Tax Rebate For Travel Expenses Web 15 janv 2020 nbsp 0183 32 Travel expenses deductible from the tax result of companies by FBA team 15 01 2020 Travel costs are in principle deductible insofar as they have been incurred in the interest of business

Web 6 avr 2023 nbsp 0183 32 If your travel qualifies for tax relief then assuming your employer does not pay or reimburse the expenses you should be able to claim a tax deduction for your travel expenses for example train or Web To make your claim for travel expenses you will need to complete a P87 form and possibly a self assessment tax return depending on the value of your travel claim The P87 and

Tax Rebate For Travel Expenses

Tax Rebate For Travel Expenses

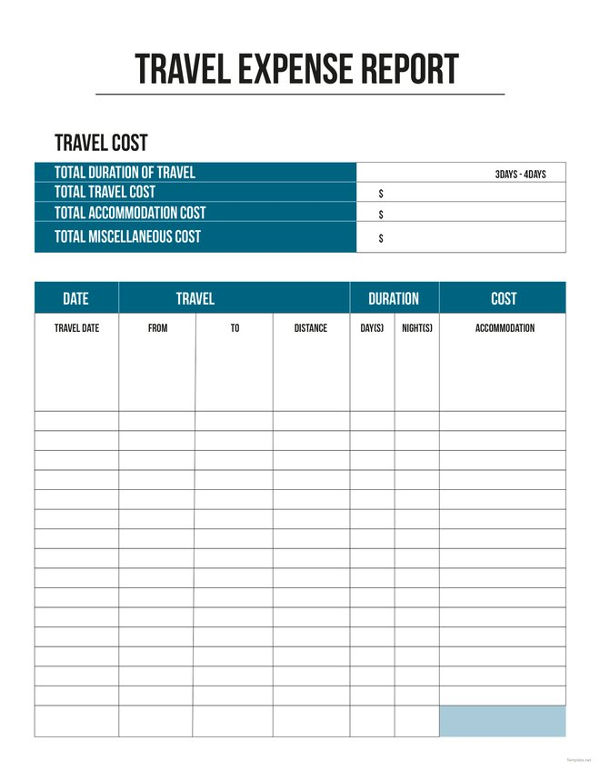

https://images.template.net/wp-content/uploads/2015/05/Free-Travel-Expense-Report-Template.jpg

