Tax Rebate For Kids Web 8 juin 2023 nbsp 0183 32 Vous faites garder vos enfants ou petits enfants 224 charge de moins de 6 ans 224 l ext 233 rieur de votre domicile Vous pouvez b 233 n 233 ficier d un cr 233 dit d imp 244 t pour les frais de garde

Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of six and Web 21 juil 2023 nbsp 0183 32 Les parents qui font garder 224 l ext 233 rieur de leur domicile leurs enfants 226 g 233 s de moins de six ans au 1er janvier 2022 b 233 n 233 ficient d un cr 233 dit d imp 244 t sur le montant de l imp 244 t sur les revenus 2022 d 233 claration 2023 Il s agit des sommes vers 233 es 224 des assistantes ou assistants maternels agr 233 233 s des cr 232 ches des haltes garderies

Tax Rebate For Kids

Tax Rebate For Kids

https://i.ytimg.com/vi/tODlBXdH0gE/maxresdefault.jpg

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

https://borgidacpas.com/wp-content/uploads/2022/06/CTCTRLOGOforweb.jpg

Web Le cr 233 dit d imp 244 t de garde d enfant sur les frais de cr 232 che s 233 l 232 ve 224 50 des frais de garde dans la limite de 1750 par enfant et par an Le montant d 233 clar 233 au fisc est 233 gal aux montants vers 233 s 224 votre cr 232 che Somme maximale 224 d 233 clarer par enfant 2 300 1 750 Par enfant en garde altern 233 e Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Web 18 mai 2021 nbsp 0183 32 It increases the existing tax benefit from 2 000 up to 3 600 for younger kids and 3 000 for older ones for the 2021 tax year It also broadens the umbrella of who s eligible for the full Web 28 mars 2023 nbsp 0183 32 You can claim the full amount of the 2021 Child Tax Credit if you re eligible even if you don t normally file a tax return To claim the full Child Tax Credit file a 2021 tax return Who is Eligible To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have

Download Tax Rebate For Kids

More picture related to Tax Rebate For Kids

Index Of wp content uploads 2022 03

https://www.theastuteparent.com/wp-content/uploads/2022/03/tax-savings.png

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Tax Rebates Made Simple YouTube

https://i.ytimg.com/vi/EFZn93RDFJI/maxresdefault.jpg

Web 17 mai 2021 nbsp 0183 32 Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above The American Rescue Plan increased the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Web 17 ao 251 t 2023 nbsp 0183 32 People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For 2023 1 600 of the credit is potentially refundable

Web 29 ao 251 t 2022 nbsp 0183 32 The rebate caps at 750 for three kids Here s who qualifies PDF couples filing jointly who made 200 000 or less in 2021 single filers who earned 100 000 or less and heads of households Web 7 janv 2022 nbsp 0183 32 Families with children 5 and younger are eligible for credits of as much as 3 600 per child with up to 300 received monthly in advance those with children ages 6 to 17 are eligible for up to

5 Reasons To Use Irish Tax Rebates Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2017/07/1.png

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

https://www.service-public.fr/particuliers/vosdroits/F8

Web 8 juin 2023 nbsp 0183 32 Vous faites garder vos enfants ou petits enfants 224 charge de moins de 6 ans 224 l ext 233 rieur de votre domicile Vous pouvez b 233 n 233 ficier d un cr 233 dit d imp 244 t pour les frais de garde

https://www.whitehouse.gov/child-tax-credit

Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of six and

2022 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

5 Reasons To Use Irish Tax Rebates Irish Tax Rebates

Tips To Finding Tax Rebates Without The Hassle

Have You Received Your 150 Council Tax Rebate

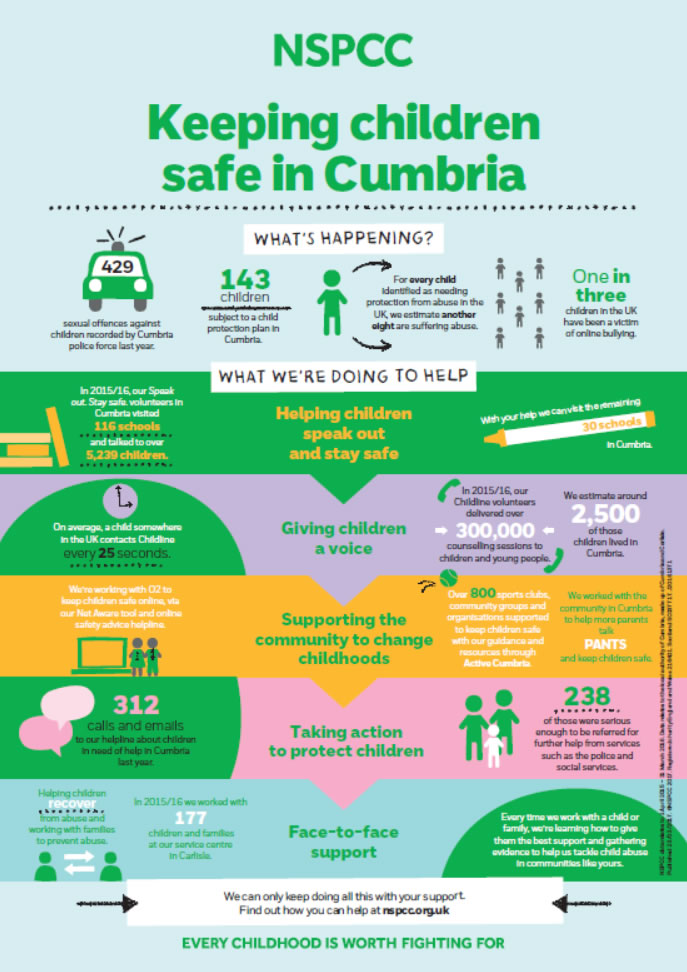

NSPCC Keeping Children Safe In Cumbria Tax Rebate Services

Council Tax Rebate Energy

Council Tax Rebate Energy

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate On Income Upto 5 Lakh Under Section 87A

What Are The Best Ways To Manage Tax Rebates

Tax Rebate For Kids - Web 28 mars 2023 nbsp 0183 32 You can claim the full amount of the 2021 Child Tax Credit if you re eligible even if you don t normally file a tax return To claim the full Child Tax Credit file a 2021 tax return Who is Eligible To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have