Tax Rebate For Insulation Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

Web 17 avr 2022 nbsp 0183 32 Concernant les travaux d isolation ou des d 233 penses en vue d en r 233 duire la consommation 233 nerg 233 tique il existe un cr 233 dit d imp 244 t pour la transition 233 cologique Web Le montant des d 233 penses pay 233 es par le propri 233 taire doit 234 tre sup 233 rieur 224 10 000 TTC hors main d uvre par logement au cours de l ann 233 e qui pr 233 c 232 de la premi 232 re ann 233 e

Tax Rebate For Insulation

Tax Rebate For Insulation

https://fortkampfoam.com/wp-content/uploads/2017/09/insulationAirSealingRebate.png

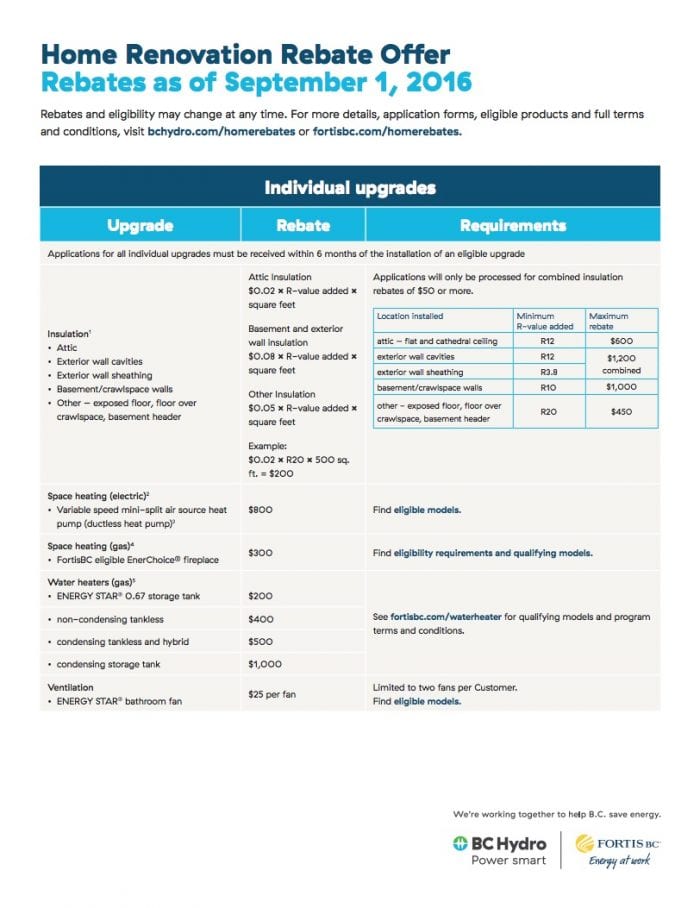

BC Hydro Fortis BC Rebates Home Renovation Rebate Program

https://www.okinsulation.ca/assets/components/phpthumbof/cache/Upgrade_Location_2.d7fd283ae259bacb27459c18b8e11278.png

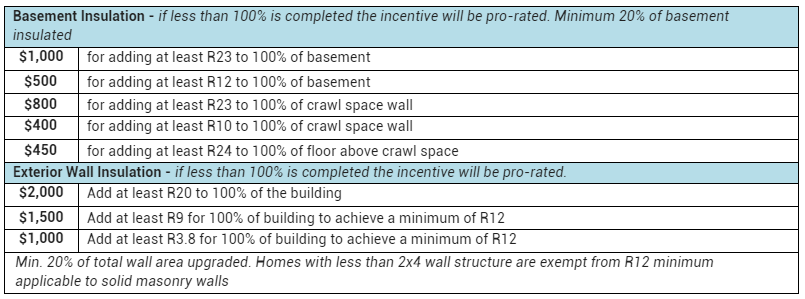

GreenON Rebate Rebate Rumble Toronto Home Renovation Rebate

https://www.gni.ca/uploads/upload/insulation123.png

Web The 25c tax credit for insulation and air sealing upgrades is increasing in 2023 to a max of 1200 per year Insulation rebates are also available in some cases you can get up Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 3 f 233 vr 2023 nbsp 0183 32 Weatherize your home with a 30 percent tax credit on insulation doors and windows 5 Ask a Pro Don t know where to begin Not a problem Home energy Web In 2022 this provision allows qualifying homeowners to obtain a 10 credit for certain home upgrades including energy efficient exterior windows doors and skylights and

