Tax Rebate For Pellet Stove Web replace an existing wood heating system as well as pellet stoves The financing is exclusively for private individuals Amount the contribution is paid in the form of a non

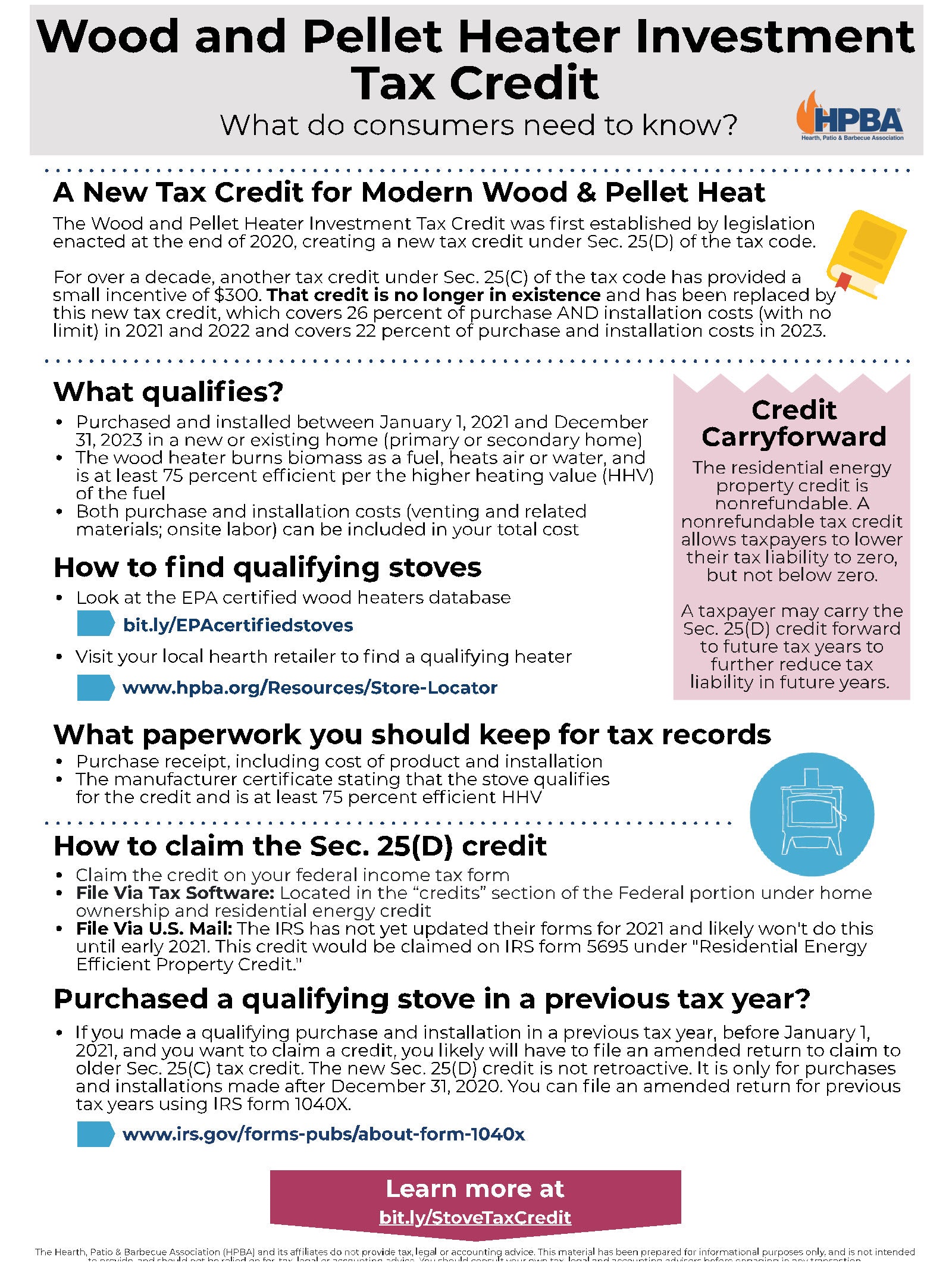

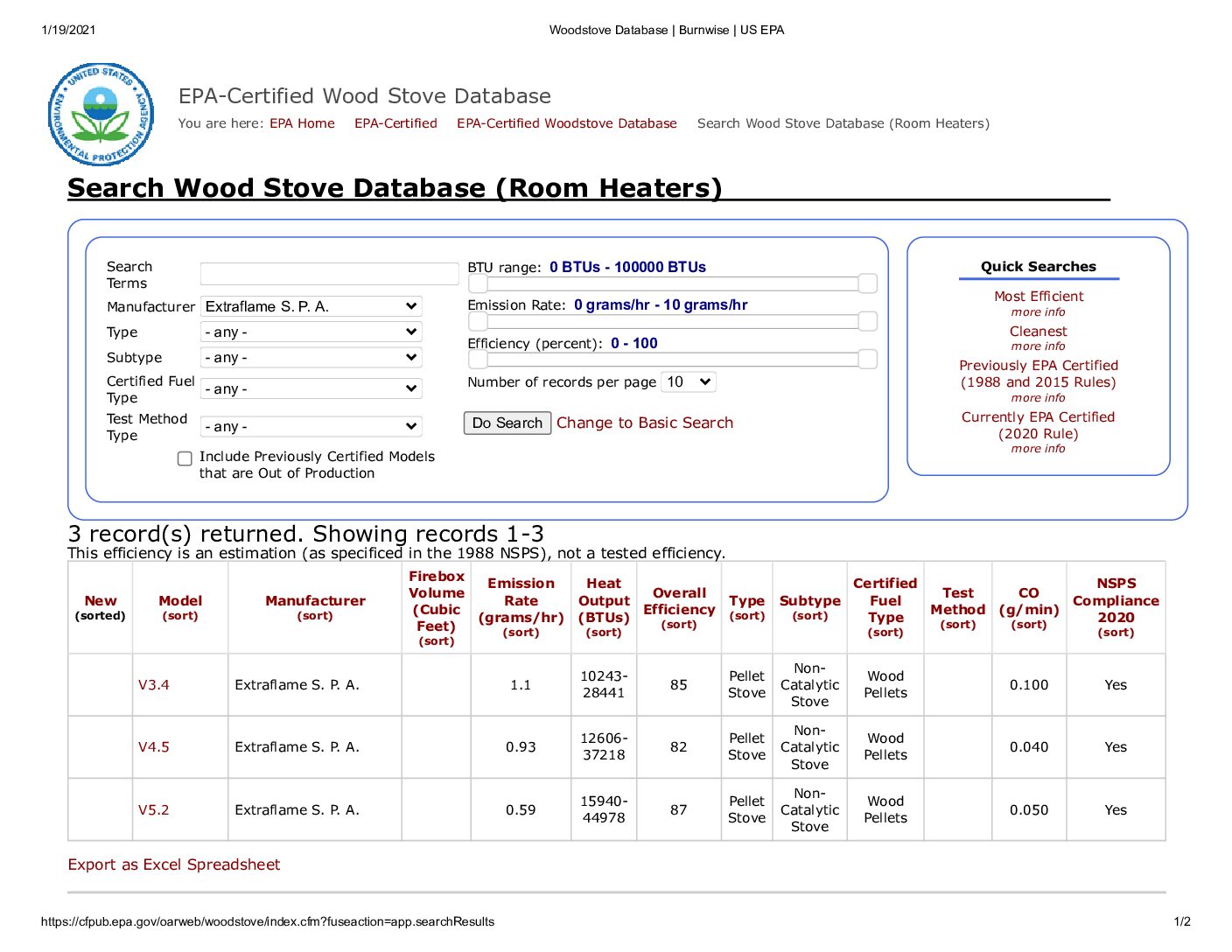

Web 26 oct 2021 nbsp 0183 32 The 2021 pellet stove tax credit applies to qualifying biomass fueled heaters at least 75 efficient or greater based on the higher heating value HHV To get Web 2 000 maximum amount credited What products are eligible Biomass stoves burn biomass fuel to heat a home or heat water Biomass fuel includes agricultural crops and