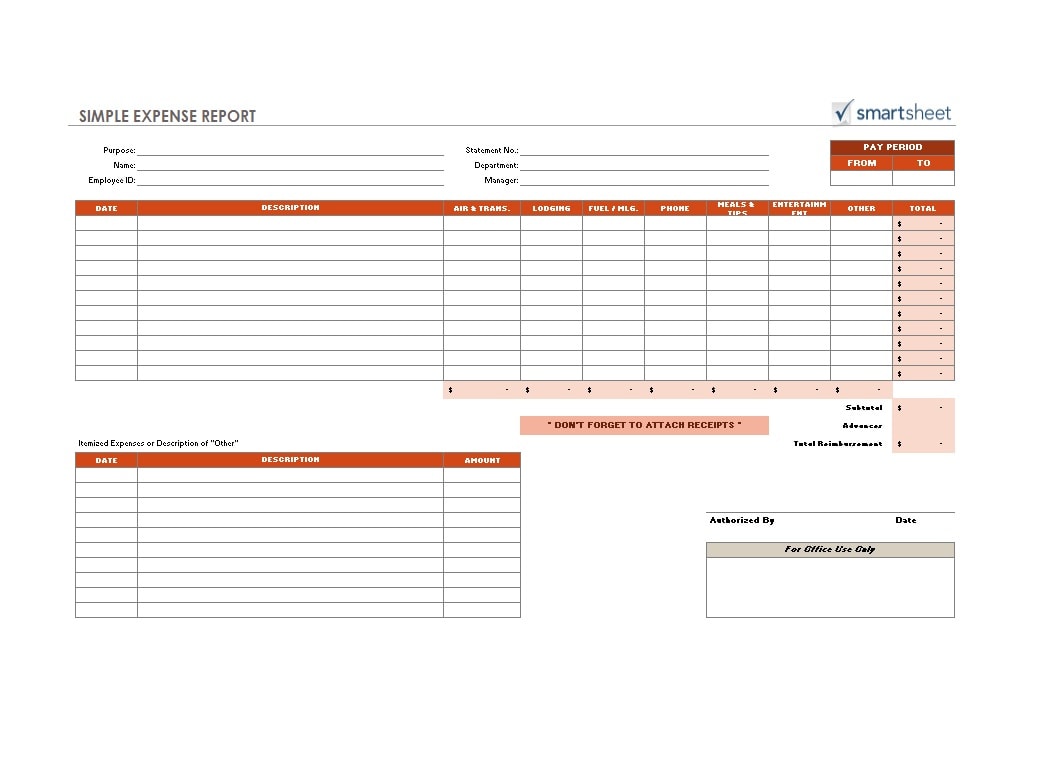

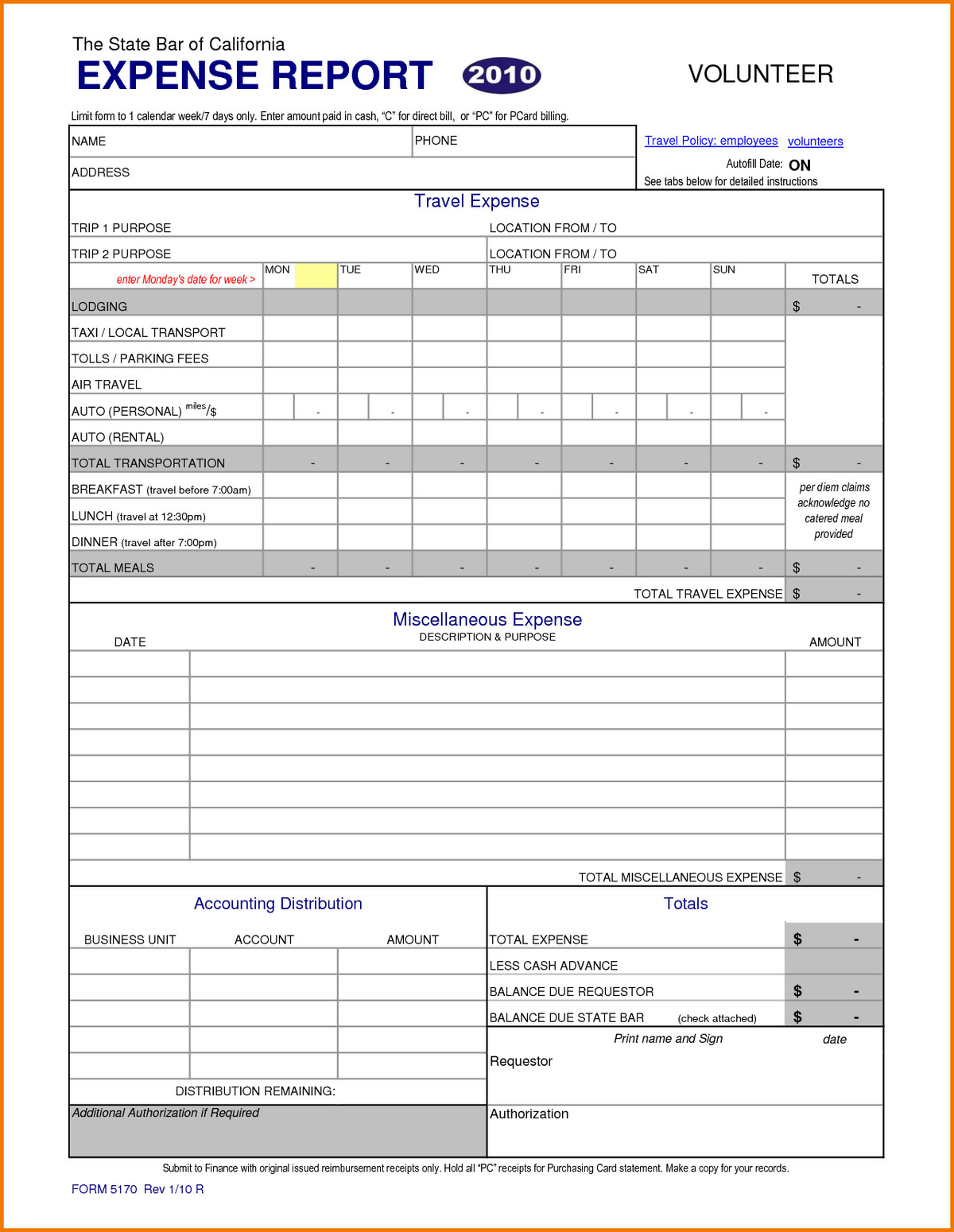

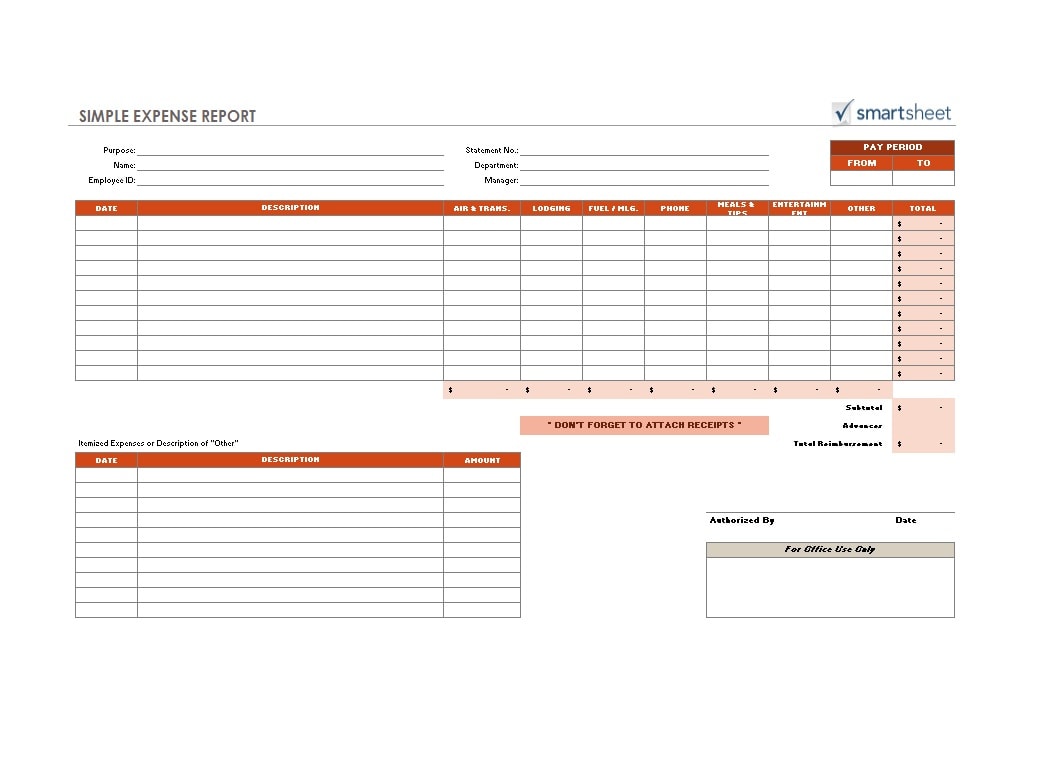

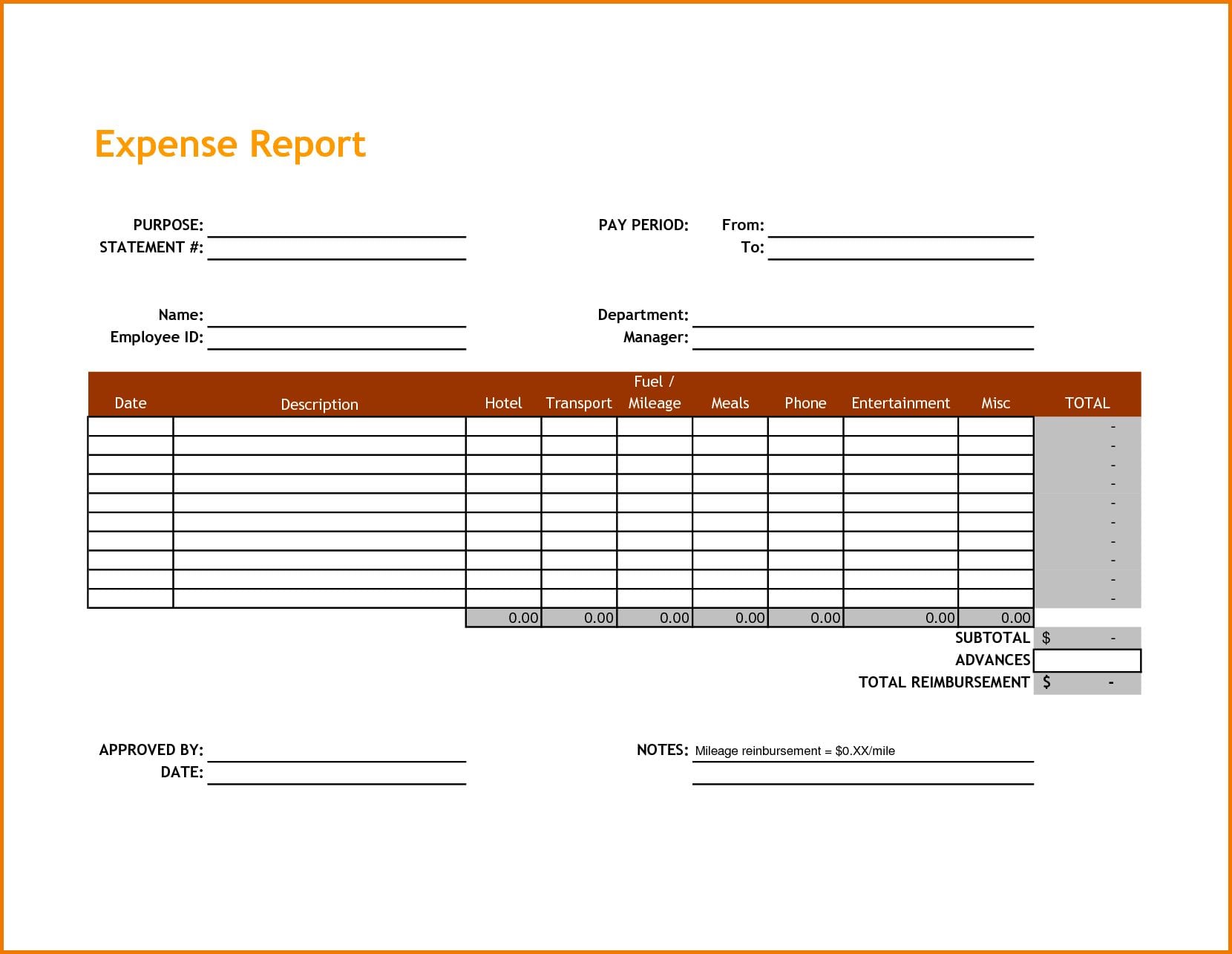

