Tax Rebate For Individual Rm400 Rebate RM400 Go ahead and claim this rebate if your chargeable income after tax reliefs and deductions is less than RM35 000 and you have been allowed the

There are the types of tax rebates available Individual for chargeable income less until RM35 000 can get a tax rebate of RM400 It directly affects your amount of tax charged 1 Tax rebate for self Rebate RM400 You will be entitled to this rebate of RM400 on the tax charged if your chargeable income after tax relief and deductions

Tax Rebate For Individual Rm400

Tax Rebate For Individual Rm400

https://malaysiafreebies.com/wp-content/uploads/2022/01/seda-3.0.png

2022 South Carolina Tax Rebate What You Need To Know Wltx

https://media.wltx.com/assets/WLTX/images/537945567/537945567_1920x1080.jpg

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080-1536x864.png

Tax rebates for resident individuals The above rebate granted is deducted from tax charged and any excess is not refundable Personal Income Tax Without a tax rebate RM555 would be the amount of tax that you have to pay However since you are eligible for the individual tax rebate RM400 off tax charged for individuals with a chargeable income

Rebate RM400 You can claim this rebate if your chargeable income after tax relief and deductions does not exceed RM35 000 and you have been granted tax Individuals with an annual chargeable income not exceeding RM35 000 can avail a rebate of RM400 If the spouse does not receive an income or is jointly

Download Tax Rebate For Individual Rm400

More picture related to Tax Rebate For Individual Rm400

Samsung Is Offering An RM400 Rebate Off The Galaxy Note9 Just In Time

https://www.hitechcentury.com/wp-content/uploads/2018/09/20180925_163950-01-e1537874146591-1024x512.jpeg

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Tax Cut By 2 Ppts For RM50 000 RM100 000 Income Group Raised To 25

https://assets.theedgemarkets.com/Ringgit-2_budget2023_theedgemarkets.jpg?tCkFEMgJggEn.0SpJhyrt5g9OSLYTh2p

A A rebate of RM400 is granted to an individual who has been allowed a deduction for self and dependent relatives under paragraph 46 1 a of the ITA for that year of assessment A rebate of RM400 is available to individuals with an annual chargeable income not exceeding RM35 000 Where the spouse does not receive an income or is jointly

Let s say your chargeable income after tax reliefs and tax exemptions is RM33 000 The amount of tax charged on your changeable income is RM755 Since your chargeable income is below RM35 000 The basic individual reliefs may include individuals and his dependent relatives dependents as well as husband wife and children under the age of 18 years old for