Download Tax Rebate For Insulation

More picture related to Tax Rebate For Insulation

New LADWP Home Insulation Rebate Program Greensolartechnologies

https://www.greensolartechnologies.com/sites/default/files/styles/bootstrap3_col12/public/blog-images/LADWP_REBATE_blackborder.jpg?itok=4OzNIBR2

Massachusetts Insulation Tax Rebates 5C Energy

https://5cenergyinc.com/wp-content/uploads/2023/02/massachusetts-insulation-tax-rebate-scaled.jpg

Rebates Eco Insulation Go Green Save Green

https://ecoinsulation.ca/wp-content/uploads/2018/05/eco-insulation-union-gas-rebate-chart.jpg

Web 26 juil 2023 nbsp 0183 32 Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and Web 9 sept 2022 nbsp 0183 32 Ranging from 4 000 to more than 7 000 each heat pumps can cost a pretty penny The two rebate programs may help offset part or even all of the cost of these

Web 17 mars 2023 nbsp 0183 32 The previous expired credit was worth 10 of the costs of installing certain energy efficient insulation windows doors roofing and similar energy saving Web For spray foam insulation you can receive a tax credit of up to 10 of the cost not including installation labor up to 500 in total To claim the credit homeowners must fill

Xcel Energy Minnesota Insulation Rebates Rebate Marketing

https://imgv2-1-f.scribdassets.com/img/document/127028630/original/46442daf50/1585833818?v=1

Avista Corp Commercial Windows and Insulation Rebates Building

https://imgv2-1-f.scribdassets.com/img/document/136180060/original/6651dcc562/1567763271?v=1

https://www.energystar.gov/about/federal_tax_credits/insulation

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

https://www.midilibre.fr/2022/04/17/impots-2022-isolation-jardinage...

Web 17 avr 2022 nbsp 0183 32 Concernant les travaux d isolation ou des d 233 penses en vue d en r 233 duire la consommation 233 nerg 233 tique il existe un cr 233 dit d imp 244 t pour la transition 233 cologique