Expense Reimbursement Template Excel Templates

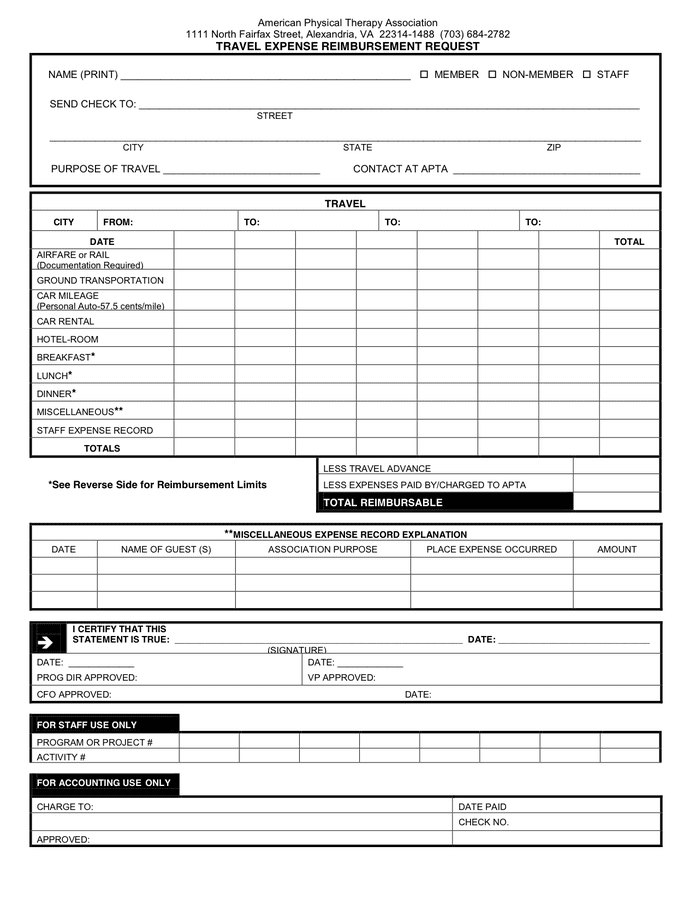

http://static.dexform.com/media/docs/4845/travel-expense-reimbursement-form-1_1.png

