Tax Rebate For Small Businesses Web Small Business and Self Employed Tax Center Online resources for taxpayers who file Form 1040 or 1040 SR Schedules C E F or Form 2106 as well as small businesses

Web 13 mai 2021 nbsp 0183 32 Small business tax credits can be powerful because they can directly reduce your tax bill This guide explains how tax credits work the best small business tax Web The tax credit is 50 of the wages paid up to 10 000 per employee capped at 5 000 per employee If the amount of the tax credit for an employer is more than the amount of the

Tax Rebate For Small Businesses

Tax Rebate For Small Businesses

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

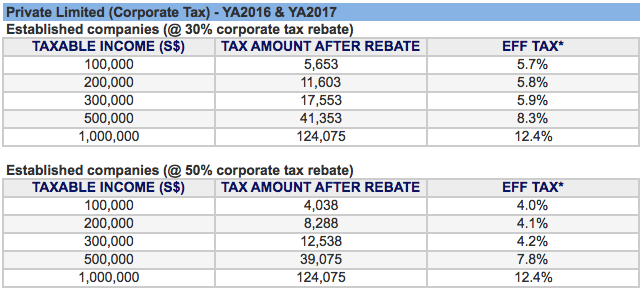

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

Web 11 f 233 vr 2022 nbsp 0183 32 As filers reckon with the tax effects of recent small business relief programs and rule changes these tips can help create some tax saving opportunities Web 12 sept 2022 nbsp 0183 32 Small business building owners can receive a tax credit up to 5 per square foot to support energy efficiency improvements that deliver lower utility bills

Web 21 d 233 c 2021 nbsp 0183 32 Tax credits are a dollar for dollar offset of federal income tax liability By keeping up to date on current tax credits and eligibility requirements small businesses Web 7 mai 2020 nbsp 0183 32 The refundable tax credit is 50 of up to 10 000 in wages paid by an eligible employer whose business has been financially impacted by COVID 19 The credit is

Download Tax Rebate For Small Businesses

More picture related to Tax Rebate For Small Businesses

Calam o Best CPA ERTC Application For Tax Rebates 2022 Get Small

https://p.calameoassets.com/220330072118-87691d412cf688d1bc3c1b895bf300e4/p1.jpg

P55 Tax Rebate Form Business Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Spend 100 Get A 120 Expense From The ATO Big Tax Rebates For Small

https://www.australiansmallbusiness.com.au/wp-content/uploads/2022/04/Australias-Digital-Economy-tax-incentives-and-PEPPOL-for-einvoicing-Xero-MYOB-QuickBooks-Courses-National-Bookkeeping-Courses-and-the-Career-Academy-980x384.png

Web 31 mars 2023 nbsp 0183 32 A list of forms for claiming business tax credits and a complete explanation about when carryovers credits and deductions cease Your general business credit for Web 25 janv 2023 nbsp 0183 32 En tant que micro entrepreneur vous 234 tes soumis au r 233 gime de la franchise en base de TVA article 293 B du code g 233 n 233 ral des imp 244 ts Vous 234 tes un assujetti non

Web Small Business Tax Credit Notes If you re eligible for more than one business tax credit submit Form 3800 Although each individual business tax credit requires its own form Web 12 oct 2022 nbsp 0183 32 Find out about tax reliefs and allowances available from HMRC if you run a business employ people or are self employed Tax reliefs and allowances for

Top 20 Tax Deductions For Small Business

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

NSW Small Business Fees And Charges Rebate Jigsaw Tax

https://www.jigsawtaxandadvisory.com.au/wp-content/uploads/2021/04/Copy-of-NEW-REBATE-TO-SUPPORT-SMALL-BUSINESS-5.png

https://www.irs.gov/coronavirus/coronavirus-tax-relief-for-businesses...

Web Small Business and Self Employed Tax Center Online resources for taxpayers who file Form 1040 or 1040 SR Schedules C E F or Form 2106 as well as small businesses

https://www.nerdwallet.com/article/small-business/small-business-tax...