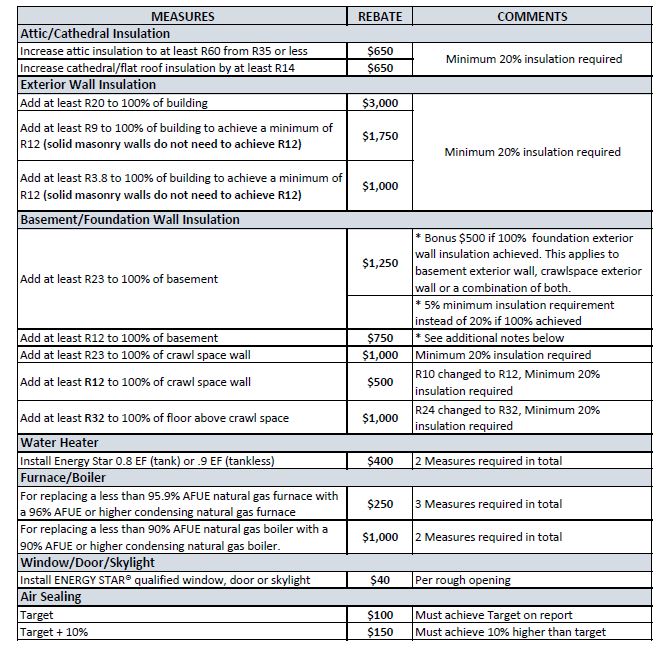

Insulation Rebates Attic Insulation Rebate Enbridge Ontario Rebate

Xcel Energy Minnesota Insulation Rebates Rebate Marketing

Earn Rebates Save Energy And Improve The Comfort Of Your Home By

Efficiency Manitoba Home Insulation Rebates Cold Country Spray Foam