Travel Expense Statement Template For MS Excel Word Excel Templates

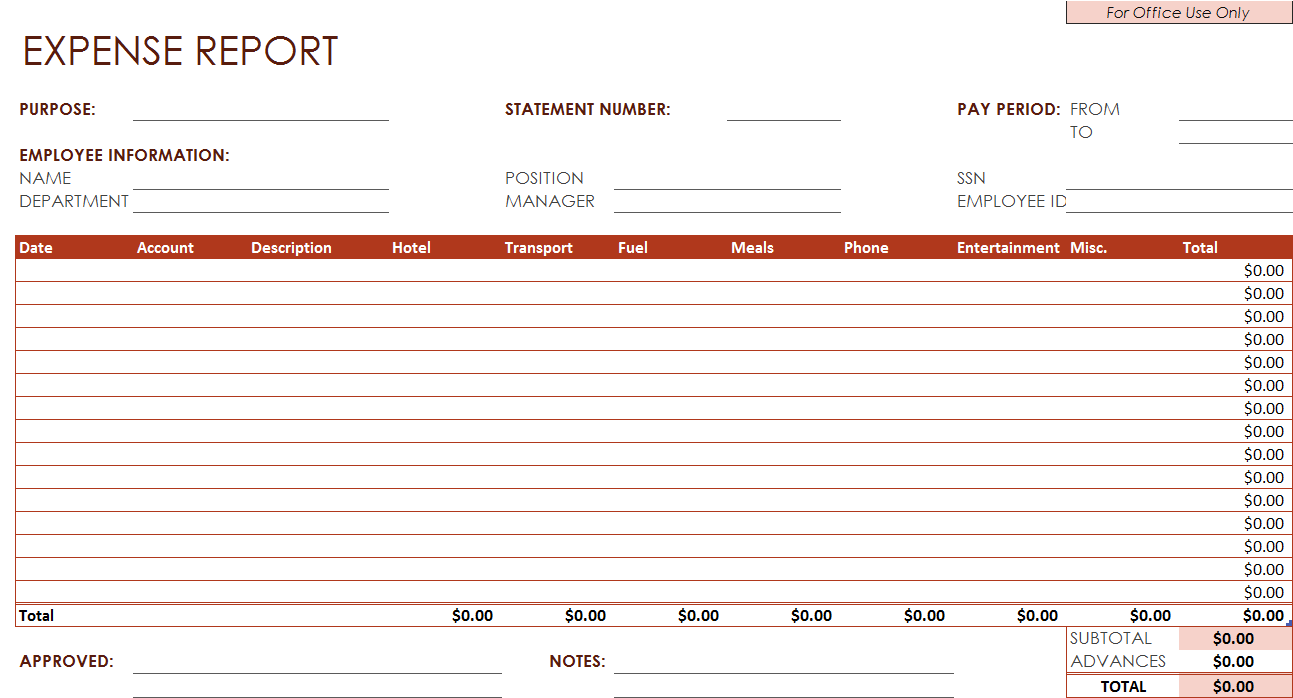

https://www.wordexceltemplates.com/wp-content/uploads/2016/11/Travel-expense-statement-template.jpg