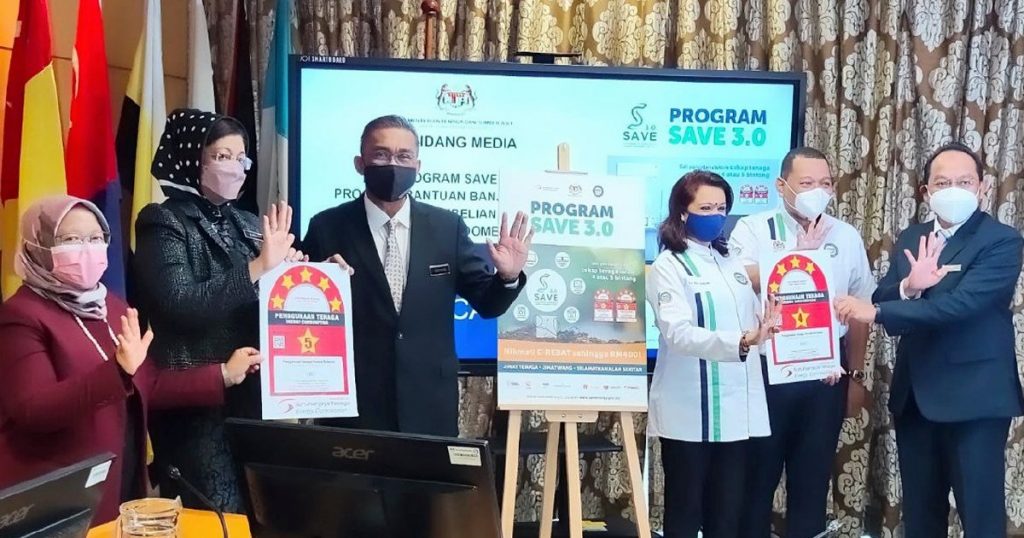

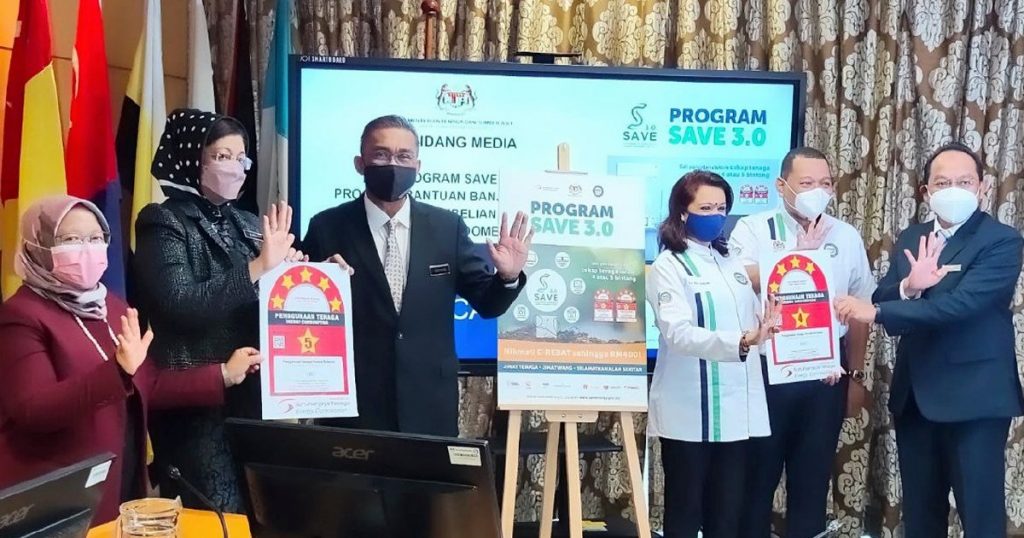

SAVE 3 0 Offers Up To RM400 Rebate To Buy Energy efficient Electrical

https://www.seda.gov.my/wp-content/uploads/2022/01/put-save_HMfield_image_socialmedia.var_1641526047-1-1024x538.jpg

Tax Cut By 2 Ppts For RM50 000 RM100 000 Income Group Raised To 25

https://assets.theedgemarkets.com/budget_tax-2_2023_theedgemarkets.jpg?oLWu_K0SG_jPbTlTW9ChNivwmH6JJgdK

https://ringgitplus.com/en/blog/income-tax/...

Rebate RM400 Go ahead and claim this rebate if your chargeable income after tax reliefs and deductions is less than RM35 000 and you have been allowed the

https://www.imoney.my/.../what-is-tax-r…

There are the types of tax rebates available Individual for chargeable income less until RM35 000 can get a tax rebate of RM400