Tax Rebate For Pellet Stove

Tax Rebate For Pellet Stove

https://cdn.shopify.com/s/files/1/0111/6880/9018/articles/Tax_Credit_2021_2048x.jpg?v=1625851065

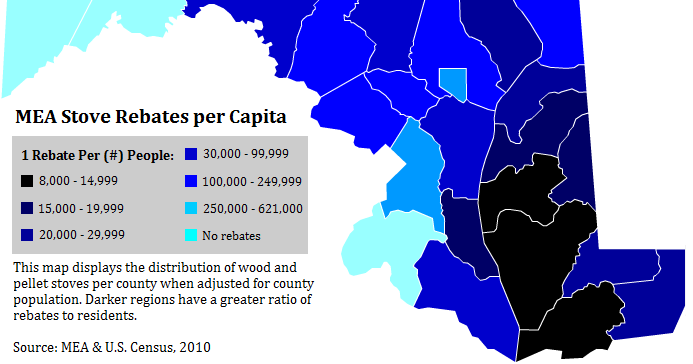

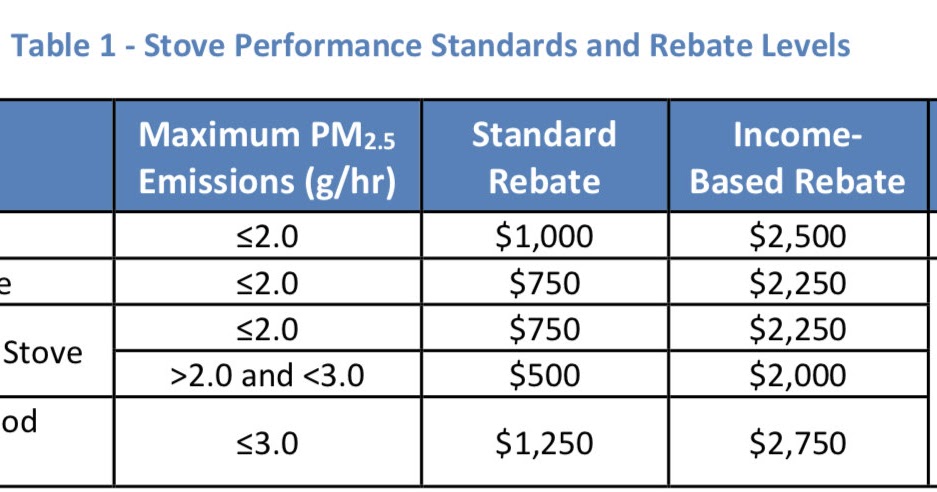

Pellet Stove Rebate Program Provide Incentives Toward The Purchase And

https://i.pinimg.com/originals/95/9f/fd/959ffd74d5f6966be9e38c43eb24df4f.png

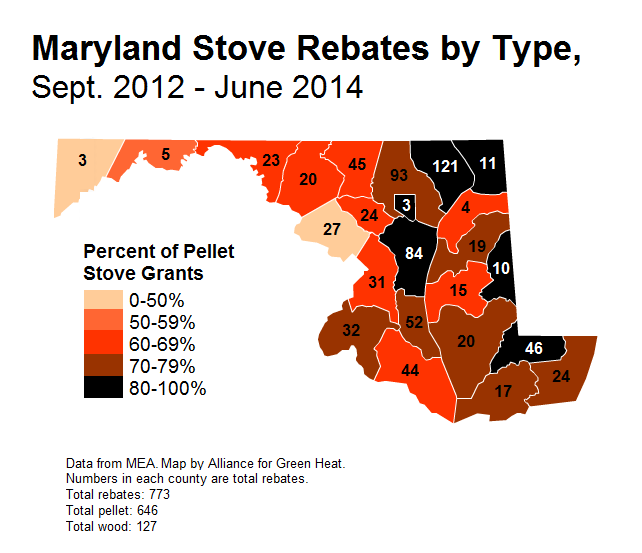

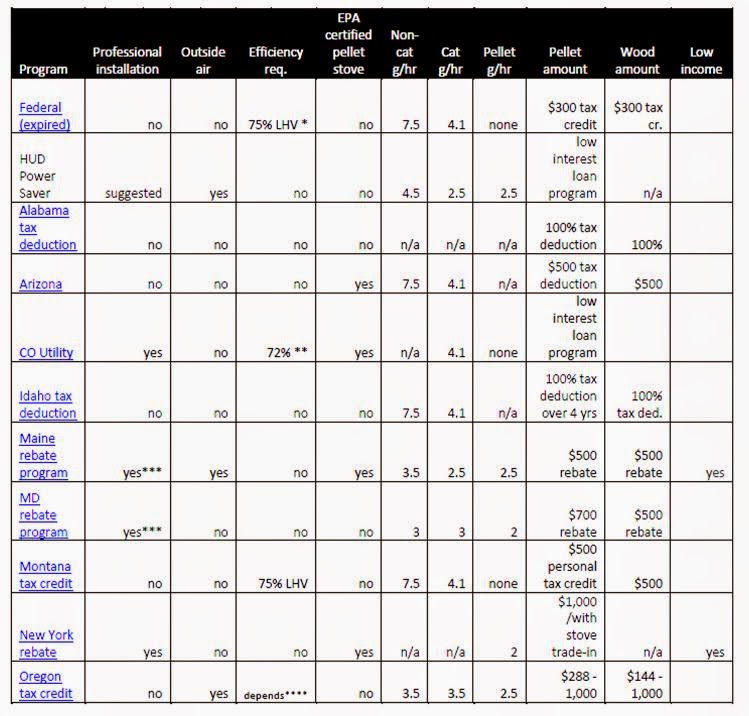

Heated Up Maryland Rebates For Wood Pellet Stoves Reach Less

http://4.bp.blogspot.com/-B9ul5isGm_4/URqhGpofTuI/AAAAAAAAAM4/6983BhW5wZ0/w1200-h630-p-k-no-nu/map+md+rebates.png

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web Beginning in 2021 consumers buying qualifying wood or pellet appliances or larger residential biomass heating systems will be able to claim an income tax credit on 26 of

Web 1 janv 2021 nbsp 0183 32 Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit Web 13 avr 2023 nbsp 0183 32 The 2021 pellet stove tax credit applies to qualifying biomass fueled heaters at least 75 efficient or greater based on the higher heating value HHV To get the

