployment 941x Fill Out Sign Online DocHub

Tax Rebate For Illinois - Web 12 sept 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer or 400 000 for joint filers will