Insulation Rebates Attic Insulation Rebate Enbridge Ontario Rebate

Assured insulation home renovation rebate offer assured insulation

Assured insulation home renovation rebate offer assured insulation

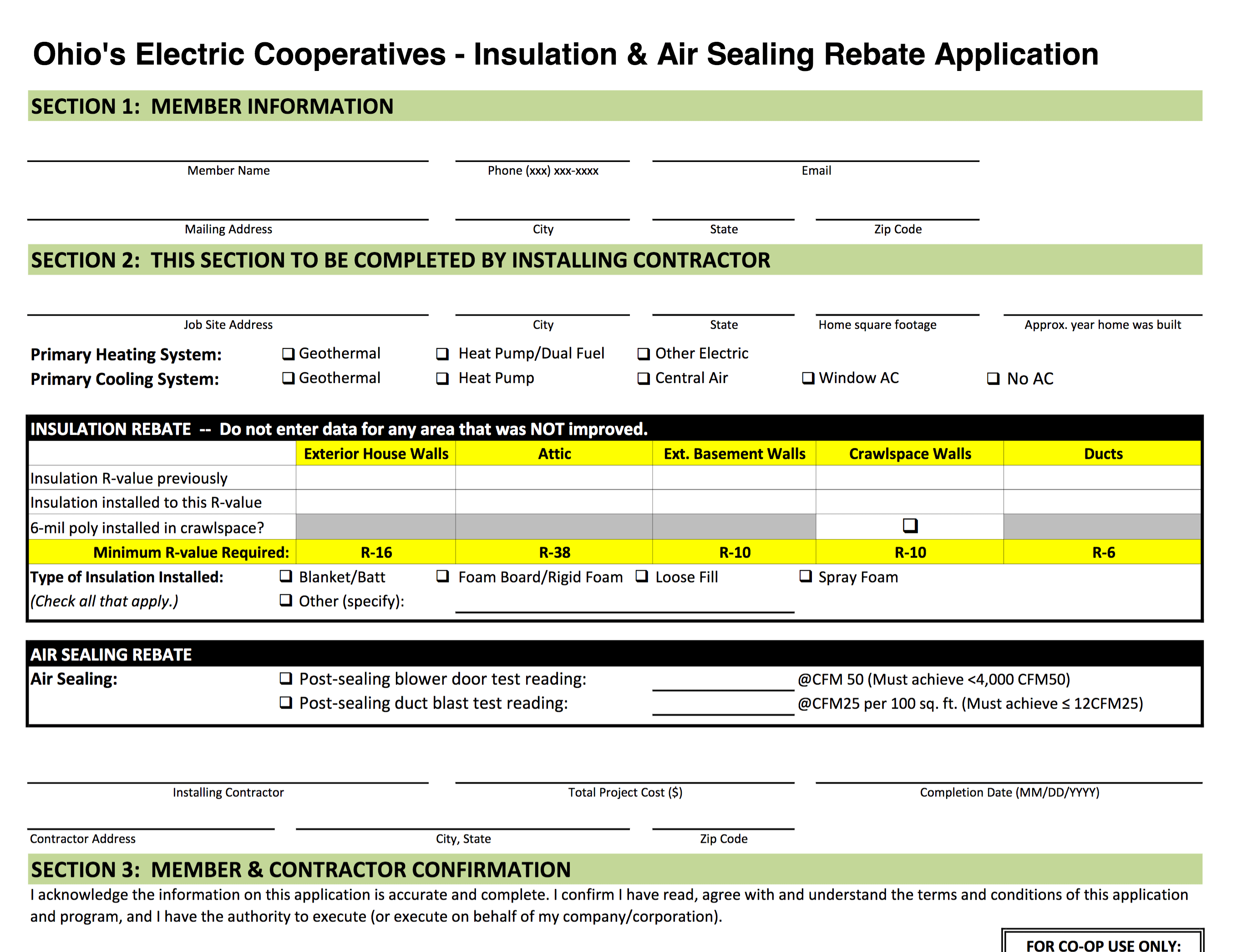

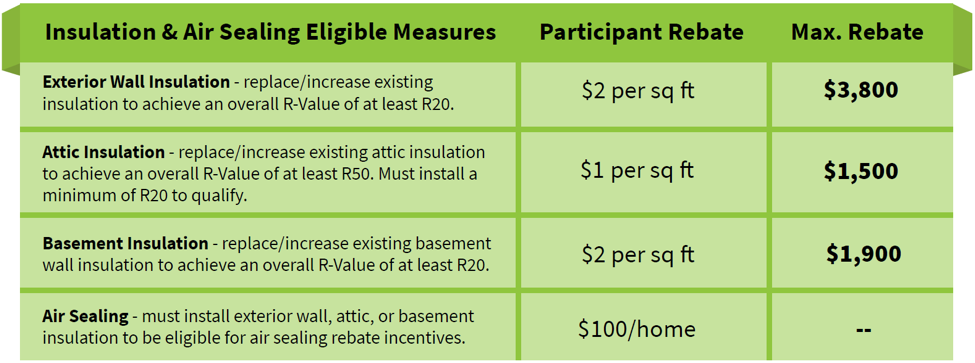

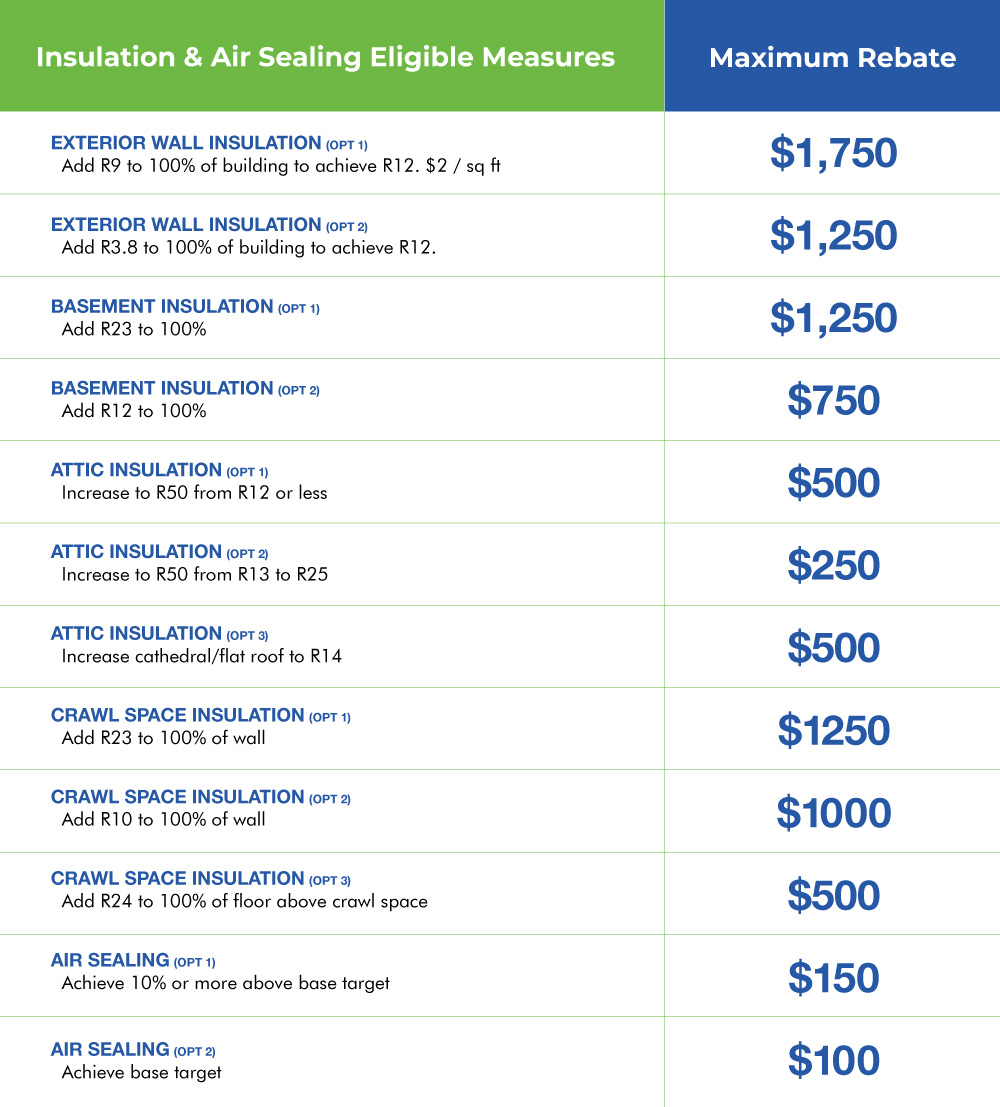

