Tax Rebate For Senior Citizens For Fy 2024 23 For example for 2024 exemption eligibility use 2022 income if TSD is 3 1 2024 but use 2023 income if TSD is 5 1 2024 The new law also clarifies the rule for fiscal year filers those that file income tax returns based on a year that starts on a date other than January 1 Those filers are required to use the latest return

Minnesota rebate checks were sent beginning in mid August of last year to about 2 5 million Minnesota households The one time payments of up to 1 300 sometimes called Walz checks or The rebate rate has been increased from 650 to 1 000 for those who meet certain criteria after Shapiro signed bipartisan legislation into law in 2023 Income limits have also been increased to

Tax Rebate For Senior Citizens For Fy 2024 23

![]()

Tax Rebate For Senior Citizens For Fy 2024 23

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_644/https://wealthtechspeaks.in/wp-content/uploads/2020/02/Senior-Citizen-Under-New-Tax-Regime-min.jpg

Income Tax Calculation For FY 2023 24 Examples FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video-1024x576.webp

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use Governor Hochul announced multiple tax relief investments in the historic FY 2023 Budget and credit beneficiaries with incomes below 250 000 and Enhanced STAR recipients are eligible for the property tax rebate where the benefit is a percentage of the homeowners existing STAR benefit Outside of New York City the average benefit will

January 16 2024 Press Release Governor Shapiro s expansion of the Property Tax Rent Rebate program delivered the largest targeted tax cut for seniors in nearly two decades expanding access to nearly 175 000 more Pennsylvanians and increasing maximum rebate from 650 to 1000 Single filers 64 and younger typically receive 13 850 in 2023 while single filers 65 and older get 15 700 in 2023 This extra 1 850 makes it even more likely that you ll claim the standard deduction than choose to itemize simplifying your tax return preparation process

Download Tax Rebate For Senior Citizens For Fy 2024 23

More picture related to Tax Rebate For Senior Citizens For Fy 2024 23

Income Tax Slabs For Senior Citizens FY 2022 23 SuperCA

https://superca.in/storage/app/public/blogs/1673417389.jpg

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Income Tax Benefits For Senior Citizens 2020 Income Tax Rebate For Senior Citizens Fy 2020 21

https://i.ytimg.com/vi/VfG-TdpojnQ/maxresdefault.jpg

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Homeowners used this lookup to determine the amount they would receive for the homeowner tax rebate credit HTRC Please note by law we cannot issue checks for the HTRC that are less than 100