Download Tax Rebate For Pellet Stove

More picture related to Tax Rebate For Pellet Stove

Tax Credit 2016 For Wood And Pellet Stoves Inserts Pellet Stove

https://i.pinimg.com/originals/20/c1/e7/20c1e747d7d5346af9d1e286679fb67a.jpg

Tax Credit For Wood And Pellet Stoves Pellet Stove Pellet Stove

https://i.pinimg.com/originals/22/c8/ae/22c8aee94b1d3618dc6a9a6338210c03.jpg

Heated Up Maryland Raises Rebate Amount And Indefinitely Extends Wood

http://3.bp.blogspot.com/-UvvMq6YW0gs/VkIbwG13G0I/AAAAAAAABmw/wW1g04_y9bc/s1600/MAPPERCENTEDIT.png

Web 5 janv 2023 nbsp 0183 32 Before January 2023 U S consumers who bought wood or pellet stoves were eligible for a 26 tax rebate that was uncapped and was based on the total cost Web New York State Pellet Stove Incentive Program Program Duration Ongoing Eligibility Residents of New York state Rebate 1 500 rebate low income residents 1 500 to

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of Web The Inflation Reduction Act of 2022 changed the wood and pellet heater tax credit for calendar years 2023 2032 This federal tax credit covers 30 percent of purchase AND