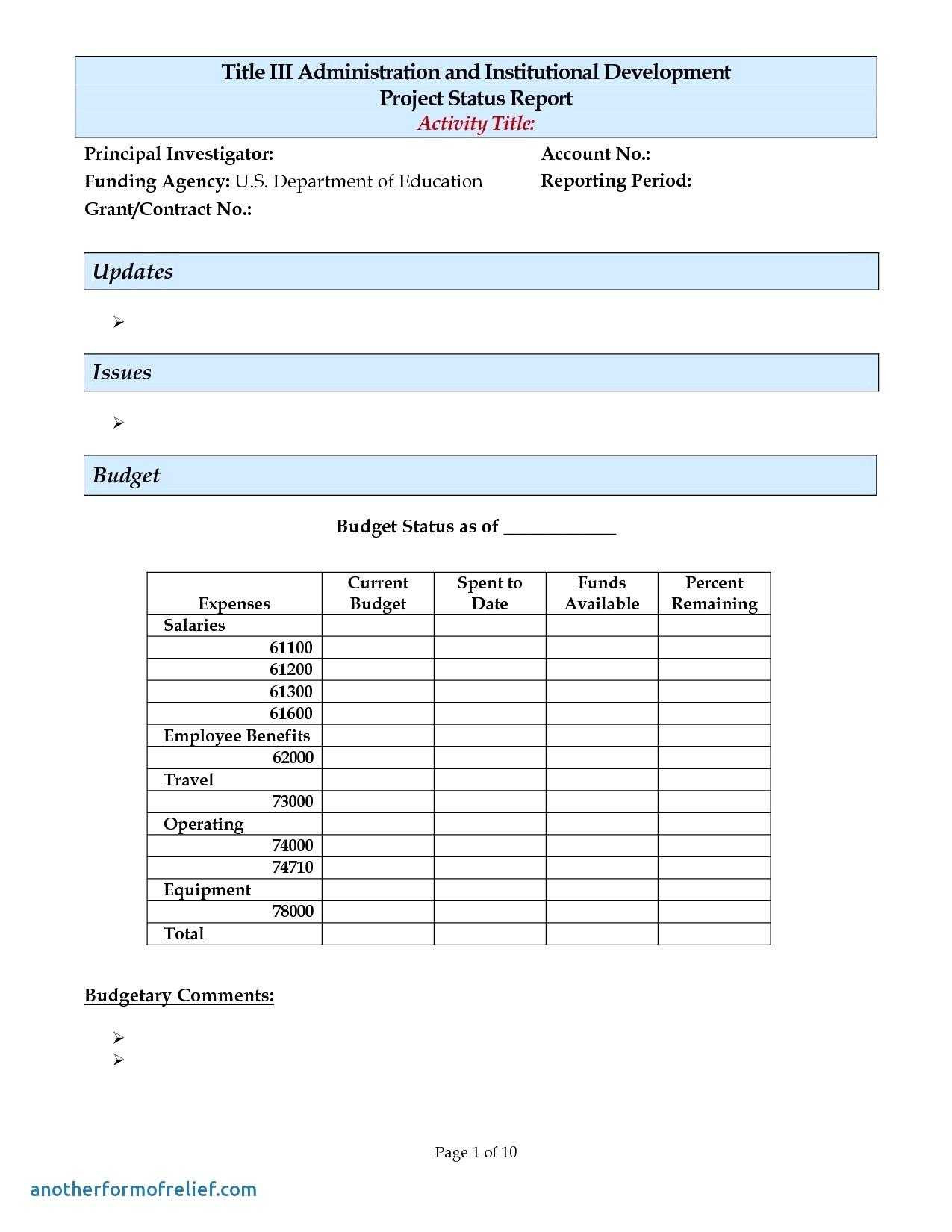

Web The tax rebate can be granted to projects that incur 250 000 or 50 of their world budgets in French expenditures and for a live action work have at least 5 days of shooting in Web What are tax deductible expenses Claiming tax relief through PAYE Claiming tax relief through a self assessment tax return Reimbursement for business travel Expenses on business trips Work uniform expenses

Web 5 mars 2023 nbsp 0183 32 Travel expenses are tax deductible only if incurred for the purpose of conducting business related activities Only ordinary and necessary travel expenses are Web Travel expenses defined For tax purposes travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job An ordinary expense is one that is common