Web 13 mai 2021 nbsp 0183 32 Small business tax credits can be powerful because they can directly reduce your tax bill This guide explains how tax credits work the best small business tax

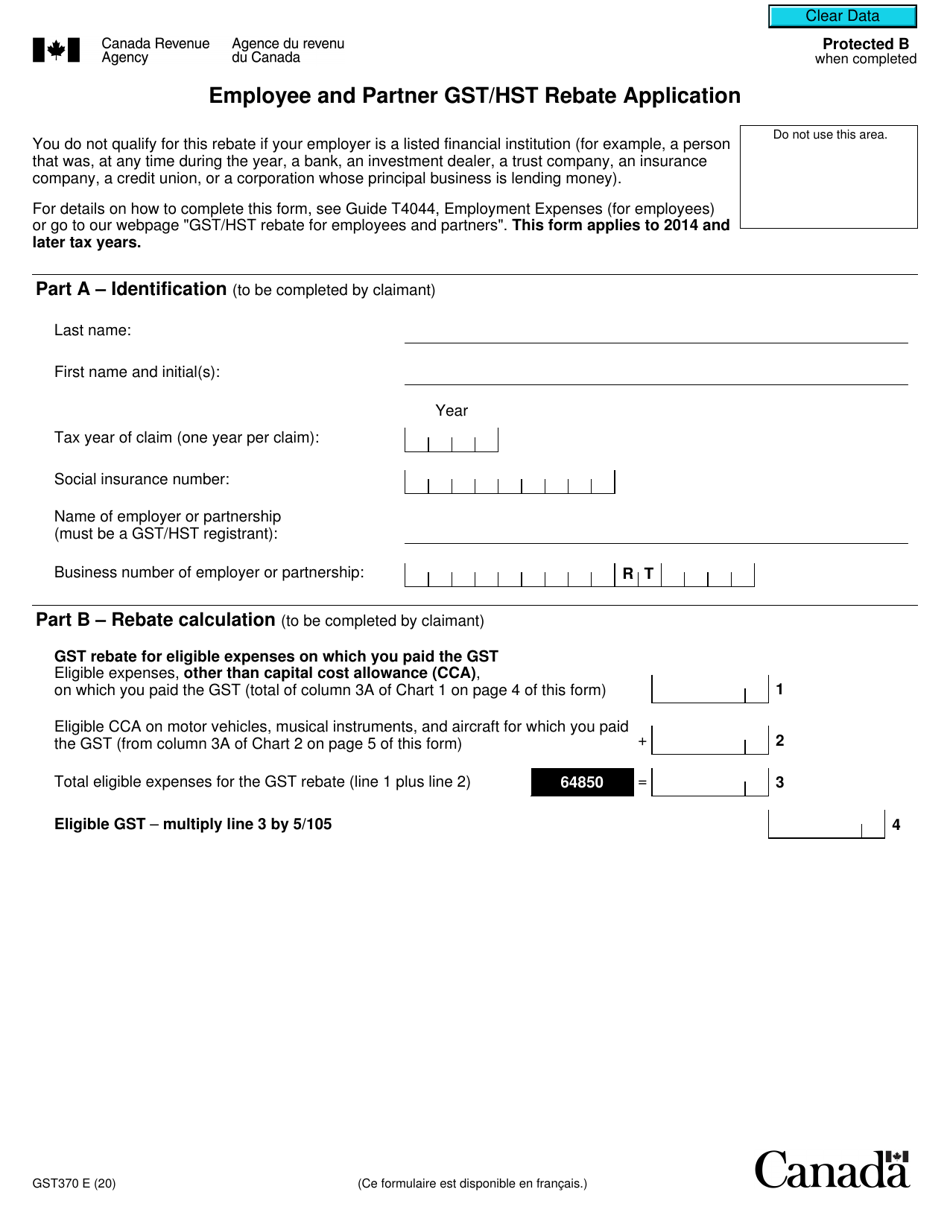

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Top 20 Tax Deductions For Small Business

Rebate Text Words Typography Written On Paper Life And Business

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Household Budget Household Hacks Income Tax Extra Income Things To

Household Budget Household Hacks Income Tax Extra Income Things To

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

What The Solar Tax Rebate Means For Your Small Business

Supplier Rebate Agreement Template

Tax Rebate For Small Businesses - Web 11 f 233 vr 2022 nbsp 0183 32 As filers reckon with the tax effects of recent small business relief programs and rule changes these tips can help create some tax saving opportunities