Tax Rebate For Solar Panels 2024 Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

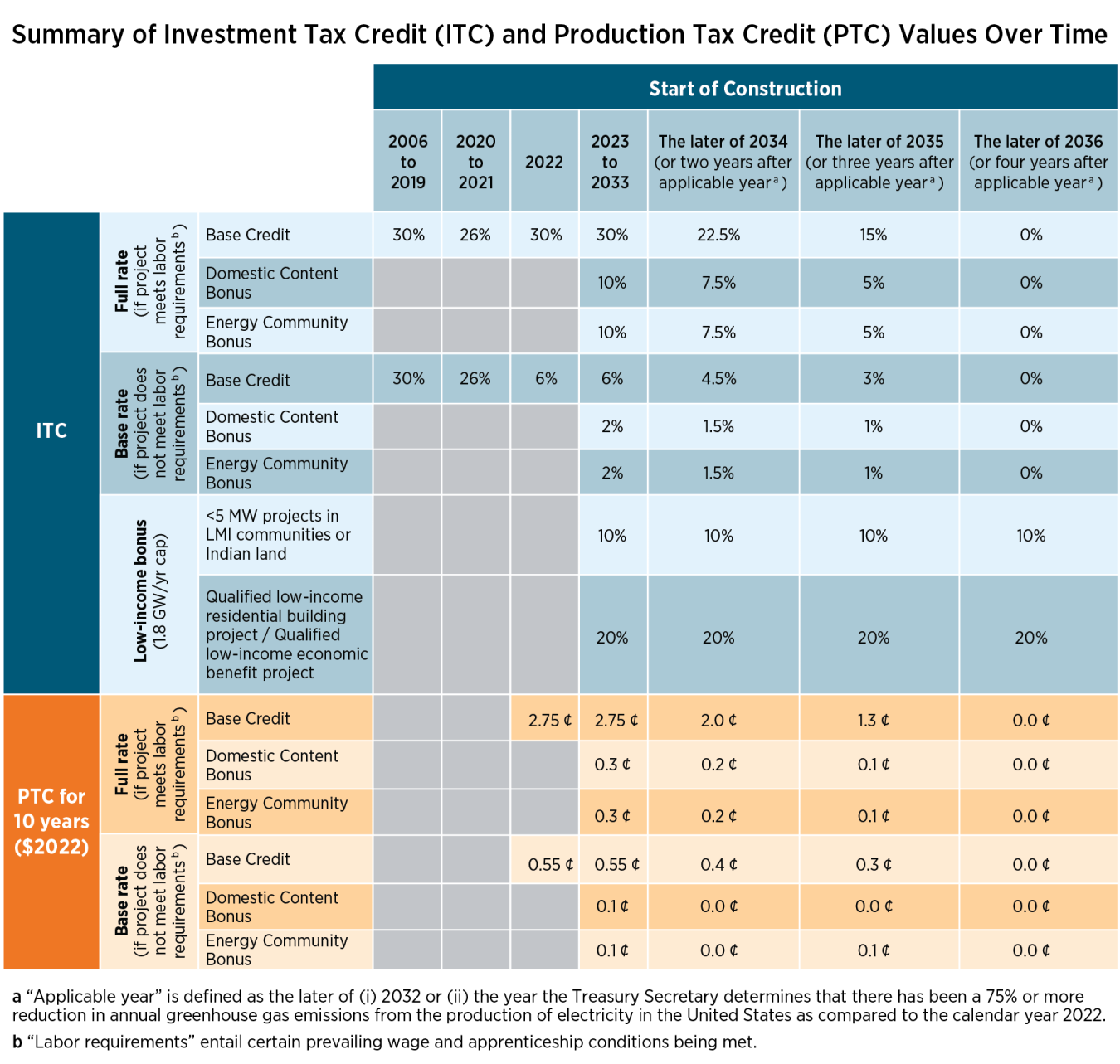

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Tax Rebate For Solar Panels 2024

Tax Rebate For Solar Panels 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

How To Claim Solar Rebate Regen Power

https://regenpower.com/wp-content/uploads/2021/09/solar-rebate.jpg

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2021/01/Solar-Tax-Credit-ITC-Step-Down-2.jpg

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

Download Tax Rebate For Solar Panels 2024

More picture related to Tax Rebate For Solar Panels 2024

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Commercial Solar Tax Credit Guide 2023

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

Let s Shine Some Light On The Tax Relief Available On Solar Panels Barth Consulting Limited

https://www.barthconsulting.co.uk/wp-content/uploads/2020/07/Lets-shine-some-light-on-the-tax-relief-available-on-Solar-Panels.jpg

A percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates

However starting in 2022 those who installed new solar panels or invested in an off site community solar project could get a tax credit of up to 30 percent through the Residential Clean Energy If your household income is between 80 150 AMI you could only use 1 125 of the rebate to cover the maximum 50 of the all in cost and the other 1 125 comes out of your pocket

Tax Benefits Of Installing Solar Panels Solarismypassion

https://solarismypassion.com/wp-content/uploads/2023/03/tax-advantages-of-installing-solar-panels.png

Solar Panels On Your Roof In South Africa Here Is How To Qualify For A Tax Rebate SolarEyes

https://solareyesinternational.com/wp-content/uploads/2023/03/Solar-Panels-on-Your-Roof.png

https://www.nerdwallet.com/article/taxes/solar-tax-credit

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Tax Benefits Of Installing Solar Panels Solarismypassion

How Much Is The Solar Tax Credit Millionacres

The Victorian Solar Homes Rebate Explained Half Price Solar Starting Now

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

Is Solar Worth It In Arizona Solar Panels Savings Az

Is Solar Worth It In Arizona Solar Panels Savings Az

Federal Solar Tax Credit What It Is How To Claim It For 2023

Solar Panel Rebate How It Works And How To Get It

Government Rebate Solar Panels Compare Solar Quotes

Tax Rebate For Solar Panels 2024 - The program provides an up front dollars per watt W rebate for both commercial and residential solar panel systems The size of your subsidy depends on the size of your system the current Megawatt block and your region As of January 2022 the incentive values range from 0 20 W ConEdison to 0 50 W Upstate