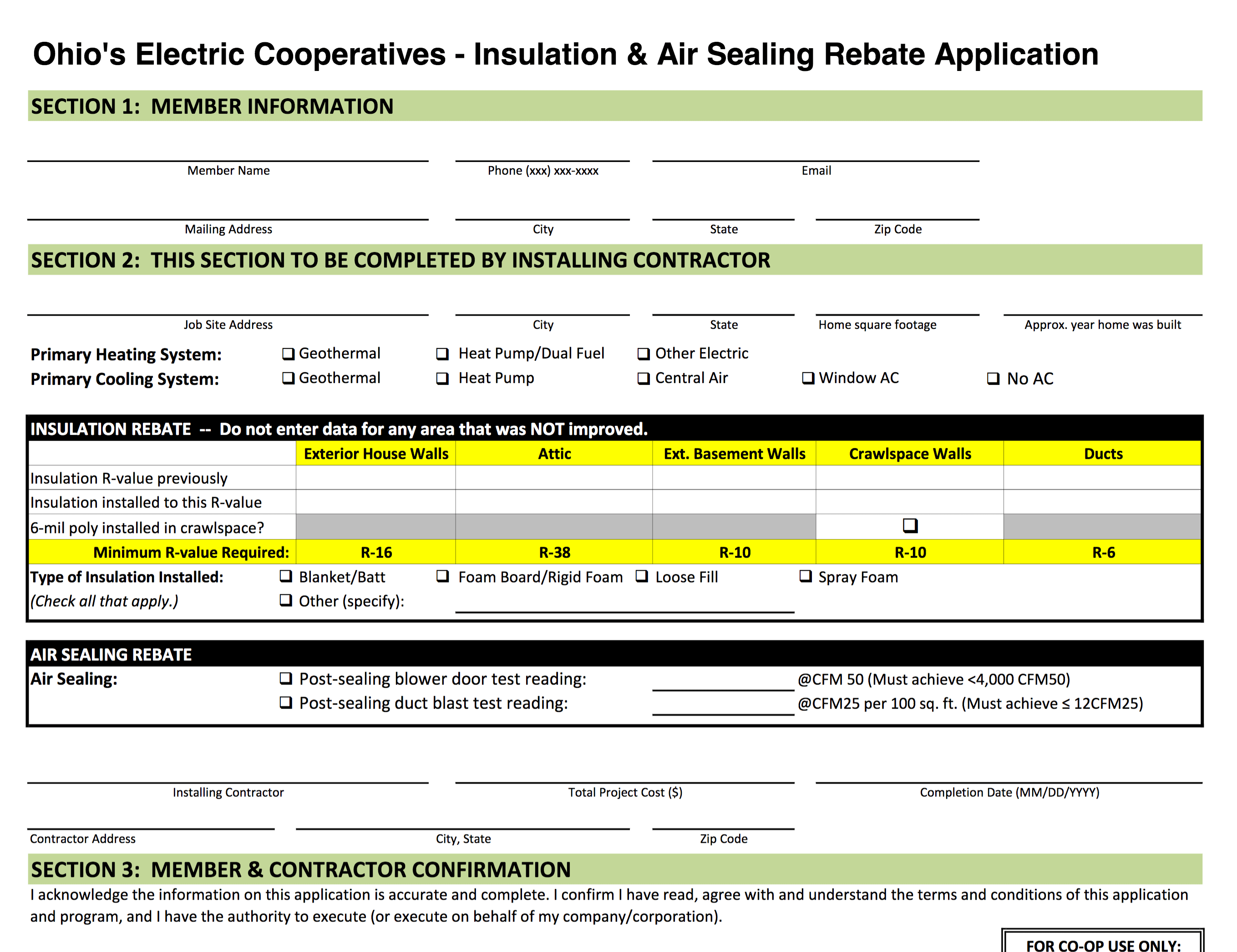

Get Up To 1 900 In Rebates For Air Sealing Attic Insulation Wall

Enbridge Rebates For Attic Insulation Increased 24 7 Furnace AC

Consumers Energy Co Insulation and Windows Rebates Building

Tax Rebate For Insulation - Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for