Download Tax Rebate For Travel Expenses

More picture related to Tax Rebate For Travel Expenses

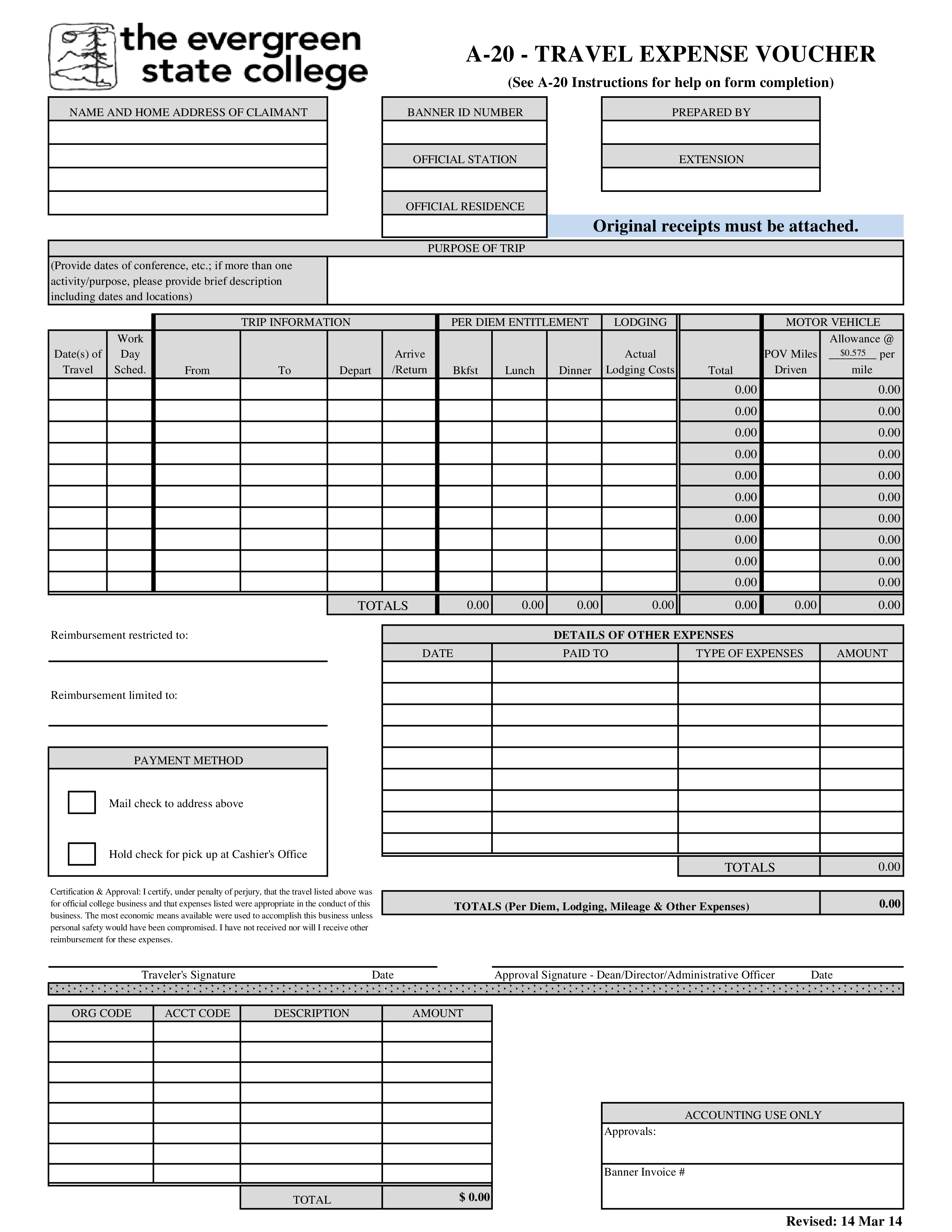

Travel Expense Report Example Excel Templates

https://www.excelwordtemplate.com/wp-content/uploads/2016/11/Expense-Report.png

4 Tours And Travels Bill Format Dupont Work Schedule Invoice Template

https://i.pinimg.com/originals/d6/7b/95/d67b95da26c8f3fee872f8e5202dcaca.jpg

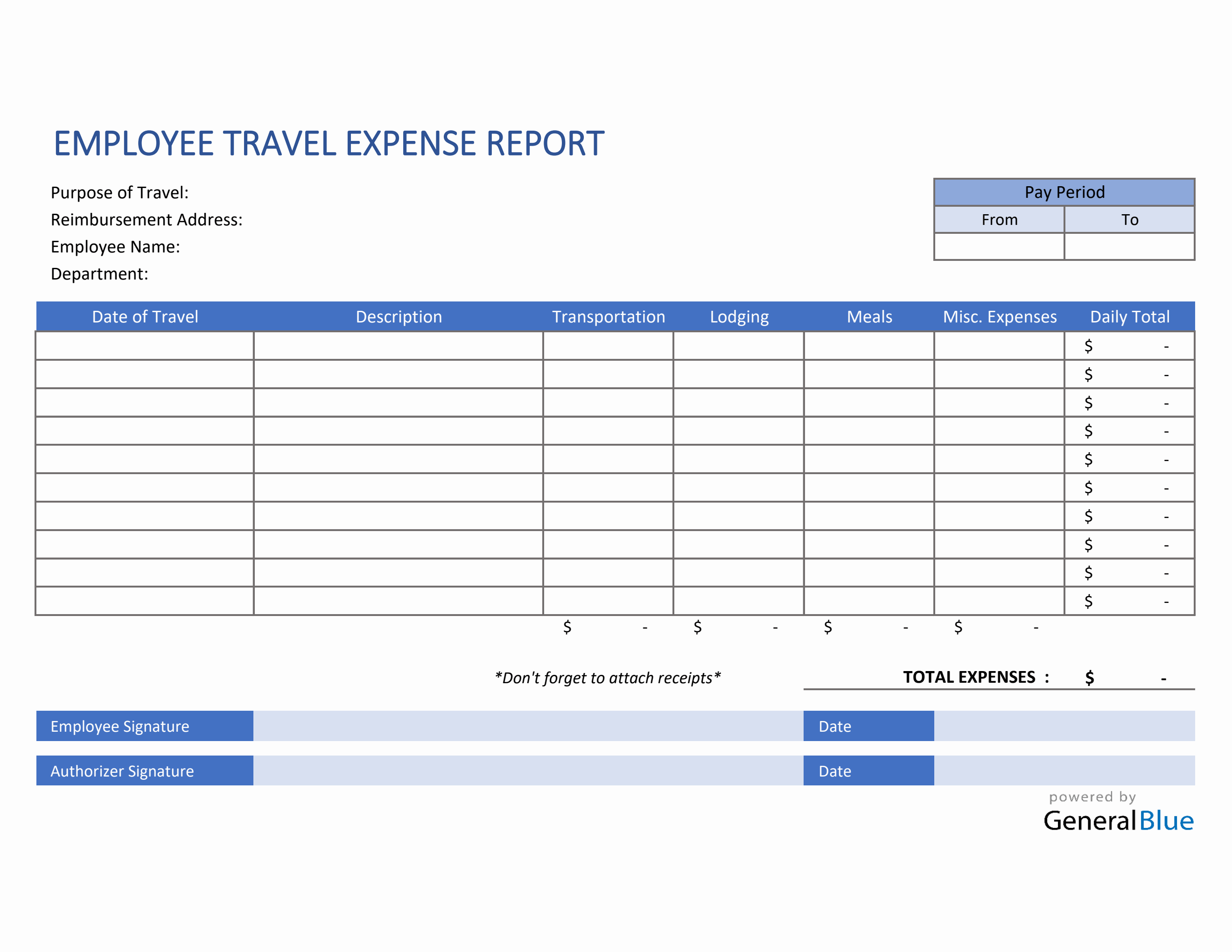

Employee Travel Expense Report Template In Excel

https://www.generalblue.com/employee-travel-expense-report-template/p/tg8k76w7f/f/employee-travel-expense-report-template-in-excel-lg.png?v=675d23cf5e1bbb3f947a2f451cc6de4c

Web Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job You can t deduct expenses that are lavish or Web 28 mars 2014 nbsp 0183 32 Tax relief for these costs may be available as incidental overnight expenses go to paragraph 8 2 of Tax rules on other types of travel and related

Web 7 oct 2021 nbsp 0183 32 According to the IRS your trip and its varying expenses can be 100 percent tax deductible if it meets four considerations 1 You need to leave your tax home that Web The average mileage expenses rebate made with RIFT Tax Refunds is worth 163 3 000 Many people don t realise that it s not something HMRC will automatically give back to you you

Travel Expense Log Template HQ Printable Documents

https://templatearchive.com/wp-content/uploads/2018/01/Travel-Expense-Report-Template-35.jpg

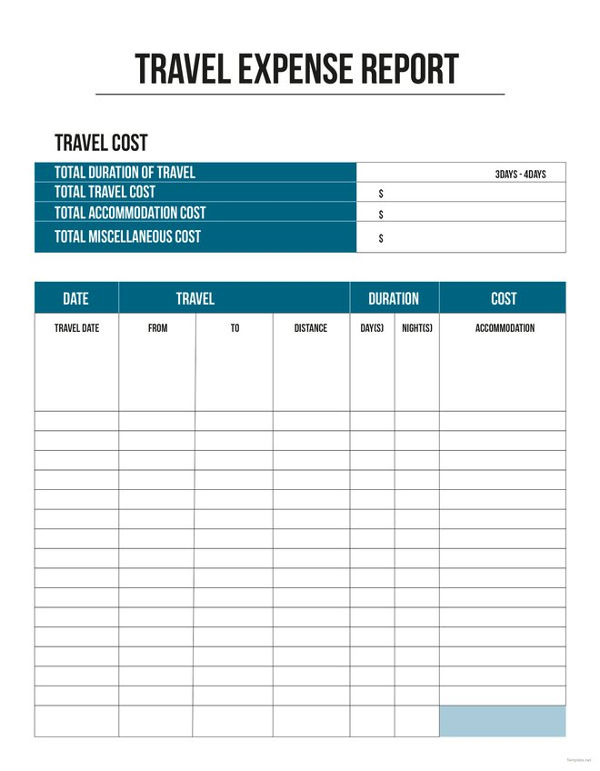

Travel Expense Template Excel Templates

https://www.allbusinesstemplates.com/thumbs/3a29ba01-5b1c-4aab-8061-014fa1ee8ce7_1.png

https://www.frenchbusinessadvice.com/Trave…

Web 15 janv 2020 nbsp 0183 32 Travel expenses deductible from the tax result of companies by FBA team 15 01 2020 Travel costs are in principle deductible insofar as they have been incurred in the interest of business

https://www.litrg.org.uk/.../what-travel-expen…

Web 6 avr 2023 nbsp 0183 32 If your travel qualifies for tax relief then assuming your employer does not pay or reimburse the expenses you should be able to claim a tax deduction for your travel expenses for example train or

