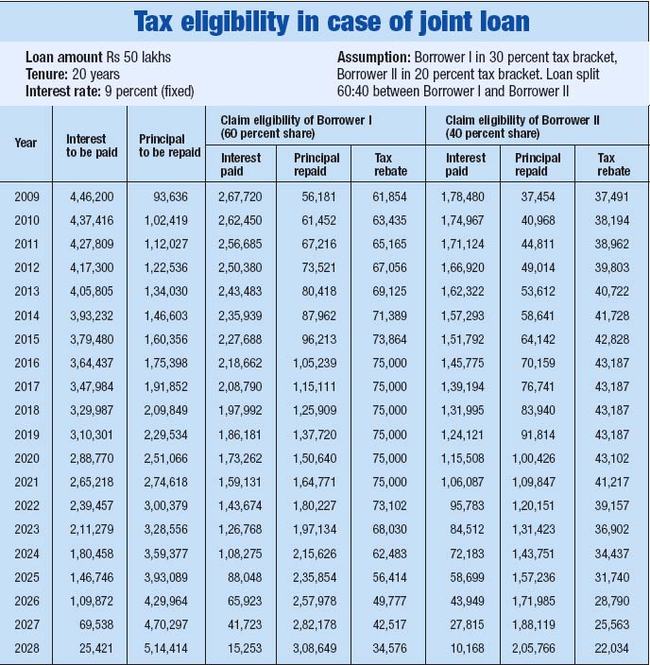

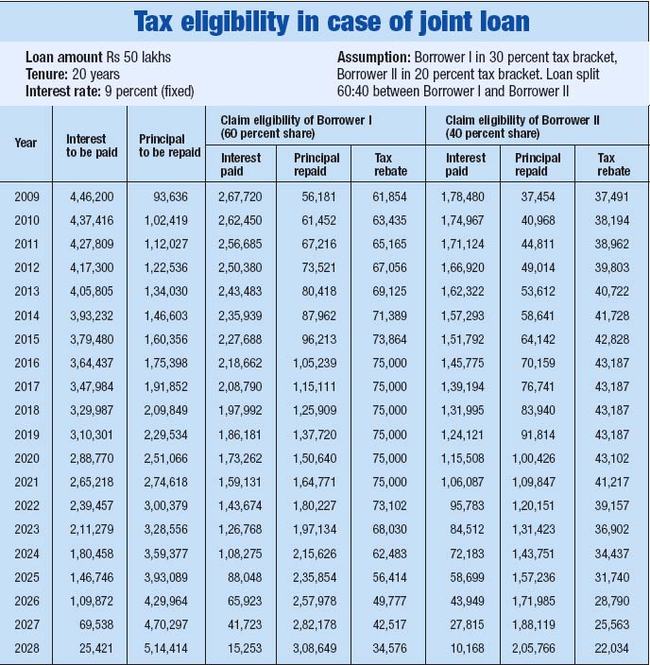

Tax Rebate For Joint Home Loan Verkko 26 hein 228 k 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming

Verkko 18 jouluk 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C Verkko 5 helmik 2023 nbsp 0183 32 Deduction for a joint home loan If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and

Tax Rebate For Joint Home Loan

Tax Rebate For Joint Home Loan

https://assetyogi.com/wp-content/uploads/2015/03/joint-home-loan-eligibility-joint-home-loan-tax-benefit-889x500.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-for-Joint-House-Loan-768x371.jpg

Latest Income Tax Rebate On Home Loan 2024

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Verkko Having a joint home loan is advantageous when both the co borrowers are tax payers But do keep in mind that to claim income tax benefits in joint home loan all the co Verkko 10 hein 228 k 2020 nbsp 0183 32 Both you and your wife will qualify for a rebate on home loan interest rates as well as higher tax benefits with registration fees as lenders offer reduced interest rates to female borrowers If

Verkko You have to be a co owner To get complete guidelines for taxation of your share in the jointly owned property do read Section 26 of the Income Tax Act The foremost Verkko The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions

Download Tax Rebate For Joint Home Loan

More picture related to Tax Rebate For Joint Home Loan

Joint Home Loans How To Claim Tax Benefits SBI Home Loan Council

https://assets-news.housing.com/news/wp-content/uploads/2020/01/27083526/How-to-claim-tax-benefits-on-joint-home-loans-FB-1200x700-compressed.jpg

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate-768x561.jpg

Verkko 12 tammik 2020 nbsp 0183 32 To claim tax benefit on a jointly owned property and home loan you must be aware of the tax laws In case of a joint home loan for self occupied house Verkko 28 helmik 2023 nbsp 0183 32 You may receive interest benefits up to Rs 2lakhs per joint owner with one self occupied property Each co borrower can claim up to Rs 1 50lakhs in tax

Verkko How to Claim Tax Benefit for Joint Home Loan More than one person can enjoy tax benefits as the tax for joint loans as it is divided among the co applicants Tax rebate Verkko This tax saving on the home loan is only applicable for first time home buyers If you have purchased a home for the first time you can claim additional deductions of up to

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

https://img.etimg.com/thumb/msid-5256148,width-650,imgsize-108731,,resizemode-4,quality-100/.jpg

Deadline For Tax And Rent Relief Extended

https://www.senatorhughes.com/wp-content/uploads/2022/06/property-tax-rebate-2021-booklet.jpg

https://taxguru.in/income-tax/tax-benefits-home-loan-joint-owners.html

Verkko 26 hein 228 k 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

Joint Property Ownership Joint Home Loan Tax Benefits In India YouTube

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Home Loan EMI And Tax Deduction On It EMI Calculator

Joint Home Loan call 9529331331

Joint Home Loan call 9529331331

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Joint Home Loan Declaration Form For Income Tax Savings And Non

Older Disabled Residents Can File For Property Tax Rent Rebate Program

Tax Rebate For Joint Home Loan - Verkko Joint owners of a property who have opted for a joint home loan are eligible for availing a maximum annual tax deduction of Rs 2 lakhs as Income Tax Returns The total