Govt Collects More Than RM400 Mln In Digital Service Tax

SAVE 3 0 Offers Up To RM400 Rebate To Buy Energy efficient Electrical

Claim A Tax Rebate For Your Uniform Rmt

2022 Property Tax Rebate Application For Seniors Braedon Clark

M sians Claim Rebate Up To RM400 With Save 3 0 Here s How

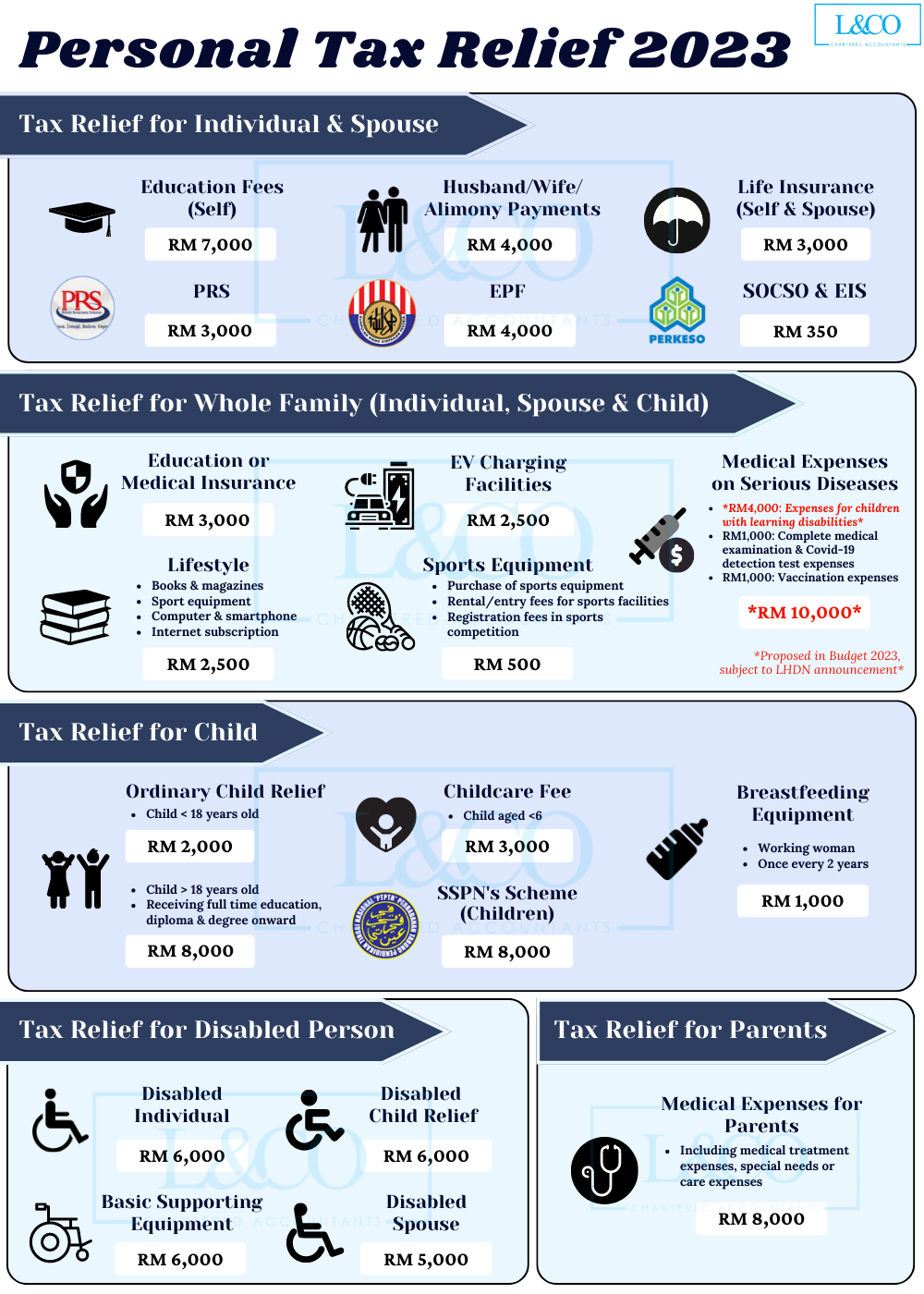

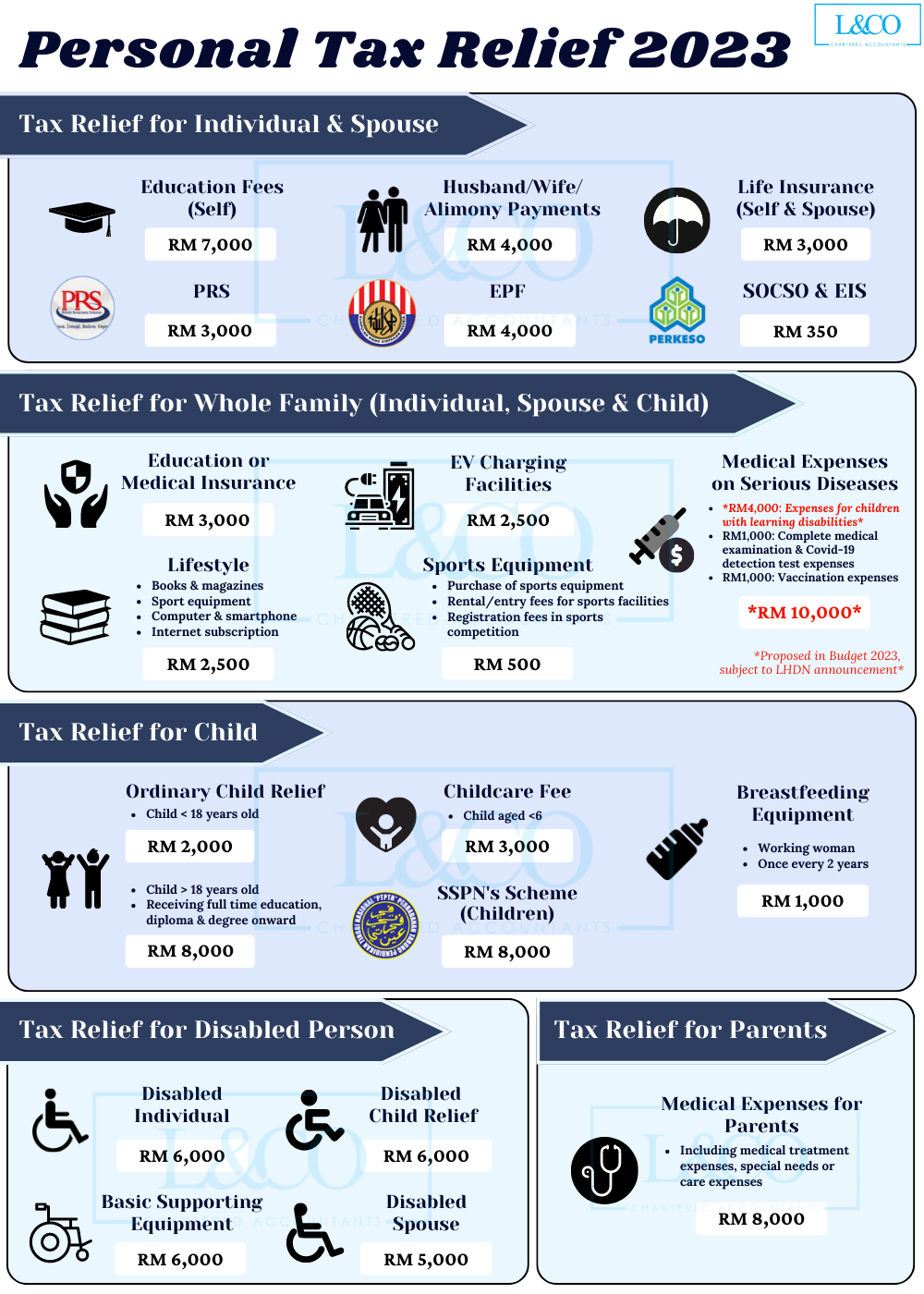

Personal Tax Relief Y A 2023 L Co Accountants

Personal Tax Relief Y A 2023 L Co Accountants

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

M sians Claim Rebate Up To RM400 With Save 3 0 Here s How

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Tax Rebate For Individual Rm400 - If your chargeable income after tax reliefs and deductions does not exceed RM35 000 you will be granted a rebate of RM400 from your tax charged Rebate