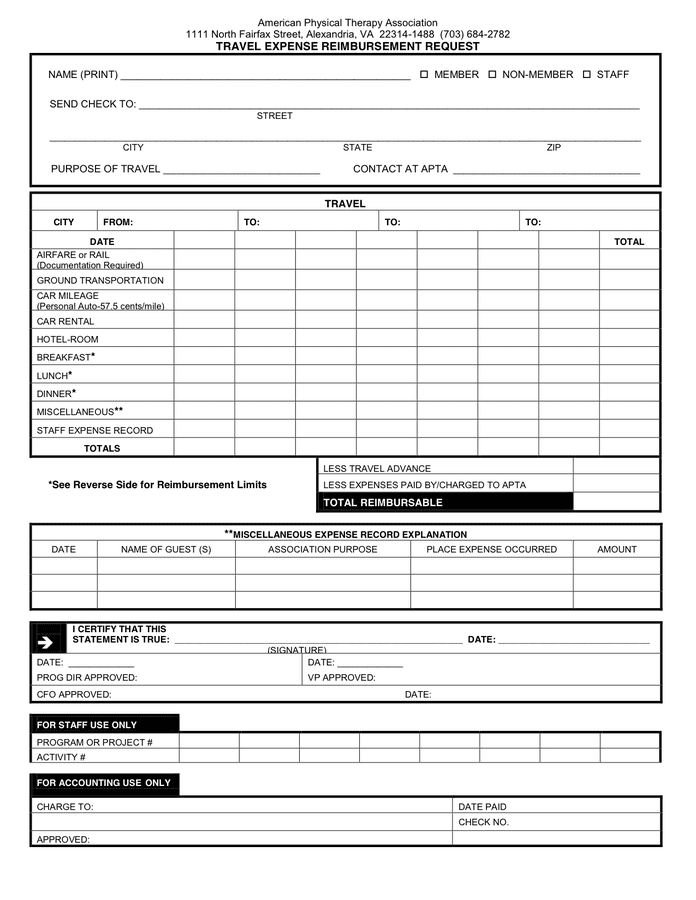

Business Trip Expenses Template Travel Expense Report Form DocTemplates

Travel Expense Log Template HQ Printable Documents

Business Trip Expenses Template Travel Expense Report Form DocTemplates

Free Printable Travel Expense Report Forms Printable Forms Free Online

Travelling Expenses Tax Deductible Malaysia Paul Springer

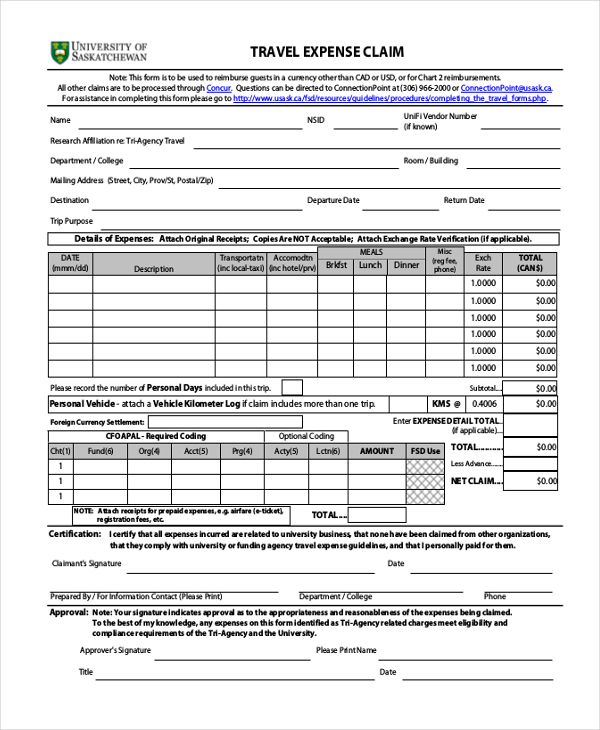

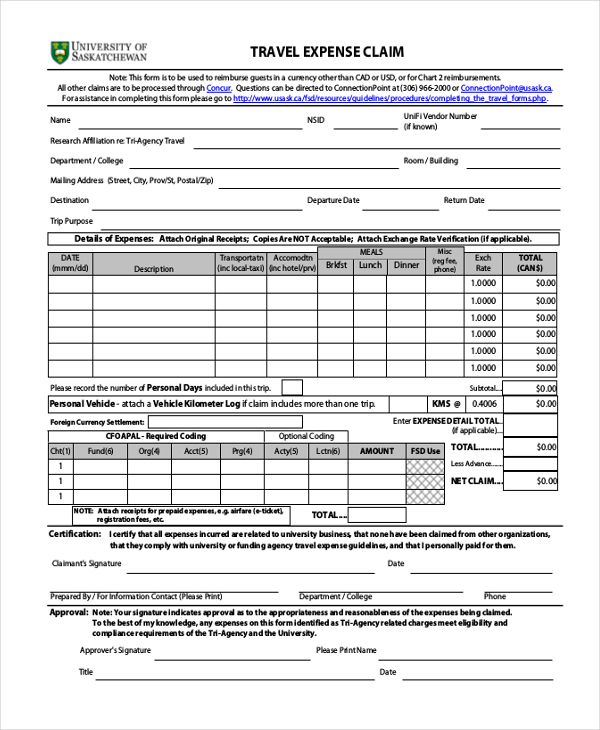

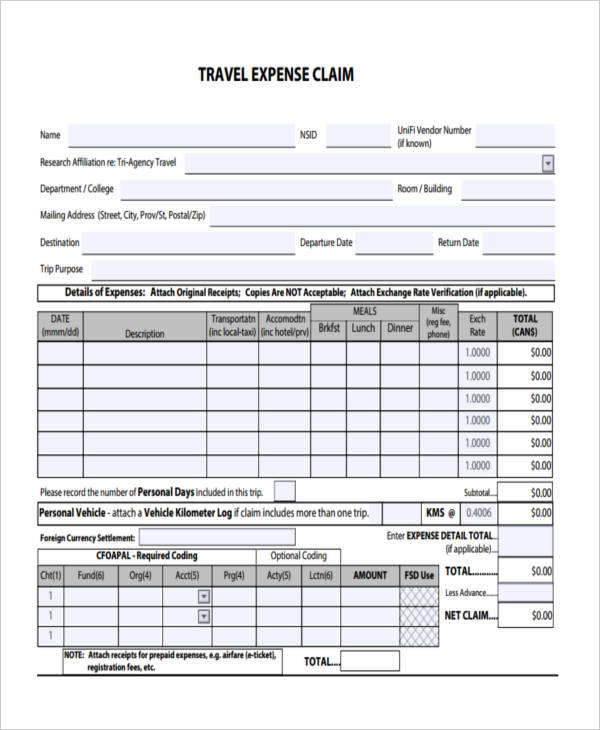