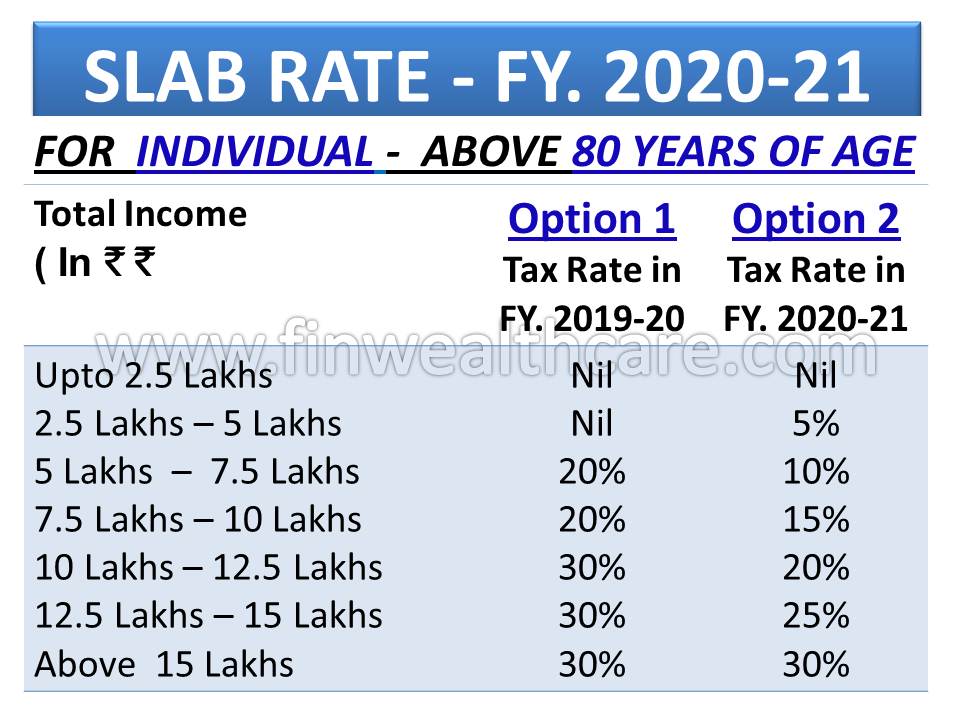

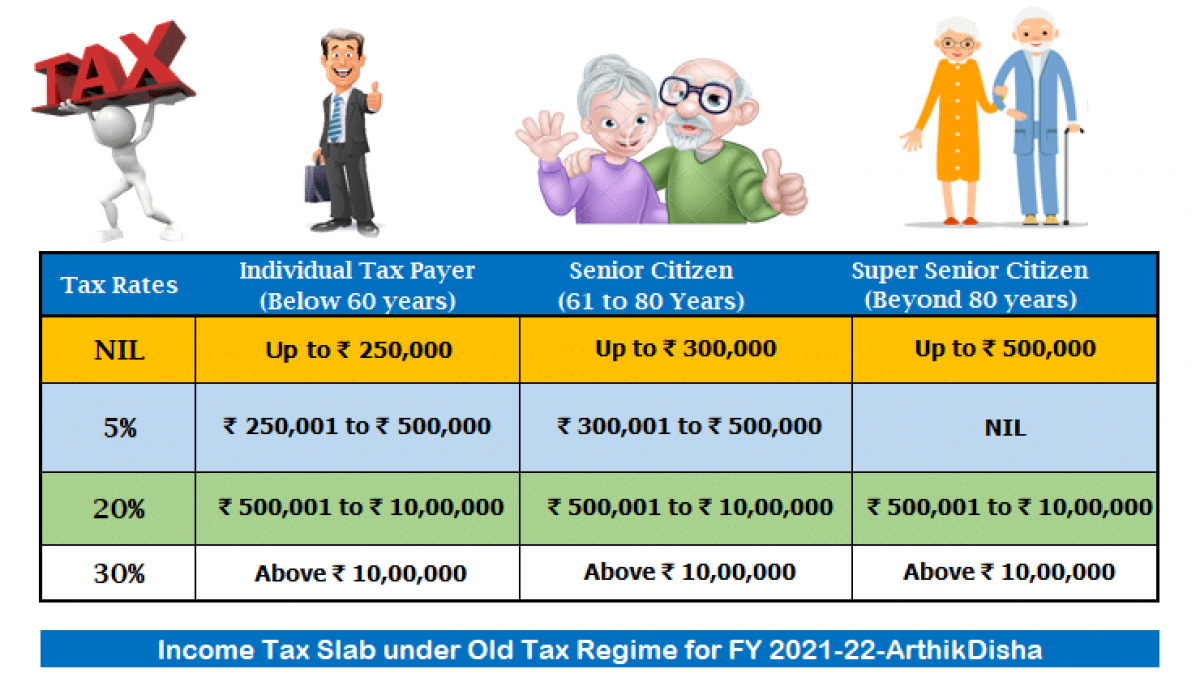

General rules for dependents A dependent must be a U S citizen resident alien or national or a resident of Canada or Mexico A person can t be claimed as a dependent on more than one tax return with rare exceptions You can t claim your spouse as a dependent if you file jointly A dependent must be a qualifying child or qualifying relative Income tax exemption limit is up to Rs 3 lakh for senior citizens aged above 60 years but less than 80 years Surcharge and cess will be applicable as discussed above Income tax slab for Individual aged more than 80 years NOTE Income tax exemption limit is up to Rs 5 lakh for super senior citizen aged above 80 years

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

https://www.the-sun.com/wp-content/uploads/sites/6/2022/04/kc-gov-little-comp.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New Year For ITR Filing Will

http://cachandanagarwal.com/wp-content/uploads/2022/12/51805DBD-BAC4-4644-8380-1BCEA472764E.png

https://www.tax.ny.gov/pit/property/exemption/459c-467changes.htm

For example for 2024 exemption eligibility use 2022 income if TSD is 3 1 2024 but use 2023 income if TSD is 5 1 2024 The new law also clarifies the rule for fiscal year filers those that file income tax returns based on a year that starts on a date other than January 1 Those filers are required to use the latest return

https://www.kiplinger.com/taxes/state-stimulus-checks

Minnesota rebate checks were sent beginning in mid August of last year to about 2 5 million Minnesota households The one time payments of up to 1 300 sometimes called Walz checks or

Income Tax Rebate For Senior Citizens Fy 201920 In India TAX

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75 Lakh Official India Today

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021 22 Vrogue

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24 2023

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download PELAJARAN

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download PELAJARAN

Income Tax Rates For Senior Citizens For Assessment Year Page My XXX Hot Girl

Income Tax Calculator For FY 2022 23 Kanakkupillai

Tax Rebate Checks What Eligible Recipients Need To Know

Tax Rebate For Senior Citizens For Fy 2024 23 - 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following sources up to 50 lakh Salary Pension One House Property Other sources Interest Family Pension Dividend etc Agricultural Income up to 5 000