Heated Up Massachusetts Renews Innovative Stove Change out Program

https://4.bp.blogspot.com/-BOQPEhAdh8I/XLCjZW2808I/AAAAAAAAC1Q/hCivEzW3RXQg4Pj8O3CaIf3fErRNpzdpQCLcBGAs/w1200-h630-p-k-no-nu/Mass%2B2019%2Bstove%2Brebate%2Bchart.jpg

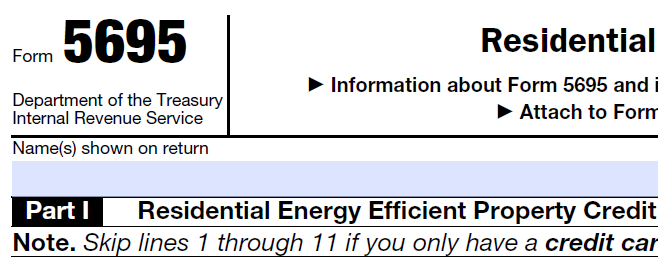

Heated Up How To Claim The 300 Stove Tax Credit

http://2.bp.blogspot.com/-ne9Y8DBs1Nw/VJnJ2asKmnI/AAAAAAAABSU/ywsCdeqMvxA/s1600/Home_Energy_Tax_Credit_IRS_Form_5695.png

https://www.coolproducts.eu/wp-content/uploads/2020/12/An…

Web replace an existing wood heating system as well as pellet stoves The financing is exclusively for private individuals Amount the contribution is paid in the form of a non

https://energex.com/news/federal-tax-credit

Web 26 oct 2021 nbsp 0183 32 The 2021 pellet stove tax credit applies to qualifying biomass fueled heaters at least 75 efficient or greater based on the higher heating value HHV To get