9 Expense Claim Form Sample Excel Templates

9 Expense Claim Form Sample Excel Templates

FREE 37 Sample Claim Forms In PDF Excel MS Word

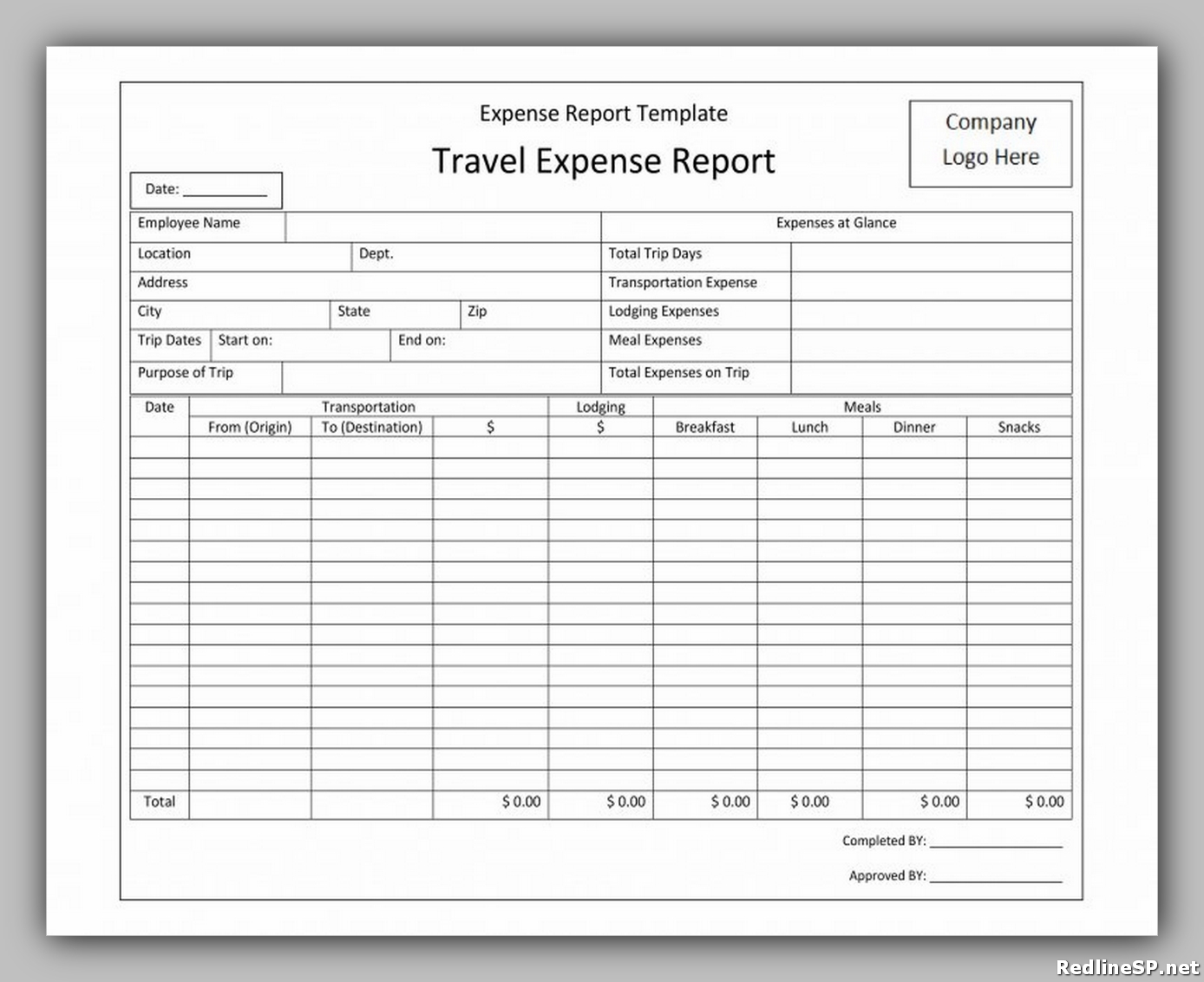

10 Amazing Travel Expense Report RedlineSP

FREE 10 Expense Authorization Forms In PDF MS Word

Tax Rebate For Travel Expenses - Web What are tax deductible expenses Claiming tax relief through PAYE Claiming tax relief through a self assessment tax return Reimbursement for business travel Expenses on business trips Work uniform expenses