WOOD STOVE PELLETS TAX EXEMPT The Family Center Super Stores

Heated Up Massachusetts Renews Innovative Stove Change out Program

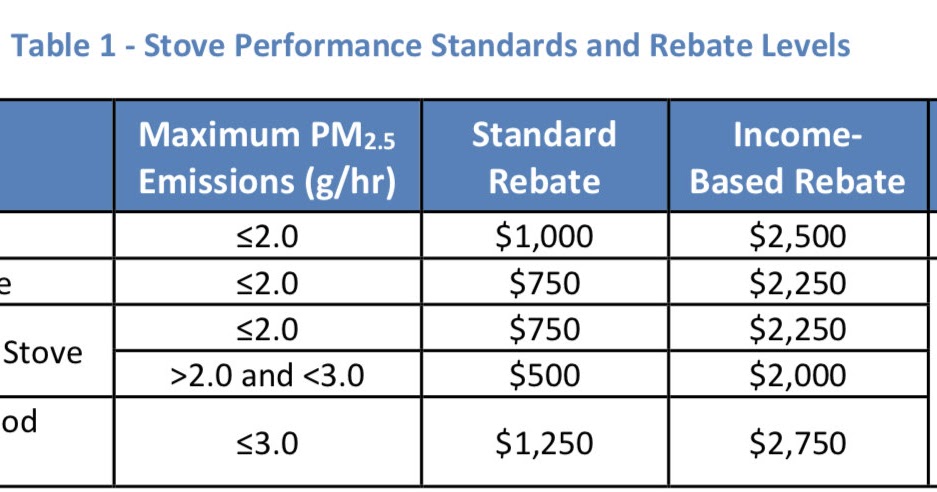

Heated Up Best Practices In Wood And Pellet Stove Incentive Programs

Vicenza Pellet Stove V4 5R 2 699 26 IRS Tax Credit Approved

Tax Credits For Efficient Wood burning And Pellet Stoves Greenstrides

BENNINGTON POOL HEARTH Category Pellet Stoves

BENNINGTON POOL HEARTH Category Pellet Stoves

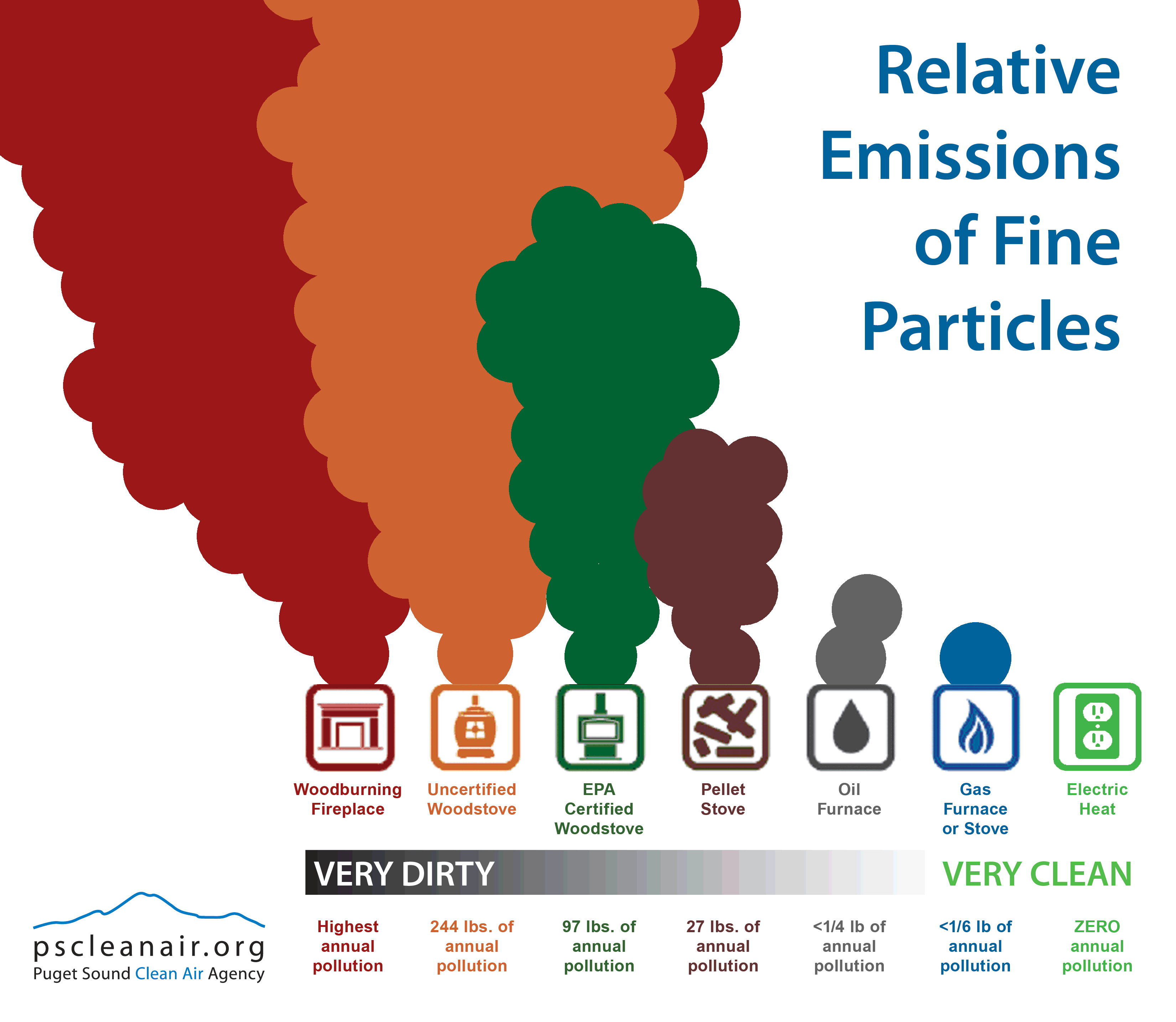

Rebates For New Wood Stoves Not Effective Solution To Pollution

Heated Up How To Claim The 300 Stove Tax Credit

Heated Up Pellet Stoves Are Hot Commodity In Maryland Rebate Program

Tax Rebate For Pellet Stove - Web 13 avr 2023 nbsp 0183 32 The 2021 pellet stove tax credit applies to qualifying biomass fueled heaters at least 75 efficient or greater based on the higher heating value HHV To get the